Review and forecast of laser markets: 1999--Part I

Review and forecast of laser markets: 1999--Part I

Manufacturers are optimistic that most laser markets will grow despite concerns about the global economic outlook.

Stephen G. Anderson, Executive Editor

In order to provide readers with detailed analysis of both the nondiode and diode laser markets, the Laser Focus World Annual Review and Forecast of the Laser Marketplace is prepared in conjunction with Strategies Unlimited, an optoelectronics market research firm based in Mountain View, CA.

Part I of the review, a report on the nondiode laser markets, is published here. Part II, written by Robert Steele of Strategies Unlimited, covers the diode-laser marketplace and will be published next month.--Ed.

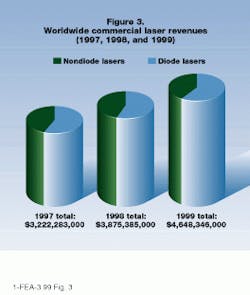

Despite major economic upheaval around the world during 1998, the laser and optoelectronics business has apparently fared pretty well. In January last year we projected an overall increase of 19%--to $3.8 billion--for the worldwide laser marketplace compared to 1997. This year the restated 1998 global sales--at $3.9 billion--agrees remarkably well with this number and suggests a stronger marketplace in 1998 than many observers had expected. Furthermore, for 1999 the forecast is for an overall worldwide market of $4.6 billion, a tremendous year-to-year increase of 20%. For the same period, the diode-laser share of the total market also is projected to increase. In 1998, nondiode lasers accounted for $1.7 billion (45%) and diode lasers for $2.1 billion (55%) of the total. But in 1999 the nondiode lasers share of market drops to 41% (or $1.9 billion--a 9% increase despite the smaller share of market), while diode laser sales increase by 28% to $2.8 billion.

There are several reasons for such a large expansion in the size of the diode-laser markets. According to Robert Steele, director of optoelectronics at Strategies Unlimited, these reasons include the current worldwide strength of the telecommunications industry, new optical data storage applications such as digital versatile disks (DVDs), as well as emerging high-power diode-laser applications particularly in medicine and materials processing. Steele will elaborate on these markets next month, and, as many laser markets involve both diode and nondiode lasers, readers interested in specific applications that involve both types of lasers should read both articles.

For nondiode lasers an overall revenue growth of 9% is forecast into 1999, with unit sales basically flat. Reasons for the lower growth of nondiode lasers are varied but there are a couple of significant overall factors. First, there are no very-high-growth applications driving the revenues up--as telecommunications is doing for diode lasers. Second, as diode-laser prices drop and output powers increase, these lasers are tending to gain market share at the expense of nondiode lasers--barcode scanning being one of the best examples of this transition. The latter is, in fact, the only nondiode laser application showing negative revenue growth into 1999, although these revenues increase 7% overall (diode and nondiode lasers) for the year. Moderate double-digit revenue increases are forecast for the nondiode laser materials processing and medical markets. Smaller percentage unit growth in these areas points to a gradual increase in average sales price. Restated total 1998 nondiode laser revenues of $1.7 billion are about 2% higher than was forecast last January.

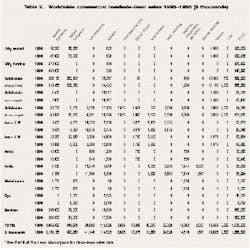

Nondiode laser sales data for 1998 and 1999 are charted in detail by application and laser type in Figures 1 and 2, respectively. Total worldwide commercial laser revenues for 1997, 1998, and 1999 are charted in Figure 3. Tables 1 and 2 provide nondiode-laser sales data by unit shipments and dollar revenues, respectively. The corresponding charts and tables for diode lasers will appear next month. See also "Where the numbers come from," p. 87.

