The sluggish telecommunications market has pushed the price of optical components to their lowest levels in three years, and the end may not yet be in sight, according to presentations at the Lasers and Electro-Optics Applications Program, held during the Conference on Lasers and Electro-Optics in May (Long Beach, CA). This scenario is putting new pressure on components manufacturers to find more effective ways to reduce production costs. On a positive note, however, it is also spurring new forms of cooperation and collaboration, despite the increasingly competitive environment.

Between 2000 and 2003, the price of erbium-doped amplifiers is expected to drop 90% (from $16,000 to $1500), while the average price of arrayed waveguides will decline 85% during the same period; variable optical amplifiers have fallen 72% over the last two years, according to Bob Shine, director of marketing for WaveSplitter (Fremont, CA).

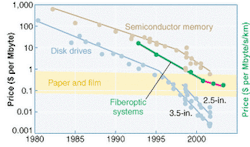

Volumes are expected to rise once inventories are cleared out, but price erosion will continue because the drive to provide more broadband network capacity is not really there yet, creating a highly competitive environment for components providers (see figure). In addition, the newer technologies financed by the influx of venture capital over the last two years are still waiting to move into the market, further inflating component prices in the near term, according to Phil Anthony, president of the amplification-products group at JDS Uniphase (San Jose, CA).

"The investment boom led to tremendous improvements in components technology, but the economy still needs to learn to absorb this technology leap," he said. "And you can't make something like tunable lasers at lower volumes without expecting the price to go up."

For many companies, the short-term solution is to move manufacturing offshore to take advantage of lower labor rates. But Shine argues that there are other methods for reducing component costs that may be more beneficial in the long run, including using different technologies to achieve the same functionality of existing components and minimize the cost of individual functions, integrating functions to reduce the bill of materials, and attacking yield points through automation.

Standardization efforts

Another long-term solution that has been a weak point for the photonics industry is standardization. Manufacturing and standardization issues have taken a front seat in the optoelectronics industry over the past year, prompting a flurry of conferences and seminars devoted to these topics and fueling the establishment of the Photonics Manufacturers Association (PMA). Organized as a council within the IPC (formerly the Institute for Printed Circuits, now IPC – Association Connecting Electronics Industries; Northbrook, IL), the primary mission of the PMA is to facilitate the development of standards and practices that will lead to easier, low-cost, higher-yield, more automated assembly of photonic devices.

Much of the PMA's initial focus is on standards development and road-mapping, according to Randy Heyler, vice president of business development for Newport Corp. (Irvine, CA) and chairman of the PMA for 2002. The PMA is also working closely with the National Electronics Manufacturing Initiative (NEMI; Herndon, VA), the Optoelectronics Industry Development Association (OIDA; Washington, DC), SPIE—The International Society for Optical Engineering (Bellingham, WA), the Optical Society of America (Washington, DC), and other industry organizations.

"Taking a lesson from experiences that precede us in the electronics and semiconductor industries, it has become increasingly clear that standardization can and should play a pivotal role in helping the photonics industry transition successfully into the next business cycle," Heyler said.

While the photonics industry has nowhere near the potential volume or the device or process maturity of either the semiconductor or electronics sectors, there is still a strong need for proprietary development in both devices and processes, limiting some standardization efforts, Heyler adds. Similar situations have existed, however, and in those cases Heyler points out that standards first emerged on simple, lowest-common-denominator issues like form factors and material handling, allowing ample room for competitive differentiation.

"Eventually, of course, we will see more materials, processes, and subcomponents become standardized, ultimately delivering the promised economic advantages," Heyler said.

The IPC has already initiated an "umbrella standard" document called IPC-040 that provides a background and structure for creating new manufacturing, test, and measurement standards. Independently, NEMI has launched several technical working group efforts to develop specific standards in the areas of fiber handling, package soldering, fiber/connector cleanliness and inspection, and so on. In addition, the OIDA is hosting workshops on cost-reduction technologies and manufacturing automation that should further assist the identification and prioritization of standards and direct government-policy recommendations and roadmaps for technology development.

About the Author

Kathy Kincade

Contributing Editor

Kathy Kincade is the founding editor of BioOptics World and a veteran reporter on optical technologies for biomedicine. She also served as the editor-in-chief of DrBicuspid.com, a web portal for dental professionals.