Annual Laser Market Review & Forecast: Can laser markets trump a global slowdown?

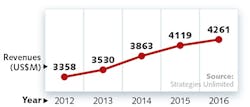

Can the laser industry, with its ability to forge 21st century innovations1 while leveraging its newfound International Year of Light clout,2 manage to trump a global slowdown by actually beating approximate 3% worldwide gross domestic product (GDP) growth3 projections? Our answer: yes. Our worldwide laser sales forecast calls for 4.2% growth in 2016 to nearly $10.5 billion.

More than seven years have passed since the start of the global financial crisis of 2008/2009 that left laser markets in a state of "high anxiety."4 Stock markets recovered and, in some cases, temporarily surged to new highs: the UK's FTSE 100 approached its near-7000 peaks in 2000, 2007, and 2014/early 2015, and the Shanghai Stock Exchange (SSE) touched 5000 in mid-2015 after a post-recession drop to around 2000.

Although the late 2015 Dow Jones Industrial Average rallied to more than 18,000 (from the 2009 low of around 7000), there are signs of trouble worldwide. Europe continues to see high unemployment and now a refugee crisis, quantitative easing in the U.S. has reached an end, orders for non-defense capital goods in the U.S. declined5 3.8% in the first 10 months of 2015, fears of rising interest rates loom, and, as of November, China's Caixin purchasing manager's index (PMI)6 has been below the nominal 50 value in each of the past nine months.

Even the Organisation for Economic Co-operation and Development (OECD; Paris, France) said in November 2015, "Emerging market challenges, weak trade and concerns about potential output suggest higher downside risks7 and vulnerabilities compared with the OECD's June Outlook," and forecasts "weakened global growth to around 2.9% this year—well below the long-run average."

And yet, for some companies, laser sales refuse to be anything but average. The materials-processing portfolio of fiber lasers from IPG Photonics (Oxford, MA) continues to gain market share from mechanical/conventional cutting and welding tools, leaving the company to bask in the glow of 22% revenue growth in Q3 2015 to $243.5 million, while laser additive manufacturing (LAM) or 3D printing systems company EOS (Munich, Germany) saw revenue rise 53% in 20158 to $282 million on the sales of 400 systems, bringing its worldwide installed base to 2000 systems over its 26-year history.

While these high double-digit growth rates are outliers among the 5.5% average revenue growth seen from 2012 through 2014 for the 15 major laser companies that we track, the global success of fiber lasers and 3D printing systems are by no means anomalies. They are simply two examples—among many more—of winning laser technologies that should be able to beat the pack in any economic environment by improving ROI and manufacturing efficiencies for industrialized and emerging economies alike.

Bulls and bears

"The U.S. cannot depend on exports when its neighbors are hurting," says Ken Kaufmann, VP of marketing at Hamamatsu (Bridgewater, NJ). "China is slowing despite low oil prices, Australia and Brazil are in danger of recession due to their dependence on commodity exports to China, and Europe is caught in a sub-2% growth rut." Indeed, the global economies are intertwined and interdependent.

And yet, Kaufmann is bullish on technology: "Aging populations translate to a strong bioinstrumentation and medical industry, the oil and gas industry will require increased emissions monitoring, and the corresponding need for sensing instrumentation and quantum cascade laser [QCL] technology, for example, and electronics/cameras/imaging equipment will surge for Internet of Things [IoT] applications."

In Japan, Hamamatsu's GM of overseas sales management Atsushi Tsujimura says "Japan's economy is improving; corporate earnings and personal consumption remain high, and exporting companies retain price competitiveness due to the favorable exchange rate." Tsujimura points out that despite overall economic slowing, noninvasive, noncontact, and nondestructive methods enabled by photonics and lasers are highly sought after. "We expect demand to continue for lasers and LEDs paired with our detectors, photomultiplier tubes, photodiodes, and imaging devices," he says.

"The Wall Street Journal and New York Times paint a negative picture; economics can be largely psychological and threats of a downturn perpetuate the possibility—but underlying fundamentals are strong if you look at the future demands of the growing urbanization in China for the next 10–20 years," says Bo Gu, president of Bos Photonics, a consulting firm located in Boston, MA. "Each year, about 22 million new Chinese urbanites will fuel the economy—needing housing, cars, and middle-class electronic devices. The world may see growth slowing in China, but 6.8% is still a tremendous high-water mark in a sea of 3% nominal growth worldwide, considering that China is already the second largest economy in the world."

A BRIC foundation

First and foremost, talk of China and its slowing growth consumes the conversation on Wall Street and the financial halls of Europe, since many major laser manufacturers sell into this emerging powerhouse. An interactive chart in The Economist9 allows you to predict when China's gross domestic product (GPD) will exceed that of the U.S., based on GPD growth, inflation, and Yuan appreciation/depreciation values. While the year varies according to the inputs, it will probably happen around 2020 despite the fact that the International Monetary Fund forecasts10 China's GDP growth rate to drop from 6.8% in 2015 to 6.3% in 2016—nonetheless, very healthy figures compared to the slight uptick from 2.6% to 2.8% in 2015 and 2016, respectively, forecast for U.S. GDP growth.

Companies like Coherent (Santa Clara, CA) continue to profit from China's success in certain market areas, especially considering that sales to Asia account for 51% of its revenues followed by 26% to North America and 17% into Europe. Coherent's fiscal Q4 sales for the period ended October 5, 2015, were up modestly to $802.5 million from $794.6 million on strong sales of its Linebeam laser systems for flat-panel display (FPD) processing. In fact, sales to China were strong, as IHS (Englewood, CO) expects China to dominate the FPD market11 with a 35% market share by 2018.

China has also been acquiring technologies and IP in disk drives, CMOS image sensors, servers, memory chips, and advanced semiconductor packaging and test services. And while Gartner (Stamford, CT) forecasts12 that semiconductor capital equipment spending will be down 1% in 2015 and down 3.3% more in 2016, it is predicted that China's chip production will outpace the growth of the overall integrated circuit (IC) market,13 thanks to government investment of nearly $170 billion over the next 5–10 years.

