Diode-laser market grows at a slower rate

The Laser Focus World 2005 Annual Review and Forecast of the Laser Marketplace is conducted in conjunction with Strategies Unlimited of Mountain View, CA. Part II covers the diode-laser marketplace. Part I, which reported on nondiode-laser markets appeared last month.

fter growing in 2003 for the first time in several years, the diode-laser market continued the trend in 2004. However, unlike the robust growth of 18% in 2003, the market managed to eke out just a 4% increase in 2004, to reach $3.20 billion. This was despite the fact that the telecom laser market grew for the first time since 2000 and the yen appreciated by 7% against the dollar, which is usually a positive factor for growth expressed in dollar terms (because most of the optical-storage lasers, which accounted for 58% of the diode-laser market in 2004, are produced and sold in Japan). The optical-storage laser market was flat in 2004, even though unit shipments increased. The primary reason for the lack of revenue growth was a significant drop in diode-laser selling prices across all optical-storage segments.

In fact, one of the more interesting developments that characterized the diode-laser market in 2004 was significant price declines across almost all laser product categories. Ranging from 780- and 650-nm lasers for optical storage, to the 1-W diodes used in commercial printing applications, to telecom lasers, to VCSELs for data communications, price decreases were ubiquitous and often large-as high as 25% to 30% in some categories. The reasons are many and varied, and perhaps unique to each laser type. Typically, however, they were due either to competitive pressures or customer expectations, or a combination of both. Although price decreases are the norm for many types of diode lasers, it is not often that decreases are so widespread and of such magnitude in any given year.

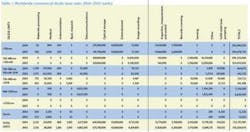

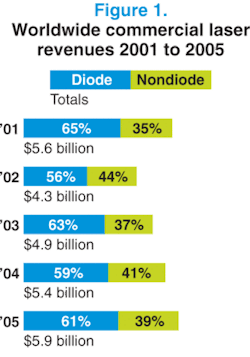

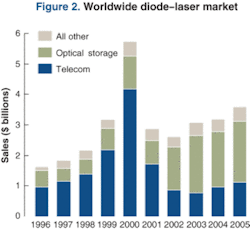

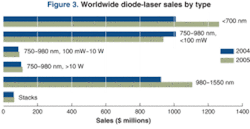

The recent history of the overall market is shown in Fig. 1, and the diode-laser market in Fig. 2. Diode-laser sales data for 2004 and 2005 are charted in detail by application and by type in Fig. 3 and Fig. 4. Diode-laser sales data by unit shipment and dollar revenues are shown in Tables 1 and 2, respectively. The history shown in Fig. 1 includes a forecast for 2005. The chart shows the continuing recovery of the diode-laser market since the peak of the telecom bubble in 2000. Since the bottoming of the market in 2002, growth has been driven primarily by the optical-storage sector. However, in 2004 the telecom laser market started to recover, which contributed to the modest growth of the overall market last year. The average market growth rate from 1996 to 2005 was approximately 9% per year.

For 2005, growth is projected for all applications, including telecom. Telecom will continue its recovery with a projected growth of 20%. Oddly enough, given its recent history, telecom will be the leading growth sector, with optical storage projected to grow by just 9%. Overall, the diode-laser market is forecast to grow 12% to $3.58 billion in 2005.

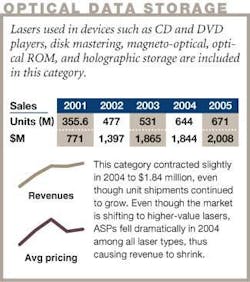

Optical storage

After several years of being the main growth driver for the diode-laser market, the optical-storage engine ground to a halt in 2004. Revenue was basically flat at $1.84 billion (compared to $1.87 billion in 2003). Unit shipments grew by 6% to 644 million, due primarily to the continuing popularity of DVD-based drives, including both read-only and recordable drives. However, price declines were very significant in 2004, with typical yen-denominated decreases of 20% to 25%, but as high as 35% for some diode-laser products. Moreover, more of the production of low-end diodes is shifting to Taiwan, where production costs, and consequently selling prices, are much lower than in Japan. The yen-dominated decreases were moderated somewhat when converted to dollar values because of the appreciation of the yen.

