Review and forecast of the laser markets Part II: Diode lasers

THE LASER MARKETPLACE 2001PART II: DIODE LASERS

The Laser Focus World 2001 Annual Review and Forecast of the Laser Marketplace is conducted in conjunction with Strategies Unlimited, an optoelectronics market research firm based in Mountain View, CA. Part II covers the diode laser marketplace. Part I, which reported on the nondiode laser markets, appeared last month.Robert V. Steele

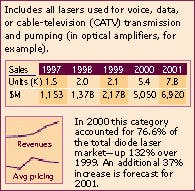

As a result of explosive growth in telecommunications applications and solid, if less spectacular, growth in most other applications, the worldwide market for diode lasers reached the stratospheric level of $6.59 billion in 2000. This figure represents a growth rate of 108% over the $3.17 billion reported for 1999, which is by far the largest increase ever recorded for the diode laser market since the laser marketplace has been tracked by Laser Focus World. It is also much larger than the growth rate forecasted one year ago. Underlying this incredible performance was a growth rate of 132% for telecom laser revenue, resulting in a market value of $5.05 billion for 2000, which accounted for 76.6% of the diode laser market.

The unit growth was a substantial, but far less spectacular, 17.6%, to 420.4 million units in 2000. The reason for the disconnect between revenue growth and unit growth has to do with the contribution of telecom lasers compared to other diode laser types. Large revenue growth is due primarily to telecom lasers, which are relatively small in terms of units but which have high average selling prices ($100 to $2000). The increase in unit shipments is due primarily to optical storage lasers, which have high unit volumes but are low in average selling price ($1 to $10).

Although, as it has for the past several years, the telecom use of diode lasers has taken center stage, other applications of diode lasers also experienced robust growth. If telecom lasers are excluded, the remainder of the diode laser market grew from $994 million in 1999 to $1.54 billion in 2000, corresponding to a growth rate of 54.9%.

Because a large fraction of the nontelecom diode-laser market originates in Japan, the value of the yen can sometimes play a significant role in the market size expressed in dollars. Between 1999 and 2000 the value of the yen underwent only a modest changefrom 114 per dollar in 1999 to 107 in 2000. This increase in value gave a slight boost to the market, but more importantly, a firming of prices for low-power diode lasers in the Japanese optical-storage market, after many years of decline, helped to increase revenues significantly.

Overall diode-laser market growth for 2001 is forecast at a healthy, although somewhat less spectacular, 36.2%, due primarily to moderation in the growth rate for telecom lasers.

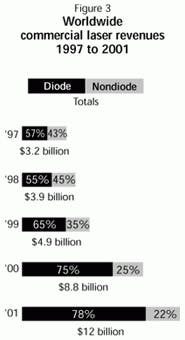

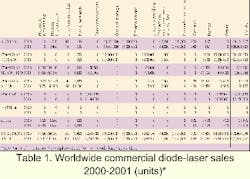

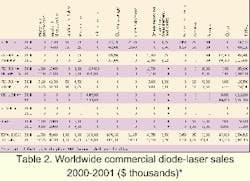

Figure 1 depicts worldwide diode-laser sales for 2000 and 2001 for applications; Figure 2 does the same for product types. Table 1 provides the breakout of diode-laser unit sales by product type and application, while Table 2 provides revenue data. Figure 3 shows worldwide commercial laser revenues, both diode and nondiode, for 1997 to 2001.

Telecommunications

The growth in the market for telecommunications diode lasers was nothing short of astounding in 2000. Driven by insatiable requirements for bandwidth to support the growth of the Internet, telecommunications service providers went on a dense wavelength-division multiplexing (DWDM) deployment binge that left seasoned observers shaking their heads at the demand growth experienced by telecom components suppliers. This growth was unprecedented, even in an industry that has begun to view 100%+ growth rates as a normal business pattern.

The growth in business volume experienced by some of the leading providers of telecom equipment and components illustrates the effect of rising demand: SDL (San Jose, CA), one of the two leading suppliers of 980-nm pump lasers for optical amplifiers, experienced revenue growth in its communications business unit of 157% in the third quarter of 2000 compared to the third quarter of 1999; JDS Uniphase (San Jose, CA), the world's largest independent supplier of telecom components, experienced growth of 171% in the third quarter of 2000 relative to the same quarter in 1999; Nortel Networks (Brampton, Ontario, Canada), the leading pro-vider of optical networking equipment, had 90% revenue growth in its optical networking business in the third quarter of 2000 compared to the third quarter of 1999; Corning (Corning, NY), the world's largest supplier of optical fiber and a major supplier of telecom components and subsystems, saw sales of its photonics technologies products (which do not include fiber or cable) increase by 113% in the third quarter of 2000 relative to the previous year

All of the figures reported above have been adjusted to exclude the effects of acquisitions.