Historically, much of the qualitative summary for our readers in this report has focused on the U.S., Europe, and China. But what is happening in the remaining BRIC nations of Brazil, Russia, and India, as well as other emerging markets such as Africa? Are these nations importing or exporting laser technology, and will their evolution from emerging to industrialized countries allow them to build a sturdy foundation for future laser sales growth?

"The so-called BRIC market is funneling down into a C-market; only China is significantly contributing to laser sales," says Jörg Neukum, sales and marketing director at Dilas Diodenlaser (Mainz, Germany). "Brazil does not have significant OEM industries integrating high-power laser diodes and Brazil's needs in laser processing are mainly served by European or American laser system providers, besides a few local laser machine builders. Exchange rate issues have slowed the ability of Russian customers to buy abroad and more importantly, Russia has been under extreme export control because of the Ukrainian conflict and we weren't able to deliver to even long-term customers." And finally, Neukum adds, "India has mainly been a scientific market for us, but with all the boundary conditions of tenders and/or export licenses."

To put India into perspective, sources tell us that they have something like 70 high-power laser cutting machines vs. 1500 or more in China—so just about 5% of Chinese volumes. Although India manufactures and sells $6000 cars and could benefit from laser technology, their infrastructure and bureaucratic development methods support a larger workforce and less automation.

Today, many lower-power laser sales to India and Africa go to Chinese suppliers, but U.S.- and European-based suppliers are carefully following these emerging markets as well as burgeoning markets in Mexico, where there is a lot of investment from automotive and electronics manufacturers. These suppliers are also following Russia for applications in telecommunications and pipe welding and cladding to support mining and oil and gas operations.

Beam delivery advances for high-power lasers have enabled them to overtake traditional plasma techniques for thick-material cutting and, in some cases, 4X faster welding speeds that bring about compelling manufacturing efficiencies that even emerging countries with cheap labor forces will embrace. In addition to the major cutting, welding, ablation, and additive manufacturing markets for fiber laser materials processing, there are another hundred or so applications like medical device processing and laser projection that represent very strong growth opportunities for any laser company—growth that is capable of outpacing global GDP.

Beware commoditization

Indeed, the presence of surveillance cameras on nearly every street corner and shopping center exemplifies the ubiquitous presence of technology in our society. And like cameras, lasers are joining the OEM equipment list for high-volume ubiquitous applications. Already, miniature $100 light detection and ranging (lidar) systems16 promise all-seeing drones and affordable self-driving cars, and freeform optics17 deliver automotive laser diode lighting and complex light-emitting diode (LED) luminaire designs.

Unfortunately, as the laser solution grows in various applications, volumes rise and manufacturing costs (and selling price) inevitably fall, resulting in lower margins and the commoditization/price erosion status18 that has plagued many telecommunications component suppliers and CD/DVD optical storage laser manufacturers.

One case in point is the decision by General Electric (GE; Fairfield, CT) to rethink the profitability model for its lighting business, especially for LED-based light bulbs. "Lighting is our oldest business. The combination of LEDs and analytics puts a computer where a light bulb used to be," said Jeff Immelt in his CEO letter19 within GE's 2014 annual report. "In cities around the world, GE is working to transform street lighting into the analytical brain of urban life."

An article in Lux Review20 surmises that GE aims to use the bulb as a loss leader in a more profitable lighting services and infrastructure business, considering that the price of an LED light bulb has dropped from $25 to less than $4 over the past three years—a trajectory with little room for respectable margins and nearly zero replacement business for a product that lasts 20 years. This reality easily extends to high-volume laser applications, wherein a "niche" product may indeed prove more profitable than the next "hot" laser technology that falls victim to gross-margin depletion.

"Be careful what you wish for," says Tom Hausken, senior advisor for The Optical Society (OSA; Washington, DC). "The technology in a quantum-well laser in a 400G transceiver or a kilowatt fiber laser or a smartphone display is phenomenal. For an average person, it's indistinguishable from magic. But sometimes we engineers are too smart for our own good. Achieving rapid technological improvement and submitting to the tyranny of standards can mean that the return on R&D for one generation is not fully captured before another takes over the market. Good examples are solar cells and LEDs," adds Hausken. "Ambitious goals for price declines have been achieved, but now it's hard to make a profit. Alternatively, companies selling what I call dumb 'bent metal' products can often earn better margins by buying low-margin products like FTTH [fiber-to-the-home] lasers or LEDs and sticking them in an enclosure that meets the customers' needs."

But Hausken isn't advising against high-volume laser sales. "Companies that get to market first reap the benefits in terms of premium pricing, scale, and return on investment. It also places them in a better position for the next big thing."

AIM high

In the U.S., government agencies are betting that the next big thing can only come from targeted investment in key scientific disciplines. To that end, the National Network for Manufacturing Innovation (NNMI) was designed to coordinate public and private investment in emerging advanced manufacturing technologies, bringing together industry, academia, and government partners to advance manufacturing innovation and accelerate commercialization.

Of the seven Institutes for Manufacturing Innovation already established by the Obama Administration, the first was America Makes, focusing on additive manufacturing and 3D printing. In mid-2015, a consortium led by the State University of New York (SUNY) was awarded a $110 million matching grant by the Department of Defense to establish the Integrated Photonics Institute for Manufacturing Innovation (IP-IMI), now called the American Institute for Manufacturing Integrated Photonics or AIM Photonics. This IP-IMI21 is intended to advance the state-of-the-art in the design, manufacture, testing, assembly, and packaging of photonic integrated circuits (PICs).

In Europe, the Framework Programmes and Key Enabling Technologies (KET) centers for advanced manufacturing and materials, industrial biotechnology, micro-/nanoelectronics, photonics, and nanotechnology have blazed a trail for Horizon 2020, the European Union's Research and Innovation program, with nearly $85 billion in funding available from 2014 to 2020 (in addition to private investments). The funding aims to generate breakthroughs in science and industry while tackling societal challenges and taking ideas from the laboratory to the marketplace.

