LASER MARKETPLACE 2006: Market’s messages are mixed

The good news is that, after more than 40 years, the laser industry is beginning to mature-or at least parts of it are. This is good news for several reasons, not least of which is the overall stability that comes with an increasingly diverse technology and applications base. Maturity also brings a more mainstream profile-photonics has entered the mass-market arena and is much less likely today to inspire the “gee whiz” reaction that it has garnered for so long. The bad news is that company sales and earnings grow more slowly in a mature industry, and growth opportunities are harder to come by. In addition, many of the markets served by laser manufacturers are also maturing, which means their investment in this industry may have peaked.

So calling the laser industry “mature” may actually be a bit, well, premature. Truth is, growth opportunities for lasers and optoelectronics-especially in applications in which they function as enabling technologies (see www. laserfocusworld.com/articles/229672)-appear to be wide open. In addition, innovation is by no means on the decline. In fact, despite its decades-long history, the laser and optoelectronics industry is still considered “early stage” in many circles-which is very good news, according to Samuel Kahan, senior economist at the Federal Reserve Bank of Chicago.

“While this industry is at the moment relatively small, it is on the cutting edge of many things,” he said. “Think of automobiles and airplanes in their infancy.”

Equating lasers and optoelectronics with automobiles and airplanes? That’s heady stuff for an industry that has long depended on the research community for its bread and butter. But looking at recent application trends, Kahan may be right. As has been the case for the last few years, the biggest market driver continues to be the consumer. Computers, cell phones, cameras, fiber-to-the-home, vision correction, wrinkle removal, engraving, automobiles, home entertainment, laser light shows . . . whether directly or indirectly, it is sometimes hard to comprehend how pervasive lasers and optoelectronics have become in the consumer world.1 In fact, Michael Lebby, executive director of the Optoelectronics Industry Development Association (OIDA; Washington, D.C.) told attendees at the CS-MAX 2005 conference in Palm Springs last fall that some of the strongest potential growth markets for optoelectronics are in consumer electronics: displays for handheld products, image sensors for camera phones, and optical storage.

“There is no question that the issue is about serving the consumer,” said Fred Leonberger, an industry consultant and senior advisor at the MIT Center for Integrated Photonics Systems (Cambridge, MA). “In photonics, there are a lot of consumer applications, and the biggest ones are associated with displays. In fiberoptics, the drivers right now are associated with providing broadband access to the end user, which in turn is driving innovation at the photonics level. A lot of the progress made in the telecom area is helping to enable progress in other areas, such as high-power fiber lasers for marking and machining. These advances are enabling other markets to adopt a good supply of products at a price-performance point that makes sense.”

Growing pains

While this all paints an optimistic picture going forward, there are some downsides. Or maybe call them growing pains. For example, the bigger and more global this industry becomes, and the more its products are deployed in consumer electronics, the more the laser business is affected by (and sometimes even dependent on) macroeconomic factors such as interest rates, foreign exchange rates, trade imbalances, oil prices, and consumer spending/saving. In addition, as the big public companies get bigger through mergers and acquisitions and gain the very spotlight they desire to further grow their businesses, the pressure to satisfy stockholders also increases.

“In the past decade, growth has occurred from expanding applications, not just selling more lasers into the same markets,” said John Ambroseo, president and CEO of Coherent (Santa Clara, CA). “But 2005 was disappointing from a growth perspective compared to 2004, especially for public companies. No one wants to be caught with overcapacities like they were in 1999 and 2000. Is this restricting growth? I think so.”

As if to underscore Ambroseo’s sentiments regarding 2005, the global laser markets apparently remained basically flat last year, gaining only about 1% overall to reach almost $5.5 billion in 2005. And the performance was equally lackluster in both primary segments-nondiode and diode lasers (see Fig. 1). Among the many factors underpinning these numbers were a stalled semiconductor equipment market, “better than expected” industrial market performance, continuing growth in the defense/security sector, an uptick in optical communications, and a modest reduction in revenues for optical data storage (more information about diode-laser applications will be available in Part II of this report next month). The global market is expected to reach $5.9 billion in 2006-an 8% gain over 2005-which is where last year’s forecast pegged it for 2005.

Many photonics firms privately confirm moderate-to-high single-digit growth in sales during 2005. And results from some of the major public players are rather mixed, in line with a somewhat sluggish global market. Coherent, still the largest laser manufacturer worldwide, reported sales of $516 million in FY2005 (ending Oct. 1, 2005), up 4% from $495 million the previous year. Newport (Irvine, CA) reported a net sales gain of 10.5% in the first nine months of 2005 compared to the same period of 2004 (this number does not include Spectra-Physics revenues); while sales of the GSI Group (Billerica, MA) actually fell 22% to $194 million for the nine months ended Sept. 30, 2005, compared to the prior year period.