With this kind of across-the-board growth in the telecom sector, it might then come as no surprise that the market for telecom lasers increased by 132% to reach $5.05 billion in 2000. The demand for both transmission lasers (which generate the signals that are propagated through optical fiber) and pump lasers (which are used to energize optical amplifiers) saw spectacular increases. The transmission-laser market grew by 119% to reach $3.61 billion, while the pump-laser market grew by 173% to reach $1.44 billion.

The most dynamic sector of the transmission market was in 10-Gbit/s lasers, which are supporting the leading edge of DWDM system deployment. Demand for these lasers grew by more than a factor of six in revenue terms. Revenues for lasers at other data rates had growth rates ranging from 59% to 130%. In the pump-laser market, both 980- and 1480-nm lasers are being deployed in terrestrial systems, and both have experienced solid growth. However, as DWDM systems move to increasing numbers of wavelengths, more and more amplification power is re-quired, which in turn requires more pump power. Increasing numbers of 1480-nm pump lasers are being used in amplifiers as power boosters. The result is that the demand for 1480-nm pumps grew by more than a factor of three in 2000. The growth rate for 980-nm pump lasers, which are used in the low-noise preamplifier stage of terrestrial optical amplifiers, and increasingly in undersea systems, was 141%.

Although continued robust growth in the telecommunications market is expected for 2001, there are increasingly mixed signals regarding the actual pace of deployment. Several telecommunications suppliers appear to be backing off on the rate of new capacity additions, and there are other signs that growth will be significantly lower than in 2000. For this and a variety of other reasons, the telecom diode laser market is forecast to grow "just" 37% next year to reach $6.92 billion.

Optical data storage

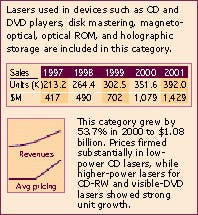

Although significantly smaller in size than telecommunications, the optical-storage application of diode lasers continues to be a dynamic and rapidly evolving market. The market has changed substantially in recent years, from one dominated by low-cost 780-nm lasers used in CD players and CD-ROM drives to one in which visible lasers for DVD players and DVD-ROM drives, as well as higher-power 780-nm lasers for CD-RW drives, are playing an increasing role.

In 2000, the market for diode lasers used in optical storage grew by 53.7% to $1.079 billion, roughly in line with last year's forecast (when adjusted for the fluctuating value of the yen). The market for visible lasers (<700 nm) used in DVD-related applications grew by 23.0% to $273 million, while the market for lasers in the 750- to 980-nm, less than 100-mW category grew by 67.9% to $806 million. This seemingly odd phenomenon, in which a dynamic newer market has slower growth than an older, mature market, actually has a logical explanation. The unit growth for visible lasers used in optical storage was 63% in 2000. However, substantial price erosion in the 650-nm lasers used in DVDs held revenue growth to just 23%. Unit growth of lasers in the 750- to 980-nm, less than 100-mW category was just 12%. However, a large part of the revenue growth came from higher-power (30 mW) 780-nm lasers used in CD-RW drives and recordable MiniDisc players. Unit growth for these higher priced lasers was around 100%.

The demand for lower-power (5 mW) 780-nm lasers used in CD players and CD-ROM drives actually decreased in 2000 as CD-ROM drives continued to be displaced in personal computers by DVD-ROM drives. It would have declined even faster, except for the fact that a large fraction of DVD players come equipped with a 780-nm laser to play CDs, and all DVD-ROM drives come equipped with a 780-nm laser to allow them to read CD-ROM disks. Finally, after years of steady decline, prices actually increased significantly in 2000 for these high-volume CD-type lasers. As Japanese diode-laser suppliers have switched production capacity to visible lasers to support the growing DVD market, a capacity shortage for CD-type lasers has apparently arisen, causing an upturn in prices.