The data presented in these tables are available with more detailed commentary in the January 1, 1999, issue of Optoelectronics Report. The survey data will also be analyzed at the 13th annual Laser Marketplace Seminar on January 27, 1999, held in conjunction with Photonics West (San Jose, CA) and sponsored by Laser Focus World in association with Strategies Unlimited.*

World economy sends mixed signals

The worldwide economic climate of 1998 was characterized by major financial disruptions in many areas. Outside the USA a financial crisis in Asia spawned the now-infamous "Asian flu," while significant international efforts focused on averting an economic shutdown in Russia. Japan`s economy is depressed--the Nikkei 225 stock market index was down about 8% over the 12 months ended November 19, 1998--and foreign exchange rates changed significantly throughout the year, increasing the currency risks in certain markets. And in South America a capital-expenditure slowdown is impacting both European and American manufacturers.

According to contributing editor Paul Mortensen, there is little economic relief in sight for Japan. In October the Economic Planning Agency there slashed its growth forecast for 1998 to -1.8% (from +1.9%), marking the second year that the world`s second-largest economy has shrunk.

The picture is not all bleak, however. Mortensen notes that the optoelectronics industry is currently suffering less than other industries in Japan; he says that overall research spending there is rising steadily--for fiscal year 1997 (ending March 1998) it rose 8% from 1996, according to a survey by the Science and Technology Agency in Tokyo. And the government is currently implementing an economic stimulus package worth up to 䂒 trillion ($222 billion)--one of several measures intended to give the economy a "soft landing."

In Germany, too, signals are mixed. The current overall economic growth rate of 2.6% (year ending December 31, 1998) is lower than expected because of the problems in Russia and Asia, says contributing editor Achim Strass. But the Frankfurt DAX-30 stock index is up 22% for the past 12 months and reached an all-time high in July 1998. German exports are also up by more than 4%, although Strass notes that some high-technology firms have suffered disproportionately because of the Asian flu.

Elsewhere in Europe, the consensus seems to be that 1998 has been a generally good year--various US firms have indicated strong sales activity in Europe for 1998 with an outlook for 1999 that is cautious but optimistic. In the UK, the Financial Times 100 stock index gained 13% during the 12 months ended November 17, 1998, and contributing editor Bridget R. Marx says that most laser and optoelectronic firms there reported steady business across all application areas. She cautions, however, that exporters are handicapped by the strong pound, which has hit profits. In France, the Paris CAC-40 stock index gained 30% over the same period, and contributing editor Roland Roux confirms that the majority of the laser and optoelectronics firms in France reported positive sales trends with healthy exports. And in Italy, contributing editor Luciano Garifo reports that 1998 sales of industrial lasers were up 25% over 1997--about twice the rate that was expected. For 1999, he suggests that sales in Italy will likely remain flat after two years of strong growth.

The US economic picture has clearly been affected by the problems in other parts of the world, although the impact has so far been mixed. Industrial laser suppliers not directly involved in Asia remain upbeat about the first half of 1999, with reduced confidence for the second half, according to David Belforte, editor of Industrial Laser Solutions. And although the semiconductor equipment business has seen steadily declining orders during 1998, there are new signs of health in what could be the beginning of an expansion period, according to Wafer News editor Peter Dunn. Nonetheless, the Dow Jones Industrial Average was up 19.1% for the 12 months ending November 25, 1998, while the Nasdaq Composite index was up more than 23.7% over the same period. And most major laser firms indicated ongoing overall sales growth during 1998 with some profit reductions due to adverse exchange rates, poor exports, and soft orders in certain markets. The general laser and optoelectronics market outlook for 1999 can best be characterized as optimistic--which is reflected in the high growth rate forecast here--although nearly all the companies interviewed noted specific concerns about the global economic outlook.

The following discussion of all the major laser-application categories is based on the information in the tables, interviews with analysts and key members of the industry, as well as other publicly available information. It is worth noting here that Optoelectronics Report has covered more than 50 mergers and acquisitions in the past 12 months. Many of these will materially affect the predictions generated by this market survey--when former competitors come together into a single firm, for example, their view of the market can change drastically.

Materials processing stands firm

This market sector--the largest of nondiode laser categories--includes laser-based processing of metals and plastics as well as marking, semiconductor and microelectronics processing, and rapid prototyping. Last year we projected that materials processing revenues--for nondiode lasers--would pass the $1 billion mark in 1998. And according to this year`s restated 1998 revenue numbers, they did! Looking forward, for 1999, nondiode laser revenues are expected to reach $1.2 billion, an increase of 10%, with unit volumes increasing by 6%. Diode lasers currently account for a very small proportion (about 3%) of this category.

