Each of us must have said “I have an idea” thousands of times. Most of us grew up believing that an idea can bring us fame and fortune. Nothing is farther from the truth! Ideas are everywhere, but they’re worthless until someone makes a commitment to do something about them.

We can also do better in planning our careers if we make a commitment. When I ask young engineers where they want to be at age 65, most of them are surprised at the question and don’t know what to say. In the absence of a long-term goal, people zigzag on their career paths, often swayed by small incremental benefits that seem important at the time, but that is hardly efficient. It’s all too easy to focus on the immediate benefits of what we do and then, too late, we question why. What we do today will lead us to a logical set of opportunities; conversely, some choices can preclude us from ever reaching the goal that’s really important to us.

A far better model is to plan ahead, so that each thing we do and learn will give us more options, each step preparing us for the next and taking us closer to the goal. That means we need a clear understanding of what’s really important to us, why we do what we do, how to do things right, and what are the likely consequences of our actions.

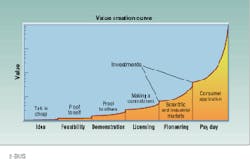

This article, the last in the Business Engineering Series Part I, looks at the whole process of starting your own business in terms of a value-creation curve to help you plan ahead and think long term (see figure). The curve emphasizes the major stages of building an idea into a company using the low-risk model that underlies this series (see Laser Focus World, March 1995, p. 61). The value you gain for your company increases exponentially as you invest progressively more human and financial resources in successive steps.

The key point is to work backward from a goal. When you know what the future may bring, you’re less likely to be overwhelmed by immediate, tangible benefits and more likely to consider the intangibles that can contribute to later successes. You can use this value-creation curve in school, too, as well as on the job, because that’s where it all begins. Long-range planning will help you create earning power that derives from what you know and what you can do including starting your own company. Knowing that you can do anything you set our mind to is more important than the specifics you learn in school, and once you realize you’re really working for your own future good, you’ll work hard to speed up the process. You’ll willingly take on new challenges and carry your assignments to completion, so you can build a reputation, create a network of contacts, and develop a habit of being successful. Experience and reputation are yours to keep, and they’ll open doors of opportunity, even, perhaps, the opportunity to start your own business.

Creating value at the idea stage

Most ideas languish because the inventors see so many unknowns that they conclude, “It can’t be done,” or even “It’s not a good idea.” It’s therefore important to develop a broad perspective on how people make something of their ideas. You should learn to execute projects such as building a prototype, motivating people to help you, and negotiating a deal. People with first-hand experience who are also intellectually inclined can help you develop a portfolio of scenarios to give you choices.

At the idea stage, your actions are highly leveraged; it actually doesn’t require too much effort to create value. First, you want to make sure that your idea is more than just good; it must be the best idea compared to the alternatives. Once you commit to an idea, it immediately gains more value than all your other ideas. So the core value at this stage is your idea backed by your commitment.

Most often we simply hope other people will run with our idea; we delegate to a university technology licensing office or to corporate business development people. Many inventors try this easy way. For example, the technology licensing office at MIT (Massachusetts Institute of Technology, Cambridge, MA) receives about 350 patent disclosures a year. To impress them you have to give them a reason to commit to your idea. Again, we’re back to the importance of commitment.

Since everyone can put on a good show, you can differentiate your idea by getting a few potential licensees excited. The further you can push the idea up the value curve, the more likely someone else will buy in. Potential licensees want to know that your idea is technically feasible and that there’s a market for it (and, of course, so do you). People are skeptical when engineers don’t quantify the effort required to resolve technical difficulties. So you’ll want to concentrate on making your technology bulletproof and also devote some effort to understanding the market. By convention, you can earn a royalty income of 1% to 5% on licensed technology . This approach creates value for society as a whole because you are building on an existing infrastructure. You aren’t blocking the idea from moving forward, and you can go on to do what you do best.

The worst of all alternatives is to go through the motions of creating a company without making the personal commitment to build a successful business. Many people incubate their idea slowly without outside investments, perhaps on a part-time basis, often leveraging off government contracts. That “success” can generate some degree of comfort, even though the company may be losing ground in the window of opportunity in either technology or the market. And if the company also has exclusive rights, then all can be lost at the end. We must remind ourselves constantly that even great ideas are worthless unless we execute them properly and move them up the value-creation curve.

Optimizing value creation in your business

Now we will get into what is, in effect, selling the company, part or whole, to get additional working capital and to gain liquidity. Most people who start their own business without professional venture-capital investors have only a vague notion about selling their business. Before discussing what makes your business more valuable at each stage of development, I would like to emphasize the need for an explicit exit strategy. People often view this step negatively. Founders fear they will lose independence and others perceive that the leaders are bailing out on them. In reality, selling the company is a natural way to optimize the system, to allow people to grow and to do what they do best. A company has lasting value only if it’s a self-sustaining entity that does not rely on any one person. Furthermore, the nature of the business will change—technology can become obsolete—and people with different skill sets are needed to build the company at the various stages of its development (see Built to last: successful habits of visionary companies, by James C. Collins and Jerry I. Porras, HarperBusiness, New York, NY, 1994).

In the absence of a clear exit strategy, most entrepreneurs tend to be controlling, treating their business like their own sandbox. Companies in this position tend to remain small because decisions are not pushed down to the rest of the organization. Employees never learn to take charge, and they eventually lose motivation. The company will stop growing when the entrepreneur runs out of steam. Since small companies cannot go public, these companies are also poorly capitalized to seize new business opportunities. Worse yet, employees who have invested a substantial part of their career become frustrated because they can’t enjoy the fruits of their labor by cashing in their stock options. Everyone loses in this model, and yet it’s prevalent in our optics industry.

