MICROLASERS: Expiring license opens field for solid-state blue lasers

Twelve months from now at the dawn of the new millennium, the planet Earth is likely to experience a precipitous increase in the number of companies selling blue microlasers. Unlike many millennial predictions, this one did not come from deciphering ancient texts miraculously restored with laser technology, gazing into optically correct crystal balls, or even consulting fortune tellers with PhDs. This particular prophetic inspiration arose during a recent telephone interview with Jon Sandelin, a senior associate in the office of technology licensing at Stanford University (Palo Alto, CA).

An exclusive license held by Uniphase (now JDS Uniphase; San Jose, CA) to US patent #4,809,291, "Diode Pumped Laser and Doubling to Obtain Blue Light," issued to Robert L. Byer and Tso Y. Fan, expires in December 2000, according to Sandelin (see Fig. 1). And there is likely to be much broader interest in the patent at the end of this year than there was in February 1989, when the patent was originally issued. [The Laser Industry Report on p. 67 highlights major shifts in the blue microlaser marketplace that began after this article was written and just as the magazine was going to press.—Ed.]"This blue laser turns out to be a fairly fundamental patent," Sandelin said. "That's why we're seeing a lot of interest in it, and I expect that we will have a fairly broad, nonexclusive licensing program come next December."

The adventures of the blue-laser patent during the last decade and its likely course of licensing for the remaining decade of its lifetime are interesting for a number of reasons. For one thing, the life of the patent covers a transition period during which the market for laser-based products and thus interest in laser-related intellectual property has grown significantly. For another thing, the lion's share of obvious commercial activity in blue microlasers to date has come from a company that was not among the original patent licensees, which illustrates the relatively high degree of serendipity that accompanies the whole process of patent licensing. In addition, the development of blue microlaser technology, beyond the scope of the Stanford patent, has reached the point where applications with moderate-sized markets have begun to open and further progress into applications with very large potential markets seems imminent.

Quasi three-level laser

The 1989 patent involves diode pumping neodymium:yttrium aluminum garnet (Nd:YAG) to get 946-nm light and then frequency-doubling the signal to get blue at 473 nm. It is based on the PhD thesis of Tso Y. Fan on pumping a quasi three-level laser system with optical diodes, which was completed in the late 1980s under Robert Byer at Stanford University. "Back at the time I was a graduate student, the idea of making RGB laser sources was an interesting one, and it still is," said Fan, currently at MIT Lincoln Laboratory (Lexington, MA). "One of the main contributions [of the patent work] from my point of view is recognizing the fact that even though diodes back then had relatively low power, you could still use them to pump these 946-nm lasers and make them work efficiently—thereby doubling them to get blue."

Fan's actual thesis described a thulium holmium:YAG laser, and the patent was written to describe the achievement of a quasi three-level laser transition through diode-pumping using any host material, not just 946-nm in Nd:YAG, Byer said.

"You pump more efficiently with a lot less heat in the material if you diode pump," Byer said. "So when T. Y. [Fan] realized that the high brightness of laser diode pumping allowed him to pump 946 nm in YAG, almost immediately the next thing pumped was thulium holmium:YAG—another quasi three-level laser system that lases at 2 µm and is eye safe."

Nevertheless there was no great rush to take commercial advantage of this news at the time, partially because a much broader technological foundation had yet to be established that could actually support the development of products. "If you dial back the timeline [about 13 years] to when I did the work as a graduate student, [achieving the 946-nm transition using a diode laser pump] was definitely a very marginal thing," Fan said. Available diode power out of a 200-µm aperture at the time might have provided 200 mW, he said. Today 2 W can be obtained from devices of the same size. "Certainly back then there was no hope of coming out with a robust product based on this," Fan said. "That's different today."

What about displays?

In the early 1990s, researchers at Laser Power Corp. (San Diego, CA) were also developing blue microlaser technology, independent of the Stanford patent, according to David Hargis, vice president of microlaser technology at Laser Power. "In 1990 we started writing proposals, and we won a number of contracts," he said. "We demonstrated a few milliwatts of blue light out of a diode-pumped solid-state laser, as well as some green and some red, and we had a display company come to us and say, 'Hey what about using that for displays.'" As a result, Laser Power received substantial development money to make laser light bulbs for displays, which allowed the company to devote several researchers to the project for a number of years, Hargis said.

The initial focus was on commercializing small products, such as milliwatt-class blue lasers. But the path to market seemed blocked initially, when the researchers learned that Uniphase had an exclusive license to a Stanford patent on the same technology that they were developing. They also learned of two nonexclusive licenses that had been obtained prior to the Uniphase deal by Lightwave Electronics (Mountain View, CA) and Scientific Atlanta (Naperville, IL). "It turned out that Scientific Atlanta was focused on telecom applications," Hargis said. "They had no need for this blue-laser patent anymore. It wasn't in their charter, so we were able to gain access to their license."

