Follow the money: Two stories of quantum tech investment

When isolated, even the most robust market data can tell opposing stories. This is particularly true within the quantum tech landscape, where government billions meet venture capital (VC) caution, and market consolidation either signals maturity or concern. Global Quantum Intelligence (GQI) can help detangle these threads and transform intricate market signals into actionable intelligence for your strategic decisions.

A money timeline: From NISQ gold rush to strategic patience

Looking at capital investment patterns (see Fig. 1) in quantum tech from 2020 through November 2024 (excluding national quantum strategies and major government programs like EIC, Horizon Europe, and DARPA), the data reveals a fascinating dichotomy. Our chart tracking $7.06B total investment across 296 funding rounds shows remarkable resilience, with 2024 potentially hitting a record despite the broader tech market downturn.

But this apparent strength deserves closer scrutiny. PsiQuantum’s $620M commitment for its Australian facility comes with specific deployment conditions and timelines—bracketing just this deal reshapes the 2024 perspective entirely. The year’s bar is constructed from a handful of large deals, while the proportion of smaller deals and diverse investments has notably shrunk compared to previous years.

Rounds are taking longer to close, but investors are doubling down where they see fundamental value: quantum hardware and midstack solutions. This shift from earlier “spray and pray” approaches to focused bets in 2024 is accompanied by steady investment levels in quantum sensing and communications and declining interest in pure-play software ventures. The median round size of $5.42M vs. an average of $24.01M illuminates this barbell strategy—continued support for early-stage innovation alongside concentrated bets on scale-up leaders.

Natural selection: Market exits, mergers and acquisitions, and power players

The quantum tech sector is experiencing its first wave of natural selection, with stark contrasts between market exits and strategic consolidation. As tracked by GQI, publicly traded quantum companies that went public via special-purpose acquisition company (SPAC) mergers reveal a worrying picture (see Fig. 2).

While IonQ maintains relatively stable share prices despite high volatility ($5.7B market cap), others frequently flirt with the $1 delisting threshold. Zapata's closure in 2024 marks the first high-profile market exit.

Yet simultaneously, the industry shows clear signs of maturation through strategic merger and acquisition (M&A) activities: IonQ’s acquisition of Qubitekk, Kipu Quantum’s purchase of Anaqor, and SandboxAQ’s absorption of Good Chemistry signal the beginning of market consolidation.

The real industrial momentum is evident in manufacturing scale-up initiatives: IQM's fabrication facility in France, Diraq’s partnership with GlobalFoundries, Quandela’s photonic qubit manufacturing pilot line, PsiQuantum’s utility-scale facility plans in Australia and the U.S., and Equal1’s new center in Canada. With 57 on-premise quantum computer deployments totaling $1.22B in spending, the industry is decisively shifting from scientific exploration to engineering implementation. The quantum sector is entering its “crossing the chasm” moment—where winners and losers become more clearly defined through market performance and manufacturing capability rather than technical promises alone.

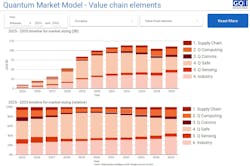

Value chain perspective: When money meets market reality—2025 to 2035

Market dynamics in quantum tech present a sobering reality check to the trillion-dollar projections frequently adorning startups’ pitch decks. GQI’s Total Addressable Market (TAM) Quantum Market Model (QMM) projections (see Fig. 3) reveal the immediate value capture is being driven by the quantum-safe cryptography transition—a fear-based but tangible market catalyst that the model shows will dominate the next five to seven years, and account for the largest share of realizable market value.

This defensive spending creates an interesting paradox: While the broader quantum computing promise remains speculative, the urgency to protect against its threat is generating real revenue today. Meanwhile, quantum enabling technologies—from cryogenics to photonics—maintain a steady 7% market share in GQI’s projections, which demonstrates “picking and shovels” plays remain resilient regardless of which quantum computing architecture ultimately prevails.

Quantum sensing, targeting 10% market share by 2027, offers another path to near-term commercialization. The key insight for investors isn’t about the absolute size of the quantum market, but rather understanding their addressable slice across time horizons. Our model shows quantum computing’s inflection point in 2028 will require preceding infrastructure investment, particularly in quantum communications networks that enable modular architectures. Success in quantum tech requires matching your organization’s capabilities to specific value chain opportunities rather than chasing headline market sizes.

The long view: Where public capital meets private ambition

The quantum technology investment landscape presents a fascinating study in contrasts— success metrics must be viewed through multiple lenses simultaneously. The apparent dichotomy between private market caution and technological momentum could be bridged by strategic public funding, which is historically the key enabler for emerging technologies crossing their “valley of death.”

While private capital is becoming more selective and concentrated, evidenced by the barbell investment strategy and market consolidation through M&As, the quantum sector’s fundamental trajectory remains strong, backed by $1.22B in quantum computing on-premise deployments and aggressive manufacturing scale-up initiatives.

GQI’s Market Model suggests that both near- and long-term value capture opportunities exist across quantum technologies. The elevated status of quantum technology on national agendas—driven by technological sovereignty concerns, security implications, and its increasingly recognized dual-use potential—further reinforces its strategic importance.

The key to navigating this complex landscape lies in understanding that public funding isn’t merely a stopgap, it’s the essential catalyst that can transform today’s technological promises into tomorrow’s market realities while securing national strategic interests.

About the Author

Michael Baczyk

Michael Baczyk is VP of business intelligence for Global Quantum Intelligence (GQI), a business intelligence firm for quantum technology (New York, NY and London, U.K.).