The diode-laser market for optical storage is actually quite complicated, involving a mix of 780- and 650-nm lasers for read-only applications and recordable applications involving CD- and DVD-type media, respectively. Some lasers are sold on a stand-alone basis, while others are sold as integrated pick-ups that include detectors and optics. In recent years dual-wavelength lasers (produced by Matsushita, Toshiba, Rohm, Sharp, and Sony) have become increasingly important in DVD read-only drives. Each dual-wavelength laser replaces a 780-nm laser plus a 650‑nm laser, thus reducing overall unit growth (the 780-nm laser is required for back compatibility with CD-type media). Over time, the market is gradually shifting to higher-value products, including the lasers for recordable applications and dual-wavelength lasers. This contributes to revenue growth, and explains why the market did not shrink further in 2004 as prices dropped across all categories.

Visible lasers for DVD-based applications have been growing much faster than 780-nm lasers. In 2005, 650-nm laser unit shipments are forecast to exceed 780-nm laser shipments for the first time ever, at 342 million and 329 million units, respectively. These figures correspond to changes of +25% and −4%, respectively over 2004. The decrease in the 780-nm laser market is primarily due to a decrease in the shipment of CD-ROM drives, which are gradually being replaced by DVD-ROM drives. Shipment of other CD-based drives such as CD players, CD-RW drives, and combo drives (which read DVD-ROM discs and write CD-RW discs) are relatively steady.

After a high rate of growth over the past several years, the market for DVD players and DVD-ROM drives appears to be maturing, and market growth after 2005 will be limited. However, there is still significant growth in the market for DVD recorders for consumer video and recordable DVD drives for personal computers. Within the past year, the prices of DVD recorders have fallen well below $300 for brand-name systems, and they are now edging toward $200. Typically, consumers have purchased DVD players because of their high image quality and the wide availability of movie titles. However, for recording purposes consumers needed a VCR. So as the prices of DVD recorders have come down, the attractiveness of owning an “all-in-one” video player/recorder has become apparent, and the market has surged.

Although there is significant growth potential left in DVD recorders, it’s clear that the overall DVD market is beginning to mature. For several years, Japan’s major optical-storage manufacturers (as well as those outside Japan, such as Samsung and Philips) have been looking to the next generation of optical-storage drives as a way to keep the market growing. These drives will use a blue-violet (405-nm) diode laser to enable storage of up to 27 Gbytes per disc, compared to 4.7 Gbytes for DVD. Most of the major optical-storage drive manufacturers are developing next-generation DVD products, and several have already introduced products to the market, including Sony in April 2003 and Matsushita later in the year. These products, which are recordable drives, have been available only in Japan, and because of their high prices (around $4,000) sales to date have been modest, on the order of thousands.

Complicating the picture for the development of the next-generation DVD market is the existence of two competing formats. One format, supported by Sony and an alliance of consumer electronics and media companies (including Dell, Hewlett-Packard, Hitachi, LG Electronics, Matsushita Electric, Mitsubishi Electric, Pioneer, Royal Philips Electronics, Samsung Electronics, Sharp, TDK, Thomson, and 20th Century Fox), is known as the Blu-ray Disc format. The other format, supported by Toshiba and NEC, is known as HD-DVD (for high-density DVD). While both formats make use of a 405-nm diode laser to read and write data, the disc structures are completely different, and thus the formats are incompatible. This development is reminiscent of the VHS-Betamax “wars” associated with the introduction of the VCR in the early 1980s, and the competing DVD formats of the late 1990s. While a compromise was eventually reached regarding the DVD read-only format, there still are multiple versions of the DVD recordable format (DVD-RAM, DVD+RW, DVD-RW, and so on).

