Review and forecast of the laser markets Part II: Diode lasers

The Laser Focus World 2002 Annual Review and Forecast of the Laser Markets is conducted in conjunction with Strategies Unlimited, an optoelectronics market research firm based in Mountain View, CA. Part II covers the diode-laser marketplace. Part I, which reported on the nondiode-laser markets, appeared last month.

ROBERT V. STEELE

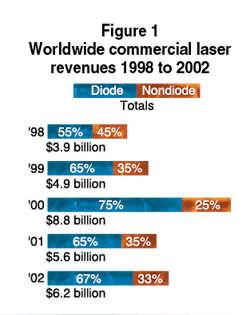

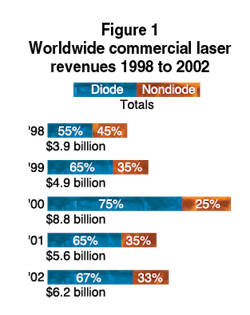

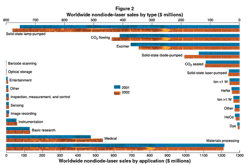

As discussed in the “Review and Forecast of the Laser Market, Part I: Nondiode Lasers” (see Laser Focus World, January 2002, p. 81), last year at this time the diode-laser market was projected to grow by 36% in 2001. Despite this optimism, the worldwide diode-laser market actually contracted by 36%, the first time in the six years that Strategies Unlimited has been tracking the diode-laser market in conjunction with Laser Focus World that the market has declined rather than grown (see Fig. 1). From a restated $5.71 billion in 2000, the market declined to $3.66 billion in 2001. Moreover, the decline was broadly based, with all market segments undergoing substantial decreases. A conjunction of many factors caused the large contraction, including a sharp drop in telecommunications capital investment, a slowdown in the world economy, pricing softness in the Japanese optical storage market, and a weakening of the Japanese yen.

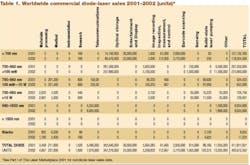

Although price declines were a factor in the 2001 market, unit sales also dropped, although the decrease varied widely from sector to sector (see Table 1). The decline for all product types was 2%, to 412 million units. The decrease in unit sipments was due primarily to optical storage lasers, which have high unit volumes, but are low in average selling price ($1 to $10). The large variance between unit decrease and revenue decrease is because the largest part of the diode-laser revenue decrease was due to telecom lasers, a small market in terms of units but with high average selling prices ($100 to $2000).

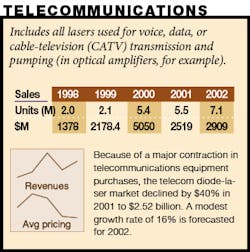

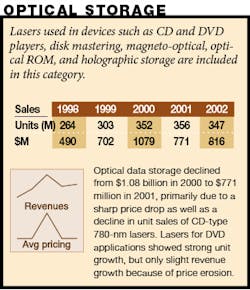

The telecommunications segment was the hardest hit, with overall revenues of $2.52 billion in 2001 compared to $4.17 billion in 2000, revised downward from the $5.05 billion estimated last year (see Laser Focus World, February 2001, p. 84), corresponding to a decrease of 40% (see Table 2). Optical storage, the second largest segment, decreased by 28.5% to $771 million. All of the other segments together decreased to $360 million from $466 million (−21%) in 2001.

Because a large portion of the non-telecom diode-laser market originates in Japan, the value of the yen can sometimes play a significant role in the market size expressed in dollars. Between 2000 and 2001 the value of the yen weakened from 108 per dollar to 121 per dollar. This change by itself would have caused an 11% contraction in the optical storage market in dollar terms, even if unit volumes and yen-based pricing had held steady.

Although a year-to-year decrease of 36% appears to be startling, it should be considered in relation to the overall market history of diode lasers in recent years (see Fig. 2). The trend line for the period from 1996 to 2002 corresponds to an average annual growth rate of 16.9%. In the context of this history, 2000 appears to be something of an anomaly. Many factors came together simultaneously in 2000 to cause the market “spike” seen in 2000. These include a surge in DWDM systems deployment in the telecom segment, substantial price increases in the optical storage diode-laser market in Japan, a strengthening of the yen which boosted the revenue for the optical storage market as reported in dollars, and several other minor factors. In 2000 these trends were reversed, leading to the large year-to-year decrease discussed above. Nevertheless, in the context of the recent history of the diode-laser market, 2001 was not an especially “bad” year.

