High-brightness LEDs open new illumination markets

Since the development of the first commercial visible light-emitting diodes (LEDs) in 1968, LED technology has undergone a series of both evolutionary and revolutionary changes. For the first 25 years of their history, the materials available for LED fabrication (primarily gallium phosphide (GaP) and gallium arsenide phosphide (GaAsP)) were low in efficiency and allowed LEDs to be used primarily as low-brightness indicator lamps and alphanumeric displays. Moreover, their spectral range was limited to yellow-green, orange, and red.

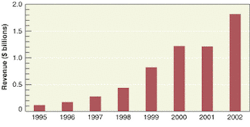

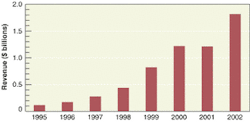

In the early to mid-1990s a new generation of LED materials was developed that enabled the fabrication of high-brightness devices across the entire visible spectrum, opening up large new markets that were not addressable by previous material technologies. These materials, indium gallium aluminum phosphide (InGaAlP) and indium gallium nitride (InGaN), have formed the foundation for the large ($1.8 billion in 2002) high-brightness LED industry that has evolved since 1995 (see Fig. 1). Note that a high-brightness LED material, aluminum gallium arsenide (AlGaAs), was developed in the mid-1980s, but it can only produce a single color—red at 660 nm—and its use has been relatively limited. Currently, the high-brightness LED market can be conveniently divided into six major application categories (see Fig. 2).

LEDs for illumination

Illumination applications accounted for just 5% of the high-brightness market ($85 million) in 2002. However, it is one of the fastest growing applications, and the one that is driving the most current interest in high-brightness LED technology. Also known as solid-state lighting, the use of high-brightness LEDs for illumination has the potential to revolutionize the lighting industry over the next 10 to 20 years.

The current and potential future market for LEDs in lighting applications exists only because LED technology offers real, often quantifiable, benefits in these applications. Whereas LEDs have several years of history in some lighting applications, such as machine vision and architectural/theme/retail applications, in many other applications lighting-system designers are just beginning to understand their properties and to experiment with LEDs as new tools for lighting.

Lighting designers are attracted by the design flexibility accorded by a directional light source that is capable of saturated color. The combination of red, blue, and green (RGB) LEDs provides a far greater selection of color than any other light source (16.7 million). The color is also delivered without the use of a filter. Color is available with less energy consumption than filtered conventional white-light sources, and with the production of no heat in the light beam.

The long lifetime of LEDs relative to conventional light sources has been a key attribute in their adoption, especially in applications in which a high premium is placed upon reliability. In applications such as machine vision, for example, the cost of downtime due to lamp failure is much higher than the cost difference between LED sources and conventional sources.

Another attribute of key importance is energy efficiency, especially for colored LEDs. Most applications for LEDs in lighting to date have been for colored LEDs. Compared to filtered incandescent sources, colored LEDs consume 80% to 90% less electricity to deliver a given number of lumens. White LEDs are more efficient than low-wattage incandescent and halogen by a significant margin, and the best white-LED technology is more efficient than standard 60- to 100-W incandescent lamps.

The solid-state compact nature of high-brightness LEDs is one of the primary drivers behind their use. Compact arrays of LEDs can be assembled that are digitally addressable so that a large variety of colors can be produced using programmable controls. Similarly, long linear strips of LEDs can be assembled for use in contour lighting and channel-letter lighting, and by using three-color arrays color-changing effects are possible.

Pros and cons

The advantages of LEDs are well known (see "The advantages of LEDs," this page). On the downside, the main disadvantages of LEDs are their much higher cost than conventional light sources, and their low lumen output per lamp. Both of these problems are being vigorously addressed by the LED industry, and substantial progress has been made within the past two years. For commercial white LEDs, the lumen output per package has increased by a factor of 100, and cost per lumen has decreased by a factor of 5. Even greater performance and cost improvements are imminent in products announced, but not yet fully commercial. Clearly, much additional progress must be made before LEDs can effectively penetrate the large-scale general-illumination market. However, substantial growth in the penetration of LEDs into the lighting market can be expected in the next five years based on the attributes described above.

Near-term illumination markets

The key to the near-term adoption of high-brightness LEDs in lighting applications is not to target applications where traditional lighting (fluorescent, halogen, incandescent) is firmly entrenched, much lower in cost, and where maintenance and replacement costs are low. It takes a great deal of effort, time, and money to convince lighting manufacturers and their customers to shift away from applications in which traditional lighting has been used successfully for many years. What will help the illumination market for LEDs the most is to use LEDs in new applications where it is not possible (or at least very undesirable) to use traditional lighting, or in applications that place a high premium on a particular attribute of LEDs, such as reliability.

Currently, the major uses of LEDs in lighting applications fall primarily within eight application areas: channel letter/contour lighting; architectural/retail/theme; industrial/.machine vision; consumer portable/novelty (such as flashlights and key lights); maintenance retrofit (socket-compatible replacement lamps; safety/security (exit signs and emergency lighting); accent/marker/decorative (such as colored accent lamps and marker lights); and specialty illumination (such as aircraft interior lighting and task lights).

These applications are being developed primarily by lighting-systems companies that are manufacturing lighting fixtures, or luminaires, or other products, including control electronics and optics, that use the devices provided by the LED manufacturers to address a specific lighting task. These companies are generally not the mainstream lighting-system manufacturers, although there is some participation by such companies, but are smaller specialized companies that are focused on the development of LED lighting. Such companies include pioneers in the field such as Color Kinetics, TIR Systems, Boca Flasher, Permlight Products, and many others. Nevertheless, mainstream lighting companies are beginning to evaluate the potential of LEDs and a number of them have even developed LED products. At lighting industry trade shows, such as LightFair, the largest in North America, a significant number of exhibit booths display LED products.

These specialized lighting applications represent one of the fastest growing markets for high-brightness LEDs. While they are relatively limited compared to the $12 billion general illumination market (for all types of lamps—incandescent, fluorescent, and others) that is envisioned as the "Holy Grail" of the high-brightness LED industry, they nevertheless constitute a transition stage that will provide a point of entry into this larger market. Moreover, these applications are being developed based on the current price and performance characteristics of LEDs, whereas the development of the general illumination market will require prices that are much lower and performance that is much higher that those available today. As the price/performance characteristics of high-brightness LEDs continue to improve, this market will continue to expand.

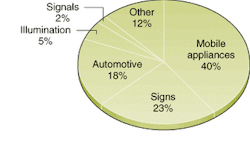

The overall high-brightness LED market is forecast to grow at an average annual rate of just under 20% to reach $4.4 billion in 2007. The market for high-brightness LEDs in illumination is forecast to grow at 44% per year, or more than twice the overall rate, to reach $520 million in 2007 (see Fig. 3).

ROBERT V. STEELE is director of optoelectronics at Strategies Unlimited, 201 San Antonio Circle, Suite 205, Mountain View, CA 94040; e-mail:[email protected].

The benefits of LEDs

HB LEDs' major benefits include:

- Long lifetime/reduced maintenance costs

- Energy efficiency

- Design flexibility

- Saturated colors

- Directional light

- Robustness

- Dynamic color control

- Dimmability without color shift

- No strike time—immediate ignition

- No mercury

- Cold-start-capable

- No heat in light beam

- Low-voltage DC operation

Compared to conventional light sources, high-brightness LEDs are not subject to:

- Sudden failure—"nonpassive" failure, or explosions as can occur with high-intensity-discharge lamps

- Inconsistencies in dimming

- Defined environmental hazards in disposal, such as the mercury in fluorescent lamps