BIOPHOTONICS INSTRUMENTATION/COMMERCIALIZATION: From bench to business: NIH tech transfer needs industry

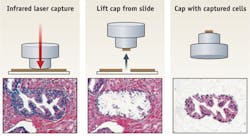

Over the last two decades, the National Institutes of Health (NIH) has fostered the commercial introduction of some 600 technologies, including laser capture microdissection (LCM; see figure as well as sidebar for details). Annually, sales from licensed projects top $6 billion and royalties reach almost $100 million. While these figures are strong enough to rank NIH among the Fortune 500, they also point to NIH's highly successful technology transfer program.

A small army of technology and business experts employed by NIH's Office of Technology Transfer (OTT) evaluate promising intramural laboratory prototypes and processes to determine if they are ready for commercialization. These inventions then become part of OTT's technology portfolio, which is available online (http://www.ott.nih.gov/Technologies/AbsSearchBox.aspx) for businesses to review. The current portfolio contains about 1,400 inventions from NIH's intramural labs and the U.S. Food and Drug Administration (FDA).

The actual transfer of technology from NIH to a business occurs through the execution of one or more research agreements. These include cooperative research and development agreements (used primarily for industry), exclusive and non-exclusive licenses, material transfer agreements, and biological material and patent licenses. In addition to assisting with intramural research transfer, OTT also provides patent and licensing guidance to those involved in NIH-funded extramural research.

In addition to assessing technology within the NIH laboratories, OTT staff tracks previously licensed inventions to measure their progress toward the goal of a commercially viable product. Staff also oversees royalty income distribution to inventors and their home institutes. Royalty payments to the institutes fund additional technology development and tech transfer expenses.

More for research tools

Since its founding in 1989, OTT has witnessed a gradual shift in the kinds of companies and agreements needed to transfer technology. Early on, OTT's resources focused primarily on agreements with large pharmaceutical companies. Now, OTT specialists spend more time assisting early stage companies, particularly start-ups. In 2011, over half of the 197 license agreements executed were with small companies. Between 2009 and 2011, the number of small U.S. businesses that licensed technology from NIH for the first time rose by 350%.1

The shift reflects the changing landscape of healthcare markets. "Back then companies weren't so fixated on late stage products," says OTT Deputy Director Steven M. Ferguson. "We still do a lot of agreements with pharmaceutical companies, but these are more for research tools."

Because early-stage technologies and early-stage companies have similar profiles, matching technologies with these firms is one of the easier parts of the tech-transfer process. "We're finding more and more interest from early-stage biotech companies," says Ferguson.

Creating agreements that suit small companies with limited capital often requires a two-stage process. Initially, OTT creates an agreement between the start-up and the technology innovator and then crafts a second agreement for late-stage clinical development. This second agreement usually involves a highly committed investment partner with extensive funding resources.

New options for small companies

To entice even more small companies to consider NIH-developed technologies, OTT has initiated two new efforts. The first, a pilot program begun in October 2011, offers specialized license agreements for start-ups. To qualify for the program, a life science company must be less than five years old, have 50 or fewer employees, and capital resources of $5 million or less. One of the goals of these agreements is to reduce the time and upfront costs required to execute an exclusive license.

Because patent filings can cost up to $50,000, the start-up agreements "make it easier for a company to get in the game if they find a technology they want to try to commercialize," says Ferguson. The express agreements also give NIH real-time feedback on a technology's chances of success. "If no one takes [a technology] on, then maybe it's not really a commercial product. If we find out early, maybe we can save some money." The pilot program ends September 30, 2012.

The second effort aimed at small businesses involves adding an "Entrepreneur-in-Residence" (EIR) to the OTT staff through a partnership with BioHealth Innovation-a Maryland economic development group. The EIR will examine OTT's portfolio and determine which technologies may be ripe for commercialization, but require a few additional elements to make them more attractive to commercial partners. "This 'second set of eyes' will help us to better understand the needs of start-ups and what these companies are looking for," explains Ferguson.

Partners with industry

Attracting businesses with continued improvements to NIH's tech transfer program will ensure that the U.S. remains a leader in healthcare innovation. Ferguson is keenly aware that the inventions created by NIH researchers are just the beginning of the product life cycle. "Even with the size of NIH, it's not the government who brings products to market. There are no medical devices or pills on the market that say, 'NIH Brand.' We need commercial partners. Without them, the things that matter most to patients such as therapies and medical devices would not be available."

REFERENCE

1. NIH Office of Technology Transfer, Annual Report FY-2011, http://www.ott.nih.gov/about_nih/AnnualReport-FY2011.pdf, accessed May 3, 2012.

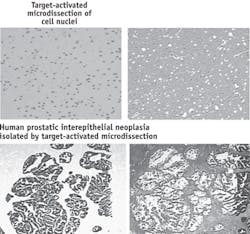

Laser capture microdissection: Commercialization with a ripple effect

One example of a highly successful NIH tech transfer involved laser capture microdissection (LCM)—now an integral tool for isolating individual or small groups of cells. Developed on NIH's Bethesda campus in the mid-1990s, the LCM technology was transferred to Arcturus Bioscience, a start-up formed to commercialize the product in 1996 through a cooperative research and development agreement. Once on the market, LCM generated $20 million in sales annually.Arcturus sold the LCM business for $10 million in 2006, and, after a series of acquisitions, it is now part of Life Technologies. LCM tech transfer spurred other companies such as Leica Microsystems and Zeiss to develop systems and to generate new tools based on the original technology. For six of the last eight years, LCM has ranked on NIH's top 20 commercial products list.

About the Author