Rebooting: The next opportunities in photonics

by Bill Nighan and Milton Chang

Photonics companies that survived the recent market correction must now focus on age-old business fundamentals while creating real value in the marketplace

Those of us in a technology business have likely adjusted to our respective market corrections. Survival is a strong motivator for established companies and startups alike. Numerous 20/20 hindsight analyses help us understand why several years of unprecedented, seemingly robust growth in communications and semiconductor sectors reversed in 2001. We would like to think that by understanding the reasons for the late 1990s technology bull market, especially in fiberoptics, we can act effectively in the future. The basics apply both to entrepreneurs interested in new ventures, and "intrapreneurs" in established companies looking for growth. We see some very healthy opportunities ahead in a variety of markets where optical technology can be enabling. We simply need to remember that technology must provide genuine benefit to be valuable. This is part of the return to good, old, basic business fundamentals.

'Bubble' economics: an artificial market

We are all familiar with the extraordinary 1999-to-2000 "bubble" in fiberoptic sales growth, primarily driven by what seemed to be a fundamental forcedemand for communications bandwidth that doubled at least annually. Just a single application, Napster, was estimated by some to consume up to 10% of the capacity of our communications infrastructure. Never mind that it was free, surely there will be more such "killer apps," we all thought. This growth in bandwidth demand was thought to be so fundamental that even the best industry analysts used it as a basis for their forecasts. Pre-2001, this demand, coupled with an availability of capital at a scale never before seen, drove a tremendous network buildout, approaching 50 Tbit/s of installed lit capacity by the end of 2000, and a systems market of approximately $20 billion in 2001.1, 2 By some estimates, $7 billion of that market was an unsustainable "bubble." Ciena (Linthicum, Md) has referred to that bubble as an "artificial market" superimposed upon the sustainable market for optical networking gear.3

The recent era can be summarized as a confluence of fundamental demand for bandwidth, unprecedented availability of capital for carriers, and rapid dense wavelength-division multiplexing (DWDM) technology advancement to meet the former and spend the latter. One bright note is that demand for bandwidth is still growing, even post bubble. The growth rate estimates are between 50% and 125% per year, depending on the model. And enhancements in DWDM technology have greatly exceeded even Moore's law, doubling in capacity perhaps every nine to twelve months.4 What returned to Earth was Wall Street's appetite for telecom debt, as most of the competitive local exchange carriers still couldn't forecast profit with all that capacity.

Venture investment in gold rush

Venture capitalist (VC) behavior in 1999 and 2000 was influenced by some additional factors as wellabundant VC funds, high public company valuations, high demand for "infrastructure" IPOs, and heavy merger and acquisition activity facilitated by high stock prices. These factors led to a perceived, and even demonstrated, short-time-to-liquid opportunity for new venture investment that achieves its return through an IPO or acquisition. Even the most conservative of us made investing and buying decisions that mutually reinforced a period of "irrational exuberance." One way to describe certain "bubble" VC behavior is that it was rational for that time, but high risk. The bubble investment model could work only as long as market size and valuations increased rapidlyan enlarging bubble, like musical chairs as long as the music does not stop. Private company valuations reached all-time highs in 2000, based upon expected potential values in near-term liquidity events. And high valuations created a sellers' market for optical entrepreneurs seeking funding.

Just past peak

The corollary, however, is that as an investment exit becomes less visible, the availability of investment dollars decreases correspondingly. This is exactly what happened with VC funding in 2001as established companies missed targets and capital markets correspondingly tightened, a great "fear of the unknown" struck high-tech investment, both public and private. The size, shape, and time of a return on investment in a private company became unknown, even undefined, in early 2001. This situation has not completely corrected, especially with the events of September 11. Potential return on a start-up company investment is still hard to calculate.

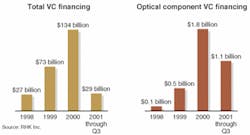

On the positive side, approximately $3.7 billion has been invested in optical communications startups in the past three years, and even in a steep decline, 2001 is on track to be about $1.3 billion (see Fig. 1). Five years ago, just $14 million of venture money was invested in three new Silicon Valley optical companies.5 While funding was still available post bubble, in 2001, fear of the unknown caused the entrepreneur's sellers' market to become an investor's buyers' market.

Where are we now?

The end of the "artificial market" resulted from the end of that positive alignment of factors. We have returned to an environment where a capital equipment purchase decision is primarily dependent upon ability to pay for it, and an expectation that revenue will be generated immediately by its deployment. The "buy" decisions have moved from the chief technology officer (capacity driven) back to that of the chief financial officer (financially driven).

