Review and forecast of laser markets Part I: Nondiode lasers

The Laser Focus World 2000 Annual Review and Forecast of the Laser Marketplace is conducted in conjunction with Strategies Unlimited, an optoelectronics market research firm based in Mountain View, CA. Part I of the review reports on the nondiode laser markets. Part II, written by Robert Steele of Strategies Unlimited, covers the diode laser marketplace and will be published next monthEd.

Stephen G. Anderson,Executive Editor

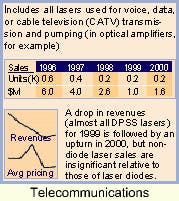

Telecommunications is taking over the laser and optoelectronics industryor so it might seem to those of us who have followed the events of the last year or so. Companies have changed direction, apparently overnight, to reconfigure themselves as telecommunications firms; mergers and acquisitions are occurring on an almost daily basis, consolidating what was once a much more diverse group of companies; and significant new financial investments are being made in telecommunications technologies, often at the expense of other aspects of optoelectronics.

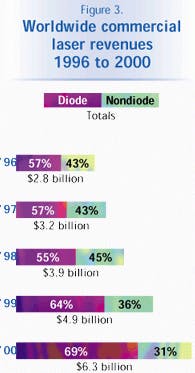

In fact, as an applications category for lasers, telecom laser revenues now dwarf the rest. It has become so large that by the end of this year, telecom laser sales alone could exceed the total size of the laser market only three years previously. So there are really two stories to be told here: the total laser market grew 27% (revenues) in 1999 if telecom lasers are included, but only about 10% if telecom sales are excluded. Looking into 2000, an overall (all lasers) market growth of 28% is forecast, with the total laser market topping $6 billion, of which almost $3 billion is for telecom.

For diode lasers, lots of growth is taking place in other applications besides telecom. Optical memories, local-area networking, and entertainment all reported double-digit growth for 1999 and almost all the diode laser applications segments are expected to show significant upward movement in 2000, resulting in a diode laser market of $4.3 billion, a gain of 38% over 1999. Much more detail on the diode laser markets will be provided next month in Part II of this report.

Nondiode lasers show a different picture, however. The overall market was flat between 1998 and 1999 but a modest increase of 11% is forecast for 2000, bringing total nondiode laser sales to just shy of $2 billion. The overall "traditional" (non-telecom) laser and optoelectronics business climate in the USA has been rather subdued for much of 1999. Layoffs and restructurings have occurred at several US laser firms, and some executives have admitted to 1999 being a rather disappointing year.

Problems include softer diode-pumped solid-state (DPSS) laser pricing than in previous years, softness in the semiconductor equipment business, and softness in some high-power laser diode markets. Looking forward, a shakeout in the DPSS laser market is likely, and gradual improvement in the semiconductor equipment business has started.

Diode-pumped technology is becoming a major driver for many of the trends in this market. The most prominent is the "coming of age" of DPSS lasers. Revenues were up 11% in 1999 and are expected jump 23%, crossing the $100 million mark in 2000. They were clearly evident at last year's Laser 99 trade fair in Munich, Germany, where several attendees pointed out that every marking company on the show floor seemed to have a DPSS laser. Would-be manufacturers of DPSS lasers are proliferating, too, with the result that, for the time being at least, price erosion is reported as a significant problem in the marketplace.

A related trend is the convergence of what used to be relatively distinct laser technologies or systems. A single box can now house a turnkey all-solid-state tunable ultrafast laser, for example, or a Ti:sapphire regenerative amplifier system.

A slightly different facet of DPSS technology looks set to cause an upheaval of sorts, although probably not for another year. Microlasers have been around commercially for a couple of years, but in December, an exclusive license originally granted to Uniphase (now JDS Uniphase; San Jose, CA) by Stanford University (Palo Alto, CA) concerning a patent for diode pumping and frequency doubling to obtain blue light will expire. If the patent subsequently is more broadly licensed, one can expect these lasers to have a more significant effect on aspects of the nondiode laser marketplace, especially those that benefit from blue light (see p. 133).

Yet another variation on diode pumping, fiber lasers, has emerged to become a commercial reality. 1999 saw real recognition of their potential by at least two major laser producers. SDL (San Jose, CA) consolidated its fiber laser activities with Polaroid by purchasing all of that company's fiber laser business, while Spectra-Physics Lasers (Mountain View, CA) also entered the market with a fiber laser designed for OEM applications. These include graphic arts, telecommunications, and materials processing (see Laser Focus World, June 1999, p. 95). Fiber laser sales are counted for the first time this yearthey are included in the "other" laser categorytogether with metal-vapor lasersbut no applications-specific data are currently available.

