When it comes to funding bioscience the federal government isn’t the only game in town. For the last decade states across the U.S. have taken a hard look at the biosciences and crafted economic initiatives to capitalize on this field’s promise. Those initiatives are now starting to pay dividends–big dividends in terms of jobs, revenues, and economic expansion.

In 2006 the bioscience field accounted for nearly 10 million U.S. jobs. Bioscience employment continues to expand with 5.7% growth since 2001 compared with just 3.1% in the private sector. And during the current financial meltdown, bioscience stocks have fared better than most. States are fully embracing biosciences as a critical piece to their economic future.

North Carolina, the “steady Freddy” of bioscience investment, has already invested $1 billion in bioscience and reaps a whopping $45 billion annually from that expenditure. In June 2008 two states, Maryland and Massachusetts, announced plans to invest $1 billion each in bioscience over the next decade.

“We’re just on the cusp of a real growth curve,” says Walter Plosila, former vice president of Battelle’s Technology Partnership Practice and an author of Technology, talent and capital: State Bioscience Initiatives 2008, a report commissioned by BIO (Biotechnology Industry Organization).

Even in economic downturns, Plosilla says he’d be surprised if bio-related programs were eliminated completely because “they are one of the few opportunity areas.” That’s not to say that the stewards of these initiatives can sit back and ride the wave. They have to be ready to partner with global entities if local opportunities shrink, which means continually building relationships within the state and across oceans. Arizona, for example, has found partners in Canada and Luxembourg to infuse capital into new ventures.

Support from the top

Gubernatorial support often favors the success of bioscience initiatives. When Janet Napolitano (the new U.S. secretary of homeland security) took office as Arizona’s Governor in 2002, she strongly supported the efforts to promote biosciences. “It was a really dramatic moment when she said, ‘I’m with you on this,’” says John Murphy, CEO of the Flinn Foundation, a private philanthropic supporter of nonprofit bioscience programs in Arizona. At that point, Arizona’s bioscience base was relatively small but a broad coalition of university, industry leaders, and philanthropic organizations had built momentum for bioscience both in the state legislature and with voters.

“We were able to create a supportive environment for startups,” says Murphy. Intellectual property rights policies were revamped, a tax-incentive plan was developed, and Battelle–working with the coalition–had produced a 10-year strategic plan in the form of a bioscience roadmap. Napolitano has continued to back bioscience, even chairing the Arizona Commission on Medical Education and Research. In a key staff move, Napolitano recently appointed Jan Lesher, director of the State Commerce Department, as her chief of staff. The Commerce Department oversees Arizona’s Science Foundation. “Lesher understands the issues and knows the players so this cannot help but make a difference,” says Murphy.

Creating a dialogue with policymakers is also critical to gaining support for bioscience initiatives. “Legislators sometimes don’t understand the issue [bioscience], don’t want to know about it, or want go with conventional wisdom,” says Plosila. But with the results of the November election he anticipates a more congenial legislative atmosphere for bioscience across the nation. Part of the education process is making lawmakers comfortable with the language and mission of the bioscience because “it [bioscience] scares people to death,” he says.

Paying for it all

So, states do all the right things to develop their bioscience initiatives: they build consensus that bioscience is a worthwhile investment and persuade corporate, academic, and government leaders that bioscience is the right economic path follow. How do they pay for this golden petri dish that may grow into an economic juggernaut? Many states must rely on tax revenues or general funds. This approach makes bioscience investment particularly vulnerable in economic downturns. “In these cases bioscience could wind up on the cutting room floor,” says Mel Billingsly, president and CEO of The Life Sciences Greenhouse of Central Pennsylvania (LSGPA), a public/private partnership aimed at commercializing bioscience technologies.

Some states, however, such as Pennsylvania, are growing their bioscience businesses with money from the Tobacco Settlement of 2001. This ruling resulted from the 1998 Master Settlement Agreement between major tobacco companies and 46 states. The agreement settled claims filed against the tobacco industry to recover Medicaid costs associated with treating smoking-related illnesses. In exchange for the states dropping their lawsuits, the tobacco companies agreed to make annual payments to the states in perpetuity.

“In the very beginning the Ridge administration had a big pile of cash to use [from the settlement],” says Billingsly. The use of unrestricted funds provides flexibility in shaping economic bioscience programs. Pennsylvania leaders opted to create three “greenhouses” in the state, each covering a specific bioscience area. The Central Pennsylvania greenhouse focuses on growing businesses whose targets are drug discovery and nanobiology. The Philadelphia area greenhouse promotes biopharmaceuticals and bioinformatics and the Pittsburgh greenhouse concentrates on programs supporting regenerative medicine, neurological medicine and devices.

In just five years Pennsylvania has created a bioscience triad–the greenhouses, venture capital funding, and funding to academic institutions for basic biomedical research that will exceed $1 billion according to Billingsly.

Planning for the future

Even the most successful bioscience initiatives will be tested in this severe economic climate as credit tightens, layoffs occur, and tax revenues decrease. Continued success will require identifying new research areas and reaching out to global partners. Rapidly evolving technologies also mean staying ahead of the curve. “It’s a constant race to stay in front,” says Arizona’s Murphy. “We’re always looking down the road.”

Not only will states have to consider what the next two or three new innovation platforms are, they’ll have to ensure that their information technology infrastructure and advanced manufacturing base can handle the demands of greater bandwidth and production tolerances.

State bioscience boosters seem eager to embrace these challenges and mindful of what’s at stake. As Pennsylvania’s Billingsly puts it, “You don’t invest in biosciences per quarter. You invest in diverse new approaches that will transform human health.”

Rating the States

In the Battelle report, Technology, talent and capital: State Bioscience Initiatives 2008, the authors highlight what’s going right with bioscience at the state level and offer guidance on how to ensure bioscience investment pays off. Eight key elements are essential to build a robust state and regional economy based on bioscience:

- Engaged universities with active leadership

- Supportive environments for entrepreneurs with strong networks across sectors and with industry

- Funding for all stages of the business cycle

- Additional capital whether from the federal government or other sources

- A strong workforce

- An infrastructure of facilities and equipment

- Business, tax, and regulatory policies that ease the way for innovation

- A focus on the longer-term future rather than the next economic quarter

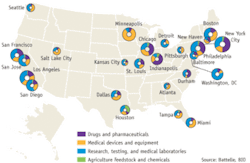

Ever-widening market opportunities are also making states more successful because they can leverage a number of different technology sectors. The traditional bioscience arena–drug development, medical devices and equipment, research, testing and medical laboratories–has grown to include agriculture feedstock and chemicals and now energy. Read the report at the BIO website: http://bio.org/local/battelle2008.

About the Author