The major stories in 2000 for optical storage were the DVD and the CD-RW. DVD players continued the fast growth pace first begun in 1998, as player prices continued to fall (to well under $200 in some cases) and the number of available movie titles continued to increase (approaching 6000 at last count). Worldwide sales of DVD players approximately doubled, to more than 11 million units, and the largest market continued to be in the United States. Shipments of DVD-ROM drives in personal computers also grew substantially, but not at the rate previously anticipated. These drives are still largely considered to be a premium feature on high-end computers, and there is currently little in the way of software that requires the 4.7 Gbytes that these drives can store. On the other hand, the introduction to the market of the DVD-ROM based PlayStation 2 by Sony has been a resounding success. Since its introduction in April of 2000, more than 5 million players have been sold worldwide.

Unlike the case with DVD-ROM drives, the market for CD-RW drives has performed better than anticipated, with sales more than doubling in 2000. Now recognized as among the lowest-cost rewritable storage technologies, these drives come as standard equipment on many PCs. Moreover, the popularity of "burning" CDs among the music-loving public has accelerated the acceptance of this technology in the consumer electronics market.

The market for diode lasers used in optical storage is forecast to grow by 32.4% in 2001 to $1.43 billion. As in 2000 the largest growth will be in visible lasers used in the various DVD-related applications. Lasers in the 750- to 980-nm, less than 100-mW category will experience only modest unit and revenue growth, with the growth in 30-mW lasers for CD-RW drives and 5-mW lasers used for CD compatibility in DVD players and drives slightly more than offsetting the continuing decline in 5-mW lasers used in CD-ROM drives.

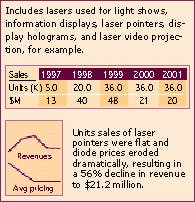

Entertainment and display

The use of visible diode lasers in pointers was more or less flat in 2000 in unit terms, but there was a drop of more than 50% in sales revenue due to a continuing price erosion that left many suppliers shaking their heads and questioning whether this business is worth staying in. With prices falling to as low as $0.70 for lasers in TO cans, and to as low as $0.30 for lasers in chip-on-board form, several suppliers have already left the market or are in the process of doing so. Presumably, with a reduction on the supply side, prices may begin to firm up in the future.

Despite falling prices for laser pointers and the diodes used in them, the market is stagnant in unit terms. This can be attributed partly to the situation in the United States, in which many municipalities have passed ordinances prohibiting the sale of pointers to minors. Although they are still popular in other parts of the world, it appears that the peak of the laser pointer fad has passed, and flat sales are forecast for 2001. Prices are expected to remain steady.

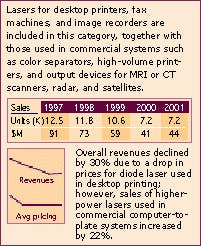

Image recording

Although the desktop image-recording (laser printer) market for diode lasers is stagnant, or even declining, according to supplier surveys, the commercial image-recording (computer-to-plate and computer-to-press; CTP) market appears to be quite healthy. Since 1995, CTP systems have moved into the mainstream of the printing/graphic-arts industry, and thermal-plate systems, which increasingly use diode lasersthe other option is diode-pumped solid-state lasers (DPSSLs)are becoming the CTP systems of choice. The use of diode lasers in CTP systems grew by 26% in 2000 to $21.7 million.

The major worldwide printing and graphic-arts trade show known as DRUPA, which takes place every five years, was held in May 2000. All the major players in the industry that offer CTP systems (such as Heidelberg, Kodak, Scitex, Agfa, Karat, Dai Nippon Screen, and ECRM) showed new or improved thermal-plate systems that use diode lasers. All of these companies are aggressively gearing up for a new system product life cycle, which typically lasts about five years. Heavy product rollout is expected through 2001, and increasing use of diode lasers in CTP systems is assured.

In an interesting twist on the use of diode lasers in CTP systems, one of the exhibitors at DRUPA showed a system that uses photosensitive plates (an alternative to thermal plates) in which a 405-nm diode laser made by Nichia Corporation is used to expose the plates. Traditionally, argon-ion lasers or green -emitting DPSSLs have been used as the laser sources for these systems.