Nondiode laser sales data for 1999 and 2000 are charted in detail by application and laser type in Figures 1 and 2, respectively. Total worldwide commercial laser revenues for 1996 to 2000 are charted in Figure 3. Tables 1 and 2 provide nondiode-laser sales data by unit shipments and dollar revenues, respectively. The corresponding charts and tables for diode lasers will appear next month. See also "Where the numbers come from," p. 98.

The data presented in the tables are available with more detailed commentary in the January 1, 2000, issue of Optoelectronics Report. The survey data will also be analyzed at the 14th annual Laser Marketplace Seminar on January 26, 2000, held in conjunction with Photonics West (San Jose, CA) and sponsored by Laser Focus World in association with Strategies Unlimited.*

Economic picture bright

Looking beyond the technology, economic conditions in 1999 have been fairly upbeat. The US economy shows little sign of slowing downon the contrary, inflation fears caused a small rise in interest rates toward the end of the year. Unemployment reached a 29-year low in the last quarter, the stock markets trended upward all year, and the mergers and acquisitions activity continued apparently unabated from previous years. In Asia and Japan, a slow recovery is underway. Laser Focus World contributing editor Craig Addison notes that optoelectronics is currently one of the bright spots in Japan's economy. After two years of recession in 1997 and 1998, business sentiment in Japan is showing a sharp improvement, but companies continue to be cautious about making new investments. In Korea, says Addison, as the economy stabilizes, major optoelectronics firms are beginning to re-invest. And Taiwan also will increase its investment in optoelectronics research and production next year.

In Europe a similar picture emerges. UK contributing editor Bridget Marx says 1999 was a good year for the UK, with most companies reporting significant growth. Both home and export markets have been strong, she says, with exchange rates more favorable in 1999 than 1998. In Germany, contributing editor Uwe Brinkmann reports that the laser-producing industry is in good shape. He says lasers are spreading into new applications, while new laser sources are being developed, and the lasers and electro-optics community is becoming aware of the necessity to combine forces to meet the challenges of the next decade. France, too, has benefited from a healthy economic situation combined with a significant boost from telecommunications, says contributing editor Roland Roux. (For a more detailed discussion of the situation in Europe and Asia, see Optoelectronics Report, January 1, 2000).

A lackluster increase of only 4% over 1998 marked the materials-processing sector's end to the 20th century. Semiconductor and microelectronics processing was the primary culprit, dropping 11% in revenues atwhat appears to bethe tail end of a slow period.

According to market research firm Dataquest (San Jose, CA), wafer fabrication equipment capital expenditures fell 28% in 1998 and inched up a meager 2% in 1999 to top $15 billion. A much more respectable increase of 26% is forecast by Dataquest for 2000, and, according to many laser firms surveyed late in 1999, is starting to show up in a healthier order rate for lasers. For 2000, our survey predicts a 12% increase in laser sales into the semiconductor sector and 16% for all materials processing, which brings total revenues to $1.3 billion.

The largest-revenue laser in the semiconductor processing market is the excimer, sales of which are up 100 units for 1999 compared to last year's forecast. Revenues are actually down slightly due to some average-pricing adjustments that we made. For 2000, excimer laser revenues are expected to increase 13%, driven mostly by higher demand for fiber Bragg gratings (used in fiberoptic communications), which can be made with excimers, and for microlithography lasers.

In the metal-processing part of the business, total laser revenues were up 13% for 1999 and are projected to increase another 12% into 2000. High-power carbon dioxide (CO2) laser revenues increased 12% and 13% in 1999 and 2000, respectively. David Belforte, editor of Industrial Laser Solutions, says growth in the automotive and fabricated metal industries drove much of the increase, adding that the demand for continuous-wave (CW) Nd:YAG lasers (used to cut penetrations into hydroformed tubing) in the automotive market led one supplier to add 30% to its production facility and to establish a US-based laser assembly operation.

Another materials-processing category, marking, also moved up during the year and is forecast to rise a further 9% in 2000. In percentage terms it's also interesting to note that laser diode sales are forecast to increase in two- and three-digit percentages across the board. Clearly as laser diode powers increase, their impact on this market will be more significant each year.

