Review and forecast of laser marketsPart II: Diode lasers

THE LASER MARKETPLACE 2000PART II: Diode lasers

The Laser Focus World 2000 Annual Review and Forecast of the Laser Marketplace is conducted in conjunction with Strategies Unlimited, an optoelectronics market research firm based in Mountain View, CA. Part II covers the diode laser marketplace. Part I, which reported on the nondiode laser markets, appeared last month.

Robert V. Steele

null

The worldwide market for diode lasersmuch like the Energizer Bunny and the US stock marketjust seems to keep going and going. In 1999 the market grew by an unprecedented 47.2% to $3.17 billion, far outstripping the 28.4% growth forecast at the beginning of last year. Although the dollar-denominated market was given a boost by some favorable exchange rate trends (primarily the appreciation of the Japanese yen), a large part of the growth was unit-driven and based on solid trends in the end-use markets that are served by diode laser components. Despite weakness in some sectors, especially high-power diode lasers, continuing strength in the telecommunications and optical storage categories propelled the market to dizzying new heights.

Although growth in diode laser revenues was spectacular, unit shipments increased by a modest, but certainly respectable, 18.9% to reach 357.6 million units in 1999. The principal reason for the dramatic difference between unit and revenue growth is the increasing contribution of telecom diode lasers to the market total. These lasers have average selling prices (ASPs) on the order of $1000 compared to the $1-$10 selling prices of the low-power lasers used in optical storage. Even though the low-power lasers constitute the vast majority of the unit volume, large increases in telecom laser revenues boost the total market with only modest increases in unit volume.

A secondary factor is the effect of exchange rates on the average selling prices of low-power diodes. Because most of these devices are made and sold in Japan, their revenues are reported in yen. In 1999, the yen appreciated by about 14% relative to the dollar (in specific terms the change was x114 per dollar in 1999 compared to x130 per dollar in 1998), producing an automatic rise of 14% in dollar-denominated selling prices of diode lasers produced in Japan.

Although the market growth in 1999 might be considered an aberration, the growth forecast for 2000 is hardly less spectacular. The total diode laser market is expected to grow to $4.37 billion, an increase of just under 39%. The unit total is forecast at just over 400 million, an increase of 12.3%. As in 1999, growth will be led by the telecommunications category, but strong growth is expected among all other categories and products as well, including high-power diodes, which stagnated somewhat in 1999.

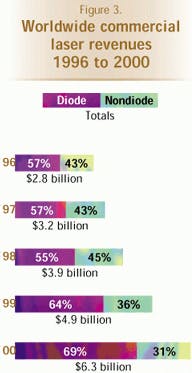

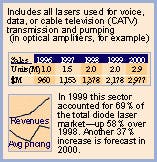

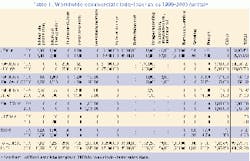

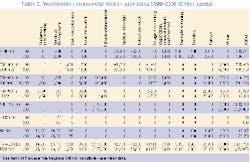

Figure 1 depicts worldwide diode-laser sales for 1999 and 2000 for applications; Fig. 2 does the same for product types. Table 1 provides the breakout of diode-laser unit sales by product type and application, while Table 2 provides revenue data. Readers should note that there has been a change in the diode laser product categories from previous years (see "Categories keep up with markets," p. 78; see also "Packaging and ASPs," p. 76, and "Where the numbers come from," p. 83). Figure 3 shows worldwide commercial laser revenues, both diode and nondiode, for 1996 through 2000.

Telecommunications

As in previous years, the telecommunications category is the jewel in the crown of the diode laser market. In 1999, diode lasers used in telecom accounted for 68.7% of the overall market, or $2.18 billion. This figure includes lasers used in signal transmission as well as those used as pumps for erbium-doped fiber amplifiers (EDFAs). The increase over 1998 was an astounding 58.1%, which was a major contributor to dramatic increase in the total diode laser market referred to above.