The format dispute over next-generation DVD players is not likely to be resolved soon. Several major movie studios, such as Universal, Paramount, and New Line Cinema, have endorsed the HD-DVD format, but most of the major consumer electronics companies support Blu-ray Disc, as previously noted. There are advantages and disadvantages to both approaches. Blu-ray Disc has the highest storage capacity, at 25 Gbyte, compared to 15 Gbyte for HD-DVD. The HD-DVD camp claims the ability to achieve 30 Gbyte using a two-layer approach. However, the two-layer approach can also be applied to the Blu-ray Disc format. Toshiba and NEC tout the fact that the HD-DVD disc structure is similar to the current DVD disc structure, and therefore HD-DVD discs can be produced at lower cost with only slight modifications of existing DVD disc equipment.

Whichever approach ultimately wins, or whether they somehow both coexist in the marketplace, producers of 405‑nm diode lasers will still benefit from this new market. Today Nichia is the only commercial producer of these lasers, but several other companies have been developing them and expect to begin commercial production in 2005. These include Sony, Sanyo, and perhaps NEC and Samsung. The prices of 405-nm lasers, at around $1,000, have been considered an inhibiting factor for the development of the next-generation DVD market. However, once production begins to ramp up (now widely expected to occur in the second half of 2005), prices will drop substantially. Nichia has indicated a target price of less than $300 in this time frame. Of course, ultimately, laser prices must fall to much lower levels for a truly mass market in next-generation DVD products to develop.

The next-generation DVD market will not have a significant impact on overall diode-laser sales until 2006. For 2005, the optical-storage laser market is forecast to grow by 9% to $2.01 billion, with very little impact from 405-nm laser sales.

Telecommunications

In 2004 the telecom market for diode lasers showed growth for the first time since 2000, growing by 21% to reach $943 million. Growth was across the board, including both transmission and pump lasers for optical amplifiers. However, the overall story in telecom lasers is actually somewhat more complicated, and includes good news and bad new.

On the positive side, the growth in transmitter-laser unit shipments was at a healthy 31% pace, driven by the relentless demand for more telecommunications traffic. Most of these lasers are commodity transceiver products, operating at lower data rates and over short distances, but there is steady migration to higher data rates. The 10‑Gbit/s transceivers grew in volume in 2004 for 10‑Gigabit Ethernet, and with the higher prices for that category, the 10-Gigabit Ethernet products represent a high growth segment. Prices for specific products continued to fall in 2004, although more slowly than in recent years. There are expectations that prices will stabilize in 2005. Revenues for transmitters saw a reasonable revenue growth of almost 20% in 2004, the first positive growth since 2000, and should see more than 20% growth in 2005.

On the negative side, the income statements of leading telecom transmission-laser suppliers indicate that such growth will not likely sustain the large number of competitors in the market today. Several have been losing tens of millions of dollars per quarter, with cash reserves in the range of $100 million. Companies privately report that they are operating at about 10% of capacity, which is a situation that will not be painlessly remedied. We can expect to hear of some restructuring of the telecom components market in 2005 and 2006. Already in late 2004, Triquint announced that it was shrinking its optoelectronic activities, now having jettisoned a large part of the former activity handed down from Lucent Technologies and, later, Agere Systems (see Laser Focus World, January 2005, p. 57).

For pump-laser suppliers the market situation is more promising. First, that segment is more closely associated with construction of new fiberoptic links, which took a deeper plunge through the downturn than transmitters, especially in the undersea business. The need to light dark fibers to satisfy demand has led to large growth, percentage-wise, with pump unit shipments more than doubling in 2004. Pump prices have continued to fall, however, on a per-milliwatt basis. Thus, while unit shipments are recovering to 1997-1998 levels, the prices are below $3 per milliwatt (compared to $10 per milliwatt as recently as 2000). This leaves suppliers with a growing market, but still one that is much smaller than it once was.

In contrast to transmission-laser suppliers, pump suppliers are already relatively consolidated. There are now just three leading suppliers: Bookham Technology and JDS Uniphase, in 980‑nm pumps, and Furukawa Electric in 1480-nm-range pumps. All of the pump manufacturers have been looking to other diode-laser applications to expand their sales.