Within the sector, high-power carbon dioxide (CO2) lasers represent about 36% of the total nondiode laser revenues in 1998, with restated revenues at $379 million--about 16% lower than forecast last year. According to Industrial Laser Solutions editor, David Belforte, sales of high-power CO2 lasers were hit by declining sales in Korea and Japan, and very-high-power units by delays in some major US automotive industry programs. For 1999, revenues for these lasers are expected to increase 16%. Restated low-power sealed CO2 laser revenues are about 29% below last year`s 1998 forecast, apparently the result of a good-faith estimate made last year based on an application that did not develop as expected--a problem that is inherent in all the market estimates provided here.

Revenues for solid-state lamp-pumped lasers, however, apparently took a major jump (more than 100%) with the restated 1998 figure at about $289 million. In fact, notes Belforte, new information from Japan indicates that revenue estimates in 1997 were low. Revising the 1997 numbers accordingly brings the 1998 increase to only about 22% (see the "Annual Market Review," Industrial Laser Solutions, January 1999). Continuous-wave Nd:YAG laser revenues almost doubled compared to 1997, driven by the automobile industry, which is switching away from CO2 lasers in on-line auto body applications, Belforte says. Also up were solid-state lasers used for marking applications. Next year, this area is expected to rise 8% to about $312 million. The diode-pumped solid-state (DPSS) laser market was softer than expected by about 48%. Belforte notes that these systems were hit by the problems in southeast Asia--revenue growth into next year is forecast to continue, reaching about $41 million--a gain of 22%.

The size of the laser market in semiconductor and microelectronics processing was about 10% lower in 1998 than expected, which was actually a very good showing considering that, for semiconductor equipment companies, 1998 represented some of the worst times ever. According to Peter Dunn, monthly order rates have been dropping all year, and, in the last quarter of 1998, were running well below half of year-ago levels and around one-third of the peak in 1996. Dunn notes that a lot of companies reported quarterly sales dropping 50% or more year to year and that no one expects any serious order activity until mid-1999 at the earliest, with revenue starting to tick up in the second half of the year. "This year`s overall equipment market will probably come in about 25% or 30% below last year, and next year is seen as being either down another 8% or 10%--or up marginally--depending on who you ask," Dunn says.

Interestingly, the actual impact of this situation on laser suppliers is rather mixed, with some suppliers reporting the problems as minimal, while others admit to having seen a slowdown in related sales. Nonetheless, laser sales into this market are forecast to grow about 5% in 1999.

Electives boost medical market

The medical laser market is no longer experiencing the 20%-30% growth it saw in 1996 and 1997, according to Medical Laser Report editor, Kathy Kincade, but sales remain strong, particularly in the cosmetic and refractive-surgery areas, which are driving the medical laser market to record revenues. Noting that US sales of medical laser end-user systems topped $1 billion for the first time in 1998, Kincade says that worldwide medical laser system sales to end users neared $2 billion.

Because few of the established laser manufacturers sell medical devices directly to end users (medical firms marketing devices for therapy tend to either manufacture their lasers internally or purchase them as an OEM from a laser producer), many of these medical-device manufacturers do not participate in our survey. With the help of Medical Laser Report contributing editor, Irving J. Arons, we derive the laser numbers reported here by tracking medical-system sales within this market sector. We believe our figures represent the market, but revenue projections by Arons and Kincade are based on medical-system sales to end users (doctors and hospitals), of which the laser is only a part. The revenue numbers in our tables, however, are based on revenue estimates based on the laser source itself.

