VCSEL transceiver market triples consumption

Dale D. Murray

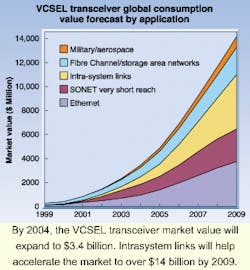

More than 20 years after the initial baseline research, vertical cavity surface-emitting laser (VCSEL) diodes emerged in 1999 into significant commercial use. According to a new market study by ElectroniCast Corporation, the VCSEL-based transceiver market took hold last year with consumption of more than three times that of 1998. Fueled by the recent success of Gigabit Ethernet and Fibre Channel, this explosive growth will continue, supported by several all-new applications (see figure).

Vertical cavity surface-emitting lasers can be modulated at high speed and perform efficient power conversion, enabling low power consumption for transmit modules. The well-confined circular output beam of a VCSEL allows efficient coupling into an optical fiber, permitting relatively coarse alignment within the optical subassembly. Surface emission allows for low-cost "LED-style" packaging schemes. Because VCSEL geometry and manufacturing tolerances are based on established lithographic techniques, the devices also are ideally suited for fabrication in arrays.

High-speed datacom

The tremendous growth of Gigabit Ethernet soon will be followed by 10-Gigabit Ethernet. We will see continued aggressive growth of Fibre Channel, migrating to 2-Gbit/s Fibre Channel, and on up to 10 Gbit/s.

After an intense standards battle, a serial VCSEL transceiver was chosen as one of four acceptable solutions for 10-Gigabit Ethernet. In the Fibre Channel committee, three of the five accepted solutions are based on 850-nm VCSEL transceivers. Included are coarse WDM (CWDM) VCSEL transceivers, a new approach that avoids 10-Gbit/s line rates and more expensive electronics. In both Gigabit Ethernet and Fibre Channel markets, multimode short-reach solutions dominate and by 2004, these two applications alone will increase by almost eight times over 1999.

VCSELs penetrate telecom

The extremely rapid growth of networking and Internet access has been fueling extraordinary growth of aggregation switches, high-speed routers, high-capacity DWDM transmission equipment, larger digital crossconnects, and now optical crossconnects for optical networking. These developments serve the needed expansion of the Internet backbone, with most equipment being installed in telephone central offices and points of presence.

As routers grow to terabit scale, and crossconnects and transport systems manage OC-192 traffic, these systems need to be interconnected at 10 Gbit/s to minimize the large number of interconnections. However, with all of this equipment within one facility, link distances are short, the majority less than 100 meters. SONET- compliant optical links are optimized for much longer reaches and cost as much as $15,000.

Low-cost solutions for very short reach (VSR) SONET at 10 Gbit/s are being defined with a target of $500 per interface. VCSEL-based parallel optical interconnects are considered the leading solution. New "converter application-specific integrated circuits" provide an interface from existing array VCSEL transmitters and receivers to SONET hardware. Deployment is about to begin and uptake will be rapid. By dividing bandwidth across multiple fibers, a VSR OC-768 array VCSEL link will provide low-cost 40-Gbit/s transport up to a few hundred meters by 2003.

Optical interconnects deployed

High-performance systems of all types are evolving rapidly. Internal backplane speeds are escalating, pushing the fundamental limits of copper. Highly scalable, carrier-class systems are beginning to consume multiple equipment racks, placing heavy emphasis on redundant interconnections between complex switch fabrics and I/O line cards. In contrast to standards-based interconnects such as Gigabit Ethernet and SONET, optical-array interconnects are now mostly a collection of proprietary intrasystem interconnects based on array-VCSEL links.

The term "optical backplanes" can mean an optical analog to traditional electrical backplanes, or it can mean the use of optical-array interconnects to create a new architecture that was not previously possible. Both are seeing rapid production deployment in terabit routers, digital crossconnects, and optical crossconnects.

Emerging applications

The now-pervasive PCI bus has been in use for about a decade. It is found in almost every type and size of system and is still evolving. But the increasing use of ever-faster CPUs, larger databases, and faster networks is now outstripping the capability of the PCI bus. PCI is a shared architecture in which all devices compete for bandwidth. In the networking domain, shared hubs have evolved into full bandwidth switches using a point-to-point architecture. In the same way, Infiniband is intended to replace the PCI bus with a high-bandwidth switched network topology. It is a network approach to I/O, effectively creating a switch inside the server using a packet protocol.

Infiniband switch fabrics will evolve in a manner similar to Fibre Channel switch fabrics, with large implementations linking perhaps 30 or more switches. With a 2.5-Gbit/s signaling rate, VCSEL-based duplex and array transceivers are ideal for the 1-, 4-, and 12-lane Infiniband links now being defined.

The bad news?

The dynamic ramp of the VCSEL transceiver market stretched the development and production capabilities of traditional transceiver vendors and provided opportunities for new vendors in the market. But margins already are thin on commodity versions and price erosion will continue. New markets, faster speeds, and wider links mean new opportunities for innovation, market differentiation, and margin recovery. Equipment manufacturers are ready to go. Demand will exceed supply for 12 to 24 months. The winning transceiver vendors will be those that appreciate the concept of time-to-volume rather than time-to-market.

DALE D. MURRAY is a senior research analyst with ElectroniCast Corporation, 800 South Claremont St., San Mateo, CA 94402; e-mail: [email protected]