Flexibility plays key role in telecom-market aftermath

According to conventional wisdom, one should not switch horses in midstream. But as the dam was bursting on an over-exuberant telecom market, several companies found that switching horses proved to be a prudent and ultimately successful strategy.

About a decade after its founding in 1990, optics manufacturer New Focus (San Jose, CA) went both public and "telecom" in May of 2000, and mushroomed in size by an order of magnitude. Founded in 1998, with a well-funded but closely guarded technology for high beam quality in semiconductor laser diodes, Novalux (Sunnyvale, CA) reaped an order-of-magnitude venture-capital funding increase in September 2000 and a mandate to focus on telecom as its first major market.

nLight Photonics (Vancouver, British Columbia, Canada) was founded in 2000 to focus its high-powered semiconductor laser diodes on the skyrocketing telecom market for Raman amplifiers. And Waveguide Solutions (Charlotte, NC) was spun out of the University of North Carolina in 2001 with spin-on-glass technology to make erbium-doped planar lightweight circuits (PLCs) for a telecom market that, in retrospect, appears to have also spun out in 2001.

New Focus, Novalux, nLight Photonics, and Waveguide Solutions all managed to negotiate the catastrophic market turbulence, however, to emerge today with different but nonetheless healthy technology-market mixes, and also to some degree as different companies.

New Focus

After hitting a peak of about 2000 employees in the U.S. and China, New Focus employs about 250 people in a single U.S. location today. In the first quarter of 2001, New Focus posted revenues of $41 million, almost double the revenue posted for the entire previous year, and projected an order-of-magnitude increase in revenues for 2001 over 2000. Order cancellations began to arrive in the second quarter of 2001, however, and New Focus ended that year with almost half of its annual revenue coming from the first quarter. "That really started a gut-wrenching process of scaling back," said Nadim Maluf, vice president, photonic tools and instruments.

The plunge into telecom had not been whimsical. New Focus received a $500 million mandate to do so in funding raised when the company went public in May of 2000. The company rapidly expanded its wavelength-management components and tunable-laser operations. But by the end of 2001, New Focus realized that the core markets for its nascent multinational production facilities were not following normal cycles.

The wavelength-management business was sold to Finisar (Sunnyvale, CA) and the fiber network tunable-laser business was sold to Intel (Santa Clara, CA). New Focus kept its test-and-measurement tunable-laser business, however, and in both transactions New Focus kept the intellectual property (IP) and the rights to market it outside of telecom. Quarterly revenues are now between $6 million and $7 million.

New Focus in 2003 is very different from New Focus in 1996, however. "The company in the early days was basically a small company with the manufacturing built for a Ph.D. by a Ph.D.," Maluf said. "During the telecom times we put in place a rock-solid manufacturing organization. We became ISO 9000 certified; a very strong Telcordia qualification team established quality manufacturing standards."

In addition to beefing up its original catalog business focused on optical R&D markets, New Focus is also taking its enhanced skill set into beam-steering components for semiconductor capital equipment and integrated subsystems for biomedical markets, while also introducing its tunable-laser technology into fiber-sensing markets (see Fig. 1).

"A very positive outcome of the telecom investment, is the significant improvement in manufacturing and reliability and control processes for manufacturing," Maluf said. "It doesn't justify of course the large amount of dollars that were spent. But there were some benefits nonetheless that were derived."

Novalux

After raising $17 million in 1998 and 1999 to commercialize its extended-cavity surface-emitting laser (NECSEL), Novalux raised $109 million in a third round of funding the following year. "That was in September of 2000, right when the decision was made that the technology platform is developed, and we are going to embody it and go after telecom first," according to Aram Mooradian, chief technology officer. "So that was the enticement for a lot of the venture capitalists to come in during the high-return-on-investment days in telecom."

Within days of the completion of that funding round and business decision, Nortel (Brampton, Ontario, Canada) announced that they were beginning to see market softness, but Novalux continued to acquire the building and equipment to produce 980-nm pump lasers for a massive projected telecom market for erbium-doped fiber amplifiers, which was even more focused on uncooled 980-nm lasers for metro applications as the telecom market continued to decline. "It was not really until the fall of 2001 that we were really starting to see tremendous softening," said Rick Waltonsmith, senior product manager.

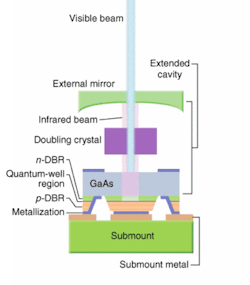

At that time, the company went back to the original platform and modified its telecom-focused technology to address the next market that was in the original business plan: intracavity frequency doubling to provide high-efficiency blue light. "In the telecom product, we were just using bulk glass in the NECSEL extended-cavity concept. But the other embodiment in the IP is what we call the long-cavity solution, in which you have a free-space resonator between the third mirror output coupler and the NECSEL die."