It is difficult to describe developments in the telecom market without resorting to superlatives. In some component sectors, annual growth rates are approaching 100%. This is reflected in the sales growth, as well as the stock prices, of component suppliers such as SDL, JDS Uniphase, and E-Tek Dynamics. Growth is being fueled by the dramatic rates of increase in the installation of wavelength-division-multiplexed (WDM) systems, primarily in the USA, but also increasingly in Europe. The installation of undersea WDM systems is also growing dramatically. These installations are, in turn, being driven by the telecom carriers' perceptions of an almost insatiable demand for bandwidth resulting from an explosive growth in Internet traffic.

Surveys indicate that the number of Internet users is growing at 50% per year, while the Internet traffic due to home use is growing at more than 300% per year. There is, therefore, an ever-increasing need in the telecom backbone for additional capacity, for which the lowest cost as well as the quickest solution is WDM systems. Whereas WDM systems using multiple wavelengths at 2.5 Gbit/s have been the norm, recently the trend is toward 10 Gbit/s per wavelength, and the demand for transmission lasers at this data rate increased dramatically in 1999. As both the number of wavelengths in WDM systems and the data rate per wavelength increase, the EDFAs used as signal amplifiers must be pumped at higher powers. This is reflected in the demand for pump lasers. Sales of 980-nm pump lasers more than doubled in 1999.

The undersea market has also been a key contributing factor in the increasing demand for pump lasers. Traditionally, 1480-nm pumps have been used in the undersea market because of their high reliability. In late 1998, however, 980-nm pumps were qualified for undersea applications, and a strong market developed in 1999, thus boosting the already strong demand for these lasers in the terrestrial market.

For 2000, the outlook for telecom lasers remains highly positive, with growth forecast at 36.7% to just under $3 billion. Though not as spectacular as the growth in 1999, this is an extremely healthy growth rate, especially considering that prices are falling at 20% per year in many product categories. As long as Internet use continues to grow at the blistering pace of recent years, there is no reason to think that the market for telecommunications equipment and components will slow down anytime soon.

Optical Data Storage

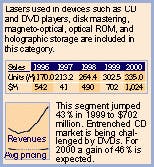

The optical storage category remains the second-largest application for diode lasers. In 1999, sales of lasers incorporated into various types of optical storage drives reached $702 million, which represented an increase of 43.3% over the $490 million recorded in 1998. As noted above, part of this increase was due to the appreciation of the yenvirtually all of these lasers are made in Japan. Nevertheless, for the large-volume components, particularly the low power CD-type lasers, yen-based prices continued to fall. This is particularly true for integrated pickups that combine the laser, detector elements, and optics into a single unit.

The dynamics of the optical storage market are changing somewhat after several years of steady and predictable trends. In particular, the emergence of optical storage drives based on digital versatile disk, or DVD, technology is beginning to challenge the well-entrenched CD-based-drive market. Reflecting this trend, the largest percentage growth in the optical storage category was in the visible (<700 nm) lasers used in DVD video players and DVD-ROM drives. Sales of these devices grew from $79 million in 1998 to $222 million in 1999a growth rate of 181%. In contrast, sales of 750-980-nm lasers of less than 100 mW power, which are used in CD-based drives, grew by only 16.8%, from

$411 million in 1998 to $480 million in 1999. Sales of the lowest-power (5 mW) CD-type laser actually declined somewhat due to the declining prices and the peaking of the CD-ROM market. The latter effect resulted as higher-end personal computers began to be equipped with DVD-ROM drives in preference to CD-ROM drives.

Buried in the market statistics for 750-980-nm lasers of less than 100 mW is a countervailing trend. This is in the use of somewhat higher-power lasers (30-35 mW) used in recordable and rewritable CD (CD-R and CD-RW) drives. These low-cost drives have become a popular method of storing large data files on personal computers. Prices have come down to less than $300, and sales have accelerated in the past few years. These drives are also being used in the consumer audio market to record music selections. In this market they are known as "CD burners." The market for diode lasers used in CD-R and CD-RW drives grew from $48 million in 1998 to $148 million in 1999. Without this growth, the 750-980-nm <100-mW category would have shrunk in 1999.