The outlook for 2002 is cautiously optimistic with a projected growth of 13.4% to $4.15 billion. This increase reflects modest growth across all market segments, including telecommunications, and incorporates an expectation of overall economic recovery during 2002.

Telecommunications

The collapse of the telecommunications equipment market in 2001 is by now a well-known story. Based on aggressive capital spending for fiberoptic system build-out by both new and established carriers, the market for telecommunications equipment expanded dramatically in 2000. As a result, the market for telecom diode lasers grew from $2.19 billion in 1999 to $4.17 billion in 2000, an increase of more than 91%. However, by the first quarter of 2001, it was becoming clear that carriers had made capital investments that far exceeded the ability of any reasonable revenue model to provide an acceptable rate of return. As a result, carriers reduced their capital spending significantly in 2001. A number of the new, smaller carriers that had used debt financing to build out their systems filed for bankruptcy.

The contraction in carrier capital spending caused the market for fiberoptic equipment to decrease sharply, resulting in large decreases in revenue and massive layoffs at equipment suppliers such as Nortel Networks and Lucent Technologies. At the component level the impact was even more severe. Equipment suppliers had built up large inventories of components, anticipating continued rapid market expansion. When the market contracted, these companies had many months of component inventories to supply the new lower demand, and new orders virtually vanished for some types of components.

The impact on the component market is readily seen in a comparison of the year-to-year revenues of some of the major telecom component suppliers, including Agere Systems (formerly Lucent Microelectronics), Alcatel Optronics, Corning Photonics, JDS Uniphase (including the SDL acquisition) and Nortel Networks Optical Components. The changes in revenue from calendar year 2000 to 2001 (with fourth quarter 2001 revenues estimated as of the time of preparation of this article in early December 2001) were as follows:

• Agere Systems Optical Components: −37%

• Alcatel Optronics: +10%

• Corning Photonics: −47%

• JDS Uniphase: −32%

• Nortel Networks Optical Components: −79%

The average for all five companies was −46%. Alcatel Optronics showed a slight increase because the European market, which it primarily serves, did not begin to decline until later in the year. Other companies were affected primarily by the sharp drop in the North American market.

While the above figures are representative of the broad range of products included in the term “telecom components,” different types of components experienced somewhat different market trends in 2001. For telecom diode lasers, there were a few bright spots in the market. In particular, as reported by Strategies Unlimited’s sister company KMI (both subsidiaries of PennWell Corp., publisher of Laser Focus World), carriers have continued to add capacity to their existing fiberoptic networks by adding OC-48 (2.5 Gbit/s) and OC-192 (10 Gbit/s) line cards to previously installed dense wavelength-division multiplexing (DWDM) terminals. When new DWDM systems are installed, the terminals at the end of each point-to-point fiber link are typically not fully populated with all the line cards that the terminals would utilize at full capacity. (Each line card provides one wavelength in a DWDM system.) Line cards are added later to increase capacity as demand grows. This “after market” for line cards has been a positive development for long-haul- transmission diode lasers. In addition, this effect has helped to sustain demand for the diode lasers used in short-reach links that connect DWDM terminals to other types of equipment such as SONET equipment and switching and routing equipment.

Overall, the market for telecom diode lasers, including both transmission lasers and pump lasers for optical amplifiers, decreased from $4.17 billion in 2000 to $2.52 billion, or −40%. However, the decrease was not as severe for transmission lasers as for pump lasers. As noted above, the market decline for transmission lasers was moderated by the continued growth in DWDM line- card installation. As a result, the year-to-year change in transmission-laser sales was −26%. For pump lasers (both 1480 and 980 nm) the market environment was more severe. The installation of new DWDM systems fell sharply in 2001, and as a result the market for terminal equipment, fiber cable and amplifiers fell dramatically as well. Consequently, the sales of pump lasers used in amplifiers dropped from $1.41 billion in 2000 to $484 million in 2001, a decrease of more than 65%.

The outlook for 2002 is cautiously optimistic, with a modest revenue growth of 16% to $2.91 billion forecast for all telecom diode lasers. This reflects continuing growth in the DWDM line-card market for transmission lasers, but a mixed bag for pump lasers, with 980-nm lasers and 1480-nm lasers increasing significantly in unit terms, but with average prices falling for 980-nm lasers as some undersea system builds are completed (undersea lasers are much higher in price than terrestrial lasers).