Diode-pumped solid-state lasers also are forecast to take an increasing share of this market sector, with a revenue increase of 29% forecast for 2000. Higher powers and increasingly efficient frequency conversion to green and ultraviolet output means that they will continue to gain momentum. At the forefront of high-power DPSS metal processing, for example, are kilowatt-class CW systems available from Rofin Sinar and others.

High-power laser sales in general, says Belforte, look solid for another year as customer requirements for more power will drive up revenues. A return to growth in the Asian market will contribute to increases in the sheet-metal cutting sector, he says. Overall, the industrial laser business seems to be settling in for a period of modest, but continuing growth.

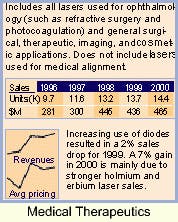

Diode lasers are spearheading a growing trend toward the adoption of compact laser systems for medical therapeutics, according to Medical Laser Report editor Kathy Kincade. As a result, sales of end-user laser systems for several medical applications are expected to increase significantly over the next year. In the USA medical end-user systems sales reached $1.3 billion in 1999, a 24% increase over 1998, and should jump another 28% in 2000 to $1.65 billion. At the same time, worldwide sales of medical laser systems are forecast to increase 19% between 1999 and 2000, heading beyond $2 billion for the first time.

Between 1998 and 1999 sales of diode lasers for therapeutic and surgical applications increased 9% to $25.4 million and should climb another 35% in 2000 to $34.4 million. Despite this increase, however, the average selling price is projected to drop 23% in 2000.

In ophthalmology, diode lasers are steadily finding new nichesdiode-laser-based systems are, for example, the predominant delivery device for the treatment of age-related macular degeneration, a consumer-oriented application with huge market potential. Nondiode-laser-based systems sales are a mixed bag. As has been the case the last few years, diode-pumped solid-state lasers are replacing ion lasers for several ophthalmic and surgical applications.

The biggest change between 1998 and 1999 was in excimer-laser sales. Laser vision correction has become a huge consumer marketlarger and more quickly than anticipatedso excimer-laser sales for photorefractive keratectomy and laser in situ keratomileusis rose from 450 units in 1998 to 800 in 1999. Some analysts believe this market has peaked, however, so excimer-laser-system sales for vision correction are projected to fall in 2000. As a consequence, a correlating end-user systems revenue decrease from $260 million in 1999 to $216 million in 2000 is forecast.

Holmium and erbium laser sales are projected to rise in the coming year, from 1600 units in 1999 to 2000 in 2000, due in large part to the anticipated approval of holmium lasers for nonablative vision correction and growing use of the erbium laser in dentistry. This translates into nearly doubled end-user systems revenues between 1999 and 2000, from $113 million to $188 million.

Trends to watch for in the coming year include increasing use of diode-laser systems for numerous office-based procedures, with significant growth in sales to general practitioners and other nonspecialists. US regulatory approval is also expected for the first biostimulation application, a diode-laser-based treatment for carpal tunnel syndrome.

Readers should note that many medical-device manufacturers do not participate in our survey. To derive the laser source revenues reported here, we rely on help from Medical Laser Report contributing editor Irving J. Arons, who tracks medical-system end-user sales within this market sector. Revenue projections by Arons and Kincade are based on medical-system sales to medical end usersthe laser is only one component of these sales. The numbers in our tables, however, are based on revenue estimates of the laser source itself.

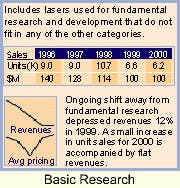

Over the past ten years or so, basic research has suffered from a significant change in funding structure as US federally funded research money has dwindled, to be replaced, if at all, by commercially driven research funding. Some optoelectronics firms are still able to exploit such funding sources as Small Business Innovation Research (SBIR) grants, but almost all of the recent growth in research results from a resurgence of industrial R&D, according to a recent study by the National Science Foundation (see Laser Focus World, Dec. 1999, p. 53).

Last year we forecast that this sector's sales would creep upward by a mere 3% in 1999 with almost all of the growth coming from diode lasers. It turns out that the basic research market declined in revenues by 12% in 1999, and this is followed by a small upturn in the forecast for 2000almost all of which is due to diode-laser revenue growth.

We also noted that DPSS lasers have made certain research-oriented laser systems much more accessible in terms of both cost and user-friendlinessgrowth of 14% (units) and 13% (revenues) was forecast. This year's numbers show a 1999 unit growth of 12%in line with that forecastbut revenues actually declined 4% to $18.5 milliononce more attesting to the price erosion in this market. For 2000, a 12% revenue growth is expected to accompany an increase of 17% in units.

