Photonics investing: Pivoting to the NBT-quantum

In parsing the photonics public stocks recent performance for “big themes,” it’s easy to overlook opportunities signaled by emerging firms and accelerating investment flows. BCG’s 2021 projection that quantum computing’s value-add can exceed $500 billion annually within a decade-plus and up to $10 billion within the next five years is eyebrow-raising, in comparison to Yole Développement’s recent projections made at Laser Focus World’s January Lasers & Photonics Marketplace Seminar (LPMS 2022) at the SPIE Photonics West 2022 conference that lidar into auto will be just over $2 billion in 2026.

With nearly $2 billion invested in commercial quantum firms in 2021 and government programs committing over $30 billion in coming years, the accelerant fuel is here. A few public quantum-driven firms exist, with stocks outperforming the prior wave of public lidar generation-one firms. One hypothesis: the entire quantum tech sector—devices, sensing, computing, new algorithmic applications, and communications—is akin to the biotech sector. It’s a long-term opportunity for users and investors for radical value-add transformations, enabling diverse applications and creating exceptional returns.

Today, 10+ public lidar-related firms with modest revenues are experiencing more than 50% stock declines over the past year, with each bleeding cash consumption. While most have cash available to burn for a few years and are showing a more aggressive market forecast than Yole, big auto customers must be asking if they can service us in 2028 and beyond, when I need my vendors to deliver reliably and with low-cost rugged solid-state performance.

Not only are they in a “show-me” state with target customers and investors, Chinese lidar firms seem to be gaining significant traction vs. U.S. and European Union (EU) firms. At LPMS 2022, Bo Gu presented his analysis of China lasers and photonics market data and trends. Among his observations was an estimate China firms had sold over $600 million of lidar in 2021, which is likely well more than all EU and U.S. firms combined. Should this be a surprise? Not when considering how China’s annual auto sales are more than the U.S., Japan, and Germany combined and how active China is in deploying smart traffic sensing and mobility automation. Robosense and Hesai are planning to go public in China and Hong Kong in the coming year, with past revenues disclosed at $98 million and $60 million in 2020. Add in other China-based lidar firms such as Huawei and DJI, and there is a well-funded, deep ecosystem projected to deliver revenue in excess of western firms Yole tracks, with $2.5 billion into China auto alone and another $2.0 billion in other applications.

Arguably the new elephant “next big thing” market in photonics’ future is quantum-based systems and applications. Notably, money and talent chasing the market are globally dispersed. QURECA is a quantum talent development firm that tracks the global ecosystem. Quantum technologies and talent developments currently are being driven to some extent by nationalistic policies for first-mover advantages or the fear of being left behind. Where talent resides and investment flows are tightly coupled in determining strategies for company developments.

In late 2021, the U.S. National Science and Technology Council (NSTC) completed a report on the needs to develop quantum information sciences and technologies (QIST): “Talent required to develop QIST is currently in short supply, both nationally and internationally. Global investments in QIST are intensifying the workforce shortage as countries strive to produce, attract, and retain top talent. Increasing the capacity for QIST R&D in companies, universities, and national laboratories, and the Federal government will require a sustained commitment to grow a diverse and expert workforce. Welcoming international researchers and fostering international cooperation will remain important. Joint efforts on education, training, and workforce development are mutually beneficial for the United States and its partners and allies.”

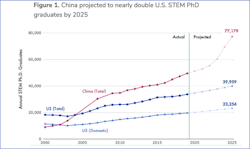

From a U.S. perspective, quantum is a field in a national competitive arms race, with China cited as a benchmark. Georgetown-based think tank Center for Security & Emerging Technology (CSET) published analysis on STEM Ph.D. graduates (see figure). There is recognition the U.S. cannot home-grow the talent needed for the future. Policy advocacy generally takes the form of attracting and retaining both foreign students and mature talent into the U.S. It worked in the past, so it sounds appealing.

In 2018, Forbes reported the U.S. “was no longer attracting the best and brightest minds in physics.” In addition, risk capital for new and growing technology hubs for large firms and startups has become well-funded around the world, so high-talent people have many choices of location. In March, the New York Times reported Toronto is the fastest growing tech company hub in North America, and its fourth largest city. “As the tech industry continues to expand and communities all over the world compete for tech jobs outside Silicon Valley, many executives, investors, and entrepreneurs are promoting warm climates like Austin and Miami as the next big tech hubs. But they are tiny tech communities compared with the new hub growing in the cool air along the shore of Lake Ontario.”

Another reference point projecting to the future direction of quantum market developments, CSET extensively tracks trends in artificial intelligence (AI) and concludes the U.S. lost its historical near-monopoly on AI R&D and commercial activity. In 2013, the U.S. accounted for more than 70% of funding deals for AI startups. By 2018, this had dropped to 40%. Other countries are opening their immigration systems and aggressively recruiting U.S.-trained AI talent. Fortune reported in late 2021 that EU venture capital (VC) funds outperformed U.S. VCs the past two decades. EU VC investments totaled over $100 billion in 2021 vs. under $10 billion a decade ago and $25 billion five years ago. China VC funding is also accelerating, with more than $130 billion in 2021 in comparison to over $300 million in the U.S. Nearly everywhere in the world, VC and corporate investment in talented innovators is flowing. For talent, this means many attractive choices exist rather than move to the U.S. or attend M.S. or Ph.D. programs here. The venture capital model and mentality is one of the great exports the U.S. gave to the world.

For companies and investors involved in or wanting to get involved in quantum-based products and solutions, these observations have profound implications for talent management and funding strategies. Given a clear path and success for other locations’ attractiveness to the desired talent pools, a strategy for companies might, and often must, entail opening multisite tech hubs. Large companies in software, semiconductors, and optical components have done this successfully for decades. Increasingly, emerging growth firms are pursuing this to develop talent, “work the clock,” diversify competencies, hedge costs of expensive locations, and gain access to national markets that desire local content.

One example of such a model is Quantinuum—the merger of U.S.-based Honeywell’s Quantum group and UK-headquartered Cambridge Quantum—with major development and operations sites in seven locations in the U.S., EU, UK, and Asia with a combined staffing of 400 people. Still private, but with a future IPO plan, the Honeywell CEO told investors in 2022 that revenue for 2026 was targeted at $2 billion, up from a planned $20 million in 2022 that will yield $150 million of earnings before interest, taxes, depreciation, and amortization (EBITDA) losses.

Even small firms at the startup phase recognize the need and opportunity in such a business model. Quantum Brilliance is a hybrid Australian and German quantum startup that took in $13 million of initial VC funding with the plan to split team members between the two locations—ramping to 75+ in each site over time. Australian-headquartered, the founder had prior German-based training and relationships and said: “Many students in Germany and throughout Europe are being educated today with a quantum-informed curriculum across technology fields.”

We should expect to see more EU emerging growth firm success and more multisite, multi-country operations, both via greenfield openings and acquisitions of complementary teams and products. Succeeding in quantum will take time, management skills, and lots of capital. My analogy to the biotech sector: “Think global, act local.”

About the Author

John Dexheimer

President, LightWave Advisors

John Dexheimer is President of LightWave Advisors. He has been a past Laser Focus World contributor on business trends and investments in the photonics sector. As an investment banker, he managed the IPO of Uniphase, assisted in their early global acquisitions, and invested in and advised several other optical component firms that have since become part of Lumentum’s global business.