After several years of slow growth, the DVD market is finally beginning to show signs of maturity. In the DVD video player arena, prices have dropped below $300 (and can even be found as low as $200 in some discount electronics stores) and more than 6000 movie titles are available. Consequently, 5 million players were sold worldwide in 1999, and sales are expected to reach 7 million in 2000. Originally purchased primarily as components of high-end home theater systems, DVD players are now being used primarily as a supplement to VCRs to play rented or purchased DVD movies. DVD players and movies are prized for their high image and sound quality and built-in features such as searching capability.

Many new high-end personal computers and an increasing number of mid-range machines now come equipped with DVD-ROM drives. Of the three new Apple iMac computers introduced last October, two come equipped with DVD-ROM drives, with the lowest-cost model offered at $1299. With the OEM price of drives dropping to under $100, many more computers will come equipped with DVD-ROM drives in the coming years. The storage capacity of DVD-ROM drives, at 4.7 Gbytes, exceeds that of CD-ROM drives by a factor of seven. Although this extra capacity remains largely unexploited by software available in the market, DVD-ROM drives are coming to be seen as the leading edge of read-only optical storage technology and are gradually taking the place of CD-ROM as the standard for personal computers. Approximately 17.5 million DVD-ROM drives were shipped in 1999, and shipments are expected to exceed 40 million in 2000.

The growth in DVD-ROM sales, as might be expected, is having an impact on the CD-ROM market and the diode lasers that support it. In 2000, for the first time ever, CD-ROM sales are expected to decline. Although the audio CD player market will continue to have modest growth, the sales forecast for 750-980-nm lasers with power output less than 100 mW used in optical storage is 275.3 million units compared to 277.6 million sold in 1999. Revenues are forecast to increase slightly, to $503 million from $480 million, because of the growth of higher-power (30-35 mW) lasers used in recordable CD drives and MiniDisc players. Overall, the optical storage market is projected to grow by 45.9% in 2000, to just over $1 billion. Visible lasers used in DVD players and DVD-ROM drives will be the main contributors to this growth.

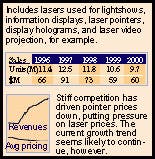

Entertainment & Display

Even with the robust growth in the DVD player and DVD-ROM drive market, laser pointers remained the largest application for visible diode lasers in terms of units36 million in 1999. At $48.2 million in revenue, however, it is second after optical storage because of the exceedingly low prices of these low-performance lasers. The average selling price of visible diode lasers used in laser pointers was $1.34 in 1999, with large numbers of lasers selling for under $1. Stiff competition in the laser pointer market has driven prices down (to under $10 in some cases), putting pressure on laser prices and forcing Taiwanese producers to relocate assembly operations to mainland China. Visible laser diode prices have probably hit rock bottom, having essentially reached parity with CD lasers.

Despite some efforts in the USA to control the possession of laser pointers by minors, the market seems poised to continue its growth for the foreseeable future. Perhaps the next major development is green laser pointers. Using diode-pumped, frequency-doubled microlasers, these products are made mainly in Taiwan and mainland China and sell in the range of $300-$400. Although priced much higher than red laser pointers, green laser pointers are finding a growing market among image-conscious professionals who are willing to pay the higher price for the distinctive green beam. If, as some in the industry predict, the price can be brought down to the range of $100-$150, then the green laser pointer market will expand enormously from the thousands of units sold annually today to perhaps hundreds of thousands in the future.

Image Recording

Image recording continues to be an important market for diode lasers, accounting for just under $60 million in sales in 1999, a 20% decrease from the previous year. Electrophotographic printing (that is, laser printers) using low-power diode lasers is basically a mature market. The desktop printer market is close to saturation. There continues to be growth in the digital copier market, but the number of units is relatively small.