Another year of healthy recovery for telecom lasers is forecast for 2005, with the market expected to increase by 20% to $1.13 billion. While this growth will certainly be welcome to an industry that has been in a severe downturn for the past several years, it should also be realized that this is roughly the market size that the industry achieved in 1997.

Pumps for solid-state lasers

High-power diode lasers used as pumps for solid-state lasers (including 750- to 980‑nm diodes in the 100 mW-10 W, >10 W, and Stacks categories) saw a decline in revenue of 13% to $110 million in 2004, even though units grew slightly. As implied by these numbers, an across-the-board decline in average selling prices was the culprit. In some categories, particularly 780-980 nm, >10 W (that is, diode-laser “bars”), unit shipments actually increased significantly-by 19% in the case cited. Unit decreases were observed in the Stacks category, likely due to reasons cited in last year’s diode-laser market review and forecast article: reduced deployment of kilowatt-class industrial diode-pumped solid-state lasers (DPSSLs) because of reliability problems in early trials.

Although the diode-laser pump market often correlates well with the DPSSL market, that was not the case this year. The DPSSL market grew 31.5% in unit terms and 49% in revenue terms in 2004 (see Laser Focus World, January 2005, p. 83). And there was substantial growth in the fiber-laser market as well. While some correlation can be expected, there are reasons these market figures may not correlate in any given year. The most likely factor is the changing mix of DPSSL products from year to year, including changes in the application mix and their associated power levels, which impacts the requirement for diode pump power.

Overall sales of diode lasers for solid-state laser pumping are forecast to increase by about 5% to $116 million in 2005, accompanied by a more significant 19% increase in unit shipments. One of the strong drivers for the pump market will be fiber lasers, the use of which is growing rapidly in a variety of applications. However, these lasers typically use lower-power (5 W) discrete diode lasers rather than the higher-priced bars or stacks. Therefore, strong unit growth does not necessarily translate into significant revenue growth for the overall pump category. In addition, continuing price decreases are forecast for all pump-diode product types.

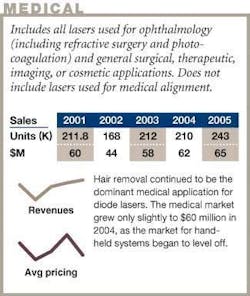

Medical

After growing by more that 30% in 2003, growth in the medical market slowed substantially in 2004, increasing by just 7% to $62 million, in line with last year’s forecast. The large increase in 2003 was driven largely by the hand-held hair-removal-systems market. However, in 2004, this market started to mature, with only a modest growth in units, which translated to a modest growth in revenue as prices held steady. Last year’s high growth in hand-held hair-removal systems more than offset the 40% decrease in revenue for large stationary hair-removal equipment offered by companies such as Lumenis. However, in 2004, sales of diode stacks for this application are estimated to have increased slightly, indicating that the downward slide for large stationary hair removal-systems may be over, and indeed a fairly steady market is forecast for 2005.

The medical diode-laser market for applications other than hair removal continues to grow at a modest rate. Ophthalmic use of diodes in the 100‑mW to 10-W range is primarily for retinal photocoagulation, and is roughly a $1 million market. Most other applications are for diode bars (>10 W) and include general medical/surgical applications as well as dental. Although still small, dental seems to be the fastest growing segment at the moment. Overall medical applications other than hair removal grew by about 33% in 2004 to $29 million, however the 2005 market is forecast to be relatively flat.

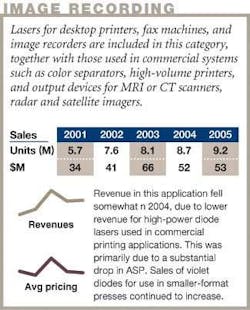

Printing/Graphic arts (image recording)

The commercial printing/graphics-art market for diode lasers encompasses a variety of applications, including computer-to-plate (CTP), imaging film for color separation, and photofinishing. Computer-to-plate is by far the largest of these, and it continues to lead the market in terms of defining its overall direction. Within the CTP market, two types of diodes are used almost exclusively-high-power (approximately 1‑W discrete devices and bars) 830-nm diodes for thermal imaging applications, and lower-power (30-60‑mW) violet diodes for applications using photopolymer or silver halide plates that are sensitive at 405 nm. A recent article in Laser Focus World explored the printing/graphics-arts market in some depth (see Laser Focus World, January 2005, p. 145).

