Technology development efforts are still climbing

The total attendance of both exhibitors and visitors in July at Semicon West 2001 (San Francisco and San Jose, CA) was 60,028, with 1467 companies filling 375,917 sq. ft. of exhibit space. The 2001 attendance figure was down about 8% from the 65,358 exhibitors and attendees who jammed the meeting during last year's economic exuberance. But the 2001 figure also represented a more typical attendance figure than the previous year for Semicon West conferences, according to Jennifer Blatt, a spokesperson for Semiconductor Equipment and Materials International (SEMI; San Jose, CA).

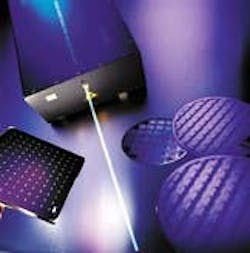

Well before total meeting attendance was tallied, conversations with exhibitors on the trade-show floor seemed to confirm the expectation of a slightly lower turnout during a down year in the cyclical semiconductor industry. Nevertheless, the turnout was better than expected, indicating that the economy may not have been doing as poorly as many were saying, according to exhibitors at Coherent (Santa Clara, CA), which exhibited in both the San Francisco show for the front-end of the manufacturing process and the San Jose show for the back-end. In the front-end show, Coherent debuted a diode-pumped, solid-state, deep-ultraviolet laser for semiconductor metrology (see figure). As with many optoelectronic-equipment manufacturers at the show, Coherent does not manufacture semiconductors but still attends and supports the exhibit because of strong sales to semiconductor manufacturers that continue, despite the market slump. Ken Rebitz, vice president of sales and marketing at Filmetrics (San Diego, CA), said that there was a good turnout at his exhibit of instrumentation for thin-film metrology in the front-end show. He estimated that about 70% of the visitors to his booth were other exhibitors, about 10% were analysts, and the other 20% turned out to be actual sales prospects.

A market briefing on semiconductor and flat-panel display industries painted a relatively grim short-term picture, particularly when viewed in light of last year's market exuberance. George Burns, founder of Strategic Marketing Associates, which focuses on semiconductor-factory market research, characterized 2001 as a year in which the "end-market bust is meeting the fab-spending bubble." Burns included a $640 billion telecom debt, layoffs, and a $19.2 billion second-quarter loss at Nortel, along with projected sales decline through the third quarter at JDS Uniphase among his indicators of the "end market blues." In terms of fab construction, less than $2 billion worth of new fabs are currently beginning construction, compared to $7 billion in July of 2000 when capital spending grew by more than 70%. Burns projected capital spending to fall by at least 15% this year and not to recover before 2003.

Yet fab growth continues, mostly in China (with a 113% growth in capital spending over last year) and less so but still growing in Taiwan, such that the percentage of fabs in the Asia-Pacific region outside of Japan is expected to eventually grow from just under 30% of the world total (at present) to more than half. One bright spot in the fab picture, however, is in the production of 300-mm wafers: Burns predicted that by the end of 2001, the capacity for 300-mm wafer production will equal the existing 200-mm capacity.

Among numerous optoelectronic companies that are already vying to help fill this growing capacity, Newport (Irvine, CA) exhibited a 300-mm edge-grip robot for which it had recently been issued a patent, and Karl Suss (Waterbury Center, VT) exhibited an integrating-sphere tool for testing wafer-mounted VCSELs that had been developed in cooperation with Labsphere (North Sutton, NH). The focus on developing new technology both as a strategy for working out of the economic downturn and as an opportunity presented by the current lull was a dominant theme throughout the conference. For many companies, meeting the demand for new technology has also meant shifting or altering business emphasis to focus on the perceived market need. For instance, Newport executives spoke of transitioning the company from its traditional role as a catalog business to become an equipment supplier in the semiconductor and fiberoptics industries. Etec (Peabody, MA) announced the expansion of its test and measurement business to include testing of MEMS and MOEMS devices, including variable optical attenuators, optical crossconnects, and micromirror arrays. Optoelectronic companies recognized at Semicon West for excellence in their semiconductor packaging technologies included Lambda Physik (Ft. Lauderdale, FL) for wafer dicing and Palomar Technologies (San Diego, CA) for laser-diode bonding.

In a keynote address at the technical symposium, Henry Becker, vice president and managing director of Infineon Technologies (Richmond, VA), perhaps best summed up the impetus for all of the continued technological development even in a down market. He began his talk with five reasons for wanting to be a technology leader: the fifth reason was, "Do you want to be in business ten years from now?"

About the Author

Hassaun A. Jones-Bey

Senior Editor and Freelance Writer

Hassaun A. Jones-Bey was a senior editor and then freelance writer for Laser Focus World.