The exciting development in the printer application remains in the impact of the digital revolution in the world of commercial printing. The market for computer-to-plate (CTP) systems continues to grow at a rapid rate, although perhaps not at such a rapid rate as last year. A shift in thermal-plate imaging technology from one to another of the major platesetter suppliers resulted in a smaller number of discrete diode lasers being sold. Also potential purchasers of CTP systems are apparently waiting until the DRUPA show in May 2000 for new-product offerings. DRUPA is the major tradeshow in the printing industry and is held every five years. With a new slate of offerings anticipated then, an upswing in the CTP market is expected.

A trend in the CTP market that is favorable for diode lasers is the shift toward thermal printing systems. The CTP systems on the market use photosensitive printing plates as well as thermal plates. The former can be exposed with argon-ion lasers or green diode-pumped solid-state lasers (DPSSLs), while the latter are exposed with infrared DPSSLs or arrays of diode lasers. For a variety of technical reasons, thermal systems seem to be winning in the marketplace, and the majority of systems shipped over the next few years will likely be thermal systems. Moreover, most of the new thermal systems being introduced to the market use arrays of diode lasers as the energy source for plate exposure, with up to 32 diodes per system.

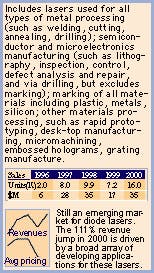

Materials Processing

The use of diode laser bars and stacks in a variety of materials-processing applications accounted for $16.7 million in sales in 1999. Although materials processing is a well-established market for nondiode lasers, with sales on the order of $1 billion, it is still an emerging market for diode lasers. No single application dominates the market. Rather, it consists of a myriad of applications that are difficult to characterize. These include soldering, heat treating, plastics welding, microwelding, and brazing, to name a few. The market has been limited by the beam-quality limitations of diode lasers as well as by the lack of availability of diode laser systems geared toward standard industrial processes.

A significant development in 1999 was the introduction by Rofin-Sinar of a complete high-power diode laser system for industrial applications. Systems are available in the range of 750 W-2.5 kW and include power supplies and cooling units as well as the diode laser head. Systems are also available with fiber coupling. Although diode laser systems have been developed by smaller companies, primarily in Europe, this development is significant because Rofin-Sinar is the first large, well-established laser company to introduce such a product. The company is well known as a supplier of high-power CO2 and Nd:YAG systems for industrial applications and, as such, is well acquainted with the industrial laser market and its requirements. Rofin-Sinar has sold a number of these units for applications ranging from kitchen-sink welding to automobile manufacturing.

In part because of developments such as this, the materials-processing market is forecast to undergo a large upturn in 2000, to $35.2 million. Although this forecast may seem somewhat optimistic, it does reflect the renewed efforts to make diode lasers a standard weapon in the arsenal of industrial laser technologies.

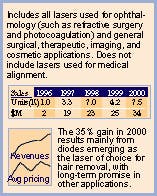

Medical Therapeutics

The use of diode lasers in medical applications advanced along several fronts in 1999. In terms of near-term developments the biggest story is in laser hair removal. Diode-laser-based hair-removal systems were introduced to the market in 1998. Although they compete with other laser-based hair-removal systems (such as ruby and alexandrite), they have proved to be highly effective, and the market increased dramatically in 1999. Diode laser systems for hair removal are not significantly cheaper than competing laser systems. The most expensive diode-laser-based hair-removal system sells for approximately $150,000. However, diode laser systems are portable, efficient, and have modest power requirements.

Photodynamic therapy (PDT) for the treatment of cancer continues to be a promising technology, and it is being explored for the treatment of other diseases such as age-related macular degeneration. Most of the drugs being developed for use in PDT are sensitive in the 630-700-nm wavelength range and are thus ideal for higher-power visible diode lasers. Currently, the only PDT drug approved for use in the USA by the FDA is Photofrin, which is manufactured by QLT PhotoTherapeutics of Vancouver, Canada. Photofrin is activated by a 630-nm light source; however, it is not yet approved for use with diode laser systems in the USA.