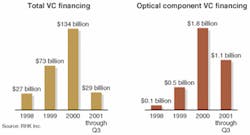

Carriers are the "customer's customer" of the components company and the components market has been the tail of the optical whip (see Fig. 2). In hindsight, the rapid market size increase was a reflection of an inventory buildup of then-scarce optical components by the systems companies to meet expectations for future system demand. In response, post bubble, when systems sales first flattened, components sales plummeted. Still, what goes down must come up: the Merrill Lynch model predicts a comeback for optical components when inventory is either deployed or obsolete, perhaps by mid-2002.

Today's start-up environment

With the exception of the 1999-to-2000 anomaly, venture capital is still much more available for a sound business proposition than ever before. The key is fundamentally sound business, not just technology.

The correction in VC funding behavior is not so much unavailability of capital as it is a return to basic requirements of a business model, and the need for better visibility of the investment return. Funding is available to those companies that feature a deep understanding of valuable customer need, the capability to apply the right technology, and a reasonable cost relative to the expected return. Valuations have also corrected. Valuations can be estimated in a rational way, starting with a value at a potential exit for an investor and accounting for the requirements of a venture return. The days of routine multibillion market capitalizations are gone and very early-stage businesses have returned to valuations of perhaps a few million dollars.

It will be more demanding to raise funds, but the demands should result in better business models. In several ways, the current environment is superior for solid companies with truly valuable offerings. The high-technology markets are not infinite but are still big, the VC and entrepreneurial community have become more educated about real next-generation needs, expectations have become rational, and venture funds are available.

As unprepared startups find it more difficult to get cash from VCs, the prepared businesses will face less competition for talent, which is truly the most valuable resource of all.

What can we learn?

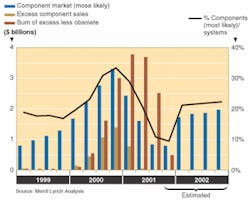

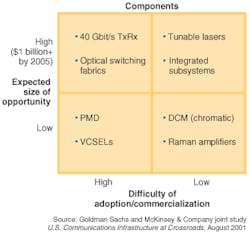

One outcome of recent years has been the thorough mining of all forms of optical technology that might even remotely apply to communications. Even commercially available technologies have compressed tremendous capacity increase into a short period of time, with commercial DWDM systems carrying 1000 times more data than six years ago. The "technology genies are out of the bottle," to paraphrase Matt Bross, chief technology officer of Williams Communications (Tulsa, OK). The right technology can be enabling, but from a business perspective, technology alone is simply not a sufficient differentiation. Thorough understanding of a customer's need in an important market may be most important. Technology marketing, therefore, comes before technologydoing the right things ahead of doing things right (see Fig. 3).

New technology must provide measurable financial benefit and invention is most valuable when market driven. Top technologists can become good technology marketers by listening, deeply understanding an application, becoming business-oriented, and complementing themselves with truly skilled business partners.

Future opportunity: back to basics

An important side-effect of the fiberoptic market is an increased awareness in the investment community of optical technology. This awareness should translate into receptiveness to sound ideas for valuable optical solutions in noncommunications markets as well. We have been encouraged to see many business plans thoughtfully focused upon real value for the customer and the customer's customer. New technology may be the enabler, but it must solve a problem and meet a real need. Creating real value will receive a fair reward.

The terrorist events of September 11, 2001, will also have an impact on technology development. The war on terrorism will likely result in some new directions.7 An example is the elevated interest in higher-quality, lower-cost video-conferencing technology to replace some business travel.

Perhaps, we are all back to basics. Environments change, but certain business basics are eternal. Creating real value by true business-building takes time, effort, resources, and a series of correct decisions. Technology companies that succeed after persisting through our recent bubble will likely be the ones making true, valuable contributions to society.

REFERENCES

1. Goldman Sachs and McKinsey & Company joint study U.S. Communications Infrastructure at a Crossroads (August 2001).

2. RHK, Looking for Recovery (October 2001).

3. Pat Nettles, Opticon (August 2001).

4. Brad Smith, The Road Ahead: Components Overview, STARTRAX 2001.

5. Chris Rust, www.sequoiacap.com

6. Merrill Lynch, Optical Components: Go Obsolescence Go! (Nov. 15, 2001).

7. Steve Lohr, N.Y. Times (Nov. 18, 2001).

Bill Nighan and Milton Chang are managing directors of Incubic, 855 Maude Ave., Mountain View CA 94043; e-mail: [email protected] and [email protected].