Optical storage

The market for optical data storage drives is largely a consumer market, and includes CD-type drives (CD audio, CD-ROM for data storage, CD-RW, CD-ROM games, and Video CD sold primarily in Asia); MiniDisc (Read-only, Rewritable); and DVD-type drives (DVD video, DVD-ROM for data storage, and DVD-ROM games, DVD-RAM/RW). Because the optical storage market is largely consumer driven, the market for mature technologies such as CD-audio and CD-ROM can be affected by the worldwide economy. While this is also true to some extent for newer technologies such as DVD video and DVD-ROM, their increasing penetration into the optical storage market usually outweighs any macroeconomic effects.

In 2001, the market for diode lasers used in optical-storage drives increased just slightly (+1.1%) in unit terms over 2000; however, in revenue terms it decreased significantly, from $1.08 billion to $771 million (−29%). The picture is complicated somewhat by the differing dynamics of 780-nm lasers used in mature CD-type drives and 650-nm lasers used in newer DVD-type drives. However, in general the decrease in revenue was due primarily to a sharp drop in prices for all laser types (following a sharp run-up in prices for 780-nm lasers in 2000 because of a supply shortage), and secondarily a weakening of the Japanese yen, which accounted for about 11 percentage points of the revenue decline, expressed in dollar terms. Virtually all optical-storage diode lasers are manufactured in Japan, and a large percentage of them are consumed there as well.

The market for the low-power 780-nm diode lasers used in CD audio players and CD-ROM data storage and video games declined in 2001 in both units and revenue. This was due to several factors, among the most significant of which was a slight decline in the unit sales of personal computers, which consume the vast majority of CD-ROM drives, and the transition from CD-ROM-based video games to DVD-ROM-based games as exemplified by the Sony PlayStation2. However, there were several other factors at work as well in this somewhat complicated market situation. Among these was the introduction by several diode laser manufacturers of a combination 650-nm/780-nm laser for use in DVD video players and DVD-ROM drives. Most DVD players and all DVD-ROM drives incorporate a 780-nm laser, in addition to a 650-nm laser, to be able to read CD-type media. However, the introduction of the combination 650-nm/780-nm laser (which is counted in the <700-nm category for statistical purposes) has reduced demand for 780-nm lasers in this application.

A bright spot in the 780-nm laser market was an increase in the higher-power 780-nm lasers (35 mW) used in CD-RW drives and recordable MiniDisc players. CD-RW drives have increased their penetration of the personal computer market as consumers demand such drives for recording music downloaded from the Internet. Data storage backup is another widespread use of such drives. However, this increase was not enough to offset the large reduction in the market for lower-power (5 mW) 780-nm diode lasers used in CD-ROM drives and CD-ROM-based games.

Visible diode lasers (650 nm) used in DVD-based drives continued their strong growth path, with unit sales increasing by 82.5% to 74.1 million in 2001. Revenues, however, increased by only 1.8% to $278.1 million due to severe price erosion relative to 20001. In spite of a slowing economy, DVD video players have continued their rapid penetration of the home video entertainment market, especially in the U.S. Driven by rapidly falling player prices (as low as $100 or less for off-brand models in discount outlets) and continuing growth in the number of available titles (over 13,000 in late 2001), including virtually all new home video releases. The DVD video player market is now growing faster than the video cassette recorder market did at the same number of years after its introduction. With unit growth in the U.S. at over 50% in 2001 to nearly 13 million, DVD players have now been placed in nearly one-quarter of U.S. households.

The growth in DVD-ROM-based video games has been even more spectacular, especially Sony's PlayStation2. Introduced to great fanfare early in 2000 as the successor to the original CD-ROM-based PlayStation, PlayStation2 consoles achieved sales of 6.4 million units through the end of 2000. Based on sales figures through September, sales of PlayStation2 consoles seemed likely to exceed 18 million units in 2001, a near tripling of the previous year's sales.

Although experiencing steady growth, DVD-ROM sales have not fared as well as DVD video and DVD-ROM games. Once seen as the successor to CD-ROM in personal computers, the lack of software for the higher-capacity DVD-ROM drives has hindered sales, along with a stagnating personal computer market in 2001. Nevertheless, unit sales increased by just under 16% in 2001 to 37 million units.