Diode systems are approved for use in Europe and are being sold there primarily by Diomed, as well as two or three other companies. Several other visible-light-sensitive drugs are in various levels of clinical trials with diode laser and other laser sources. As these systems wind their way through the tortuous FDA approval process, the main sales of visible diode lasers in the near term will be for development purposes, at least in the USA. In Europe, however, the diode laser-based PDT market seems to be off to a good start.

Pumps

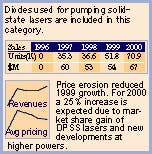

Pumping of solid-state lasers continues to be the largest single application of high-power laser diodes. The market was somewhat flat at $53.6 million in 1999, due to ongoing price erosion in diode pumps combined with a slight decline in the growth rate of diode-pumped solid-state lasers compared to previous years. However, a growth of just under 18% is forecast for 2000.

One of the most exciting developments in the DPSSL market is the introduction by two major laser companies, as well as one newcomer, of commercial kilowatt-class DPSSL systems. For a variety of reasons discussed in detail in a previous Laser Focus World article (Nov. 1999, p. 59), kilowatt-class DPSSLs are coming to be viewed as valuable tools in a variety of industrial materials-processing applications. At Laser 99 (Munich, Germany) last June, both Rofin-Sinar and Trumpf introduced kilowatt-class DPSSLs. The Rofin-Sinar system is available in increments from 550 W to 4.4 kW and is already being sold for industrial applications. The Trumpf 1-kW system is based on a unique Yb:YAG disk laser design pioneered by the IFSW at the University of Stuttgart. This laser is expected to be commercially available early this year for heavy-duty industrial metal-cutting applications. A third contender in the high-power DPSSL market is TRW, which, as a result of experience gained in the DARPA-sponsored Precision Laser Machining Program, has developed a high-power slab laser pumped by laser diode stacks. TRW is offering a 500-W model currently and is developing 3-kW and 6-kW versions.

If, as expected, high-power DPSSLs gain a foothold in the industrial materials-processing market, the demand for diode pump lasers will accelerate accordingly. This will be in addition to the already growing market for pump lasers in low-power DPSSLs.

Other Applications

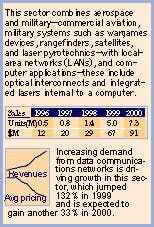

The "other" category is a catch-all that has been used to aggregate a variety of smaller unrelated applications, including military/aerospace and local-area networks (LANs). In recent years this market segment has begun to experience some interesting dynamics. In 1999 it grew by 132% to $67.4 million. The main growth trend is the use of diode lasers in transceiver modules for high-speed data communications networks, particularly Gigabit Ethernet and Fibre Channel networks. The two diode laser types used are 830-nm vertical-cavity surface-emitting lasers (VCSELs) and conventional 1300-nm edge-emitting lasers. VCSEL-based transceivers are used with multimode fiber for shorter distances (less than 300 m). The 1300-nm lasers are used with both multimode and single-mode fiber for longer distances, from 300 m up to tens of kilometers.

While Fibre Channel equipment and components operating at gigabit data rates have been available for several years, Gigabit Ethernet equipment and components began shipping in significant quantities only in 1998. In 1999, the market for this equipment skyrocketed, as did the demand for transceivers.

Demand for high-speed Fibre Channel and Gigabit Ethernet equipment is being driven by related phenomena. Gigabit Ethernet equipment is being used in backbone systems that support corporate Ethernet computer networks. As speeds to the desktop have risen from 10 to 100 Mbit/s, due to increased use of the Internet and corporate intranets, escalating demands have been placed on the backbone, requiring upgrading to gigabit capability. Backbones at 10 Gbit/s are already under development. The use of Fibre Channel equipment is somewhat different; it primarily serves storage-area networks, or SANs. These networks are used to interconnect servers and disk storage arrays. The major source of demand for SANs is for high-capacity Internet sites, which, as discussed previously in this article, are experiencing tremendous growth.