On the systems side, Rofin-Sinar (Hamburg, Germany) and Trumpf (Ditzingen, Germany) both had record years reflecting the performance of the industrial sector. Rofin reported revenues of $375 million for FY2005 (ended Sept. 30, 2005), a 16% increase over FY2004 (a 54% increase in North America), while Trumpf reported sales of $1.6 billion for FY2005, a 14% increase over FY2004.

The stalled semiconductor-equipment market drove year-over-year revenues for lithography source manufacturer Cymer (San Diego, CA) down slightly (3%) to $281 million in the first nine months of 2005, compared to the first nine months of 2004. However, like many companies in this business, Cymer is bullish about emerging opportunities in consumer entertainment.

“We are particularly encouraged by the flash [memory] production opportunity, as it enables the expansion of the market for a growing generation of newer portable products capable of storing and quickly retrieving immense amounts of data, and the impact that is just beginning to have on the consumer video entertainment marketplace-the newly announced video iPod, games, camcorder phones, and a variety of other digital consumer products,” said Bob Akins, Cymer CEO. Several of these companies have also been playing the consolidation game in the past year. Besides the Newport/Spectra-Physics merger of 2004, Coherent made two key acquisitions in 2005-TuiLaser and Iolon, while JDSU beefed up its commercial and telecom businesses in 2005 with the purchase of Lightwave Electronics, Acterna, and Agility. There were a dozen or more other mergers and acquisitions worldwide and even some IPOs, including Andor Technology (Belfast, Ireland) and SPI Lasers (Southampton, England).

This kind of deal-making is yet another indication of an industry moving forward. But the reviews remain mixed; some think consolidation is impeding expansion by making it increasingly difficult for startups to start up, let alone stay in business. But others think it is the only way for the industry to keep momentum going and for smaller companies to find and keep their footing.

“We have been seeing a lot of consolidation in lasers and optoelectronics, which is basically a good thing for a number of reasons,” said Steve Eglash of Worldview Technology Partners (Palo Alto, CA), a venture capital firm with a history of investing in photonics companies. “Sometimes the consolidation is two startups getting together or a large company that absorbs a smaller company. Either way, it helps give smaller companies enough size and scale to survive and then to do R&D and new-product development. We are also seeing U.S. companies (such as Neophotonics) merge with Asian companies (such as Photon) to bring low-cost, high-volume manufacturing to the table, which enables them to enter some markets they might not have been able to otherwise.”

Eglash acknowledges that there is some commoditization occurring, most notably in optical components for communications. At the same time, however, both innovation and investment are on the rise in other markets.

“We are seeing more venture capital becoming available again, particularly in displays and imaging, lighting and illumination, and, photovoltaics,” he said. “There is a lot of renewed investor interest and increased investment going on, even in optical communications for applications such as fiber-to-the-premises, especially in Korea and Japan.”

World markets: growth in Asia

Turning to the world markets, the strength of the U.S. dollar is helping Europe and Asia regain some economic stability and growth. China continues to experience strong growth in most sectors, including the production and consumption of lasers and laser systems for domestic industrial applications such as marking and fabric cutting. In addition, despite concerns about outsourcing and price cutting, laser companies continue to send the lower-cost segments of their manufacturing operations to Asia; witness Coherent’s decision in November to cut a third of its Auburn, CA, operations (80 jobs), where it makes power supplies, and shift the manufacturing to China and Malaysia, citing the “commoditization” of these products. However, for the time being anyway, China still appears to be a net importer, rather than an exporter, of lasers and optoelectronics.

“The industrial laser market in China is expected to continue double-digit growth, still driven by low-cost marking equipment,” said David Belforte, publisher and editor-in-chief of Industrial Laser Solutions. “The market for high-power lasers is being led by an increasing demand for imported high-quality CO2 laser cutters. China’s industry is slowly adapting to laser technology for welding, drilling, and cutting but the market today is still dominated by the international companies that have located their production facilities in China and consequently use laser processing equipment in their home plants.”

In stark contrast to the last decade, which was marked by economic stagnation and periods of recession, Japan saw growth of about 2% in 2005. The turnaround is being attributed to an increase in consumer spending and “booming trade,” according to government reports.2 In addition, companies are investing more and hiring more, further stimulating consumer confidence.

“In Asia, companies are focused more on the use of optoelectronics for entertainment and consumer applications, so they did not see the same ‘bubble’ as those companies focusing on the communications segment,” explained Lebby. “In Japan, OIDA predictions show that optoelectronics will become a trillion-dollar market by 2015.”

The European economy, on the other hand, is not faring as well as expected, according to Kahan. The machine-tool sector, for instance, grew only 3% in 2005, according to Belforte.

“Economic activity in Europe in 2005 was a disappointment,” Kahan said. “We anticipated solid growth in the United States of 3.5%, which looks pretty accurate. Japan is recovering from the disaster of the last decade, and our outlook (2.1% growth) was in line with that. And while China appears to be moderating a bit, they should still see 8% to 9% growth. The only surprise is that economic growth in the E.U., instead of 2%, is about half that. The hope was that the E.U. would be able to integrate its markets, but that doesn’t seem to be happening at a quick enough pace.”