Diode-laser products and configurations

The diode-laser revenue figures in Table 2 are based on the unit sales figures in Table 1 and average selling prices (ASPs), vary widely and are a function of wavelength, power output, and package type. The revenue figures are for packaged devices as they are sold by suppliers to the merchant market or transferred internally to other company divisions for use in system-level products. Diode-laser packaging is subject to a wide range of configurations according to the device type and application requirements, and includes variations such as thermal control and fiber coupling. Short-wavelength (<1000 nm) diode lasers at power levels less than 200 mW are almost always single-lateral-mode, single-stripe devices that are sold commercially in hermetically sealed TO-type packages. The lasers are typically mounted on a heat sink, and the complete package includes a back-facet photodetector for monitoring the laser output level. Selling prices of such devices range from less than $1 for a high-volume CD-type laser to around $3 for a low-power visible (650 nm) laser to around $7 for a 30-mW, 780-nm laser used in optical storage applications. Some low-volume specialty devices can be priced much higher.

An increasingly important packaging concept in low-power 750- to 980-nm diode-laser market, particularly in audio CD and CD-ROM applications, is hybrid integration of the diode-laser chip, detector chips, and optical elements in a single package. These integrated optical pickups are lower in cost than pickups fabricated from discrete components, and result in easier assembly for the CD player or CD-ROM drive manufacturer. Such pickups are manufactured in volume by Sony, Sharp and Matsushita, with prices averaging around $2, compared to less than $1 for a discrete packaged diode laser. The value of such pickups is included in the diode-laser market revenues in Table 2.

For high-power diode lasers (>1 W) there is a wide range of power levels and configurations. Up to five watts CW, a wide (up to 500 µm) single-stripe, multimode device is the norm. These devices are usually supplied in TO-type packages that can include Peltier coolers for temperature control. Beyond about 5 W, the only commonly used approach is a multistripe, multimode array. The standard product at these power levels is a 1-cm-wide diode-laser bar, which consists of a single multistripe array or a grouping of several arrays to build up higher-power levels. Pricing for high-power diode lasers ranges from under $200 for a 1-W discrete device in quantity up to $1000 for a 20-W bar. Single laser bars are now available at power outputs up to 40 W cw, although 20 W is still the most common configuration. Increasingly, these high-power devices are sold with fiber coupling to provide a more usable output beam for the end user. Higher-power arrays are typically available on a heatsink submount that can be attached to a water-cooled heat-removal system. For applications requiring high peak power, these arrays can be operated in the pulsed (quasi-CW, or QCW) mode at peak powers up to 100 W.

For power levels above 40 W CW, high-power diode-laser bars can be stacked in the vertical dimension (these products are included in the stacks category in Tables 1 and 2). Because of the difficulty in removing heat from such a configuration, these stacks are typically operated in the QCW mode. Peak output power approaching 5 kW can be achieved from such a stack. The packages for these devices typically include water cooling, although conduction cooling may be used in lower duty-cycle devices. With the development of more-efficient heat-removal techniques (such as microchannel coolers), CW stacks have become available.

The packages for long-wavelength (> 1000 nm) diode lasers used in telecommunications applications include special adaptations for coupling the laser output to single-mode (approximately 9-µm core diameter) optical fiber with tolerances on the order of ±1 µm. These are in the form of fiber pigtails or single-mode connectors. Telecommunication laser packages can also include other elements such as thermoelectric coolers for temperature control and optical isolators to reduce the amount of light reflected from the fiber back into the laser. All laser packages include back facet monitor photodiodes. Because of the expense of fiber coupling and other package features, telecommunications diode lasers typically have high ASPs. Prices range from less than $100 for the lowest performance Fabry-Perot devices in a connectorized coaxial package to several thousand dollars for a high-performance distributed-feedback (DFB) laser in a cooled butterfly package with fiber pigtail. Diode lasers used in short-distance data communications applications with multimode fiber have much lower prices. For example, 850-nm VCSELs packaged in several different configurations are priced at well under $10.