And as part of its "Made in China 2025" roadmap to be the world's leading manufacturing country in the next 10 years, the Chinese government also plans to create a "golden decade for the laser industry."22 In November 2015, during the 12th Optics Valley of China International Optoelectronic Exposition and Forum, Min Dayong, president of HG Laser (Wuhan, China), said that as an advanced manufacturing tool, the laser will play an important role in transforming China into a world-leading manufacturing giant in the next 10 years.

International photonics programs continue to benefit the laser industry by raising awareness of light-based technologies and hopefully improving the funding situation for small and large laser companies alike.

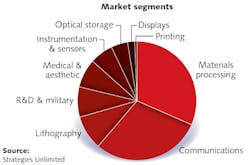

The Laser Market Segments

This year, laser revenues in the communications and optical storage segment were surpassed by materials processing and lithography laser revenues, primarily because of the commoditization issues discussed in our introduction. Lasers for scientific and military markets are the third-largest revenue segment, followed by medical and aesthetic and instrumentation and sensor markets, respectively. Entertainment, displays, and image-recording segments continue to be small—yet important—laser categories.

Materials processing and lithography

Not since the great recession of 2008/2009 has there been such uncertainty in the global manufacturing sector. World economic conditions have deteriorated in the past few months with faltering demand for finished goods in China, Southeast Asia, Europe, and the Middle East, leading to empty container ships leaving U.S. West Coast ports for the return to Asia. Even U.S. manufacturing, which had remained strong when other economies did not, began to feel the fallout as exports decreased along with consumer demand for nonessential goods.

So it was with considerable trepidation that this year's analysis of the global market for industrial lasers was put together in a rather gloomy atmosphere, where the impact that global hotspots were having on world manufacturing was drawn from headlines in business media.

Just as Europe was managing to show signs of stabilization after months of troubling economic news, a scandal at the world's leading auto company and disaster in the form of terrorist attacks shook Western Europe, leading to concerns that escalation would quench growth in the Eurozone economies. An economic slowdown in Asia, led by confusing market conditions in China and Japan (the latter now in its second recession since the election of a pro-business Prime Minister), was only exacerbated by the fact that the hoped-for contribution from emerging nations and the rest of the world did not happen.

Countering this depressing news was the upbeat attitude in the industrial laser sector, led by positive financial news from the leading makers of these products. Setting the tone was Trumpf (Ditzingen, Germany), the largest industrial laser/system supplier, whose Laser Technology group turned in a sterling 16.8% growth to $946 million in its 2014/15 fiscal year ended with the company as a whole expecting single-digit growth for the 2015/16 period.

Challenging Trumpf for market leadership is fiber laser manufacturer IPG Photonics, who reported outstanding 22% growth in the third quarter and predicted seasonally adjusted fourth quarter sales growth that would take the company close to the $1 billion revenue level. Following this are Coherent ($802 million, up 1%) and Rofin-Sinar Technologies (Plymouth, MI, and Hamburg, Germany; $520 million, down 2%).

So, what is going on here? Is the laser industry out of sync with global manufacturing in terms of market strength? Or is the historical exuberance of the technology clouding its view? After all, there is only one company turning in strong double-digit growth quarter to quarter: IPG Photonics. Industrial Laser Solutions tracks four-dozen global public companies and although overall quarterly performance is mixed, the largest companies have shown growth through the three quarters reported. These tend to be suppliers of fiber and ultrafast lasers. But aren't these lasers being used by the manufacturers experiencing economic difficulties in the market sectors identified above?

The answer is yes and no. The laser industry, which had finally come into sync with the cycles of international machine tool sales, could be lagging the curve again, supported by strong sales in key market sectors extending into first-half 2016 revenues. And the substantive revenue growth of fiber and ultrafast lasers in specific industries is towing the revenue numbers of the underperforming others along with it.

Revenue numbers for 2014 have been adjusted compared to those Industrial Laser Solutions published in January 2015, as our partner, Strategies Unlimited (who collects this data), made category changes that reflect evolution in the technology. Also note that high-power disk laser revenues are counted in the solid-state category.

In 2015, industrial laser revenues grew by 6.9%, led by the continued strong growth (22%) of fiber lasers for macroprocessing applications. Macromaterials processing represents about half of all industrial laser revenues—understandable because these lasers typically carry a high selling price per unit. Overall, macromaterial processing grew 9%, boosted by a 17% increase in welding installations.

Fiber laser growth continued at a high level in 2015, as this technology increases its share of the total market at the expense of carbon-dioxide (CO2, -5%) and solid-state (0%) lasers. Fiber laser applications grew across the board with a 6% increase in low-power lasers for marking, a 10% increase in medium-power micromaterials processing, and a 22% increase in macro applications, of which metal cutting grew 5%—consistent with growth in that industry.

Carbon-dioxide lasers lost market share across the board from low- to high-power, as a combination of medium- to high-power fiber and disk lasers eroded market shares. Solid-state lasers remained flat, as higher revenues in disk lasers offset declines in diode-pumped solid-state (DPSS) marking applications. The expected growth in high-power diodes for cutting and welding will shift to 2016.

The first indication of slowness in the laser manufacturing marketplace shows up in the 2015 modest single-digit growth in marking (4%) and micromaterials processing (4%) compared to the more-robust 9% for macroprocessing.

And then there is laser additive manufacturing—sometimes erroneously called 3D printing—which is technically not always a laser application. The use of all types of industrial lasers as a power source for direct-metal laser deposition or sintering for additive manufacturing has caught the imagination of global manufacturers, and sales of modest- to very-large size processing systems has grown rapidly. In 2015, it is 71% over 2014, and will likely do so again in 2016.

The semiconductor/PC board/display market took a hit in 2015 and, consequently, industrial lasers followed, showing the largest decline (-13%) of all the applications. This is, for the most part, a cyclical phenomenon that industry has experienced before and even though zero growth is anticipated in 2015, industry expects to see a pickup in the second half as consumer buying grows.