Elsewhere in the research market, excimer laser revenues are flat into 1999, but show a 20% increase for 2000, reaching $18 million. Overall ion laser revenues continue their decline, dropping 23% for 1999 and another 13% in 2000 to $12 million. Revenues for Ti:sapphire lasers jumped 39% in 1999 over 1998 but are expected to drop 23% in 2000.

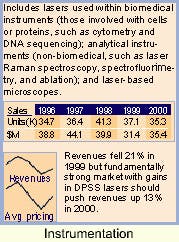

On the heels of a 9% drop in laser revenues for 1998 compared to 1997 and a forecasted 1999 increase of 4%, the instrumentation market sector apparently lost ground again in 1999 with total revenues down 25% compared to 1998. An overall increase of 12% is projected for 2000 with growth in both diode and nondiode device revenues, although nondiode laser units are expected to fall by 5%.

Diode-pumped solid-state-laser revenues for 1999 are up about 9% over 1998more or less as forecastand show a healthy jump of 47% for 2000, which is certainly consistent with the overall proliferation of DPSS lasers noted earlier. The "old technology" blue/UV-emitting laserslow-power argon-ion and HeCd systemsalso increased, due primarily to their biomedical applications, which typically involve fluorescence (see Laser Focus World, Nov. 1999, p. 147).

Despite the on-again, off-again nature of the supply-side market numbers in this sector, the fundamentals appear to remain strong. According to Gordon Wilkinson, managing editor of Analytical Instrument Industry Report (East Grinstead, England), 1999 saw several laser-based instrument innovations that could provide analysts with powerful new tools. In Japan, for instance, Horiba (Kyoto, Japan) introduced a laser-based technology for observing the pH transition caused by the metabolism of microbes. And an Australian research organization introduced a bench-top laser plasma spectrometer for the simultaneous determination of most of the important elements needed to characterize low-rank coal. Meanwhile, in the USA Chemicon (Pittsburgh, PA) commenced a three-year joint venture with II-VI (Saxonburg, PA) to integrate several imaging techniques, including laser Raman, infrared, photoluminescence, and polarized light, for inspecting semiconductor devices.

Looking forward, Wilkinson observes that the greatest opportunities for growth among OEM suppliers are for laser systems that can be used for genomics applications. He notes that although this sector is still young, it is already trending toward systems and solutions. Affymetrix (Santa Clara, CA), for example, has extended its agreement with Agilent Technologies, formerly Hewlett-Packard (Palo Alto, CA), under the terms of which Agilent will make at least 500 GeneArray confocal laser scanners to be sold by Affymetrix as part of its GeneChip system between now and the end of 2002. GSI Lumonics (Watertown, MA) is among firms that have recognized the need to provide total customer solutions and has entered into a marketing alliance with consumables supplier NEN Life Science Products (Boston, MA) to produce "an affordable solution for rapid, high-volume gene expression analysis."

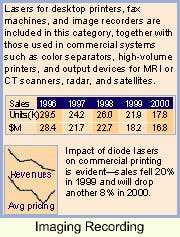

Electronic prepress is one of several arenas in which lasers have been applied to commercial image recording or reprographics. Typically it involves exposing a piece of film with a laser so that offset printing plates can be made. Historically, both HeNe and low-power argon-ion lasers have dominated this field.

A longstanding goal of developers and users, however, has been the advent of "direct-to-plate" or "computer-to-plate" technology, by which the laser directly exposes the printing plate and eliminates the need for film. Over the years, this "simple" transition has been the focus of tremendous efforts on the part of systems manufacturers and laser makers. New technologies, such as fiber lasers, DPSS devices, and fiber-coupled laser diodes, combined with cheaper computing power, are now converging to make computer-to-plate and direct digital color proofing a commercial reality. And we'll see much more of this next year (see Laser Focus World, Sept. 1999, p. 79).

According to the Printing Industries of America (Alexandria, VA), electronic prepress was the fastest-growing segment of that industry through September 1999, gaining 9%. Furthermore, it is expected to continue as the highest-growth segment for the next 12 months, adding another 12%.