Based on the growth trends in both the Internet and in corporate networks, including intranets, the outlook for the VCSEL-based and 1300-nm laser-based transceiver market is extremely positive. The "other" category is expected to grow by an additional 33.4% in 2000, to $90.6 million, almost all of which is attributable to demand from data communications networks.

ROBERT V. STEELE is director of optoelectronics at Strategies Unlimited, 201 San Antonio Circle, Ste. # 205, Mountain View, CA 94040; www.strategies-u.com.

Packaging and ASPs

The diode laser revenue figures shown in Table 2 are based on the unit sales figures in Table 1 and average selling prices (ASPs) for each type of diode laser. The ASPs for diode lasers vary widely and are a function of wavelength, power output, and package type. The revenue figures are for packaged devices as they are sold by diode laser suppliers to the merchant market or transferred internally to other company divisions to be used in system-level products.

Diode-laser packaging is subject to a wide range of configurations according to the device type and application requirements and includes variations such as thermal control and fiber coupling. Short-wavelength (<1000 nm) diode lasers at power levels less than 200 mW are almost always single-lateral-mode, single-stripe devices that are sold commercially in hermetically sealed TO-type packages. The lasers are typically mounted on a heat sink, and the complete package includes a back-facet photodetector for monitoring the laser output level. The selling prices of such devices range from less than $1 (for a high-volume CD-type laser) to around $7 for a 30-mW, 780-nm laser or a low-power visible (650-nm) laser used in optical storage applications. Some low-volume specialty devices can be priced much higher.

An increasingly important packaging concept in low-power 750-980-nm diode laser markets, particularly in audio CD and CD-ROM applications, is hybrid integration of the diode laser chip, detector chip, and optical elements in a single package. These integrated optical "pickups" are lower in cost than pickups fabricated from discrete components and result in easier assembly for the CD player or CD-ROM drive manufacturer. This concept was introduced by Sony in 1991 for its very thin (15-mm) Walkman CD player. Such pickups are now manufactured in volume by Sony, Sharp, and Matsushita, with prices averaging around $2, compared to less than $1 for a discrete packaged laser diode. The value of such pickups is included in the diode laser market revenues in Table 2.

For high-power diode lasers (>1 W) there is a wide range of power levels and configurations. Up to 5 W CW, a wide (up to 500 µm) single-stripe, multimode device is the norm. These devices are usually supplied in TO-type packages that can include Peltier coolers for temperature control. Beyond about 5 W, the only commonly used approach is a multistripe, multimode array. The standard product at these power levels is a 1-cm-wide diode laser bar, which consists of a single multistripe array or a grouping of several arrays to build up higher power levels. Pricing for high-power diode lasers ranges from under $300 for a 1-W discrete device in quantity up to $2000 or more for a 20-W bar. Single laser bars are now available at power outputs up to 40 W CW, although 20 W is still the most common configuration. Increasingly, these high-power devices are sold with fiber coupling in order to provide a more usable output beam for the end user. Higher-power arrays are typically available on a heatsink submount that can be attached to a water-cooled heat-removal system. For applications requiring high peak power, these arrays can be operated in the pulsed (quasi-CW, or QCW) mode at peak powers up to 100 W.

For power levels above 40 W CW, high-power diode laser bars can be stacked in the vertical dimension (these products are included the "Stacks" category in Tables 1 and 2). Because of the difficulty in removing heat from such a configuration, these stacks are typically operated in the QCW mode. Peak output power approaching 5 kW can be achieved from such a stack. The packages for these devices typically include water cooling, although conduction cooling may be used in lower-duty-cycle devices. With the development of more-efficient heat-removal techniques (such as microchannel coolers), CW stacks have become available.

