OIDA projects ‘opto-mism’ in optoelectronics markets

DAVID HUFF

Optoelectronics is a vibrant and exciting market and this last year has been no exception. At the Optoelectronics Industry Development Association (OIDA), we are using a new phrase, “Optomistic,” as the industry is showing signs of acceleration for optoelectronics in areas that were unimaginable a decade ago. OIDA chronicled this “optomism” with the release of our Global Optoelectronics Industry Market Report and Forecast last October, an updated edition of the 2005 review.

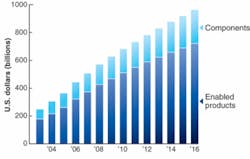

Almost all segments of the market showed strong growth in 2005—with the greatest growth in consumer optoelectronics—as total optoelectronics components and enabled products grew 20% to $364 billion, from $304 billion in 2004 (see figure). Components grew 17% in 2005 to $104 billion, from $89 billion in 2004.

The driving engine for these numbers continued to be the further penetration of display-based products and technologies into the consumer and computer markets. In particular, the products that saw strong growth were LCD TVs (79%) and camera phones/PDAs (41%). Within the components segment, much of the growth was driven by solar cells (24%), display modules (20%), and sources and detectors (10%). The sources and detectors segment includes optoelectronic components with strong growth rates such as image sensors (26%), nondiode lasers (9%), and diode lasers (6%). All segments exhibited growth in 2005 except optical-storage media, which declined (3%) due to price erosion.

There was strong growth in each of the three application segments for optoelectronics in 2005. The optical-communications business grew by 14% to $26 billion, from $23 billion in 2004. Computing grew 9% to $195 billion from $179 billion. Consumer/entertainment grew 40% in 2005 to $144 billion, from $103 billion. Some optoelectronics technologies are utilized in products that span communications, computing, and consumer/entertainment. A significant enabler driving this convergence is the LCD flat-panel display, which is now found not only in notebook PCs, but also in televisions, mobile cellular phones, PDAs, and desktop monitors.

Optoelectronics technology has demonstrated remarkable flexibility in influencing new applications. Good examples from 2005 include development of flat-panel displays for computers and television. Revenues achieved in 2005 are a good indicator that this is indeed a vibrant application. The use of small displays in mobile handheld devices grew quickly and opened up new opportunities. The three largest growth areas (compared to 2004) were LCD TVs with 79% growth, PDP TVs with 45% growth, and camera phones/PDAs with 41% growth. Technology advances in organic LEDs (OLEDs) and laser televisions promise to keep this segment dynamic for several years.

High-brightness LEDs

Development of high-brightness LEDs (HB-LEDs) is expected to provide new market opportunities in large signs, signals, general and architectural illumination, and in the automotive segment for both passenger and industrial vehicles. The use of HB-LEDs for backlighting displays, especially small displays for handhelds, is growing rapidly. However, market revenue growth slowed to 8% in 2005—a drastic change from the historic exponential growth and a marked slowing from the 37% growth realized in 2004. This was due to increased price competition hitting HB-LED revenue for the dominant, maturing market segment of mobile appliances. With the signs and displays, automotive, and general illumination segments poised to enter an adoption stage, 2006 revenue will increase 9% to $4.3 billion, and will begin another growth phase with revenue reaching $7.8 billion in 2010.

The imaging array sensor has enabled digital cameras, and the technology is near replacing the traditional photography industry. The camera phone grew quickly in 2005 and is providing an opportunity to leverage digital technology in different applications. Cameras in mobile phones are not only becoming popular; the use of white HB-LEDs for camera flash to replace filament flash is becoming the norm. Worldwide image-sensor sales grew nearly 30% in 2005, nearing $5.2 billion in revenue, due mostly to the rapid adoption of mobile-phone cameras. This market, however, is past the steep adoption phase and will grow slower in 2006 and beyond. Nevertheless, CMOS imagers, originally designed for the low-cost consumer markets, have increased in capability and performance and are replacing charge-couple devices (CCDs) in almost all applications.

Diode lasers historically were designed for optical communications; however, product revenues for diode-laser-based optical storage have exceeded those for the more expensive communications lasers. Advances in optical-disc technology with blue diode lasers are expected to fuel the growth of DVD players even though the market has been slowed by disagreement about standards. Meanwhile, optical-storage pricing for standard CD and HB-DVD lasers suffered in 2005 and affected revenue growth as the market anticipates the arrival of the new blue-laser devices.

A number of specific types of applications that are particularly dependent upon optoelectronics had strong potential for market growth in 2006—Internet and computing; cellular telephony; wireline telecommunications; and emerging applications such as games, health care, and sensors are examples. Fiber network equipment remained strong in 2005 with a growth rate of 16% over 2004, which is a good improvement over 10% the year before.

This year’s review is not only a fully revised and updated edition of the 2005 review; it also has been extended with a number of new chapters. These include optoelectronics defense research and development, telecommunications, optical networking and data communications, medical optoelectronics, UV materials, solar cells, nanotechnology, and image sensors. Expanded chapters include HB-LEDs, and lasers.

In summary, the optoelectronics market in 2005 was once again vibrant, with almost all categories, applications, and technologies, demonstrating solid revenue progress over 2004. It is expected that a similar performance in the market will continue into 2006-2007.

David Huff is vice president, marketing and business development, OIDA, 1133 Connecticut Avenue NW, Suite 600, Washington, D.C. 20036; e-mail: [email protected]; www.oida.org.

Editor’s note: For more on the laser markets see Laser Marketplace 2007, Part II, on p. 67, and Part I in the January issue on p. 82 and at www.laserfocusworld.com/articles/282527.