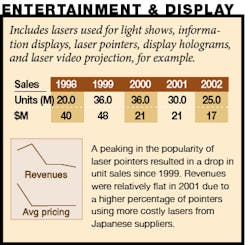

Entertainment and display

After a surge in the market in the late 1990s that reflected the rapidly increasing popularity of laser pointers, the market for visible (<700 nm) diode lasers in the entertainment and display category has begun to contract. As prices fell during the late 1990s, the use of laser pointers spread far beyond the educational and professional markets to the mass market as novelty items. However, even though prices have continued to fall, the "novelty" of laser pointers has worn off somewhat. Falling prices have forced many suppliers out of business, and virtually all laser-pointer production has moved to mainland China to take advantage of low labor costs.

The prices of the visible diode lasers used in laser pointers has also plummeted, again forcing many suppliers to leave the business. As a result of falling demand for the pointers and falling laser prices, the market for diode lasers in this application has fallen from a peak of $48 million in 1999 to $21 million in 2001. In spite of the drop-off in the pointer market, there continues to be a healthy, although much smaller, market for visible diode lasers used in measuring systems, gun sights, surveying instruments, and other such applications.

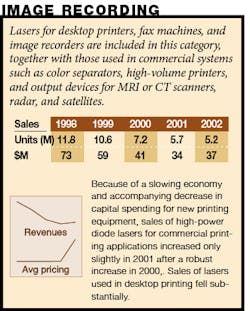

Image recording

Diode lasers continue to find significant use in the commercial printing and graphics arts business in the form of computer-to-plate and computer-to-press (collectively known as CTP) systems. Both discrete diode lasers (approximately 1 W) and diode-laser bars (20+ W) are used in these applications. At the major quinquennial worldwide printing and graphic arts show, known as DRUPA, held in May 2000, a large number of new and improved thermal plate CTP systems were introduced by major printing system companies. As expected, these new-product introductions gave a boost to the diode-laser market in 2000, with sales increasing by 26%.

The market boost provided by DRUPA did not, however, carry over into 2001. Instead, as the world economy began to slow, capital investment dropped off sharply, including investment in new printing equipment. As a result, the market for diode lasers used in CTP systems increased only slightly in 2001, with revenues of $22.7 million, compared to $21.7 million in 2000. A revenue increase of 17% is forecast for 2002, which reflects the expectation of economic recovery and an associated increase in investment in new commercial printing systems. Following recent trends, an increasing share of the printing equipment business should continue to be captured by thermal-plate CTP systems that use high-power diode lasers.

The market for low-power diode lasers for desktop printers continues to decline as laser printers and digital copiers increasingly become confined to high-end networked printing applications. Ink-jet printers have largely replaced laser printers for most low-volume personal printing functions. The market for diode lasers used in laser printers was $11.5 million, and is forecast to decrease slightly to $10.5 million in 2002.

Medical

The market for diode lasers used in all medical therapeutic applications was $60.4 million in 2001, an apparent decline from the $82 million reported for 2000. However, because of some apparent double counting of the hair removal market in 2000, that number is likely to be somewhat higher than the actual market.

Hair removal continued to be the main medical application for diode lasers in 2001, with systems ranging from large clinical models to small hand-held units for personal use. Consequently, three diode laser product types were incorporated into such systems, including 750 to 980 nm, 100 mW to 10 W; 750 to 980 nm, >10 W; and stacks. The larger systems, both stationary and handheld, are licensed by the FDA and are used in clinical and professional settings. The smallest systems are not, and are thus used mainly outside the U.S. The hair removal market has slowed somewhat following spectacular growth in 1999 and 2000. The outlook for 2002 is for a slight decrease, reflecting the fact that the market is beginning to saturate.

In other medical applications, the use of diode lasers in ophthalmic procedures such retinal photocoagulation continues to be a steady, if somewhat modest market. The use of high power visible diode lasers in photodynamic therapy (PDT) to treat age-related macular degeneration seems to have virtually vanished 2001. Although a significant market developed in 2000, it seems that all the ophthalmologists that wanted to purchase a PDT system did so in 2000, and the market saturated rather quickly. No additional sales are forecast for 2002.

There continues to be a modest market for diode-laser based surgical systems. As in the case of ophthalmic systems, the market remains small but steady. Overall, the forecast for 2002 is for a slight decrease in the medical diode-laser market, to $58 million, due to the saturation of hair removal market, as noted above.