Solar power applications were strong (9%) for micromaterials processing in 2015, as electric power rate increases drove more home-owning consumers in the U.S. to solar power. Subsidy revisions will likely slow that growth rate to 5% in 2016.

As we look at the various laser markets, it is apparent that, with the few exceptions mentioned, most of the applications are in the positive column for 2015. This realization takes us back to the opening statement in the materials processing segment, namely that the laser industry is out of sync with global manufacturing. This seems to be the case with certain industries: aerospace, automotive (SUV and light truck), fabricated metal products, and medical devices holding strong in early 2016 and consumer-driven slowness in electronics, appliances, and semiconductors carrying over into 2016. Industry tells us that 2016 will see slower growth after a good start. In essence, we are assuming 2016 to be a repeat of 2015, which wasn't all that bad.

Materials processing & lithography

Includes lasers used for all types of metal processing (welding, cutting, annealing, drilling); semiconductor and microelectronics manufacturing (lithography, scribing, defect repair, via drilling); marking of all materials; and other materials processing (such as cutting and welding organics, rapid prototyping, micromachining, and grating manufacture). Also includes lasers for lithography.

Despite a weak economy in most of Europe, the well-publicized slowing economy in China, and a strong dollar in the U.S., industrial laser sales managed to remain quite strong, especially high-power fiber laser sales. Automotive sales reached a record in 2015, especially light trucks and SUVs, and this helped drive sales for metal cutting.

In China, laser sales are in large part being supplemented by the Chinese Government's ambitions to become a hub of advanced manufacturing, with sales of lasers for this purpose being immune to any economic slowdowns. Sales of lasers for marking and other lower power applications did slow a bit, but sales of ultrafast lasers have remained strong.

Communications and optical storage

In 2015, companies like Oclaro (San Jose, CA), Infinera (Sunnyvale, CA), Finisar (Sunnyvale, CA), and NeoPhotonics (San Jose, CA) leveraged their silicon photonics and/or PIC expertise to nicely grow their telecom laser sales.

Oclaro's first fiscal quarter ended September 26, 2015 saw sales of $87.5 million compared to $82.2 million in the prior quarter, citing strong growth in its indium phosphide (InP) PIC-based 100G product offering. For this same quarter, Infinera's sales leaped to $232.5 million from $207.3 million in the previous quarter and just $173.6 million in the same quarter last year on strong metro and long-haul sales, and claimed in its financial summary that the company is "the most vertically integrated transport provider in the world."

Finisar's sales of products for telecom applications grew 2.3% for the quarter ended November 1, 2015, with revenue strength driven by 100G Ethernet transceivers and 10 GB tunable transceivers and wavelength-selective switches. And NeoPhotonics' sales for the quarter ended September 30, 2015 were up 2.4% from the same quarter last year to $83.6 million on strong 100G sales as they work to extend their products to 400G and beyond.

"Multimode fiber-optic links continue to thrive in datacenters for connections up to 300 m although the increasing data rates of 25 Gbit/s and 50 Gbit/s will limit distances to sub-100 m," says Michael Lebby, CEO of OneChip Photonics (Ottawa, ON, Canada) and Lightwave Logic (Longmont, CO) board member. "Single-mode fiber-optic links are now the preferred platform for 2 km and 10 km links, and as cost levels become more competitive, single-mode links will compete more head-on with multimode at distances in the 100 m range."

Lebby continues, "VCSELs, which are the basis source emitter for multimode links, will still hold the very short-distance links markets below 100 m, but 1310 nm-based FP [Fabry-Perot] and DFB [distributed feedback] laser devices integrated into PIC platforms will gain favor as single-mode PIC solutions continue to grow given the stringent power consumption levels, size, and cost limits imposed by the big datacenter customers. Furthermore, it is not clear what the PIC platform should be over the next five years—we know indium phosphide is the incumbent today, but silicon photonics and polymer photonics are both contenders for this market that could change the dynamics of transceiver design significantly."

"PIC-based silicon photonics are still 10 times more expensive than discrete FP and DFB lasers, yet necessary to reduce power consumption for new datacenter builds," Lebby cautions. "However, few established companies seem to be willing to take on the low margins insisted upon by the ultralarge datacenter companies that are becoming big customers of fiber-optic transceivers. In fact, it is these datacenter companies that have injected chaos—for want of a better term-into the telecom and datacom markets by demanding certain price/performance levels regardless of how their suppliers fare financially. For that reason, Taiwanese and Chinese companies will probably reap the benefits long-term as they are willing to take on lower margins at high volumes."

"Profits in the laser communications sector come primarily from lasers based on indium-gallium-arsenide-phosphide/InP (InGaAsP/InP) materials—low-power, single-mode lasers with gigabit modulation," says Carlos Lee, director general of EPIC. "Customers are a small group of systems manufacturers: Alcatel-Lucent and Huawei, for example, who use these components to design highly functional communications systems that meet network requirements."

Lee continues, "The sector is led by Finisar with 16% of the sector revenues in 2014, but most suppliers are from the U.S. or Asia. Because the communications component market typically evolves into a high-volume, low-price scenario, every company we have studied is diversifying its products to meet demand in other market segments."

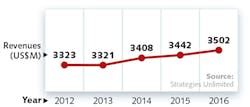

For 2016, we expect laser communications and data storage sales to reach more than $3.5 billion, around 1.7% higher than 2015 revenues.

Communications & optical storage

Includes all laser diodes used in telecommunications, data communications, and optical storage applications, including pumps for optical amplifiers.

Although 2013-2015 remained relatively strong in the communications sector, there are signs that 2016 and beyond may be slowing. This segment tends to be driven by wired and wireless data and voice demand, and while wired and wireless traffic are growing every year, the rate of this growth is slowing. In addition, service providers tend to upgrade their networks in spurts, when newer technologies are deployed network-wide. However, both wireline and wireless are between transitions, and the next generation of wireless technology won't arrive until 2020.