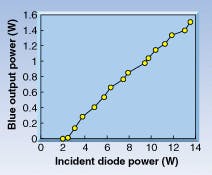

Licensing the Stanford patent cleared the way for Laser Power to further develop the technology for making high-power blue while obtaining new patents along the way (see Fig. 2). "We've demonstrated 1.5 watts of blue, out of our blue microlasers," Hargis said. "And we're shipping 400-mW-level blue microlasers now (see photo)."Market considerations

Efficiency improvements and patents obtained through additional development of the technology at Laser Power included the use of vanadate rather than YAG as a gain medium, removing heat from the gain medium at increased power, using a polarized diode beamshaper to pump the gain medium, and packaging the entire system in a small linear cavity, Hargis said.

The Stanford patent described a single-element low-power device, in which a single-element diode at perhaps half a watt could be used to pump a microlaser and provide milliwatts of blue light, Hargis said. What the Laser Power team did instead was to develop a beamshaper to focus all 20 emitters from a 10-watt diode array onto one spot in the gain medium, while preserving polarization. They have also designed a linear cavity to achieve mode quality within M2 values of 1.1 to 1.2 for blue, because the linear cavity yields improvements in production efficiency over more-complex shapes.

"There are more degrees of freedom with a V-shaped or zigzag cavity, but the linear cavity is easier to produce," he said. Production costs will still have to decrease considerably before blue microlasers will be ready for the high-volume display market, however.

"Roughly speaking we make a few hundred green and blue lasers per year. And at that volume, the prices are roughly $10,000 to $30,000 for the laser depending on the power level, noise, mode quality, and the application," he said. The display market requires devices in the range of $100 to $500 per laser module, which would require manufacturing volumes of 100,000 a year. Smaller markets are developing, however, while the potentially huge display market is on the horizon.

"Now we sell our blue laser to holographic applications, biomedical instrumentation fluorescence spectroscopy, laser display R&D, and the wafer inspection market—basically everywhere that argon-ion lasers or HeCd lasers have been used historically. We're going in with the solid-state blue microlasers and replacing the gas lasers and are having some good success," Hargis said.

Even though the display market has not yet materialized for the blue microlaser, interest in that market was what actually fueled the product-development effort at Laser Power. "If you were developing a laser for holography, it would be difficult to obtain significant research money to do research for a market that is only a few million dollars a year, and the same holds true for the semiconductor wafer inspection market," Hargis said. "So we were fortunate to receive substantial development funds to push the technology, which has allowed us to stay on the cutting edge. We are now shipping a single-frequency TEM00 mode blue laser, which yields a long coherence length for holographic and interferometric applications, and it also seems to be working well in fluorescence spectroscopy and biomedical diagnostics, such as DNA sequencing where argon lasers have traditionally been used."

Shifting interests

Even though Uniphase has developed blue microlaser products, the company preferred not to discuss its technology for publication, citing confidentiality agreements with customers. A number of other companies contacted for this article have expressed interest in the area but did not want to discuss their plans at this time. In the Uniphase case, however, it is clear that the primary developmental focus of the company shifted considerably from the initial intention upon buying an exclusive license to the Stanford patent.

"At one point, when we talked to [Uniphase], they thought this [technology] would be the major replacement for their gas laser business," Sandelin said. "They hired one of the key inventors on the patent, and they did invest a great deal of time and effort into developing the technology. They just seem to have made a turn a few years ago and decided to focus more in the telecommunications area and less in just the mainline laser supply business, which was obviously a good move, based on their stock performance. When they took the exclusive license it was to protect investments, and they did make large investments. As it turned out, their business direction shifted."

Evidently, constantly shifting directions is part of what makes the field of semiconductor and laser industry patents interesting, Sandelin said. A large number of patents are generated by the continuous development of new technologies. "We get technologies at a very very early stage, and it is unclear usually what sort of product is going to come out of a particular technology area."

More nonexclusive licenses

Byer said that, in his experience, it has usually taken about a decade for laser patents to go from the issuance to the licensing stage, but he sees a change in that pattern also. "The joke used to be, 'there's lots of laser-related patents but no companies to license the technology,'" he said. "So there used to be a lot of exclusive licensing done to small companies because those were the only companies interested in the technology. What's changed in the last few years is now there are many more companies interested in the technology. And so the licensing is now more and more nonexclusive. It's moving in that direction."

There are currently between 30 and 40 inventions available for licensing in the Stanford laser patent portfolio, and, said Sandelin, interest in licensing usually comes from small or start-up companies that would consider an early market of a few million dollars as worthwhile. Potential markets for blue microlasers are likely to exceed those numbers by a good bit, so Sandelin is expecting a much more enthusiastic interest than usual at the end of this year.

About the Author

Hassaun A. Jones-Bey

Senior Editor and Freelance Writer

Hassaun A. Jones-Bey was a senior editor and then freelance writer for Laser Focus World.