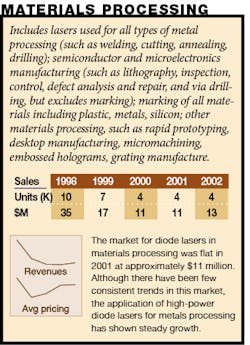

Materials processing

Materials processing using diode lasers continues to make modest inroads into the industrial materials processing market. The introduction in 1999 of complete kilowatt-scale diode-laser systems by Rofin-Sinar and several other companies including Nuvonyx, Laserline, and Jenoptik, gave a significant boost to a market that had been lacking a systematic approach to providing higher power levels for heavy-duty applications such as welding, cladding and drilling. However, the penetration of these diode systems into the broad industrial materials market has been modest at best. In spite of favorable economics and operating characteristics, the major industrial users have been slow to change their "tried and true" approaches based on solid-state and CO2 lasers.

Other lower-power applications such as soldering, epoxy curing and plastic welding have shown inconsistent progress over the past few years. The market is fragmented, with no application showing a sustainable growth trend.

In 2001, the market for diode lasers used in materials processing applications apparently declined slightly to $10.5 million from $11.3 million in 2001. However, over the years inconsistent estimates of the size of this market have made year-to-year trends difficult to characterize accurately. The outlook for 2002 is for modest growth to $12.5 million, with the largest increase anticipated in the use of diode laser stacks for high-power systems.

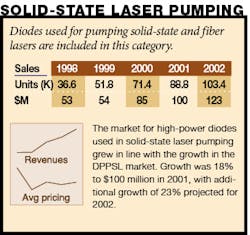

Solid-state laser pumping

In 2001 diode lasers used as pumps for solid state lasers garnered $100 million in revenue, an increase of 18% over the $85 million reported in 2000. This application continues to represent the largest use of high-power diode lasers. The increase was most notable for diode laser stacks, which are used in larger (for example,. kilowatt-class) DPSSL systems, which showed a revenue increase of 38%. Revenues for diode-laser bars (750 to 980 nm, >10 W) grew by 17%, while revenues for discrete diodes (750 to 980 nm, 100 mW to 10 W) were flat. The latter are used to pump low-power DPSSLs (such as green laser pointers) as well as fiber lasers.

The revenue increase of 18% for DPSSL pumps was roughly in line with the 16% increase in DPSSL units sold in 2001 (see Laser Focus World, January 2002, p. 81). The largest absolute DPSSL unit increases were in instrumentation (+157% to 1,624) and materials processing (+8.2% to 2,250). Although overall revenues for DPPSLs were down slightly, this decline likely reflected decreasing prices, and perhaps a shifting product mix.

The large growth in the stacks category reflects a continuing penetration of kilowatt-class DPPSL into the lamp-pumped solid state materials processing market. First pioneered by European laser companies such as Rofin-Sinar and Trumpf-Haas, these lasers have demonstrated higher beam quality, lower operating costs and higher reliability than their lamp-pumped counterparts. These features have given them a foothold in the industrial materials processing market, and although still small in numbers, are beginning to have a noticeable market presence.

Military applications of DPSSLs are also on the increase. Although the events of September 11 and the subsequent declaration of the war on terrorism have heightened the awareness of the need for sophisticated military optoelectronics hardware, most of the military laser programs have been in place for some time. Many of these programs involve replacing lamp-pumped solid state laser platforms with DPPSLs, due to their ruggedness and higher operational reliability.

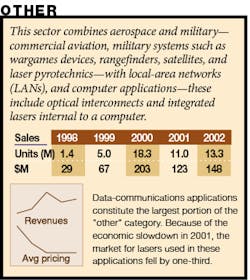

Other

The "other" category includes several unrelated applications, including military/aerospace and local area networks (LANs). Although the term LAN in its strictest sense refers to networks for interconnecting computers within the environment of a building or group of buildings (campus), for purposes of analyzing the laser marketplace we interpret it to have a more inclusive meaning that includes all localized data communications. Thus the term encompasses, in addition to actual LANs based on Ethernet (the predominant LAN standard), storage area networks, or SANs, and very short-reach (<300 meters) point-to-point connections between telecommunications equipment such as DWDM terminals and routers, and within very large switches and routers in the form of optical backplanes.

The main growth trend in this category is the use of diode lasers in transceiver modules for high-speed data communications networks, particularly Gigabit Ethernet and Fibre Channel applications. The two diode-laser types used are 850-nm vertical-cavity surface-emitting lasers, or VCSELs (accounted for in the 750 to 980 nm, <100 mW product category) and conventional 1300-nm edge-emitting lasers (accounted for in the 980 to 1550 nm product category). VCSEL-based transceivers are used with multimode fiber for shorter distance (less than 300 meter) requirements. The 1300-nm lasers are used with both multimode and single mode fiber for longer distances, from 300 meters up to 10 kilometers.