As for optical storage, the prospects continue to remain dim. DVD, CD, and Blu-ray media sales continue to drop, and more cloud-based solutions are eliminating the need for large local storage. Heat-assisted magnetic recording (HAMR), which uses a laser to increase storage capacity of magnetic media, has been promised for many years now. Seagate says it will arrive in 2017, but by then, will it really matter? Maybe for large datacenters, if anywhere.

Scientific research and military

Global R&D spending is forecast to increase in 2014 and 2015 (although at a decreasing rate in 2015) according to the 2014 Global R&D Funding Forecast23 from Battelle (Columbus, OH). Currently, the U.S., China, Japan, and Europe comprise 78% of the $1.6 trillion R&D spending forecast for 2014. Furthermore, China's total R&D spending is forecast to take first place ahead of the U.S. by 2022.

Even though Japan accounts for 10% of the total global R&D spending, Paradigm Laser Research (Tokyo, Japan) president Kunihiko Washio says, "The many imports from Europe have slowed laser development in Japan, and Japanese government investment in industrial laser technology has been sluggish until quite recently." Washio says that Japan is now reconsidering the value of lasers for processing novel high-value-added materials such as wide-bandgap silicon carbide (SiC) for high-temperature power devices and lightweight, high-strength composites such as carbon-fiber reinforced polymer (CFRP) for eco-friendly vehicles. He adds, "Japan is now going to invest in development of high-brightness and highly efficient lasers in short and ultrashort pulsed modes, as well as in CW operation modes."

Ultrafast or ultrashort-pulse lasers continue to be at the forefront of new materials processing and scientific applications, with a tremendous amount of R&D needed to bring these lasers out of the laboratory and into mainstream applications. In particular, as Washio understands, ultrashort beam delivery options using kagome24 or photonic-crystal fiber varieties need to improve to reach parity with legacy CW solid-state laser capabilities.

Fortunately, companies like Photonic Tools (Berlin, Germany) have already developed a microstructured hollow-core fiber (MHCF) ultrafast laser beam delivery system that transmits more than 100 W of average power of picosecond and femtosecond pulses with 90% transmission throughput while maintaining single-mode performance.

Helium-cadmium (HeCd) lasers at 325 and 442 nm comprise 95% of the sales for Kimmon Koha (Tokyo, Japan), which has seen slow and steady growth for applications ranging from inspection to Raman spectroscopy to photoluminescence studies. Kimmon Koha executive director Masamori Nakahara says ultraviolet HeCd lasers are enjoying double-digit growth, but that the weak Japanese yen has made imported materials very expensive, hurting profitability.

In the U.S., Newport (Irvine, CA) provides a good metric for the health of laser and photonics R&D markets, and reports scientific research revenue in its financial statements. For its third quarter ended October 3, 2015, Newport reported sales of $147.6 million, down only 0.3% from the prior quarter but up 0.9% from the same quarter the previous year. But despite weakness in its microelectronics and industrial manufacturing sectors, sales were up 9% from the prior quarter and up 13% from the previous quarter last year in its scientific research markets, in keeping with the positive trend of Battelle's global R&D funding projections.

Unlike its strength in the R&D markets, however, Newport's defense and security sales were 2% lower than the prior quarter and orders were down 13.7%—more than any other sector. But Newport's defense sales do not correlate well with major military system providers. BAE Systems (London, England) saw sales for the six months ended June 30, 2015 grow 11% to $12.7 billion compared to the same half last year. Similarly, Thales Group (Paris, France) first-half 2015 sales were also up 11% to $6.73 billion.

While we don't see military laser sales growing at these rates, we do forecast an increase in military laser revenue, led by an increase in high-power and mid-IR laser technology in particular. High-power laser companies like IPG Photonics are benefiting from a surge in directed-energy weapon (DEW) R&D projects from tier 1 defense contractors, even though many of these projects have a long gestation period.

In August 2015, the U.S. Army awarded Northrop Grumman (Los Angeles, CA) a more-than $35 million contract for engineering and manufacturing development and low-rate initial production of products for the Common Infrared Countermeasure (CIRCM) program. Northrop Grumman industry partner Daylight Solutions (San Diego, CA) will benefit by providing QCL technology for directed-laser jamming of IR missile threats.

And, as we reveal in our November Laser Focus World cover story, QCLs are making inroads in defense, biomedical, and security markets beyond IR countermeasures: Pendar Technologies (Cambridge, MA) is developing a compact QCL array module25 that operates from 7 to 11 μm for standoff explosives detection as part of the Department of Homeland Security (DHS) Widely Tunable Infrared Source (WTIRS) program.

Scientific research & military

Includes lasers used for fundamental research and development, such as by universities and national laboratories, and new and existing military applications, such as rangefinders, illuminators, infrared (IR) countermeasures, and directed-energy weapons research.

What a difference a year makes. While the U.S. Government shutdown in 2013 greatly disrupted spending on both research and military lasers (which only partially corrected in 2014), 2015 was essentially back to business as usual. While research spending overall remains flat in the U.S. and Europe, the percentage spent on lasers is definitely increasing, and research on lasers used for lighting, transportation, and for medical purposes have all increased in this past year. Research spending by China continues to increase, and could overtake spending by the U.S. in 2020.

Lasers are also playing a much larger role within the military. Gone are the grandiose Star Wars weapons that never reached their goal of destroying distant intercontinental ballistic missiles. Instead, laser-directed weapons are now used to neutralize the close-range threat of a small plane or drone attacking an aircraft carrier or even land-based targets. In September 2015, Northrop Grumman received a $35M contract to produce IR countermeasure systems for light aircraft for the first time using quantum cascade lasers (QCLs). Future contracts for just these systems could well exceed $1.5B over the next five years.

Medical and aesthetic

"We saw strong interest in our OEM Instrument Quality IQ lasers for biomedical applications that require wavelength and power stability," says Walter Burgess, VP of sales and engineering for Power Technology (Little Rock, AR). "The economy forced many customers to source lower-cost lasers from Asia in 2014 and those customers suffering with that decision have been actively pursuing higher-quality products made in the USA. Though sales growth was modest from 2014 to 2015, we expect 10% growth for 2016 leveraging the success of our Grande laser diode module that offers up to 20 W of laser light—10 times the amount we offered last year in a single laser."

