Review and forecast of laser markets: 1998—Part I

Last year Laser Focus World joined forces with Strategies Unlimited, an optoelectronics market-research firm based in Mountain View, CA, to provide readers with a more-detailed analysis of diode-laser markets. Because of its success, we are continuing the arrangement this year.

The 1998 annual review and forecast of the laser marketplace will, therefore, be published in two parts, beginning this month with a report on the nondiode-laser markets. Part II, written by Robert Steele of Strategies Unlimited, covers the diode-laser marketplace and will be published next month.—Ed.

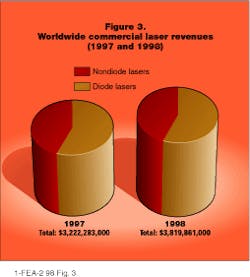

Last year we projected that the total worldwide laser market would top $3 billion in 1997. According to this year's survey, the market did indeed pass the $3 billion mark to reach $3.22 billion—an increase of 14% compared to 1996. At the same time, overall unit sales increased almost 26%. Thus, although last year's forecast apparently overestimated revenue growth for the market, the dramatic increase in unit sales indicates that average selling prices have fallen. Increasing competition in certain sectors together with higher volumes in others—such as in the sealed-off carbon dioxide (CO2) laser category—account for these trends.

The outlook for 1998 is continued strong revenue growth and a slightly lower unit-sales growth. An overall worldwide revenue increase of 19% is forecast for 1998, divided about equally—in dollar terms—between nondiode and diode lasers. Unit sales are projected up by 14%.

Nondiode lasers reached a worldwide revenue total of $1.4 billion in 1997, which compares well with last year's projection ($1.4 billion). Sales of these lasers are expected to grow 21% during the year to reach an annual total of $1.7 billion in 1998. Units are also expected to grow, perhaps signaling that the unit decline caused by a shift away from helium-neon (HeNe) lasers over the last few years is now tapering off. Restated diode laser sales came out slightly lower than last year's forecast, reaching $1.83 billion in 1997. Sales growth for next year is expected to be about 17%, with unit sales growing at a rate of 14%.

For 1997, the proportion of the overall laser market in the United States has apparently increased, with the USA accounting for 60% of the revenues, while Europe and the Pacific regions are about equally divided at 20% each. Contributing editor Achim Strass notes that in Germany exports account for about 60%-80% of the revenues of most laser firms. And in the UK, according to contributing editor Bridget Marx, the number is about 70%—a fact that makes the recently stronger British pound problematic for laser producers there. Readers should note that exchange rates and product mix can affect this revenue-distribution picture and that unit-sales distribution may be very different.

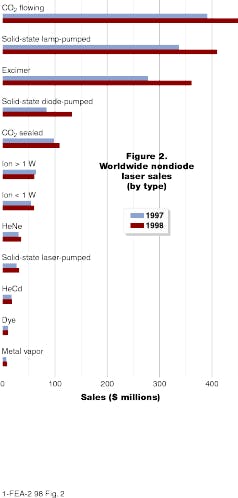

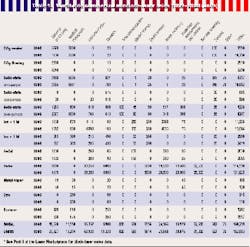

Nondiode-laser sales data for 1997 and 1998 are charted in detail by application and laser type in Figs. 1 and 2, respectively. Total worldwide commercial laser revenues for 1997 and 1998 are charted in Fig. 3. Tables 1 and 2 provide nondiode-laser sales data by unit shipments and dollar revenues, respectively. The corresponding charts and tables for diode lasers will appear next month.

The data presented in these tables are also available with more detailed commentary in the January 1, 1998, issue of Laser Report. In addition, the survey data will be analyzed at the 12th annual Laser Marketplace seminar on January 28, 1998, held in conjunction with Photonics West (San Jose, CA) and sponsored by Laser Focus World in association with Strategies Unlimited. In the following discussion, all the major laser-application categories are reviewed based on the information in the tables, interviews with analysts and key members of the industry, as well as other publicly available information.

