Thermo Electron's decision to divest Spectra-Physics earlier this year was not a big surprise to the laser industry, despite that conglomerate's concerted efforts to leverage the Spectra-Physics name across its diverse instrumentation portfolio. That the buyer was Newport, however, did raise a few eyebrows. What did a company that had built its reputation on vibration tables and motion controllers know about being a laser supplier? And wouldn't it put them in competition with their customers?

In many ways, the deal was all about timing. The idea had been kicking around Newport for more than a decade, according to Robert Deuster, chairman and CEO of Newport, but the right opportunity had never presented itself at the right time. When it became apparent that Thermo was interested in getting out of the laser business, however, Newport stepped in, paying $300 million ($200 million cash, $50 million in stock, and a $50 million promissory note payable in 2009) to become one of the largest companies in the laser business, second only to Coherent. According to Newport, the deal should yield a company with more than 2000 employees, 15,000 products, and, Deuster says, more than $400 million in sales in FY2005.

"Newport built its business in the laser industry by building everything but the laser," he said. "So we have the advantage of being an embedded organization that already understands everything that surrounds the laser."

Deuster is quick to point out that, in many ways, this transaction is more a merger than an acquisition. While the resulting company is called Newport, the Spectra-Physics brand is not going away. Spectra-Physics lasers will still be known as Spectra-Physics lasers, and Newport is evaluating the other product groups acquired in the deal (Oriel Instruments, Corion, Hilger Crystals, Richardson Gratings, and Laser Science) to determine the most appropriate branding approach.

"While the name of the company will continue to be Newport Corporation, the Spectra-Physics brand is very strong in our industry and will continue to have an important and highly visible role in the marketplace," said David Rossi, director of marketing for Newport. "Spectra's expertise in lasers, instruments, gratings, and filters is an excellent complement to Newport's brand position in vibration control, motion systems, optics, and mounts. Together we will offer our customers a truly complete photonics solution."

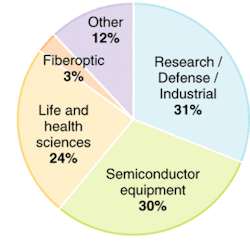

In fact, one of the prime motivators for Newport to acquire Spectra-Physics is the strong market and customer overlap between the two companies, with very little product overlap. According to Deuster, the companies have 80% market overlap and 60% customer overlap, but only 2% product overlap. Shared strategic markets include scientific, semiconductor, life sciences, and metrology; in addition, the companies have complementary positions in materials processing, aerospace/defense, image processing, and data storage (see figure).

"While we anticipate that our total sales to microelectronics customers (including semiconductor capital equipment customers) will almost double, the percentage of company sales to these markets will remain approximately one-third of our total sales," he said. "At the same time, we expect that the percentage of our sales to life- and health-sciences markets will more than double, from less than 10% today to more than 20%."

The combined company is also expected to have better geographic reach, with sales in Europe and Asia each increasing to approximately 20% of total sales.

"From Newport's standpoint, Spectra-Physics' position in Asia is a welcome addition," Deuster said. "They are direct in Japan, so we will be able to build from a stronger position there."

New structure

While Newport anticipates leaving many of Spectra-Physics' established processes and operations in place, Deuster also sees opportunities to make some strategic changes that should yield even more benefits. There will be some internal consolidation—for example, Newport has a small sales office in Silicon Valley that will be moved into Spectra-Physics' Mountain View location—and more integration of sales and services in various locations, such as Darmstadt, Germany, where both companies currently have a sales office. Certain manufacturing capabilities will likely also be combined to leverage both companies' respective expertise in volume production, which should further improve the time to market for new products, according to Tom Miller, director of product marketing for optics and optomechanics at Newport.

"Both companies machine a lot of metal, build a lot of optics, and bend a lot of metal around the world, and we plan to optimize this," Deuster said.

But Deuster, who is adamant that "this is not a takeover," is particularly excited about the new operational structure being put in place. In addition to restructuring the company into three main business operations—lasers, industrial and scientific technology, and automation—an executive council comprising senior Newport and Spectra-Physics executives has been established to oversee the integration activities, strategic direction, and overall leadership of the combined company. Deuster will remain chairman and CEO, Chuck Cargile is senior vice president and CFO, and Bob Phillippy has been appointed to the newly created role of president and COO. While they will oversee the company's operations, a cross-functional team of eight other managers—including former Spectra-Physics Lasers President Steve Sheng, who is now Newport's head of advanced photonic technology, and Bruce Craig, formerly vice president of marketing at Spectra-Physics and now head of strategic marketing—are directly responsible for operations ranging from product-development planning to channel strategies, but in a company-wide capacity. In addition, under the direction of Don Mills, who will head up operational excellence initiatives company-wide, Newport is now implementing Six Sigma–type quality-assurance programs to further improve its integrated processes.

"We want to drive a consistent product-development roadmap, with more consistent growth and more predictable profit-making capabilities," Deuster said. "We want to change the way people buy photonics products, and we think our turnkey approach makes Newport pretty attractive to the customer."