Nondiode laser revenues in this market came out about 31% higher for 1998 than forecast, with ophthalmology responsible for about 25% of the total. For 1999, a revenue increase of 11% is forecast. A turnaround in the refractive-surgery arena and new growth in the surgical field (transmyocardial revascularization) has pushed excimer laser sales up so that restated 1998 units sales are 750 units instead of the 675 in last year`s forecast. In 1999, 800 units will be sold for a total of $81 million. Meanwhile, ion lasers have been a long-time staple of ophthalmology and some surgical applications but are gradually being pushed out by diode-pumped solid-state (DPSS) systems. Although restated 1998 ion laser revenues are up from last year`s forecast, they show double-digit percentage declines into 1999. Conversely, DPSS laser revenues cross the $10 million mark in 1999, up 33% from 1998.

In the solid-state laser arena, erbium-doped YAG lasers (emitting at 2.9 µm) continue to supplant the CO2 laser for skin resurfacing--sales of erbium and holmium lasers nearly tripled between 1997 and 1998, according to Kincade, a trend she expects to continue into 1999. She also highlights diode-laser sales for hair-removal applications as a trend to watch; she anticipates that related unit sales will double in 1999.

Research market softens

Revenues for the use of nondiode lasers in basic research apparently fell 11% in 1998 compared to 1997, while units gained about 19%. For 1999, revenues are forecast essentially flat, with units gaining 5%. As noted last year, a much more commercial-results-oriented approach has changed the nature of basic research activities throughout the world so the market for very expensive and complex laser systems has been superceded by a more down-to-earth approach. Newer laser technologies, such as DPSS systems, have accentuated this change by reducing the cost of high-performance systems and making them more accessible to researchers who are not "laser jocks." The high-end lasers in this market are almost all solid-state systems, and all showed a revenue decline in the revised 1998 numbers. Looking forward, DPSS laser revenues are expected to grow 13%, putting them about where they were in 1997 and highlighting a continuing problem with DPSS lasers--the technology is so attractive compared to the alternatives for many applications that forecasts quickly get overoptimistic. Lamp-pumped solid-state laser revenues will decline about 2% into 1999.

Instrumentation market falls

Much of the new development activity in this market sector, which includes both analytical and biomedical instrumentation, involves diode lasers. In fact 1998 revenues for both diode and nondiode lasers turned out to be 24% and 26%, respectively, lower than expected. Within the individual laser types, the HeNe laser market reportedly remains healthy, with development of multiple specialized niches--such as for the green-emitting devices--helping to keep average sale prices stable. Restated 1998 HeNe revenues are about 3% higher than last year and are expected to drop about 2% into 1999. Ion-laser revenues, however, are significantly lower than expected, remaining almost flat into 1999. Diode-pumped solid-state laser revenues, which were expected to jump last year, are actually down, with the restated 1998 number at $5.5 million. For 1999 a 14% gain is forecast for DPSS lasers.

New technologies drive image recording

Both commercial and desktop printing, as well as certain specialized image recording applications, are included in this category. Taken overall, the market is about 25% lower in revenues compared to last year`s 1998 forecast, with a 3% growth forecast for 1999. Sales of desktop laser printers are being hit by increasing sales of ink-jet systems so semiconductor laser revenues are showing a drop of 3% into 1999. Commercial printing, however, is expected to increase 9% overall with growth evident in both diode and nondiode lasers. A wealth of new technologies in this market means trends are mixed for nondiode lasers. But the two largest-revenue laser types are low-power ion lasers--showing a revenue decline of about 2% into 1999--and DPSS lasers, revenues for which are expected to increase 21% to almost $9 million. This market is currently very dynamic with various technologies competing with each other for dominance.

Sensing applications decline

Total revenues for lasers sold into sensing applications were actually lower--by about 35%--in 1998 than had been expected based on last year`s forecast. Most of the difference was due to lower solid-state lamp-pumped-laser revenues--the restated 1998 revenues (and units) were less than half what was forecast. Revenue growth for these devices in 1999 is about 7%. This market includes lasers sold for various remote detection and measurement techniques such as measurement of atmospheric chemical concentrations, detection of air movements, and investigation of vegetation in forests. Certain automotive collision-avoidance systems based on semiconductor lasers are also included. Historically this sector suffers from the size and costs of the lasers required for remote sensing systems--in the long run, though, the outlook should be positive. Higher performance and lower cost and size of DPSS lasers, together with more-cost-effective diode-laser technology, should ultimately drive this market upwards.