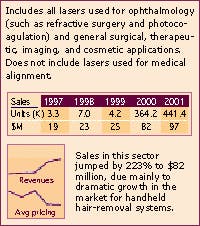

Medical therapy

The major success story for high-power diode lasers (including the categories of 750 to 980 nm, 100 mW-10 W; 750 to 980 nm, more than 10 W; and stacks) in 2000 is medical applications, primarily hair removal. This application grew by an astounding 208% to $82 million in 2000. Although some growth was seen in applications such as the use of diode-laser-based photodynamic therapy to treat age-related macular degeneration, almost all of the increase was accounted for by hair-removal applications. Most of the publicity regarding the success of diode-based hair-removal systems has been focused on the larger systems such as LightSheer developed by Coherent (Santa Clara, CA). These expensive systems ($150,000), utilizing multiple stacks of diode-laser bars, are designed primarily for use in doctors' offices.

In addition to these larger systems, however, a sizable market has developed in the past year for smaller handheld hair-removal systems, including wands that are designed for settings other than doctors' offices, such as beauty salons. These US Food and Drug Administration-approved systems use several diode-laser bars, which in many instances are fiber-coupled. An additional market has developed for personal hair-removal systems that use discrete diode lasers. These are not FDA approved, so currently are being sold only outside the United States.

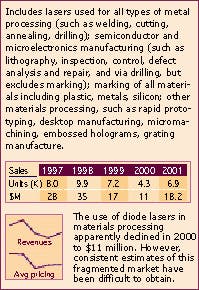

Materials processing

Materials processing using diode lasers continues to make modest inroads into the industrial materials-processing market. The introduction in 1999 of complete kilowatt-scale diode-laser systems by Rofin-Sinar and several other companies including Nuvonyx, Laserline, and Jenoptik gave a significant boost to a market that had been lacking a systematic approach to providing higher power levels for heavy-duty applications such as welding, cladding, and drilling. Other lower-power applications such as soldering, epoxy curing, and plastic welding continue to make modest gains as well.

In 2000, the market for diode lasers used in materials-processing applications apparently declined to $11.3 million from $16.7 million in 1999. However, over the years inconsistent estimates of the size of this market have made year-to-year trends difficult to characterize accurately. The outlook for 2001 is for substantial growth, 61%, with the largest increase anticipated in the use of diode-laser stacks for high-power systems.

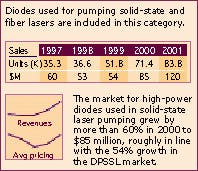

Solid-state laser pumping

As in previous years, solid-state laser pumping continues to be the largest application of high-power diode lasers, although in 2000 it just barely edged out medical applications for that honor. The market grew by 58.6% to $85 million in 2000, surpassing by a wide margin the 25% growth forecast a year ago. The largest increases were in diode-laser bars and stacks. Discrete diodes saw only a modest increase.

According to Merrill Apter, director of sales and marketing for Coherent's Semiconductor Group, in 2000 many commercial laser companies that have had a solid installation base of lamp-pumped laser technology began the evolutionary shift to diode-pumped technology. These companies recognized that the pioneering efforts of Rofin-Sinar, which first introduced kilowatt-class DPSSLs and maintains the largest installed base of these systems, are slowly and steadily taking hold, especially in the European automotive industry. North American and Japanese laser competitors are aggressively looking at diode-laser suppliers with which to team for this new class of laser. All of these competitors are driving the diode-laser industry by demanding higher power and better reliability, and by exerting constant pressure to lower the prices of pump components.

Of course, kilowatt-class DPSSLs are not the only source of growth for diode pumps. Lower-power DPSSLs continue to make strong inroads in applications such as semiconductor processing, marking, and ophthalmology. In 2000, the market for all kinds of DPSSLs increased by 54% in revenue terms compared to 1999 (see, Laser Focus World Jan. 2001, p. 88)

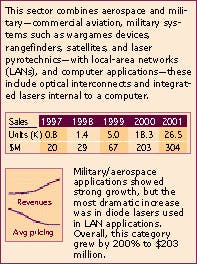

Other

The "other" category aggregates several unrelated applications, including military/aerospace and local-area networks (LANs). Although the term LAN in its strictest sense refers to interconnecting computers within the environment of a building or group of buildings (campus), for purposes of analyzing the laser marketplace we interpret it to have a meaning that includes all localized data networks. This would encompass, for example, the increasing important application known as storage-area networks, or SANs, and point-to-point connections between pieces of telecommunications equipment such as routers.