Wavelength-specific laser diodes are also in demand for photodynamic therapy (PDT) applications. For example, Theralase Technologies (Toronto, ON, Canada) is developing a range of photodynamic compounds (PDCs) that absorb red, green, and near-IR light to destroy cancer cells,26 and is currently working on Health Canada and FDA approval. A recent trial in rats of one of its osmium-based PDCs completely destroyed muscle-invasive bladder cancer (MIBC) tumors while leaving surrounding tissues and blood vessels unaffected by the treatment.

And like last year, Modulight (Tampere, Finland) saw no signs of a slowing economy and grew its medical laser system sales 30% once again as it focused less on military/industrial accounts. Modulight executive chairman Seppo Orsila said its ML7710 PDT laser system—with wavelengths from 400 to 2000 nm for a variety of applications from dentistry to surgery to photodisinfection—has expanded from exclusive use by one pharmaceutical company to now more than half a dozen.

For GSI Group (Bedford, MA)—owners of Synrad, Cambridge Technology, and, most recently, Lincoln Laser,27 Q3 2015 revenue was $92.3 million, an increase of 4% from $88.8 million in Q3 2014. In the financial release, GSI CEO John Roush said, "During the quarter, we had strong orders from medical applications, which helped to mitigate the weakness we are now seeing in the advanced industrial end markets."

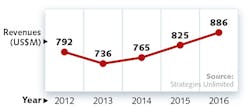

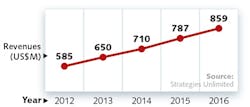

Our global medical and aesthetic laser sales figure for 2015 of $787 million is anticipated to remain on a healthy trajectory and grow to $859 million in 2016.

In the laser aesthetics markets, Cutera (Brisbane, CA) reported Q3 revenues for the period ended September 30, 2015 of $23.1 million-a 23% increase over the same quarter last year (with an 80% increase in North America) and its fifth consecutive quarter of double-digit revenue growth. The significant sales growth was attributed to its enlighten dual-wavelength (1064 nm + 532 nm) dual-pulse duration (750 ps + 2 ns) laser systems for tattoo removal and the treatment of benign pigmented lesions, as well as its excel HR long-pulse 1064 nm Nd:YAG laser and a new high-power 755 nm alexandrite laser for hair removal.

Geographically, aesthetic laser sales are growing the fastest in North America. Syneron Medical (Irvine, CA) saw 15% revenue growth in North America in Q3 2015 to $62.1 million—3% year-over-year growth, but 8% in constant currency. Similarly, Cynosure (Westford, MA) grew revenues by 10% in Q3 2015 to $78.4 million, with 29% of that revenue from North America. Compared with the same quarter last year, Cynosure said international revenue was flat because of unfavorable foreign currency exchange rates and continued weakness in Europe and China.

"With 75% of our sales in Europe, 10% in the Middle East, and 15% in Asia, we were pleased to see southern Europeans spending again on nonessential items as the economy there slowly recovers from seven years of high unemployment," says Carles Oriach Font, sales and marketing director at Monocrom (Barcelona, Spain). "Sales of our OEM lasers grew 40% in 2015 as system providers managed to complete certain FDA and CE approvals. Currently, there is a shift in our sales from high-power >2 kW lasers to lower-power lasers <1.2 kW needed for aesthetic laser devices, and next year, we anticipate sales growing 25%."

Those who say that aesthetic lasers represent a true "killer app" wouldn't be wrong, but beyond aesthetic and even surgical applications, lasers are about to gain even more notoriety through the Qualcomm Tricorder X-Prize competition (see http://tricorder.xprize.org). As of November 2015, seven finalist teams had been selected to demonstrate their handheld devices capable of measuring key health indicators such as blood pressure, respiration, and temperature, as well as diagnosing 15 diseases. Of the seven finalists, at least two disclose the use of laser technology: the DNA Medicine Institute (DMI; Cambridge, MA) uses laser fluorescence and Danvantri (Chennai, India) uses a variety of components, including a light-based pulse oximeter and IR laser diodes.

Regardless of which team wins the competition, the medical laser segment will continue to diversify, even in difficult economic environments—an aging population is an unfortunate reality of most industrialized nations, and laser-based point-of-care diagnostic tools such as a diode-laser-based breath screen for tuberculosis28 and a laser-based eye test for early Alzheimer's disease detection29 will continue to serve both industrialized and emerging nations alike.

Medical & aesthetic

Includes all lasers used for ophthalmology (including refractive surgery and photocoagulation), surgical, dental, therapeutic, skin, hair, and other cosmetic applications.

The medical laser market has remained resilient and seems to weather any economic fluctuations with ease. Lasers used for cosmetology and dermatology were especially strong in 2015, with surgical lasers coming in at a close second. While lasers have a long history of use in medicine, only in the last few years have lasers become robust and reliable enough to be used in smaller medical offices at a reasonable cost while not requiring excessive maintenance and adjustments. Dental lasers still remain a rather small market, as in many cases they are still beyond the means of many smaller dental practices.

Instrumentation and sensors

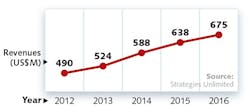

Spectroscopy, multiphoton microscopy and its myriad variations, optical coherence tomography (OCT), lidar, and distributed fiber-optic and acousto-optic sensing systems are among the numerous laser-based instrumentation and sensing systems enjoying widespread and, yes, increasingly ubiquitous use worldwide. We forecast that this laser segment will grow to $675 million in 2016.

Interestingly enough, countries large and small are cashing in on the use of lasers for a variety of instrumentation and sensing applications. A 2013 presentation30 from the Lithuanian Laser Association (Vilnius, Lithuania) claimed that Lithuania held more than 50% of the world market for high-energy picosecond lasers and ultrafast parametric light generators, and saw 2012 sales of nearly $64 million from 22 laser technology companies employing 600 individuals—10% having PhD degrees.