The market for Gigabit Ethernet and Fibre Channel transceivers grew dramatically in 2000. One measure of this growth is the number of Gigabit Ethernet switch ports and Fibre Channel switch ports shipped by equipment suppliers. The former grew by 145% while the latter grew by 240%. Transceiver shipments showed corresponding growth. In 2001, largely due to the economic downturn and the resulting contraction in corporate IT spending, growth in Gigabit Ethernet and Fibre Channel equipment deployment slowed, although neither actually declined. Nevertheless, because of the carry over of inventory from 2000, transceiver shipments declined slightly. The shipments of VCSELs for use in transceivers declined much more, however, because they are at the bottom of the "food chain," where inventory effects are more severe. Overall, the 850 nm VCSEL market fell by 28% in 2001 to $91.2 million.

On a more positive note, and somewhat offsetting the decline in the single-VCSEL transceiver market, the use of 850-nm VCSEL arrays in parallel optical interconnects showed sharp gains in 2001. The applications for these devices are primarily in short-reach interconnects between telecommunications equipment and in optical backplanes for large switches and routers. Earlier in 2001 the Optical Internetworking Forum (OIF) approved standards for very short-reach (VSR) interconnection of communications equipment at 10 Gbit/s. With standards in place, the market for VSR parallel interconnects began to move forward, although large-scale growth is not expected until 2002. Similarly, most of the parallel interconnects shipped to date for backplanes have been for development programs, but these programs began to use substantial quantities of interconnects in 2001. Many of the switch and router products in which these interconnects will be used will begin commercial rollout in 2002, and a major expansion of the parallel interconnect market is expected then. A major exception is Sycamore Networks, whose SN 16000 intelligent optical switch that uses an optical backplane has been shipping since 2000.

Military applications of high-power diode lasers are largely confined to pumps for DPPSLs. These are included in the Pumps category. The use of high peak-power pulsed diodes in war gaming applications continues as a steady, although small, market.

ROBERT V. STEELE is director of optoelectronics at Strategies Unlimited, 201 San Antonio Circle, Suite 205, Mountain View, CA 94040.

Where the numbers come from

The Laser Focus World Annual Review and Forecast of the Laser Marketplace is based on a worldwide survey of laser producers and covers 27 types of lasers and 20 applications. Information about diode-laser markets is provided by Strategies Unlimited (Mountain View, CA). The review is the only major survey of its kind in this industry whose results are made public.

For many, both inside and outside the industry, from private-sector investors to foreign and U.S. government bodies, this report is the only objective summary of major trends in our industry that is readily available. Part I, published in January, looked at the overall market trends with more detail on nondiode lasers. Part II, published here, covers the diode-laser marketplace.

Readers interested in the detailed results of both surveys will find them in the Jan. 1 and Feb. 1 editions of the Optoelectronics Report newsletter, published by Laser Focus World. A more extensive review of the data, with supporting commentary from market analysts, was available to attendees at the Laser and Optoelectronics Marketplace seminar, held in conjunction with Photonics West (San Jose, CA) on Jan. 21. To obtain the Proceedings of the seminar, see www.marketplaceseminar.com.

Collecting the data

We conducted our research and analysis for the Review and Forecast during October and November 2001. We asked manufacturers to provide an estimate of total worldwide market size (dollars and units) for 2001, based on year-to-date actual data, and a forecast for 2002. In addition to the information provided by the manufacturers, we also used data from other more narrowly focused market surveys, and we incorporated commentary provided by industry analysts who added insight into some of the markets.

Comparison with last year’s numbers

Readers who compare last year’s 2001 estimates with this year’s restated 2001 numbers will note differences and occasional discontinuities in the numbers reported as compared to last year. In general, no attempt has been made to explain these differences in detail. We request “bottom-up” market estimates, and the respondents to our survey do vary from year to year—both in terms of the companies involved and the individuals—so variations in the results are inevitable. In addition, changes in market visibility occur as market shares change. Differences in the overall numbers for 2001 last year and for 2001 this year may also reflect whatever degree of optimism or pessimism was inherent in last year’s forecast (see Laser Focus World, January 2001, p. 88).—SGA