Global economy strong

The healthy state of the world's laser markets and the firms that supply them result in large part from an overall global economic outlook that remains generally upbeat into the fourth quarter of 1997. Most of the world's financial markets have shown double-digit growth throughout the year, with investors apparently bullish about the prospects for the immediate future. In the USA, unemployment remains at historically low levels, producing a "sellers" employment market, interests rates have stayed low, and inflation is still under control. It is perhaps not surprising, then, that the bellwether Dow Jones Industrial Average stock market index gained about 20% through the 12 months that ended November 17, 1997. And outside North America, the European markets are also up—in London, the FT100 index has gained 23%, in Paris the CAC-40 is up more than 20%, and in Frankfurt, the DAX-30 boasts a gain of more than 37%.

Within the laser industry, company revenue and profit gains have benefited from the strong economic situation. Although some firms report that changes in the value of the US dollar have had an adverse impact on sales and profitability, many have recorded continuing record sales and income growth (see Laser Report,* November 15, 1997, p. 1). The increasing demand for lasers coupled with the strength of the US financial markets has also led to more initial public offerings (IPOs) this year, as firms must look for ways to raise funds for expansion. One of the industry's largest laser producers, Spectra-Physics Lasers (Mountain View, CA), may again be public very soon, having started its IPO process in October.

All this good news notwithstanding, there are concerns that economic uncertainty in Asia may adversely impact growth in other areas of the world. For Japan, in particular, the immediate outlook is fairly bleak, according to contributing editor Paul Mortensen, who reports that the Bank of Japan forecasts a 1% economic growth rate for the Japanese economy in 1997, with a similar sluggish outlook for 1998. In Tokyo, the Nikkei 225 stock market index fell almost 23% over the 12 months ended November 17, 1997, and reached its lowest level in four years in the preceding week. Mortensen notes, though, that with interest rates at an all-time low in Japan, industry there has an unprecedented opportunity to invest for the future. High-growth industries are particularly attractive, he says, and these include optoelectronics, electronics, and electrical equipment.

Material processing tops $1 billion

Material processing is still the largest nondiode-laser market sector by far, boasting an overall year-to-year revenue growth rate of 27% for all laser types; revenues for material-processing applications are projected to top $1 billion in 1998. The sector includes lasers for metal processing and marking, as well as semiconductor and microelectronic processing, rapid prototyping, desktop manufacturing, and micromachining. Restated total revenues for 1997 were up about 5% to $857 million.

The large high-power industrial CO2 lasers account for much of the total revenues in this category, due to their high average sales price. Nonetheless, David Belforte, editor of Industrial Laser Review,* notes that the big winner in 1997 was diode-pumped solid-state (DPSS) lasers. Although 1997 sales of these devices in this sector were apparently slightly less than predicted last year, a revenue increase of 80% is projected from 1997 to 1998. This means material-processing-related DPSS laser revenues should reach almost $65 million. Belforte's numbers are integrated into those reported in the tables here.

A revenue growth of almost 50% comes from the semiconductor and microelectronics-processing sector, which is forecast up 47% for 1998 compared to 1997. Excimer lasers account for much of the revenue gain, with a 200-unit increase forecast for 1998. Last year's commentary noted that the next generation of integrated semiconductor devices will require minimum feature sizes as small as 0.18 µm. Excimer lasers are used as the ultraviolet source to produce features of this size, and pilot production of such devices is gradually coming on line. The general health of the semiconductor industry means the demand for excimer lasers is unlikely to taper off for the foreseeable future--a fact noted by investors in Cymer (San Diego, CA), a company that claims an 80% market share in the production of lasers for microlithography (see Laser Focus World, Oct. 1997, p. 75).

Other related applications of excimer lasers include annealing of amorphous silicon to polysilicon during the production of flat-panel displays and the drilling of tiny holes—vias—in the printer heads of ink jet printers. Both these markets are potential opportunities for excimer-laser producers.

Within the material-processing sector, overall 1997 revenues of sealed-off CO2 lasers were apparently lower than expected but are projected to grow 20% into next year, reaching more than $73 million. Unit sales, however, were much higher than forecast, and the more than 1500-unit increase brought the average sales price down. Flowing-gas CO2 lasers came in slightly above last year's expected revenue number—they are forecast to increase by 15% into next year, reaching almost $450 million.

For next year, Belforte expects high-power Nd:YAG laser sales to remain strong, as the world's auto manufacturers continue to introduce new car models incorporating more laser-processed parts. In 1997, Nd:YAG laser sales for material processing totaled $117 million and are forecast to increase 19% to $139 million. Belforte also notes that, at the lower end of the power scale, the traditional flashlamp-pumped systems are likely to be replaced by diode-pumped lasers available at falling prices with higher output powers.