The main growth trend in this category is the use of diode lasers in transceiver modules for high-speed data communications networks, particularly Gigabit Ethernet and Fibre Channel applications. The two types of diode lasers used are 850-nm vertical-cavity surface-emitting lasers (VCSELs) and conventional 1300-nm edge-emitting lasers. VCSEL-based transceivers are used with multimode fiber for shorter distance (less than 300 m) requirements. The 1300-nm lasers are used with both multimode and single-mode fiber for longer distances, from 300 m up to 10 km.

The use of VCSELs in transceivers for Gigabit Ethernet and Fibre Channel has been growing at a lighting pacemore than 100% per year by some estimates. In fact the growth reported in this survey in 2000 is 295% (resulting in a market size of $127.5 million). However, it seems likely that the 1999 market was substantially underestimated. Several factors complicate the accounting, including assumptions regarding the yield loss between VCSEL shipment and transceiver assembly and lead times between VCSEL shipment and transceiver shipment, which can have a significant effect in a rapidly growing market.

The market for 1300-nm diode lasers in data networking is also growing rapidly, due not only to the demand for high-speed local data networks, but also to the increasing use of single-mode transceivers in metropolitan-area networks, or MANs. The growth rate for 1300-nm lasers in data networking applications was 142% in 2000 to $56 million, and 79% growth is forecast for 2001.

Military/aerospace markets have always been volatile because they are dependent on the vagaries of military procurement cycles. However, the approval and funding of several key military programs, including the US Army's avionics diode-laser platforms such as the Kiowa, Comanche, and Apache helicopters, point to a healthy and increasing market for military applications.

ROBERT V. STEELE is director of optoelectronics at Strategies Unlimited, 201 San Antonio Circle, Suite 205, Mountain View, CA 94040; www.strategies-u.com.

________________________

Diode-laser products and configurationsThe diode-laser revenue figures shown in Table 2 are based on the unit sales figures in Table 1 and average selling prices (ASPs) for each type of diode laser. The ASPs for diode lasers vary widely and are a function of wavelength, power output, and package type. The revenue figures are for packaged devices as they are sold by diode-laser suppliers to the merchant market or transferred internally to other company divisions to be used in system level products. Diode-laser packaging is subject to a wide range of configurations according to the device type and application requirements, and includes variations such as thermal control and fiber coupling. Short-wavelength (<1000 nm) diode lasers at power levels less than 200 mW are almost always single lateral-mode, single-stripe devices that are sold commercially in hermetically sealed TO-type packages. The lasers are typically mounted on a heat sink, and the complete package includes a back facet photodetector for monitoring the laser output level. The selling prices of such devices range from approximately $1 (for a high volume CD-type laser) to around $7 for a 30-mW, 780-nm laser or a low-power visible (650-nm) laser used in optical storage applications. Some low-volume specialty devices can be priced much higher.An increasingly important packaging concept in low-power 750- to 980-nm diode-laser market, particularly in audio CD and CD-ROM applications, is to carry out hybrid integration of the diode-laser chip, detector chips, and optical elements in a single package. These integrated optical pickups are lower in cost than pickups fabricated from discrete components and result in easier assembly for the CD player or CD-ROM drive manufacturer. This concept was introduced by Sony in 1991 for its very thin (15 mm) Walkman CD player. Such pickups are now manufactured in volume by Sony, Sharp, and Matsushita, with prices averaging around $2.50, compared to $1 for a discrete packaged diode laser. The value of such pickups is included in the diode-laser market revenues in Table 2.

For high-power diode lasers (>1 W) there is a wide range of power levels and configurations. Up to 5 W CW, a wide (up to 500 mm) single stripe, multimode device is the norm. These devices are usually supplied in TO-type packages that can include Peltier coolers for temperature control. Beyond about 5 W, the only commonly used approach is a multistripe, multimode array. The standard product at these power levels is a 1-cm-wide diode-laser bar, which consists of a single multistripe array or a grouping of several arrays to build up higher power levels. Pricing for high-power diode lasers ranges from less than $300 for a 1-W discrete device in quantity up to $2000 for a 20-W bar. Single-laser bars are now available at power outputs up to 40 W CW, although 20 W is still the most common configuration. Increasingly, these high-power devices are sold with fiber coupling to provide a more usable output beam for the end user. Higher-power arrays are typically available on a heatsink submount that can be attached to a water-cooled heat-removal system. For applications requiring high peak power, these arrays can be operated in the pulsed (quasi-CW, or QCW) mode at peak powers up to 100 W.

