Booming LED market looks forward to wild blue yonder

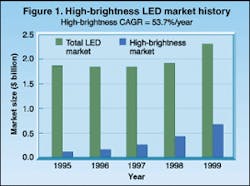

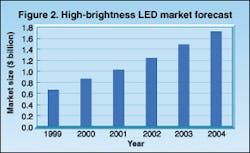

Between 1995 and 1999 the market for high-brightness light-emitting diodes (LEDs) grew 53.7% per year on average, from $120 million in 1995 to $680 million in 1999, according to Robert Steele, director of optoelectronics programs at Strategies Unlimited (Mountain View, CA). And the market size is expected to hit $1.74 billion by 2004. The components of this current and projected growth (as well as potential technology-development strategies that could boost market growth beyond these projections exponentially) were discussed by more than 200 lighting-industry attendees at a seminar sponsored by Strategies Unlimited on advanced LED business opportunities in February.

Steele described the high-brightness market against a backdrop of a total LED market of $2.3 billion in 1999 that has been growing an average of 11.4% per year over the last seven years (see Fig. 1). Of that $2.3 billion, about $1.5 billion has been in the form of individual chips packaged for applications of lamps of various sizes, shapes, colors, intensities, and mountings. The remaining $0.8 billion has been in the form of multiple chip aggregations for various display applications ranging from segmented to dot matrix and of various color configurations.

While descriptions of LED technology generally begin in the late 1960s with the development of gallium arsenide phosphide (GaAsP) materials with luminous efficiencies of less than 1 l/W, the high-brightness era did not begin until the mid-1980s with the development of aluminum gallium arsenide (AlGaAs) red and an order of magnitude increase in lumen efficiency, Steele said. The early 1990s extended the color range from red through yellow with indium gallium aluminum phosphide (InGaAlP) and luminous efficiencies on the order of 10 l/W. The mid-1990s brought blue, green, and white with indium gallium nitride (InGaN) along with today's luminous efficiencies, measured in tens of lumens per watt.

Perhaps the most high-profile indications of the burgeoning LED market at currently available brightness levels can be seen in the giant outdoor display screens that have sprouted up everywhere from rock concerts in Japan to building facades in New York City's Times Square. The market for full-color signs has grown at almost 78% per year since 1995 to about $150 million in 1999, Steele said. Gary Nalven, president of SACO SmartVision (White Plains, NY) spoke about the development and construction of the world-record-sized 90 x 120 ft (approximately one-quarter acre) LED sign on the NASDAQ building in Times Square, in the context of rapidly growing markets for entertainment and advertising.

Nalven also discussed intriguing potential applications such as programmable building facades based on LED displays as permanent architectural elements and outdoor "e-commerce" billboards where content providers might rent time and space through live Internet connections. Currently, however, price tags on the order of $5000 per square foot are relegating most high-brightness outdoor display applications to various forms of corporate image advertising. Significant growth in revenue-generating applications for outdoor displays and in consumer applications awaits order-of-magnitude-scale cost reductions.

Nevertheless, signs, which include a potpourri of applications such as full-color outdoor displays, highway signs, and traffic signals, currently account for the largest sector (23%) of the LED market, Steele said. Display applications on communications equipment run a close second (22%) and are followed just as closely by displays for computers and office equipment (21%). The remainder of the market is divided among consumer applications (15%), automotive displays and lighting (11%), and industrial instrumentation (8%). And, as might be expected, noteworthy market growth potential may still lurk in the lower percentage or as yet-nonexistent portions of the current market (see Fig. 2).Automotive applications represent a major focus of current market growth, and several speakers covered various aspects of this market during the two-day conference. The LED market for automotive interior lighting has grown at more than 95% per year since 1995 to significantly greater than $150 million in 1999, with more than $125 million reflecting high-brightness as opposed to conventional LED sales.

Automotive exterior-lighting applications have been led by center high-mounted stop lamps that appeared first in 1988 on the Nissan 280Z and have grown to include all General Motors sport-utility vehicles and vans and the Cadillac Seville/Deville and Ford Explorer in the USA. Lamps also have been installed on more than 60% of all European cars and about 25% of Japanese cars, Steele said. The annual market growth rate of 23.4% is deceptively small, however, because of two closely inter-related factors. Prices have decreased by a factor of eight or nine during the last decade, and LED performance has improved so that fewer chips are required in each unit.

Also, the LED market for traffic signals has increased just more than 87% per year on average since 1994, with almost 180,000 traffic light replacements in 1999. Enormous growth potential remains here as well. The market has focused to date primarily on relatively inexpensive and available red LEDs. Yet the cost of green LEDs has recently come down enough to stimulate significant demand and is expected to continue dropping as the supply increases to meet demand.

General illumination market

The LED market opportunity that easily dwarfs everything else lies in the area of general illumination. The market for lamps of all types (incandescent, fluorescent, halogen, and so forth) in the USA alone is currently in excess of $3 billion and is growing at 2% to 3% each year. Steele estimated a world market size of $12 billion. Significant LED market penetration in general illumination awaits three primary areas of improvement:

- Order-of-magnitude improvements in efficiency (from 20 l/W for white LEDs today to more than 100 l/W)

- Major price reductions (from $0.35 per LED lumen today to the $0.01 per lumen cost range of current compact fluorescents)

- LED products that are fully compatible with the current installed base of light sockets.

While considerable engineering effort and product-development investment will be required before LEDs become competitive in general-illumination applications (Steele estimated five to 10 years), numerous other applications are opening up in the near term with current technology and incremental improvements. These include decorative lighting, architectural lighting, stage lighting, liquid-crystal-diode backlighting, and specialty lighting applications in which difficulty of replacement outweighs other factors and makes LEDs cost-effective.

One area of LED technology development that is growing rapidly, initially for displays and perhaps ultimately for illumination also, is organic LEDs (OLEDs). Currently, more than 80 companies (more than 50 in Japan) have OLED-development programs, and commercial products began to appear in 1999. Steele forecast the OLED display market to grow from almost zero in 1999 to just more than $700 million in 2005 and to eventually capture a significant portion of the $17 billion market for flat-panel displays.

Making choices

The ultimate outcome over the next 10 years or so may be less a matter of waiting for technology to develop and more a matter of choice, according to Roland Haitz, manager of the semiconductor-products group at Agilent Technologies (San Jose, CA). Based on this perspective, Haitz and other researchers from Agilent and Sandia National Laboratories (Albuquerque, NM) made the case for a $500 million, ten-year national research program on semiconductor lighting.

In one of the closing technical presentations of the seminar, Haitz estimated that investment by the lighting industry alone is likely to achieve 50 l/W for LEDs by 2010 and a 10% market penetration by 2025, which, he added, is likely to save more than $40 billion in energy costs (35-40 nuclear power plants). A $0.5 billion government investment over a 10-year period, however, could stimulate industry, government laboratories, and academia to work together to achieve a 200-l/W lamp efficiency by 2012, which could produce 55% market penetration by 2025 and save more than $100 billion in energy costs (about 100 nuclear power plants).

One of the technological routes that might make such an advance possible would be development of a vertical-cavity surface-emitting laser in the visible wavelength range that would significantly improve on the conversion efficiencies achieved so far with LEDs.

About the Author

Hassaun A. Jones-Bey

Senior Editor and Freelance Writer

Hassaun A. Jones-Bey was a senior editor and then freelance writer for Laser Focus World.