The overall outlook, says Belforte, is for continuing worldwide sales growth of lasers for material processing. He projects a nominal 20% unit sales growth in Europe and Japan, while the USA will grow at about 15%.

Medical-laser market

Readers of last year's review and forecast will recall that elective surgery accounted for much of the medical-laser market's forecasted 8% revenue growth. At the time, Irving J. Arons, Medical Laser Report* contributing editor, commented that there was no end in sight to the surging demand for office-based cosmetic laser applications and that the hair-removal application would add further fuel. In fact, the restated revenue estimate for 1997 is up another 4% over 1996.

It should come as no surprise, then, that cosmetic applications continue to fuel this sector's growth through 1997, according to Medical Laser Report editor Kathy Kincade. She says that sales of surgical laser systems—including skin-resurfacing and hair-removal systems, the leading applications in this category—reached $645 million in 1997, a 21% increase over 1996. The US Food and Drug Administration cleared several ruby-laser-based systems for hair removal during 1997. Kincade reports that unit sales of hair-removal systems could more than double from 1996 to 1998—although the number of firms involved has prompted patent litigation, and she expects additional lawsuits to be filed during the coming year.

At this point readers should note that few of the established laser manufacturers sell medical devices directly to end users; instead, medical firms marketing devices for therapy tend to either manufacture their lasers internally or purchase them from a laser producer. Many of these medical-device manufacturers, therefore, will not participate in our survey. With the help of Arons, we derive the laser numbers reported here by tracking medical-system sales within this market sector. We believe our figures represent the market, but revenue projections by Arons and Kincade are based on medical-system sales to end users (doctors and hospitals), of which the laser is only a part. The revenue numbers in the accompanying tables, however, are based on sales estimates of the laser source itself.

This year's survey predicts an overall revenue growth of 14% for medical-laser sources (not systems) used in ophthalmology and general surgical applications. Nondiode-laser revenues, which represent about 94% of the medical-laser revenues for 1997 and 1998, are expected to grow 13% into 1998. For ophthalmology, however, the survey predicts an overall decline in revenue growth. The market for refractive-surgery applications is relatively flat, notes Kincade, so sales of these laser systems are expected to rise only 9% in 1997 compared to a 25% increase between 1995 and 1996. Into 1998, the downward trend is likely to grow steeper, with overall system revenues falling to $340 million. The lasers represent about 40% of this revenue number in 1998, and nondiode laser sales in this sector drop 8% between 1997 and 1998, although unit sales do increase.

Excimer-laser revenues account for much of the revenue reduction. Sales of excimer lasers for photorefractive keratectomy (PRK) and laser-assisted in situ keratomileusis are expected to increase only slightly in 1997 and then drop sharply in 1998. Despite initially healthy projections for PRK, this market has yet to really take off, explains Kincade. Hence, excimer-laser ophthalmology revenues are projected to drop by 32% in 1998. At the same time, though, unit sales of excimer lasers for transmyocardial revascularization are expected to double between 1997 and 1998. The net result will be a steady increase in excimer-laser unit sales over the next two years, but an overall decline in laser revenues from almost $80 million in 1997 to about $69 million in 1998.

Also in the ophthalmology segment, sales of argon-ion lasers have been adversely impacted by frequency-doubled Nd:YAG and diode-laser systems, which are gradually replacing argon-ion lasers for photocoagulation. Overall medical sales of ion lasers thus remain on a downward slide into 1998, while sales of DPSS lasers are expected to jump by 400 units between 1997 and 1998.

Kincade also notes that the erbium-doped YAG laser is becoming the device of choice for a growing number of procedures in dermatology, dentistry, and ophthalmology. Hence, she expects sales of these systems to more than double between 1997 and 1998 for skin resurfacing and hard dental-tissue applications.

Research-market shows decrease

Last year's forecast suggested revenues from all lasers sold for basic research would increase 6% to almost $150 million. In fact, the restated 1997 revenues came in at $132 million, a drop of 6% from 1996. Looking forward, the projected sales increase for 1998 is a mere 4%. Underlying these numbers is the basic softness of this market sector caused mostly by ongoing funding uncertainties throughout the world, coupled with a more commercial-results-oriented approach to research by industry. Once a staple of many laser producers, the research market has also been increasingly overshadowed by more "real-world" commercial applications that have opened up as the laser technologies themselves, such as DPSS and semiconductor lasers, have become more user-friendly and cost-effective.