For power levels above 40 W CW, high-power diode-laser bars can be stacked in the vertical dimension (these products are included the "Stacks" category in Tables 1 and 2). Because of the difficulty in removing heat from such a configuration, these stacks are typically operated in the QCW mode. Peak output power approaching 5 kW can be achieved from such a stack. The packages for these devices typically include water cooling, although conduction cooling may be used in lower-duty-cycle devices. With the development of more-efficient heat-removal techniques (microchannel coolers, for example), CW stacks have become available.

The packages for long-wavelength (>1000 nm) diode lasers used in telecommunications applications include special adaptations for coupling the laser output to single-mode (approximately 9-mm-core diameter) optical fiber with tolerances on the order of ±1 mm. These are in the form of fiber pigtails or single-mode connectors. Telecommunication laser packages may also include other elements such as thermoelectric coolers for temperature control and optical isolators to reduce the amount of light reflected from the fiber back into the laser. All laser packages include back facet monitor photodiodes. Because of the expense of fiber coupling and other package features, telecommunications diode lasers typically have high ASPs. Prices range from less than $100 for the lowest-performance Fabry-Perot devices in a connectorized coaxial package to several thousand dollars for a high-performance distributed feedback laser in a cooled butterfly package with fiber pigtail.

________________________

Where the numbers come fromThe Laser Focus World Annual Review and Forecast of the Laser Marketplace is based on a worldwide survey of laser producers and covers 27 types of lasers and 20 applications. Additional information about diode-laser markets is provided by Strategies Unlimited (Mountain View, CA) based on its interviews with both laser suppliers and users. The review quantifies current and projected laser markets by type and application and is the only major survey of its kind in this industry whose results are made public.For many, both inside and outside the industry, from private-sector investors to foreign and US government bodies, this report is the only objective summary of major trends in our industry that is readily available. It serves as a window looking into the laser industry. The numbers presented here are aggregated from the detailed information collected in the surveys. Part I of the review and forecast took a look at the overall market trends with more detail on nondiode lasers. Part II covers the diode-laser marketplace.

Readers interested in the detailed results of both surveys will find them in the Jan. 1 and Feb. 1 editions of the Optoelectronics Report newsletter, published by Laser Focus World. A more extensive review of the data, with supporting commentary from market analysts, was made available to attendees at the Laser and Optoelectronics Marketplace seminar, held in conjunction with Photonics West (San Jose, CA) on Jan. 22.

Collecting the data

We conducted our research and analysis for the Review and Forecast during October and November 2000. Laser manufacturers were contacted by email, fax, or phone and they responded with oral and written information, both qualitative and quantitative, about their markets, the business outlook, and their expectations for next year.

We asked these manufacturers to provide an estimate of total worldwide market size (dollars and units), by laser type, for the markets with which they are familiar. We requested this information for 2000, based on year-to-date actual data, and a forecast for 2001. We also asked which applications or markets are likely to have the most potential for growth in 2001, what technology trends would be most significant, relative to the respondent's business, and what business or market trends are most likely to affect his or her business.

In addition to the information provided by the manufacturers, we also used data from othermore narrowly focusedmarket surveys, and we incorporated commentary provided by industry analysts who provided additional insight to some of the markets. Quantitative information about the medical-laser marketplace was provided by Irv Arons, a contributing editor to Medical Laser Report. A global perspective with valuable local market commentary was provided by our contributing editors throughout the world. Unless noted, the sources of information used in the survey, and the names of those who participated, are, and will remain, confidential.

The market information pertaining to diode-laser markets is based on research conducted by Laser Focus World and Strategies Unlimited during 2000.

Comparison with last year's numbers

Readers who compare last year's 2000 estimates with this year's restated 2000 numbers will note differences and occasional inconsistencies in the numbers reported as compared to last year. In general, no attempt has been made to explain these differences in detail. We request "bottom-up" market estimates, and the respondents to our survey do vary from year to yearboth in terms of the companies involved and the individualsso variations in the results are inevitable. In addition, changes in market visibility occur as market shares change. Differences in the overall numbers for 2000 last year and for 2000 this year may also reflect whatever degree of optimism or pessimism was inherent in last year's forecast (see Laser Focus World, Jan. 2000, p. 92).SGA