It seems apparent that infrared diode laser-based thermal CTP will be the technology of choice for the printing/graphic-arts industry in the longer term, especially as so-called “processless” thermal plates come into wider use in the coming years (the thermal plates used today require some additional processing, and even more extensive processing is required by photosensitive plates that use silver halide or photopolymers). However, in the near term there can be hiccups in the market, depending on business conditions and growth in competing CTP technologies.

In 2004, the market for infrared diodes actually decreased by nearly 14% to $25 million, largely due to a sharp decrease in the price of the 1-W diodes used in most CTP systems. Units decreased slightly as well. On the other hand, within the IR-diode product mix, the market for diode bars, which are used exclusively by CTP equipment maker CREO (Vancouver, Canada), increased by 33%. These figures seem to indicate a near-term shift in the market shares of competing CTP equipment suppliers.

Violet diodes used in systems with photosensitive plates have increased their market share relative to IR diode-based systems, and further growth in 2005 is expected. Violet diode-based systems are less expensive on an initial cost basis, and have been making inroads in the newspaper industry and among smaller, cost-conscious printers. However, because these systems use silver halide or photopolymer plates, substantial post processing is required, along with the need for disposal of associated chemicals.

There is a mix of views about the growth of IR discrete diodes for 2005, with some observers predicting a flat to slightly increased market, while some expect a significant dip, likely due to increased competition from violet diodes, while most agree that infrared diode bars will show a healthy increase. Overall, the printing/graphics-arts market is forecast to be approximately flat in 2005 at $29 million.

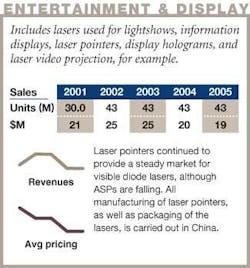

Entertainment and display/Inspection and measurement/Barcode scanning

These markets for low-power visible diode lasers do not change much from year to year, with the exception of barcode scanning, which continues to experience steady growth. While visible lasers for barcode scanning are still largely made in Japan, almost all other visible-laser applications are served by low-cost lasers that are made in Taiwan and either packaged there or in China. The latter is especially true of laser pointers, which have plummeted in price in the past few years. These three applications added up to a market of around $77 million in 2004.

The “Inspection, measurement, and control” category includes a wide variety of visible laser applications, including surveying instruments, industrial pattern generation, laser gunsights, laser levelers, and many others. For specialty applications requiring higher visibility and/or longer range, 635-nm rather than the standard 670-nm lasers are used, and higher powers may be required as well. These are more sophisticated index-guided, rather than gain-guided, devices, that are primarily made in Japan. These lasers accounted for around 17% of the units in 2004, but about 74% of the revenue in this $33 million market.

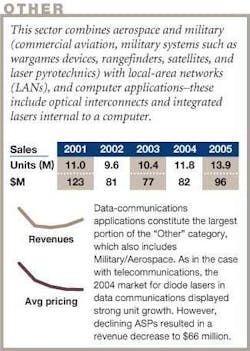

Other

The “Other” category includes military/aerospace and local-area networks. Military markets include primarily high-peak-power diode lasers used in ordnance initiation, war games, and range finding, but also some high-power CW lasers for target designation and various other applications. Wavelengths include 810, 915, and 1550 nm. The latter is used primarily for range finding because this wavelength is in the eye-safe region of the spectrum.

The military/aerospace market more than doubled in 2004 to $13.6 million, and is forecast to increase to $15.5 million in 2005. The rapid growth in 2004 should be no surprise in light of the U.S. Defense Department build-up associated with the war in Iraq and the various counter‑terrorism initiatives. It should be noted that all pump lasers for DPSSLs, whether the DPSSLs are used for commercial or military purposes, are counted in the pump-laser category.