Within this sector, once again DPSS lasers have made significant gains, especially in the ultrafast arena—a revenue jump of 112% is forecast for 1998. The advent of high-power frequency-doubled diode-pumped devices that emit as much as 10 W of continuous-wave green output has made DPSS lasers extremely useful as pump lasers for research-oriented systems, notwithstanding the price, because they are so much more convenient, in terms of cooling water and power consumption, than their ion-laser predecessors.

In the laser-pumped tunable-laser category, sales of Ti:sapphire lasers were forecast to fall last year for the first time. According to the restated 1997 numbers, revenues actually fell about 5%, with a further decline of 10% forecast for 1998. Unit sales remained about the same from 1996 to 1997 but are projected to fall 26% in 1998. Sales of optical parametric oscillators were almost 22% lower than expected for 1997, but are forecast up 19% for 1998 with a unit sales decline of 6%, reflecting a slightly higher average selling price.

Instrumentation market recovers

In a remarkable about-face from last year, the instrumentation sector, which showed a year-to-year decline in both revenues and units, is positively booming! Last year our survey projected a 3% decline in overall revenues driven primarily by a drop in diode-laser sales. This year, the restated overall 1997 number is up 5% over 1996 and is projected to gain another 21% into 1998. The reason for last year's drop was thought to be earlier overoptimistic forecasting of diode-laser sales—apparently born out by the restated 1997 number for diode-laser revenues, which is less than 3% higher than last year's 1997 number.

Total nondiode-laser sales for 1997 are $44 million and forecast to grow 22% into 1998. Unit sales are also projected up about 18% for 1998. This category includes both "conventional" analytical instrumentation as well as molecular-biology-related devices such as DNA sequencers. Projected revenue growth for nondiode lasers in both segments is similar. As with last year—and a recurring theme throughout much of this year's report—DPSS lasers showed the strongest growth by far, although the restated 1997 numbers indicate that last year`s predictions were overly aggressive. Within the biomedical sector, a revenue gain of 38% between 1996 and 1997 was much lower than the 76% forecast. But looking forward into 1998, sales are again expected to rise significantly—this time by 65%; for the analytical-instrumentation segment, however, revenue growth into 1998 is forecast to be a more modest 38%.

Among the other laser types within this sector, ion-laser revenues are expected to grow about 15%, although unit sales show a higher gain. This difference reflects the relative age of the technology and the competitive market—with more-established technologies' average prices falling faster as unit volumes increase. Helium-neon lasers are also benefiting from the need for a cost-effective light source in certain instruments, especially biomedical systems in which the different color outputs of these lasers can be an advantage—units and revenues are projected to grow at about 18% in this segment.

Image recording

Total restated 1997 revenues for image recording, which includes commercial printing and medical imaging, as well as desktop computer printers, fax machines, and copiers, are 15% higher than last year's 1997 projection. For 1998, a further 13% rise is forecast.

Commercial printing in particular is undergoing significant technology changes, and opportunities are emerging as a result of new media development as well as new lasers. Various direct-to-plate techniques that eliminate the use of film in the printing process, for example, are changing the way lasers are being used in this market sector.

For nondiode lasers, a 19% revenue increase is expected for 1998, which is entirely in the commercial image-recording sector and includes a 41% jump in DPSS laser sales and a 15% gain for low-power ion lasers. Last year's forecast was optimistic for ion lasers in this category. Restated 1997 ion-laser revenues for printing are $8 million, way down from last year's forecast of $13 million. For the DPSS lasers, however, the restated 1997 number is almost $7 million, about the same as last year.

Remote-sensing applications

The 38% revenue growth forecast last year for lasers sold for remote-sensing applications was overly optimistic. A restated 1997 revenue total of $27 million is up only about 13% over 1996. For nondiode lasers the picture was even worse—the restated 1997 revenue number is 30% lower than forecast, with a gain of 12% through 1998. The revenue numbers include laser systems sold for measurement of atmospheric chemical concentrations, detection of air movements, and investigation of vegetation in forests. Certain automotive collision-avoidance systems based on semiconductor lasers are also included.