So the company took its 980-nm process, shifted the epitaxy by 4 nm to 976 nm, and used the external cavity for nonlinear optical frequency doubling to 488 nm, which it is now marketing successfully as a solid-state replacement for air-cooled argon-ion lasers (see Fig. 2). Novalux began shipping a 5-mW version to bioanalytical markets last December and followed within the next couple of months with a 15-mW version, which was displayed at the CLEO exhibition in June. The company is also developing 460- and 530-nm lasers and eyeing markets in digital imaging, reprographics, and even semiconductor inspection along the growth path for its versatile technology platform.

As with New Focus, however, transitioning from telecom back to optics was not easy. "When we got into the January time frame, we saw that we would be running out of cash sometime in March," said Jeff Cannon, president and CEO. In collaboration with investors and creditors, the company went into Chapter 11 bankruptcy in the middle of March. The investors formed a company to purchase the assets of Novalux out of Chapter 11; the proceeds of the sale went to pay off creditors and to provide operating funds for the company during the Chapter 11 process, which closed during the first week in May. The Novalux headcount of more than 40 was reduced by more than two-thirds during the Chapter 11 process, but almost all of the furloughed employees have now been rehired.

nLight Photonics

Fortunately for nLight Photonics, its telecom Raman amplifier technology was essentially high-powered semiconductor lasers. So when the telecom market evaporated, it was able to move the technology into alternative markets such as defense, medicine, and semiconductors. "It's a challenging process taking your company off of a single vertical market focus and looking at a range of different markets," said president and CEO Scott Keeney. "But it's really requisite for companies today to make sure that they are focused on a core technology, and make sure that technology can apply to a range of different markets, as markets tend to come and go."

nLight made its transition in the summer of 2002. Realizing the need for change and then making the changes demanded a lot of communication. "We spent a lot of time talking to the carriers to find out what was really going on out there. And as we all know, some of the data that was provided by some of the carriers wasn't exactly accurate," Keeney said. "Even when you are getting really great responses from your customers, you have to be careful about whether they are getting great responses from their customers."

There was also a lot of internal communication. "We took the time to talk to everybody in the company about where we were in the market when things were going well in telecom, and as they started to change," he said. "We were clear that neither was this something capricious, nor should anybody be faulted for focusing on telecom in 2000. It was a very large market, but as that moved away, prudent people needed to move on."

The company never grew to more than 100 employees and has less than 50 today, he said. The company essentially made a quick transition from producing a single fiber-coupled pump module to high-power laser diodes in a broad range of wavelengths, from 780 nm all the way up to 1.8 µm, and in a range of packages that includes everything from fairly simple mounts up to multikilowatt stacks (see Fig. 3).

The new products were developed essentially starting in the summer of 2002 in time for introduction at the 2003 Photonics West exhibition in January. Keeney attributes the successful transition to an experienced staff that had market knowledge and the know-how to shift the technology. "Our team is very strong on semiconductor lasers as opposed to solely telecom focused," he said.

Waveguide Solutions

Waveguide Solutions CEO Scott Faris began his first day on the job on Sept. 11, 2001. "It's one of those days that you will always remember what you were doing," he said. "At 9 a.m. I was walking into my first staff meeting ever in this company. I had been literally on the job for about two minutes when our accountant showed up and broke the news. I knew at that moment that the telecom downturn was going to accelerate."

Based on his perception of photonics as an enabling technology rather than an applications-oriented technology, Faris moved the company's spin-on-glass PLC technology out of the "miniature telecom amplifier" business and into what he calls "photon management." Markets that they considered entering included biochips, LEDs, integrated detectors for sensors, and passive micro-optics.

They chose to start with LEDs because many of the problems that the LED industry was beginning to face were very similar to the challenges that the VCSEL manufacturers were also facing, such as getting the photons off the device and into the right planes, Faris said (see Fig. 4). In some cases, they were the same companies, and many of the LED people were former VCSEL people. There was a key difference for Waveguide Solutions, however.

"Before we were actually building a product, now we are working with LED manufacturers to do on-chip light conversion and on-chip light extraction," he said. "We felt by validating the technology with the LED manufacturers at this phase, we would be in a very good position to demonstrate the technology, to show that it works and then down the road start to develop our own discrete product platforms."

The LED industry is not booming like telecom was in 2000, but it's not doing badly either. "We're looking at an industry growth curve in the high-brightness LED market in the 20% to 25% range for probably the next four to five years," he said. And the LED market also offers high volume. "In the LED world, you are literally shipping tens of millions of chips per month, and because you are shipping in those volumes, your economies of scale go up, but you are also much more cost sensitive. So the business model tends to become much more consumer-cost oriented."

Faris attributes the company's ability to transition quickly in part to what initially seemed to be a disadvantage—the company hadn't raised a lot of money or built large facilities like its competitors had. He also believes that long-term benefits for optoelectronics as a whole, such as moving from bulk to planar technology are also accruing as a result of the telecom disaster.

"The benefit wasn't there for what the telecom guys wanted to accomplish in 18 months," he said. "But I think a decade down the road it will be fairly evident that this was a real renaissance for the photonics industry."