The packages for long-wavelength (<1000 nm) diode lasers used in telecom applications include special adaptations for coupling the laser output to single-mode (approximately 9-µm core diameter) optical fiber with tolerances on the order of ±1 µm. These are in the form of fiber pigtails or single-mode connectors. Telecommunication laser packages may also include other elements such as thermoelectric coolers for temperature control and optical isolators to reduce the amount of light reflected from the fiber back into the laser. All laser packages include back-facet monitor photodiodes. Because of the expense of fiber coupling and other package features, telecom diode lasers typically have high ASPs. Prices range from less than $100 for the lowest-performance Fabry-Perot devices in a connectorized coaxial package to several thousand dollars for a high-performance distributed feedback (DFB) laser in a cooled butterfly package with fiber pigtail.

Categories keep up with markets

The power levels used to distinguish the three categories of diode lasers in the 750-980-nm wavelength range have been increased this year to more accurately reflect the characteristics and product groupings of diode lasers sold into the marketplace.

Specifically, <10 mW has been increased to <100 mW, 10 mW-1 W has been changed to 100 mW-10 W, and <1 W has been changed to >10 W.In this report, all diode lasers with powers greater than 10 W are arrays of lasers fabricated on a single 1-cm chip, also known as laser bars. Diode lasers with powers of a few hundred milliwatts up to 10 W are discrete devices that use broad stripes to achieve high power and operate in multiple transverse modes (that is, multimode devices). Diode lasers with powers of less than 100 mW are all discrete, narrow-stripe, single-mode devices.

Where the numbers come from

The Laser Focus World Annual Review and Forecast of the Laser Marketplace is based on a worldwide survey of laser producers and covers 27 types of lasers and 20 applications. Additional information about diode-laser markets is provided by Strategies Unlimited (Mountain View, CA) based on its interviews with both laser suppliers and users. The review quantifies current and projected laser markets by type and application and is the only major survey of its kind in this industry whose results are made public. The numbers presented here are aggregated from the detailed information collected in the surveys.

Readers interested in the detailed results of both surveys will find them in the January 1 and February 1, 2000, editions of the Optoelectronics Report newsletter, published by Laser Focus World. A more extensive review of the data, with supporting commentary from market analysts, was made available to attendees of the Laser Marketplace seminar, held in conjunction with Photonics West (San Jose, CA) on January 26, 2000. For more information call Carole Root at 603-891-9138.

Collecting the data

We conducted our research and analysis for the Review and Forecast during October and November 1999. Laser manufacturers were contacted by e-mail, fax, or phone, and they responded with oral and written information, both qualitative and quantitative, about their markets, the business outlook, and their expectations for next year.

We asked these manufacturers to provide an estimate of total worldwide market size (dollars and units) by laser type for the markets with which they are familiar. We requested this information for 1999, based on year-to-date actual data, and a forecast for 2000. We also asked which applications or markets are likely to have the most potential for growth in 2000, what technology trends would be most significant relative to the respondent's business, and what business or market trends are most likely to affect his or her business.

In addition to the information provided by manufacturers, we used data from othermore narrowly focusedmarket surveys, and for some of the markets, we incorporated commentary from industry analysts. Quantitative information about the medical laser marketplace comes from Irv Arons, a contributing editor to Medical Laser Report. A discussion of the instrumentation market comes from Gordon Wilkinson, managing editor of Analytical Instrument Industry Report (East Grinstead, England). A global perspective with valuable local-market commentary was provided by our contributing editors in Europe and Japan. Unless noted, the sources of information used in the survey and the names of those who participated are, and will remain, confidential.

The market information pertaining to diode laser markets is based on research conducted by Laser Focus World and Strategies Unlimited during 1999.

Comparison with last year's numbers

Readers who compare last year's 1999 estimates with this year's restated 1999 numbers will note differences and occasional discontinuities in the numbers reported. In general, no attempt has been made to explain these differences in detail. We request "bottom-up" market estimates, and the respondents to our survey do vary from year to yearboth in terms of the companies involved and the individualsso variations in the results are inevitable. In addition, changes in market visibility occur as market shares change. Differences in the overall numbers for 1999 last year and for 1999 this year may also reflect whatever degree of optimism or pessimism was inherent in last year's forecast (see Laser Focus World, Jan. 1999, p. 80 and Feb. 1999, p. 52).