Again, the largest revenue gain for 1998 comes from DPSS lasers, which are shown up by 83%. Nonetheless, lamp-pumped solid-state laser revenues are up 9% for the same period. As with so many of the other applications, the advent of relatively convenient, high-power, cost-effective DPSS lasers may well give remote-sensing a major boost. Growth in this segment has been hampered by the size and costs of the lasers required to make a useful remote-sensing system.

Inspection

Inspection, measurement, and control accounts for less than 1% of all the lasers sold, but the sector includes lasers sold into a wide variety of relatively small applications that do not fit elsewhere. Revenues relating to alignment lasers sold for construction and agriculture are thus combined with those of lasers sold for nondestructive testing or machine vision. Last year's forecast indicated upward movement in the revenue number after a previous decline. The restated 1997 revenues for nondiode lasers in this sector are almost $17 million, about the same as forecast. For 1998 an increase of 18% is projected, mostly the result of a 28% jump in DPSS laser sales. Solid-state lamp-pumped laser revenues also grow into 1998 but only by 8%.

Entertainment

Most readers probably think of light shows when laser entertainment and display is mentioned, but this sector also includes revenues for lasers sold in lecture pointers, display holograms, and information displays. Diode lasers—primarily for laser pointers—account for about half of the total $26 million restated 1997 revenues. The sector is up about 4% for 1997 compared to 1996, but is showing an increase of 16% for 1998, which would mean that 1998 revenues end up about where they were forecast to be last year in 1997. Nondiode-laser revenues for 1997 represent about $13 million and include sales of ion lasers, DPSS lasers, and Nd:YAG systems, as well as HeNe lasers.

As with many of the other market sectors, DPSS lasers lead the percentage-growth tables, showing a revenue increase of 88% between 1997 and 1998. Last year, 60 units were forecast for 1997 sales, the restated 1997 number is 50, with sales of 90 units projected for 1998. The convenience relative to the highly visible output power of these lasers makes them attractive for this market, and their use will no doubt increase as they become more powerful and cost-effective. On the other hand, indications are that the use of high-power CW green-emitting Nd:YAG lasers is tapering off, although sales of 25 units are forecast for next year.

Optical memories

Most of the lasers used for optical data storage are semiconductor devices and will be covered in next month's article. Total restated 1997 revenues for this sector are reported at $427 million, which is significantly lower than last year's projection of $713 million. Of the restated 1997 number, $9.6 million are nondiode lasers—used primarily in the manufacture of optical and magneto-optical disks—which is fairly close to last year's 1997 forecast of $9.2 million, although the product mix has changed. Nondiode lasers are expected to increase 10% in 1998, with much of the gain arising from DPSS lasers. They jumped by 101% from 1996 into 1997 and are expected to move up another 33% through 1998. These nondiode lasers are used primarily for optical-disk mastering.

Telecommunications

Although the results are not shown in detail here, this year we collected information on two new communications categories—telecommunications pump lasers for fiber amplifiers and transmission lasers. Making this distinction allows us to better reflect the details of the laser types used in communications. The more-detailed version of the survey results, which shows these categories, is included in the January and February issues of Laser Report. Overall, lasers for telecommunications accounted for almost $1.2 billion of sales in 1997, an increase of about 10% compared to last year`s 1997 figure. For 1998 the sector is expected to grow to $1.4 billion—an increase of 17%. Unit growth is forecast at 46%. Only $4 million of telecommunications revenues result from sales of nondiode lasers—all DPSS devices. The remainder are semiconductor lasers and will be discussed in detail next month. The decline in DPSS laser sales for telecommunications was noted last year, and the sales are expected to remain flat through 1998.

Barcode scanning

Overall revenues for barcode scanning are projected to grow 15% into 1998. Nondiode-laser sales in this category are all HeNe devices, which are currently sold for supporting the existing installed base; new scanning systems use diode lasers. Restated nondiode-laser revenues for 1997 are down about 19% compared to 1996, and an increase of 5% is forecast for 1998.

Other emerging applications

Our survey of laser manufacturers requests information about three other general areas of laser applications—aerospace and military, local-area networks (LANs), and computers. The feedback we received for all three categories is aggregated and included here for completeness in the "other" category.

Aerospace and military applications include commercial aviation, military systems such as war-games devices, rangefinders, satellites, and laser pyrotechnics. The use of lasers for local interconnection of computers is included in the LAN category, which will be addressed in more detail next month. Optical interconnects and integrated lasers internal to a computer are in the computer category but the application is new enough that the data are inconsistent.

