U.S. may be ceding solar-energy development to others

The immediate and brutal reality of ongoing warfare in the Persian Gulf, dramatically backlit by looming threats, projected mere decades away, of disastrous economic and climatic crises caused by fossil-fuel depletion and global warming appears to be lending credence to increasingly worldwide efforts to develop and establish widespread use of renewable energy resources. Among renewable-energy alternatives, photovoltaic (PV) technology, in particular, draws high marks for its potential to dramatically alleviate both fossil-fuel dependence and its associated atmospheric carbon dioxide burden, while producing significantly less global greenhouse pollutants than competing renewable energy sources.

Last year marked the 50th anniversary of the landmark introduction by scientists at Bell Laboratories (Murray Hill, NJ) of a silicon solar cell with a 4.5% energy efficiency. The anniversary provided a sobering reminder for some that solar-energy technology, originally developed in the U.S., is in at least one way on the verge of becoming like petroleum-an essential energy resource for which Americans are desperately dependent upon foreign suppliers.

The sun continues to shine in the U.S., of course, but the capacity for cost-effectively developing and manufacturing equipment to create electricity from sunlight has been emigrating for some time now. One decade ago, U.S.-based manufacturing capacity accounted for about 45% of worldwide shipments of photovoltaic modules and systems, with Europe and Japan each accounting for just over 20%. Five years later, U.S. shipments had dropped to 30% of the world total, while Japanese shipments had climbed to 40%, due in large part to an aggressive government-subsidized program in Japan to integrate photovoltaic materials into building construction.1 The subsidies are already phasing out of the successful Japanese program, according to Ken Zweibel of the thin-film PV partnership at the National Renewable Energy Laboratory (Golden, CO), who spoke last summer at the annual meeting of the International Society for Optical Engineering (SPIE) in Denver, CO. And notably the three largest PV manufacturers, Sharp, Sanyo, and Kyocera, are also located in Japan.

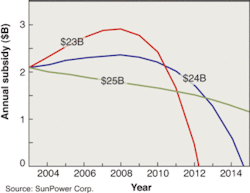

Aggressive government subsidies could also work in the U.S., according to comments by Richard Swanson, president and CTO of SunPower (Sunnyvale, CA) at the Materials Research Society (MRS) meeting in San Francisco last spring. During the next 10 years, PV system prices are likely to fall below $3/W, he said. And a government program to stimulate the PV market during that same period by subsidizing system costs in excess of $3/W would cost about $23 billion total. Such a program would put the U.S. PV-power industry on a 30% growth curve, enabling economies of scale to ultimately yield fully cost-effective, renewable, and pollution-free generation of distributed or retail power (as in rooftop PV systems), along with the phasing out of subsidies (see figure). The eventual development of cost-effective bulk or wholesale power systems (to replace centralized power plants) is still at least two decades out and will require development of emerging PV technologies.

The established crystalline silicon PV technology might be thought of as the first generation, with thin films (based on amorphous silicon, cadmium telluride or copper indium gallium diselenide) as an emerging second generation, and organics as a distant third generation not likely to have much market impact for the next couple of decades, according to Robert Birkmire, from the University of Delaware Institute of Energy Conversion (Newark, DE), who also spoke at the SPIE meeting. Crystalline silicon solar cell technology, well developed and continuing to improve-thanks in large part to the semiconductor industry-will continue to dominate the PV landscape for at least the next 10 years.

Practical market barriers to rapid and widespread deployment of thin-PV systems, despite impressive technology gains, include a relatively long cycle time for change in energy technology and a need to demonstrate the long-term reliability that has already been demonstrated by crystalline silicon. In addition, efficiency is likely to become a major competitive factor in PV market sales. Thin-film modules are approaching the 15% efficiency region of a conventional silicon solar cell, but crystalline silicon efficiencies continue to improve and could climb to just under 25% based on current technology. The conventional 15% efficiency, less than half of the thermodynamic efficiency ceiling of 33%, is due largely to “implementation” losses on the order of 14%, which Swanson said he believes can be reduced to just over 4% using process improvements to boost minority carrier lifetimes in the crystalline silicon PV material above 1 ms.

New module designs and lamination materials, improved manufacturing efficiency, and thinner wafers will also contribute to reductions in PV system prices below $3/W over the next decade, Swanson said. He described wafer thickness reduction (halving every decade) as the “Moore’s Law of crystalline PV.” Another area of development is the emergence of dedicated raw material suppliers. Solar Grade Silicon (Moses Lake, WA), a former supplier of polysilicon raw material to the semiconductor industry has become the first dedicated supplier of polysilicon material to PV industry. In 2003, that company announced the expansion of manufacturing capacity as well as the development of a new granular polysilicon process. Other plans to enter this area have been announced, including work at Dow Corning (Midland, MI) to refine its existing manufacturing processes for metallurgical-grade silicon to produce silicon stock for the PV industry.

Like many PV business ventures in the U.S., solar-grade silicon-a joint venture of Advanced Silicon Materials, a subsidiary of Komatsu (Japan), and Silicon Technologies, a subsidiary of Renewable Energy (Norway)-might actually be described as part of an increasingly international effort launched primarily from countries outside of the U.S. that are actively developing photovoltaic energy capacity. Germany has already launched an aggressive PV development program and other European countries are following suit. Rather than view the situation as a matter of international competition, however, Swanson described it, in a telephone interview last month, as an opportunity for international collaboration in which Europe, Japan, and the U.S. might each contribute a third.

“Manufacturing and technology expertise gravitate to where the markets are,” he said. “So since the U.S. represents only about 10% of the world market it makes sense that we’ve fallen a bit behind in development.” We could wait while others develop the technology and systems and then shop around for the best deals, he added. “But that would bring about a similar situation to the one we’ve encountered with oil.”

REFERENCE

1. P. Holihan, www.eia.doe.gov/cneaf/solar.renewables/rea_issues/solar.html.