Although 25% of its sales come from industrial materials processing markets, Lithuanian laser companies (all listed here are in Vilnius) are heavily engaged in supplying lasers for instrumentation and sensing: Brolis Semiconductors' mid-IR semiconductor broadband gain chips suit widely tunable spectroscopy applications; Ekspla manufactures terahertz, second-harmonic generation (SHG), vibrational sum frequency generation (SFG), and coherent anti-Stokes Raman spectrometers (CARS); Integrated Optics holds patents for miniature MatchBox series lasers for Raman and fluorescence spectroscopy as well as surface-enhanced Raman scattering (SERS) substrates; and TeraVil manufactures terahertz time-domain spectroscopy systems and components.

"I believe that the year 2015 was the industrial breakthrough year for ultrafast lasers in general, and ultrafast fiber lasers in particular," says Wilhelm Kaenders, president of Toptica Photonics, which grew sales 10% in its fiscal year ended September 30, 2015. "This holds true for all the markets that Toptica serves, from biophotonics to biomedical and from two-photon polymerization to high-speed materials processing, where Toptica is a subsupplier."

Kaenders says that the field of multiphoton/nonlinear microscopy is opening up more and more for novel laser schemes—particularly for fiber-based laser solutions and their relatively easy access to the wavelength range not accessible for Ti:sapphire lasers. "We have also seen more interest in our multi-color laser engines, as they are frequently used in confocal microscopy or cytometry."

In addition to microscopy, spectroscopy, and cytometry instrumentation, OCT and fiber-optic sensing show no signs of slowing down. In 2013, OCT pioneer Eric Swanson estimated the OCT instrumentation market at $450 million31 and some forecasting services see the OCT market growing annually at more than 10%. Ophthalmic OCT remains the most popular application, followed by cardiovascular and gastrointestinal applications. For example, Carl Zeiss Meditec (Jena, Germany) said revenue in the nine months preceding its Q3 financials for its Ophthalmic Systems business unit increased 13.9%, or 5.7% after currency adjustments. In particular, it said that refractive lasers played a significant role in this revenue growth.

And although fuel prices are at all-time lows, Strategic Directions International (SDi; Los Angeles, CA), publishers of the Instrument Business Outlook newsletter as well as market reports on Raman and Fourier transform infrared (FTIR) spectroscopy, oil and gas sensing, and particle analysis markets, said the following in an August 2015 oil and gas summary report:32 "During the last half of 2014, the price of oil fell roughly 50%, and it has not yet recovered. While this might suggest that oil companies are tightening their belts and demand for instrumentation may suffer, the truth is quite another story. In SDi's survey of oil & gas scientists, more than half expected their instrumentation budgets to increase next year."

Instrumentation & sensors

Includes lasers used within biomedical instruments, analytical instruments (such as spectroscopy), wafer and mask inspection, metrology, levelers, optical mice, gesture recognition, lidar, barcode readers, and other sensors.

The laser instrumentation and sensors category includes a variety of applications that are becoming increasingly important in many areas. Not only is lidar essential for most self-driving cars, but laser sensors are increasingly appearing in regular automotive applications for self-parking functions, lane departure applications, automatic cruise control, and other safety applications. While the number of fiber sensors sold for gas and oil drilling is down sharply, other applications for fiber sensors such as bridge monitoring and security applications have taken up much of the slack.

While some applications within this segment are flat or dropping in demand, such as lasers for barcode readers and laser PC mice (and these applications will never return to prior levels), new applications such as gesture and facial recognition are in their very early stages and could greatly exceed the applications that they are replacing. In addition, smartphones are enabling a range of low-cost applications that could bring laser sensing to a wider range of users in higher numbers and at a lower cost than ever seen before.

Entertainment, displays, and printing

This year, we have combined the former "Entertainment and Displays" and "Image Recording and Printing" categories into a single category entitled "Entertainment, Displays, and Printing." While some of these categories are enjoying healthy growth, the numbers are still small in comparison to the other laser segments we track.

In 2015, laser-based entertainment and light shows continued to gain popularity for most televised concerts and awards programs, although no significant technical changes have taken place in recent years other than the cost of visible entertainment lasers (typically red, green, and blue) continues to drop, making them affordable for a broader audience.

For the holidays, the Star Shower laser light33 will spray red and green spots over your house without the hassle of hanging Christmas lights—not a bad business at $40 each if only a fraction of the public buys one (and hopefully, makes sure—as the online advertisement cautions—not to point the laser up into the sky if one's house is within 10 nautical miles of an airport).

Laser-based cinema projection is continuing to penetrate movie theater venues worldwide, and even some fiber laser manufacturers are looking to enter the sector. In a recent press release,34 Christie (Cypress, CA) announced that its 6-Primary (6P) dual-head laser projection system is a preferred choice for 3D cinema and reported that "To date, about 100 state-of-the-art RGB laser projectors and hundreds of laser modules have been shipped to premium cinemas and theme parks around the world."

"Display and projection are finally materializing into a viable market," says Neukum of Dilas. "This market is served by our 40 W, 638 nm fiber-coupled laser diodes, as well as our 25 W, 450 nm fiber-coupled products. For both wavelengths, we have already shown higher powers and currently working on 80 W, 638 nm and 150 W, 675 nm as well as 50 W, 450 nm fiber-coupled devices." Neukum says that sales grew approximately 7% in 2015 over 2014 and he expects to see similar growth rates in 2016.

In the picoprojection world, MicroVision's (Redmond, WA) PicoP technology has been integrated into Sharp's (Osaka, Japan) new RoBoHoN robot—a cute, 20-cm-tall robot with integrated smartphone and camera functionality that projects images from its forehead, has an LCD screen on its back, and comes with a mic, speakers, and both facial and voice recognition.