Overall, this sector is reported at almost $27 million for 1997 increasing to $30 million in 1998. Most of these revenues are accounted for by semiconductor lasers.

Where the numbers come from

The Laser Focus World Annual Review and Forecast of the Laser Marketplace is based on a worldwide survey of laser producers and covers 27 types of lasers and 20 applications. Additional information about diode-laser markets is provided by Strategies Unlimited (Mountain View, CA), based on its interviews with both laser suppliers and users. The review quantifies current and projected laser markets by type and application and is the only major survey of its kind in this industry whose results are made public.

For many, both inside and outside the industry, from private-sector investors to foreign and US government bodies, this report is the only objective summary of major trends in our industry that is readily available. It serves as a window looking into the laser industry. The numbers presented here are aggregated from the detailed information collected in the surveys.

By joining forces with Strategies Unlimited, we are able to provide readers with a more detailed review and analysis of the diode-laser market than in previous years. Part II of the review and forecast covering the diode-laser marketplace will be published next month and is based on the additional market research done by Strategies Unlimited.

Readers interested in the detailed results of both surveys will find them in the January 1 and February 1, 1998, editions of the Laser Report newsletter, published by Laser Focus World. A more extensive review of the data, with supporting commentary from market analysts, will be available to attendees at the Laser Marketplace seminar, held in conjunction with Photonics West (San Jose, CA) on January 28, 1998.

Collecting the data

We conducted our research and analysis for the Review and Forecast during October and November 1997. Laser manufacturers were contacted by mail, fax, phone, or e-mail, and they responded with oral and written information, both qualitative and quantitative, about their markets, the business outlook, and their expectations for next year.

We asked these manufacturers to provide an estimate of total worldwide market size (dollars and units), by laser type, for the markets of which they are knowledgeable. We requested this information for 1997, based on year-to-date actual data, and a forecast for 1998. We also asked which applications or markets are likely to have the most potential for growth in 1998, what technology trends would be most significant, relative to the respondent`s business, and what business or market trends are most likely to affect his or her business.

In addition to the information provided by the manufacturers, we also used data from other—more narrowly focused—market surveys, and we incorporated commentary provided by industry analysts David Belforte, editor of Industrial Laser Review, and Irving J. Arons, a contributing editor to Medical Laser Report, who provided additional insight to the industrial- and medical-laser markets, respectively. A global perspective with valuable local market commentary was provided by our contributing editors in Europe and Japan, as well as by Medical Laser Report editor Kathy Kincade. Unless noted, the sources of information used in the survey, and the names of those who participated, is, and will remain, confidential.

The market information pertaining to diode-laser markets is based on research conducted by Laser Focus World and Strategies Unlimited during 1997.

Comparison with last year's numbers

Readers who compare last year's 1997 estimates with this year's restated 1997 numbers will note differences and occasional discontinuities in the numbers reported as compared to last year's report. In general, no attempt has been made to explain these differences in detail. We request "bottom-up" market estimates, and the respondents to our survey do vary from year to year—both in terms of the companies involved and the individuals—so variations in the results are inevitable. In addition, changes in market visibility occur as market shares change. Differences in the overall numbers for 1997 last year and for 1997 this year may also reflect whatever degree of optimism or pessimism was inherent in last year's forecast (see Laser Focus World, January 1997, p. 72).

Note that the laser and applications categories used in the report have been updated this year. The 750-980-nm (>10 mW) diode-laser category has been divided between 10 mW-1 W and >1 W. On the applications side, a category has been added for semiconductor pump lasers for diode pumping, and the telecommunications category has been divided between telecommunications pump lasers for fiber amplifiers and transmission lasers.

This year there are no specific corrections to the numbers resulting from revisions subsequent to last year's publication date.

About the Author

Stephen G. Anderson

Director, Industry Development - SPIE

Stephen Anderson is a photonics industry expert with an international background and has been actively involved with lasers and photonics for more than 30 years. As Director, Industry Development at SPIE – The international society for optics and photonics – he is responsible for tracking the photonics industry markets and technology to help define long-term strategy, while also facilitating development of SPIE’s industry activities. Before joining SPIE, Anderson was Associate Publisher and Editor in Chief of Laser Focus World and chaired the Lasers & Photonics Marketplace Seminar. Anderson also co-founded the BioOptics World brand. Anderson holds a chemistry degree from the University of York and an Executive MBA from Golden Gate University.