In terms of lasers, commercial segment revenues fell 19% due to lower diode laser sales, with a 13% drop in revenues for the segment overall. Nondiode lasers in this segment gained 7% in 1999 and are expected to remain flat in 2000. Laser diode revenues for desktop printers fell 7% in 1999 and are expected to fall another 9% in 2000; the improving quality and falling costs of ink-jet printers are giving laser printers a hard time.

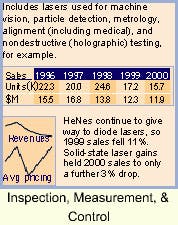

With total 1999 revenues of $11 million, the sensing market showed a huge 57% revenue drop compared to 1998 and a paltry 2% overall increase for 2000. Sales of both diode and nondiode lasers were lower than forecast in 1999. Diode lasers dropped about $5 million, while solid-state lasers were down across the boardlamp-pumped lasers fell $5 million, laser-pumped $1.5 million, and DPSS devices were off $1.5 million. For 2000, laser diodes show a $0.5 million (33%) increase, while nondiode lasers are expected to lose another $0.25 million (3%).

Many otherwise-unrelated applications fall into this category, which is down across the board for 1999 (3% overall) with a 5% increase in overall revenues projected for 2000all this increase comes from diode lasers. For nondiode lasers, HeNe revenues are the largest laser type and were higher than forecast for 1999, but are again expected to fall in 2000 as visible-output laser diodes take away more markets. There are still a few "hold-out" applications for HeNes, such as those that make use of nonred wavelengths or that use the HeNe as a wavelength reference source. Pulsed solid-state lasers, both lamp-pumped and diode-pumped, show revenue gains and are used, for example, in nondestructive testing.

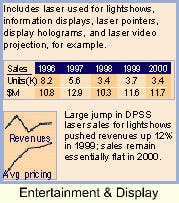

The Millennium has undoubtedly been a major boost for business at lightshow firms (no doubt for fireworks manufacturers, too). From private parties to city-wide celebrations, there were more laser lightshows occurring on the Eve of 2000 than on any other single night in history. Lightshows represent the largest application of nondiode lasers in this market sector, making use of HeNe lasers at the low end and large-frame ion lasers or doubled Nd:YAG lasers at the high.

The size and inconvenience of water-cooled ion lasers have always worked against them in this application and as viable alternatives become available, sales will continue a downward spiral. A 9% drop in 1999 will be followed by a further 8% in 2000.

The most interesting alternatives are currently based on DPSS technology. Driven partly by microlasers emitting at blue and green wavelengths, sales of these devices made a stratospheric jump of more than 350% into 1999, with a further 22% forecast for 2000. Displays are still very much an emerging application for DPSS lasers and currently make more use of laser diodes. Although HeNe revenues gained 7% in 1999, visible-output laser diodes are also gradually pushing them aside and revenues are expected to drop 12% in 2000. Sales of laser diodes for pointers account for the bulk of units sold in this category.

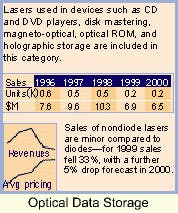

With the exception of optical disk mastering and a few experimental systems, such as for holographic data storage (see p. 209), this market sector involves the use of laser diodes in optical storage devices such as CDs and in CD-ROM drives. Foreign-exchange variations, together with the increasing number of optical disk formats (DVD, CD-R and the MiniDisc formats, for example), are driving revenues to new heights. Overall sales are up 42% and 45%, respectively, in 1999 and 2000, with nondiode lasers showing decreases in both years. More on this sector in next month's report.

A voracious appetite for more bandwidth in all types of communicationsfrom long-haul to localis driving sales of lasers for telecommunications, which are almost all laser diodes; they exceeded the $2 billion mark in 1999, a whopping 58% increase (that's almost $800 million!) over 1998. This makes the telecom segment almost twice as big as the next largest laser market, materials processing. Another revenue increase of $800 million (37%) is forecast for 2000, putting the telecom market at almost $3 billion by the end of the year. To put this in perspective, remember that the entire laser market (including telecom applications) only crossed the $3 billion threshold in 1997.

This surging market is also driving other laser applications. Wavelength-division-multiplexing systems make use of fiber Bragg gratings, for example, which are made using UV lasers and which are counted in this survey under materials processing (see Laser Focus World, March 1999, p. 99). The increasing complexities of communications networks, meanwhile, demand new breeds of test and measurement equipment, some of which are laser-based (see WDM Solutions, Sept. 1999, p. 27). Because lasers used currently for telecom applications are almost exclusively semiconductor devices, this market sector will be discussed in more detail next month.