A clearly stated exit plan with financial goals that allow people to gain liquidity is a much better approach. Once people have a target and know what the future might bring, they feel less need to be controlling. People become much more willing to hire people better than themselves, to let go of responsibilities, and to help each other grow. That’s a model for sustainable growth because you’re likely to have more champions to drive the business. A financial goal provides a measure everyone understands. Your employees and investors are capable of making informed decisions. A focus on meeting quarterly goals doesn’t mean the company has to de-emphasize other important things. You can maintain the proper balance by expressing a vision and a long-term competitive strategy and by constantly emphasizing the importance of serving customers well. When the exit does occur, people can choose to stay or to leave, and new champions will join to invigorate the business.

When to sell your business

The right time to exit is a judgment call tied to your personal goals and the capability of your organization. For sure, exit when you want to, not when you have to, if you want to get the most out of your hard work. Because value creation requires investments along the way, you’re making a trade-off between a small wedge of a potentially bigger pie or a big piece of a smaller pie. If funds can be generated internally, then you’ll be taking on more risk and creating more work to gamble for a bigger reward. Potential investors, speculators aside, are making the same assessment.

During the early stages of your business development, your preoccupation should be the validity of your technology and its application—many entrepreneurs fail because they fall in love with their ideas and underestimate the virtues of alternative solutions. “Angels” (mostly private investors) base their valuation on your vision and salesmanship. Corporate investors usually are looking for a jump start in the marketplace. Their internal valuation is based on the return on the total investment required to pay you and to develop the business.

When you have a real business, the focus shifts from sales potential to the actual rate of sales growth. Institutional investors will also look at the gross margin because that’s usually a good indication of how unique your product is and how profitable the business can potentially be. Corporate investors at this stage will also pay attention to management quality and organizational depth, because the company must be able to sustain itself after being acquired.

As the company matures, investors will look at earnings in addition to sales growth. People will begin to focus on price/earning ratios as they relate to the rate of sales growth. Corporate investors tend to look at the earning power. They’ll pay more attention to the quality of the business infrastructure (the “software” described in the article on manufacturing and operations, Laser Focus World, Nov. 1995, p. 59), the company’s reputation, and brand recognition in the marketplace. Eventually, conservative investors will base their valuations on assets, expected earnings, and even dividend rate.

How the exit actually occurs is the easy part. There are professional specialists in financial services, like investment bankers and business brokers, who are trained to help you plan and implement the transaction. Once you make up your mind and sign on, the project takes on a life of its own.

A personal note

The ultimate value we create for ourselves is the happiness that goes with self-esteem and the personal satisfaction of a job well done. That’s more likely to occur when you choose a career that relates to what you do best and what you believe in. So trust your intuition and move forward vigorously. You’ll be most productive when you have a passion for what you do, and productivity maximizes your value creation as well.

Writing this article made me pause to think about my relationship with my people at New Focus. They are good at developing products and commercializing them, and I am good at incubating new businesses. That’s what we should—and will—be doing! New Focus will be more aggressively seeking new commercialization opportunities, including developing products for people and companies. I’ll be “kicked upstairs” (as chairman) and will phase myself out of the day-to-day activities, entrusting the company to the current management and to champions we’ll bring in. We’ve built a company that will last with its people, its culture, its infrastructure, and its reputation. We need to add operational skills to accommodate the rapid growth, so we can make products at a competitive price and get them to our customers the moment they need them.

The articles in this series have summarized what I know and believe about trusting your ideas and starting your own high-tech business. I hope they have been helpful to you and will do the optics community some good. Writing them has helped me tremendously in developing a more explicit understanding of business, of relationships, and of myself. I am planning to publish a book expanding on what I covered in these articles and will donate the profits to benefit the optics community, which has been good to me.

Starting in the March issue of Laser Focus World, as a follow-on to these articles, I will offer a question-and-answer column, Business Q&A, for which I welcome your questions and comments on pursuing your high-tech dreams—choosing a career, finding the right job, starting or running your own business. Please feel free to communicate with me on a personal level as well; I will do what I can to help you.*

I would like to take this opportunity to thank the people who helped make this series happen: Jeff Bairstow for having the foresight and suggesting the series title, Barbara Murray for giving me freedom of speech while keeping me on the straight and narrow, Donn Forbes for making it come out right, and all the folks at New Focus, especially Frank Luecke and Pattie Cortese, for their support and input. I would also acknowledge Dr. Anis Husain of ARPA for funding Focused Research under a manufacturing contract that helped me better understand some of the issues covered in this series.

*Milton Chang will answer in his Q&A column starting in the March issue of Laser Focus World questions received on topics covered in the Business Engineering Series. Call or send your questions to Milton Chang, New Focus, 2630 Walsh Ave., Santa Clara, CA 95051; tel.: (408) 980-8989, ext. 117; FAX: (408) 960-8883; e-mail: [email protected]

About the Author

Milton Chang

MILTON CHANG of Incubic Management was president of Newport and New Focus. He is currently director of mBio Diagnostics and Aurrion; a trustee of Caltech; a member of the SEC Advisory Committee on Small and Emerging Companies; and serves on advisory boards and mentors entrepreneurs. Chang is a Fellow of IEEE, OSA, and LIA. Direct your business, management, and career questions to him at [email protected], and check out his book Toward Entrepreneurship at www.miltonchang.com.