In the image-recording category, International Data Corporation (IDC; Framingham, MA) saw a slight decrease in 2015 printer sales worldwide, and estimates that around 10 million laser printers are sold each quarter.35 Most forecasters agree that laser multifunction printers, however, will continue strong growth rates of around 8%.

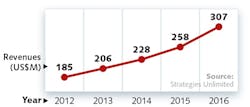

Revenues for the combined entertainment, displays, and printing category are forecast to grow nearly 19% in 2016 to $307 million.

Entertainment, displays & printing

Includes lasers used for light shows, games, digital cinema, front and rear projectors, picoprojectors, and laser pointers. Also includes lasers for commercial pre-press systems and photofinishing, as well as conventional laser printers for consumer and commercial applications.

While the majority of laser revenue in this segment is currently tied to laser light shows, increasingly lasers are being used in business-type digital projectors, small laser picoprojectors, automotive head-up displays, and in a few types of laser projection TVs. But while all these display applications are growing, there is one that could exceed them all: lasers used for digital cinema projection. To date, there are approximately 15 laser-powered digital cinemas in operation worldwide, but as more theater chains back the technology, this number could grow rapidly. IMAX is already running nine of these theaters and expects to have many more running by the end of next year.

REFERENCES

For the complete list of references, please see www.laserfocusworld.com/jan2016references.

For more in-depth analysis

Much more detail on the laser markets is available from Strategies Unlimited in its report, Worldwide Market for Lasers 2016 (www.strategies-u.com). Details include forecasts to 2018 of laser units, average prices, and revenues by segment, estimates of market share, and discussion of the dynamics within each laser segment. The report is the only comprehensive report on the laser market, and the 13th in a series that includes fiber lasers and industrial lasers. Special topics reports in the series cover mid-IR lasers and ultrafast lasers.

Strategies Unlimited specializes in photonics markets, including lasers, LEDs and lighting, and imaging. It was founded in 1979 and is located in Mountain View, CA. Strategies Unlimited is one of PennWell's many brands, which also include Laser Focus World, Industrial Laser Solutions, BioOptics World, Vision Systems Design, LEDs Magazine, and Lightwave.

About the numbers

The estimates and forecasts of laser shipments were based on both supply and demand side analyses by Strategies Unlimited (www.strategies-u.com), a PennWell business. Strategies Unlimited has been conducting market research in photonics products for more than 30 years, with specialties in lasers and high-brightness LEDs. The effort considered both quarterly trends and long-term historical trends; results were then compared and adjusted to correct for known errors. More information will be available from Strategies Unlimited and at the Lasers & Photonics Marketplace Seminar (www.marketplaceseminar.com) held in conjunction with SPIE Photonics West in San Francisco on Monday, February 15, 2016.

About the Author

Gail Overton

Senior Editor (2004-2020)

Gail has more than 30 years of engineering, marketing, product management, and editorial experience in the photonics and optical communications industry. Before joining the staff at Laser Focus World in 2004, she held many product management and product marketing roles in the fiber-optics industry, most notably at Hughes (El Segundo, CA), GTE Labs (Waltham, MA), Corning (Corning, NY), Photon Kinetics (Beaverton, OR), and Newport Corporation (Irvine, CA). During her marketing career, Gail published articles in WDM Solutions and Sensors magazine and traveled internationally to conduct product and sales training. Gail received her BS degree in physics, with an emphasis in optics, from San Diego State University in San Diego, CA in May 1986.

Allen Nogee

President, Laser Markets Research

Allen Nogee has over 30 years' experience in the electronics and technology industry including almost 20 years in technology market research. He has held design-engineering positions at MCI Communications, GTE, and General Electric, and senior research positions at In-Stat, NPD Group, and Strategies Unlimited.

Nogee has become a well-known and respected analyst in the area of lasers and laser applications, with his research and forecasts appearing in publications such as Laser Focus World, Industrial Laser Solutions, Optics.org, and Laser Institute of America. He has also been invited to speak at conferences such as the Conference on Lasers and Electro-Optics (CLEO), Laser Focus World's Lasers & Photonics Marketplace Seminar, the European Photonics Industry Consortium Executive Laser Meeting, and SPIE Photonics West.

Nogee has a Bachelor's degree in Electrical Engineering Technology from the Rochester Institute of Technology, and a Master's of Business Administration from Arizona State University.

Conard Holton

Conard Holton has 25 years of science and technology editing and writing experience. He was formerly a staff member and consultant for government agencies such as the New York State Energy Research and Development Authority and the International Atomic Energy Agency, and engineering companies such as Bechtel. He joined Laser Focus World in 1997 as senior editor, becoming editor in chief of WDM Solutions, which he founded in 1999. In 2003 he joined Vision Systems Design as editor in chief, while continuing as contributing editor at Laser Focus World. Conard became editor in chief of Laser Focus World in August 2011, a role in which he served through August 2018. He then served as Editor at Large for Laser Focus World and Co-Chair of the Lasers & Photonics Marketplace Seminar from August 2018 through January 2022. He received his B.A. from the University of Pennsylvania, with additional studies at the Colorado School of Mines and Medill School of Journalism at Northwestern University.

David Belforte

Contributing Editor

David Belforte (1932-2023) was an internationally recognized authority on industrial laser materials processing and had been actively involved in this technology for more than 50 years. His consulting business, Belforte Associates, served clients interested in advanced manufacturing applications. David held degrees in Chemistry and Production Technology from Northeastern University (Boston, MA). As a researcher, he conducted basic studies in material synthesis for high-temperature applications and held increasingly important positions with companies involved with high-technology materials processing. He co-founded a company that introduced several firsts in advanced welding technology and equipment. David's career in lasers started with the commercialization of the first industrial solid-state laser and a compact CO2 laser for sheet-metal cutting. For several years, he led the development of very high power CO2 lasers for welding and surface treating applications. In addition to consulting, David was the Founder and Editor-in-Chief of Industrial Laser Solutions magazine (1986-2022) and contributed to other laser publications, including Laser Focus World. He retired from Laser Focus World in late June 2022.