A 35% growth in laser diode revenues for barcode scanning drove this market sector to achieve a 20% overall revenue growth for 1999 but the nondiode laser revenuesall HeNes declined by 12%. Although laser diode units are expected to grow 15% (to 1.5 million devices) into 2000, the lower average sales price of the diodes ($4) compared to the older HeNe laser ($71) means overall sales dollars for the sector will remain essentially flateven as nondiode lasers drop 36% in revenues and units. Total unit sales of HeNes will decline to 16,000 units in 2000, commensurate with the falling population of HeNe-based scanners in the field that need retubing.

On the demand side, the overall outlook for barcode scanning is upbeat. Symbol Technologies (Holtsville, NY), for example, a leading supplier of scanners in this field, reported year-over-year third-quarter 1999 sales were up 14%, and analysts are predicting a 22% sales growth for 2000. According to the company, barcode readers represented about 40% of its revenues through FY98.

The 1999 forecast for this group of applications was for revenues to reach $41 million. In fact 1999 overall sales were $71 million, with the largest part of this increase coming from diode lasers. For 2000, diode lasers are expected to push this number up to $94 million. Nondiode laser revenues are forecast to remain flat at $3.5 million.

Coming Next Month: THE LASER MARKETPLACE 2000

Part IIDiode Lasers

Where the numbers come from

The Laser Focus World Annual Review and Forecast of the Laser Marketplace is based on a worldwide survey of laser producers and covers 27 types of lasers and 20 applications. Additional information about diode-laser markets is provided by Strategies Unlimited (Mountain View, CA) based on its interviews with both laser suppliers and users. The review quantifies current and projected laser markets by type and application and is the only major survey of its kind in this industry whose results are made public.

For many people, both inside and outside the industry, from private-sector investors to foreign and US government bodies, this report is the only objective summary of major trends in our industry that is readily available. It serves as a window looking into the laser industry. The numbers presented here are aggregated from the detailed information collected in the surveys.

By joining forces with Strategies Unlimited, we are able to provide readers with a more-detailed review and analysis of the diode laser market than in previous years. Part II of the Review and Forecast covers the diode laser marketplace and will be published next month.

Readers interested in the detailed results of both surveys will find them in the January 1 and February 1, 2000, editions of the Optoelectronics Report newsletter, published by Laser Focus World. A more extensive review of the data, with supporting commentary from market analysts, will be available to attendees at the Laser Marketplace seminar, held in conjunction with Photonics West (San Jose, CA) on January 26, 2000. For more information call Carole Root at 603-891-9138.

Collecting the data

We conducted our research and analysis for the Review and Forecast during October and November 1999. Laser manufacturers were contacted by email, fax, or phone, and they responded with oral and written information, both qualitative and quantitative, about their markets, the business outlook, and their expectations for next year.

We asked these manufacturers to provide an estimate of total worldwide market size (dollars and units) by laser type for the markets with which they are familiar. We requested this information for 1999, based on year-to-date actual data, and a forecast for 2000. We also asked which applications or markets are likely to have the most potential for growth in 2000, what technology trends would be most significant relative to the respondent's business, and what business or market trends are most likely to affect his or her business.

In addition to the information

provided by manufacturers, we used data from othermore narrowly focusedmarket surveys, and for some of the markets, we incorporated commentary from industry analysts. Quantitative information about the medical laser marketplace comes from Irv Arons, a contributing editor to Medical Laser Report. A discussion of the instrumentation market comes from Gordon Wilkinson, managing editor of Analytical Instrument Industry Report (East Grinstead, England). A global perspective with valuable local-market commentary was provided by our contributing editors in Europe and Japan. Unless noted, the sources of information used in the survey and the names of those who participated are, and will remain, confidential.

The market information pertaining to diode laser markets is based on research conducted by Laser Focus World and Strategies Unlimited during 1999.

Comparison with last year's numbers

Readers who compare last year's 1999 estimates with this year's restated 1999 numbers will note differences and occasional discontinuities in the numbers reported. In general, no attempt has been made to explain these differences in detail. We request "bottom-up" market estimates, and the respondents to our survey do vary from year to yearboth in terms of the companies involved and the individualsso variations in the results are inevitable. In addition, changes in market visibility occur as market shares change. Differences in the overall numbers for 1999 last year and for 1999 this year may also reflect whatever degree of optimism or pessimism was inherent in last year's forecast (see Laser Focus World, Jan. 1999, p. 80).