Inspection and measurement

This category includes lasers sold into a broad range of applications that are individually quite small. It involves lasers sold for inspection, measurement, and control; thus it combines markets that may be otherwise unrelated. With total restated 1998 revenues of $16 million the category was about 27% smaller than expected. Diode-laser markets in this sector include the alignment lasers sold for construction and agriculture, for instance. Nondiode lasers sold--for applications including nondestructive testing, machine vision, and alignment, for example--include HeNe, ion, and DPSS lasers. Last year DPSS lasers were expected to account for about 24% of nondiode laser revenues in this market; the restated 1998 number shows they were approximately 23% and are expected to be 25% in 1999. HeNe lasers in this market are up by about 750 units (restated 1998) and remain flat through 1999 at about 24,000 units.

Entertainment revenues jump

A huge increase in semiconductor laser revenues has pushed the total restated 1998 revenues for this sector to 68% above where it was forecast last year, meaning an overall increase of almost 96% over 1997. Low-cost laser pointers account for much of the gain in diode laser revenues. Nondiode laser revenues--at $10 million--are actually lower than the $15 million forecast for 1998; number of units is also lower. HeNe laser sales in 1998 were 1500 units below expectations, mostly due to the continuing inroads made by diode lasers. Looking forward, nondiode revenues are forecast to grow 16% (18% for units), with DPSS lasers leading the percentage growth tables at 135%, ion lasers up 6%, and HeNe lasers showing an increase of 16%. This sector includes all revenues for lasers used in entertainment (light shows), as well as those for lasers sold in lecture pointers, display holograms, and information displays.

Optical memories

Total restated overall 1998 revenues for optical data storage markets are $500 million, which is about consistent with last year`s projection. For 1999, overall revenues are expected to reach $646 million. Nondiode lasers in this sector are used primarily in the manufacture of optical and magneto-optical disks, and restated 1998 nondiode laser revenues are about the same as forecast at $10 million. For next year this market is expected to remain essentially flat in units and dollars. Most of these nondiode lasers are used in capital equipment for disk mastering. Changes are taking place within the sector as manufacturers find that new wavelengths offer additional benefits--helium cadmium lasers, for example, are no longer used in new mastering systems--but existing units continue to generate some replacement business. Meanwhile some firms have moved to krypton-ion lasers because of the output available at 413 nm.

Telecommunications

Telecommunications lasers are almost exclusively semiconductor devices, although a small number of DPSS lasers emitting at 1310 or 1550 nm are used for CATV transmission. However, this application has never really taken off. Restated 1998 revenues for all lasers in this sector are reported at almost $1.4 billion, which is about where they were expected to be last year and which represents a jump of approximately 20% compared to 1997. During 1999 this very healthy market is expected to continue growing rapidly--revenues should rise about 30% overall with units growing 37%. About $2 million of telecommunications-laser revenues result from sales of DPSS devices in 1998, which remain flat in 1999. The market for semiconductor telecommunications lasers will be discussed in more detail next month.

Barcode scanning revenues drop

Restated 1998 overall revenues indicate that the market for barcode scanner lasers in 1998 fell substantially (40%), whereas the forecast was for a 15% rise into 1998, with a unit increase of 17%. In fact unit volumes were only about 19% lower than forecast. Although the forecast was apparently overoptimistic, this huge reduction in revenues results from a drop in the average sales price of laser diodes. Nondiode-laser sales in this category are all HeNe devices, which are currently sold exclusively for supporting (re-tubing) existing scanners but are still used in significant unit volumes (about 30,000 units annually). Not surprisingly, restated nondiode-laser revenues for 1998 are about 11% lower than expected, with units about 7% lower. For 1999 a continuing drop is forecast, with an estimated 18% falloff in nondiode laser revenues (17% units). For nondiode lasers this means the market will have fallen by almost 24% since 1997.

Other emerging applications

Last year overall revenues in this sector--which combines aerospace and military, local-area networks (LANs), and computer applications--were expected to reach $30 million in 1998. The restated overall 1998 revenue figure is $31 million--mostly diode lasers--and is forecast to reach about $41 million in 1999.

