Battle heats up between bars and single-emitter diodes

Tom Hausken

Two powerful and versatile lasers, the fiber laser and the thin-disk laser, are threatening to upset the industrial-laser market. A large part of the cost of these lasers is in the diode lasers used to pump them, single-emitters and bars, respectively. This raises the question: how will the cost trajectory of each of these diodes affect the competitiveness of the laser systems they go into?

Most fiber lasers use diodes with each emitter coupled to an optical fiber. Diode-pumped solid-state lasers, such as the thin-disk laser, generally use laser bars-each with many emitters on the same die-coupled through free space to the gain material. Because the cost of the diodes is a large part of the price of both types of lasers, comparing the cost of the lasers often amounts to comparing the cost of fiber-coupled single-emitters to the cost of water-cooled bars or stacks of bars.

Single-emitters produce only a few watts of power and can run uncooled, so laser systems need many more of them to offer the same pump power as bars. But packaging is relatively expensive, especially for fiber coupling. Consequently packaging costs are proportionally higher when single-emitters are used.

Managing high-power bars and stacks is not straightforward either. The highest power designs require water-cooling, which increases the complexity, cost, and bulk of the overall system.

Interestingly, the best solution for fiber lasers may be somewhere between single-emitters and bars. Bars are, after all, just emitters monolithically integrated on a single die. The optimum design would launch the highest brightness into the fiber for the lowest cost. IPG Photonics (Oxford, MA) has presented data on packaged devices with multiple discrete emitters that produce more than 25 W of optical power into a 100 μm fiber.1

Package price trends

The prices for packaged high-power diodes have declined substantially over the years, but that may be changing. As long as volumes remain more or less stable, cumulative sales increase by only a smaller percentage each year. According to experience-curve theory, this means that improvements in manufacturing cost should take longer to achieve. Put another way, all of the costs have been driven out, unless they can be spread over larger volumes. But, such volumes are elusive in the bar business, which is a niche market. Volumes are found in DVD players and laser pointers, not industrial laser systems.

For this reason we expect the package prices of the highest power commercial products to decline perhaps only 5% per year, on average. For bars, even this may be too aggressive. For the single-emitters, there may be more room for several more years of price declines.Because more single-emitters are needed for the same pump power, fiber lasers do offer some additional volume in this small-volume market. Also, customers may shift to less-expensive packages that are more suited to the industrial laser market; that is, that aren’t rated to the reliability standards expected for telecom applications.

For example, we estimate that IPG manufactured more than 300,000 diodes in 2005, making it the largest manufacturer in units of high-power diode lasers in the world. This demonstrates the importance of factory utilization. Because much of its costs are fixed, such a large volume brings IPG’s unit cost very low. Indeed, IPG claims that it can manufacture fiber-coupled diodes for as low as $6 per watt, which presumably counts only its direct materials and labor cost.

Trends in price per watt.

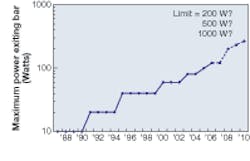

The supplier sells packages, and must make a profit doing so, but the customer needs affordable pump power, so the important metric is the price per watt. To understand this we need to track the output power per package. Over the history of fiber-coupled single-emitters and mounted bars, the optical power has increased at a compound rate of about 17% and 15%, respectively, for the highest power commercial products. In single-emitters, this may continue to as much as 15 W per emitter, or perhaps 30 W if one considers the multi-emitter design. In bars, the limit may be 200, 500, or perhaps even 1000 W per bar. The very highest power products, however, would likely require more expensive packaging (see figure).

Projecting forward at current rates, the industry should be able to achieve volume prices of $10 to $15 per watt for fiber-coupled single-emitters by 2010. Bars are already in this range, with room to go lower. Once the power limits are reached, however, gains become more difficult to achieve. Without a new application to drive the volume, the price per watt will stabilize. This is already happening in the market for single-mode pumps for telecom. Another scenario is that suppliers may cut margins to gain market share in a maturing market, not an attractive outcome.

Other issues

One can make elaborate models that project where the output power, package pricing, and price per watt will go, but much will depend on the position and execution of the suppliers and the needs of the customers.

For example, both IPG and Trumpf (Ditzingen, Germany), a supplier of thin-disk lasers, believe in vertical integration, as do other leading diode makers. This means that IPG has no marketing costs associated with its diode business because it makes them only for itself. And, because it takes its profit on system sales, it essentially manufactures its diodes with no profit margin, giving itself more room in its laser system pricing. Moreover, cutting its fiber-laser prices could increase its volume further, compounding its advantage in reducing its cost of making diodes and allowing it still to retain a decent margin.

Reliability is also important. Suppliers of single-emitters can point to lifetimes of 200,000 hours to millions of hours, while bars have lifetimes of 20,000 hours. But, customers may be overpaying for single-emitter reliability, while bars can require water-cooling that drives up the complexity, power consumption, and cost. What is important is system reliability, and the cost and benefit to the customer to improve it.

The diode business is also well known for its highly fragmented, customized nature. Customers differentiate their system products with clever designs that often require custom packaging or other specifications, such as an unusual wavelength, or high brightness. This customization keeps the prices and margins high, to the benefit of the suppliers.

It appears that both single-emitters and bars, and even a multi-emitter hybrid, will be able to offer cost-effective opportunities. The rest will be up to the system engineers who design the diodes into their systems.

REFERENCE

1. OIDA Workshop on High Power Diode Laser Sources, May 10, 2006, PaloAlto, CA.

TOM HAUSKEN directs the components practice at Strategies Unlimited, 201 San Antonio Circle, Suite 205, Mountain View, CA 94040; e-mail: [email protected]; www.strategies-u.com.