The designation “local-area networks” includes storage-area networks (SANs), which operate using the Fibre Channel communications standard, true local-area networks (LANs) that operate with the Ethernet protocol, as well as point-to-point data links, including parallel optical interconnects used in backplanes for high-data-rate telecom switches and supercomputers. The diode lasers used in these applications include 850-nm VCSELS (included in the 750-980 nm, <100 mW category) and 1310-nm edge-emitting lasers incorporated into transceiver modules. Ethernet networks are characterized by a variety of data rates, from 10 Mbit/s to 10 Gbit/s, but lasers are only used at 1 Gbit/s and above. The move to 10-Gbit/s in Ethernet-based LANs began two years ago, but penetration has been very low, mainly due to the high cost of 10-Gbit/s equipment. For 2004, it is estimated that less than 1% of Ethernet transceivers were 10-Gbit/s. Fibre Channel-based SANs have shifted almost entirely from 1 Gbit/s to 2 Gbit/s, with 4 Gbit/s just starting to come into use.Although the SAN and LAN market declined each year from 2001 through 2003, due to the economic downturn and steadily decreasing corporate investment in information-technology equipment, it appears to have bottomed out in 2003. In 2004 the LAN/SAN market grew by 13% in unit terms. However, because of decreases in average selling prices, market revenue declined by 7% to $68 million. In 2005, the more robust growth characteristic of the LAN/SAN market experienced in the late 1990s is expected to return, with an 18% increase to $81 million forecast.

ROBERT V. STEELEis director of optoelectronics at Strategies Unlimited, 201 San Antonio Circle, Suite 205, Mountain View, CA 94040

Diode-laser products and configurations

The diode-laser revenue figures shown in Table 2 are based on the unit sales figures in Table 1 and average selling prices (ASPs). The ASPs for diode lasers vary widely and are a function of wavelength, power output, and package type. The revenue figures are for packaged devices as they are sold by diode-laser suppliers to the merchant market or transferred internally to other company divisions to be used in system-level products. Diode-laser packaging has a wide range of configurations according to the device type and application requirements, and includes variations such as thermal control and fiber coupling. Short-wavelength (<1000 nm) diode lasers at power levels less than 200 mW are almost always single-lateral-mode, single-stripe devices that are sold commercially in hermetically sealed TO-type packages. The lasers are typically mounted on a heat sink, and the complete package includes a back facet photodetector for monitoring the laser output level. The selling prices of such devices range from less than $1 for a high-volume CD-type laser to around $1.50 for a low-power visible (650-nm) laser, to around $7 for a 50-mW, 650-nm laser used in rewritable DVD applications. Some low-volume specialty devices can be much higher.An increasingly important packaging concept in the low-power diode-laser market, originating in CD and CD-ROM applications with 780-nm laser diodes, but now used widely in DVD applications that use 650-nm laser diodes, is integration of the diode-laser chip, detector chips, and optical elements in a single package. These integrated optical pickups are lower in cost than pickups fabricated from discrete components, and result in easier assembly for the optical-disk-drive manufacturer. Such pickups are now manufactured in volume by Sony, Sharp, and Matsushita, with prices around $1.60 (780 nm) to $3 (650 nm), compared to less than $1 to $2 for discrete packaged diode lasers. The value of such pickups is included in the diode-laser market units and revenues in Tables 1 and 2. Integration has also extended to combining 780- and 650-nm lasers in a single package, which are used in DVD players and DVD-ROM drives so that CD-type media can be read in the same drives. This type of integrated package, priced at around $3.30, is included in the statistics on lasers in the <700-nm category in Tables 1 and 2.