Aerospace and military applications include commercial aviation, military systems such as wargames devices, rangefinders, satellites, and laser pyrotechnics. The use of lasers for local interconnection of computers is included in the LAN category, which is addressed in more detail next month. Optical interconnects and integrated lasers internal to a computer are in the computer category, but the application is new enough that the data are inconsistent. o

*To obtain back copies or subscription information about Optoelectronics Report (incorporating Laser Report), Medical Laser Report, and Industrial Laser Solutions, or to purchase the tables on disk, contact PennWell ATD Circulation, tel.: (603) 891-0123.

For information about attending the Laser Marketplace Seminar at Photonics West (San Jose, CA) on January 27, 1999, call Carole Root at (603) 891-9138.

Where the numbers come from

The Laser Focus World Annual Review and Forecast of the Laser Marketplace is based on a worldwide survey of laser producers and covers 27 types of lasers and 20 applications. Additional information about diode-laser markets is provided by Strategies Unlimited (Mountain View, CA) based on its interviews with both laser suppliers and users. The review quantifies current and projected laser markets by type and application and is the only major survey of its kind in this industry whose results are made public.

For many individuals and groups, both inside and outside the industry, from private-sector investors to foreign and US government bodies, this report is the only objective summary of major trends in our industry that is readily available. It serves as a window looking into the laser industry. The numbers presented here are aggregated from the detailed information collected in the surveys.

By joining forces with Strategies Unlimited, we are able to provide readers with a more detailed review and analysis of the diode-laser market than in previous years. Part II of the review and forecast, covering the diode-laser marketplace, will be published next month and is based on the additional market research done by Strategies Unlimited.

Readers interested in the detailed results of both surveys will find them in the January 1 and February 1, 1999, editions of the Optoelectronics Report newsletter, published by Laser Focus World. A more extensive review of the data, with supporting commentary from market analysts, will be available to attendees at the Laser Marketplace seminar, held in conjunction with Photonics West (San Jose, CA) on January 27, 1999. For more information call (603) 891-9138.

Collecting the data

We conducted our research and analysis for the Review and Forecast during October and November 1998. Laser manufacturers were contacted by mail, fax, phone, or email, and they responded with oral and written information, both qualitative and quantitative, about their markets, the business outlook, and their expectations for next year.

We asked these manufacturers to provide an estimate of total worldwide market size (dollars and units), by laser type, for the markets of which they are knowledgeable. We requested this information for 1998, based on year-to-date actual data, and we asked for a forecast for 1999. We also asked which applications or markets are likely to have the most potential for growth in 1999, what technology trends would be most significant, relative to the respondent`s business, and what business or market trends are most likely to affect his or her business.

In addition to the information provided by the manufacturers, we also used data from other--more narrowly focused--market surveys, and we incorporated commentary provided by industry analysts David Belforte, editor of Industrial Laser Solutions, and Kathy Kincade, editor of Medical Laser Report, who provided additional insight to the industrial and medical laser markets, respectively. Quantitative information about the medical laser marketplace was also provided by Irving J. Arons, a contributing editor to Medical Laser Report. A global perspective with valuable local market commentary was provided by our contributing editors in Europe and Japan. Unless noted, the sources of information used in the survey, and the names of those who participated, are, and will remain, confidential.

The market information pertaining to diode-laser markets is based on research conducted by Laser Focus World and Strategies Unlimited during 1998.

Comparing the numbers

Readers who compare last year`s 1998 estimates with this year`s restated 1998 numbers will note differences and occasional discontinuities in the numbers reported as compared to last year. In general, no attempt has been made to explain these differences in detail. We request "bottom-up" market estimates, and the respondents to our survey do vary from year to year--both in terms of the companies involved and the individuals--so variations in the results are inevitable. In addition, changes in market visibility occur as market shares change. Differences in the overall numbers for 1998 last year and for 1998 this year may also reflect whatever degree of optimism or pessimism was inherent in last year`s forecast (see Laser Focus World, Jan. 1998, p. 78).

S. G. A