Trade, tariffs, and tumult: New challenges for lasers in China

BO GU, Ph.D., Bos Photonics

In 2018, the Chinese GDP grew to RMB 90 trillion ($13.45 trillion). In doing so, it overtook the Eurozone, which came in at $12.8 trillion. With 3X stronger growth, it will remain ahead for the foreseeable future. The U.S. economy grew to a GDP of $20.5 trillion or 24.2% of the world’s GDP. With China’s share at 15.8%, the two countries represent about 40% of the world economy. This is one more reason why it is so important that the two countries learn how to deal with each other.

The Chinese economic growth is slowing from 6.8% in Q1 to 6.4% in Q4 of 2018. In total, China’s economy grew 6.6% in 2018, which is still within the range of 6% to 7% required for a soft landing. The reasons for the slowdown are plenty, as Gu said. One reason is a transition from a steel and concrete economy toward high-tech production. Another reason is a decreasing level of business confidence and tightening finances. Gu noted that, together with U.S. President Trump’s unpredictable policies, this causes uncertainty and leads to fewer investments—people will need to just wait and see.

From another vantage point, the high-tech industry is still growing in China: 11.7% in total, with 40% growth in electric cars and 183% in high-speed trains. Most of these high-tech industries make use of lasers—for example, batteries and cars, smart TVs, ICs, lidar, and 5G wireless technology. 5G is predicted to add $5 trillion to the global market, which helps explains why the U.S. and China fight for this market.

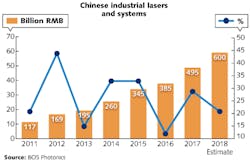

The Chinese market for lasers and laser systems has evolved positively in 2018. After the unique 2017 with almost 30% growth, Gu expects more than 20% for 2018 to RMB 60 billion ($9 billion) in revenue. Among the different types of laser sources, fiber lasers are still conquering more shares, from 51% in 2016 to 55% in 2017, and 60% in 2018. This goes mostly on the expense of CO2 lasers, which are expected to decline 7% in 2018 (see figure).

Additive manufacturing—or 3D printing, as Gu called it—is growing rapidly in China. In 2015, 2016, and 2017, the growth was more than 50% and reached $2 billion in 2017. The technology is widely employed and only cost issues prevent even more applications. The same holds for ultrafast laser technology.

One important question is the relation between imported and domestic systems, which becomes particularly interesting for fiber lasers. For low-power fiber lasers with <100 W, domestic laser manufacturers have taken over the market. For mid-power lasers of <1.5 kW, the share of domestic systems is at about 43% in 2017 and 2018. Only within the high-power segments of over 2 kW power do imported systems dominate the market with about 81% (estimate for 2018). But the number of domestic systems in this market has more than doubled every year within the last three years. A Chinese 10 kW prototype has been tested at the customer site, and a 20 kW system has been announced.

The picture is slightly different if we look at laser components. In 2017, components for about $2 billion have been imported and exports were at about $609 million. The imports grew much faster than the exports. In other words, foreign companies still dominate the market for core laser components.

Any forecast for the Chinese laser market strongly depends on relations between China and the U.S. Gu compared the two economies and had a look at the first consequences of their recent trade conflicts. While the trade dropped in 2016, it grew in 2017, and the trade deficit between both countries reached an all-time high of $375 billion. The most adverse effect became visible in the number of Chinese investments in the U.S.—from the first half of 2016 to the first half of 2018, it dropped more than 90%.

The actual issues to be solved between the two nations are plenty: Some are relatively easy to solve (such as protection of IP rights), while others are more difficult to deal with (for example, subsidies and state-owned enterprises). Although Gu listed eight major trade talk issues, he expressed his optimism that most of them will be solved.

His optimism is partly based on major strategic plans in China. One is “Made in China 2025,” in which China details its steps from a low-value adding manufacturing house toward a high-tech nation. This initiative refers to 10 key areas such as next-generation IT, new energy automobiles, bioengineering, and medical devices, all of which require lasers. Current tariffs hinder the development in these fields. On the other hand, as Gu showed, about 75% of U.S. companies plan for investments in China. So, there is currently a lot of uncertainty, which hopefully will be diminished by a new trade agreement in March.

In his conclusion, Gu drew a mixed picture: After a good year in 2018, the Chinese laser industry may face headwinds in 2019, depending on Sino-American relations. Personally, he expects “that China very soon is going to sign the deal with the U.S. and then just outplay everybody else, including the European Union.”

The laser business in China will grow substantially with applications such as welding, micro- and nanofabrication, cleaning, additive manufacturing, face recognition, displays, and more. For mature applications fields such as cutting and marking, the price erosion will continue.

CONTINUE READING >>>

DOWNLOAD FULL REPORT >>>

About the Author

Andreas Thoss

Contributing Editor, Germany

Andreas Thoss is the Managing Director of THOSS Media (Berlin) and has many years of experience in photonics-related research, publishing, marketing, and public relations. He worked with John Wiley & Sons until 2010, when he founded THOSS Media. In 2012, he founded the scientific journal Advanced Optical Technologies. His university research focused on ultrashort and ultra-intense laser pulses, and he holds several patents.