For high-power diode lasers (>1 W) there is a wide range of power levels and configurations. Up to 5-W CW, a wide (up to 500 μm) single stripe, multimode device is the norm, usually in TO-type packages that can include Peltier coolers for temperature control. Beyond about 5 W, the only commonly used approach is a multistripe, multimode array. The standard product at these power levels is a 1-cm-wide diode-laser bar, consisting of a single multistripe array or a grouping of several arrays to build up higher power levels. Pricing for high-power diode lasers ranges from under $200 for a 1-W discrete device in quantity up to $2000 for a 50-W bar. Single laser bars are now available at power outputs up to 60-W CW. Increasingly, these high-power devices are sold with fiber coupling to provide a more usable output beam. Higher-power arrays are typically available on a heat-sink submount that can be attached to a water-cooled heat-removal system. For applications requiring high peak power, these arrays can be operated in the pulsed (quasi-CW, or QCW) mode at peak powers up to 100 W.

For power levels above 60-W CW, high-power diode-laser bars can be stacked in the vertically (these products are included in the Stacks category in Tables 1 and 2). Because of the difficulty in removing heat from such a configuration, these stacks are typically operated in the QCW mode. Peak output power approaching 5 kW can be achieved from such a stack. The packages for these devices typically include water cooling, although conduction cooling may be used in lower-duty-cycle devices. With the development of more-efficient heat-removal techniques (microchannel coolers, for example), CW stacks have become available.

The packages for long-wavelength (>1000 nm) diode lasers used in telecommunications applications include special adaptations for coupling the laser output to single-mode (approximately 9-μm core diameter) optical fiber with tolerances on the order of +1 µm. These are in the form of fiber pigtails or single-mode connectors. Telecommunication laser packages can also include other elements such as thermoelectric coolers for temperature control and optical isolators to reduce the amount of light reflected from the fiber back into the laser. All laser packages include back-facet-monitor photodiodes. Because of the expense of fiber coupling and other package features, telecommunications diode lasers typically have high ASPs. Prices range from less than $50 for the lowest performance 1310-nm Fabry-Perot devices in a connectorized coaxial package to $500 to $1000 for a high-performance distributed-feedback (DFB) laser in a cooled butterfly package with fiber pigtail. Diode lasers used in short-distance data-communications applications with multimode fiber have much lower prices. For example, 850-nm VCSELs packaged in several different configurations are priced at under $5.

Where the numbers come from

The Laser Focus World Annual Review and Forecast of the Laser Marketplace is based on a worldwide survey of laser producers and covers 27 types of lasers and 20 applications. Diode-laser market information is provided by Strategies Unlimited (Mountain View, CA). Industrial-laser market information is provided by Industrial Laser Solutions, and the Medical Laser Report newsletter provides the medical market analysis. This review is the only major survey of its kind in this -industry whose results are made public.

For many, both inside and outside the industry, from private-sector investors to foreign and U.S. government bodies, this report is the only objective summary of major trends in our industry that is readily available. This article, Part II, covers the diode-laser marketplace. Part I, published in January, examined the overall market trends with more detail on nondiode lasers.

Readers interested in the detailed results of both surveys will find them in the January 1 and February 1 editions of the Optoelectronics Report newsletter, published by Laser Focus World.

Collecting the data

We conducted our research and analysis for the Review and Forecast during October and November 2004. We asked manufacturers to provide a confidential estimate of total worldwide market size (dollars and units) for 2004, based on year-to-date actual data, and a forecast for 2005. In addition to the information provided by the manufacturers, we also used data from other more narrowly focused market surveys, and we incorporated commentary provided by industry analysts who added market insight for specific segments. The detailed fiber-laser sales information this year was provided by SLI Optics (Southampton, England), whose help over the past couple of years in getting a handle on the fiber-laser business has been invaluable.

Changes from last year

A comparison of last year’s 2004 estimates with this year’s restated 2004 numbers will show differences and occasional discontinuities in the numbers reported as compared to last year. In general, no attempt has been made to explain these differences in detail. We request “bottom-up” market estimates, and the respondents to our survey do vary from year to year-both in terms of the companies involved and the individuals-so variations in the results are inevitable. In addition, changes in market visibility occur as market shares change. Differences in the overall numbers for 2004 last year and for 2004 this year may also reflect whatever degree of optimism or pessimism was inherent in last year’s forecast (see Laser Focus World, February 2004, p. 71). -SGA