Looking more closely at several European companies, 2005 was indeed a year of mixed fortunes. One of the oldest companies in the business, Ferranti Photonics (Dundee, Scotland) went into liquidation in April, after having operated continuously since 1970 (see Optoelectronics Report, April 15, 2005). Similarly, after watching its stock price plummet in April when it failed to land a critical contract with BT, Marconi (London, England) agreed to a deal with Swedish telecom giant Eriksson (Stockholm, Sweden) that gives its former business rival assets representing about 75% of Marconi’s turnover.

One U.K.-based company currently faring better is fiber-laser specialist SPI Lasers (Southampton, England). The company’s focus has shifted from telecom to producing lasers for a wide variety of market sectors and applications, and in October, SPI floated on the Alternative Investments Market (AIM) and in November the company company announced two major contracts to supply pulsed lasers to customers in the laser-marking market, worth a total of between US$1.8 million and US$4.8 million before the end of 2006.

Moving away from the telecom sector has also worked for Intense (Glasgow, Scotland), formerly Intense Photonics. The company now designs and manufactures laser modules for the printing, defense, and medical industries, and is reportedly looking at a possible flotation in the near future.

Turning to mainland Europe, in addition to strong showings by Rofin-Sinar and Trumpf, bottom-line improvement was reported by German optics specialist Linos (Göttingen) through cost cutting, which included reducing its German locations from five to three and expanding its production plant in Poland. Another German company, Jenoptik Laser (Jena) acquired 51% of fellow German firm Photonic Sense (Eisenach) and a 51% stake in Sinar (Schaffhausen, Switzerland), providing Jenoptik with what it describes as “the optimum platform for our digital camera backs.”

The markets, and the numbers

Aside from the various forces at play in the markets, important shifts are also occurring in the technologies-most notably the continued displacement of nondiode lasers by diode lasers for many applications, from medical therapy to the graphic arts. The rise of diode-pumped solid-state (DPSS) lasers continues, driven in part by the ongoing improvements in lifetime and reliability of the semiconductor pump lasers. And fiber lasers are rapidly grabbing a significant piece of the pie, especially for industrial applications. Hence sales of fiber lasers in 2005 were up 53% over 2004 and are projected to grow yet another 47% this year.

As we noted last year, the application groupings or market segments we use are intended to make manageable a complex and interlocking picture of laser technologies and applications. Because of the complexity, the following discussion presents a necessarily brief look at a few of the key segments from this year’s market review.

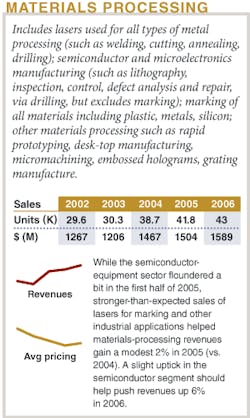

Materials processing

Weak performance in the semiconductor-equipment business overshadowed better performance in other materials-processing segments to produce a net gain of only 3% in revenues for 2005 over 2004, though unit growth did fare a little better. Total materials-processing sales in 2005 were $1.5 billion and are projected to grow another 6% in 2006 to reach $1.6 billion.

According to Belforte, 2005 was a better year than expected in the industrial materials-processing market (primarily metal-working and marking). Compared to the projections made last year, unit sales growth for the lasers used in industrial applications more than doubled and revenue growth doubled. Along similar lines, 2005 sales of fiber lasers for industrial applications grew an amazing 33%, of which more than 75% came at the expense of solid-state laser sales, mainly lamp-pumped Nd:YAG. The application driving this growth-marking-remains the hottest industrial laser application with almost 15,000 units delivered in 2005, half of which were solid-state and of that amount one-third were fiber lasers. And this trend is expected to continue at a strong pace.

On a revenue basis, solid-state lasers are under severe pricing pressure in the marking sector, especially in China and Japan, which are the most active markets for laser marking. One major international solid-state laser supplier has essentially abandoned this extremely cost-sensitive market to concentrate on higher value-added applications. This explains the 10% drop in solid-state revenues and part of the 53% increase in fiber-laser revenues.

The market for CO2 lasers is not yet feeling much impact from fiber lasers. On the high-power end, sales and unit prices are up and there is little pressure for dramatic change. Unit sales are expected to be up 9% and revenues up 7% for 2006. Sheet-metal and plate cutting are the main markets for these lasers. On the low-power end it remains a very competitive playing field with unit sales expected to increase 5% and revenues only 3%, the latter due to what an executive at a leading supplier calls a brutal pricing situation. Marking/engraving is the major application for these lasers.

Despite its best efforts, the North American semiconductor equipment industry appears to be stalled as we near the end of 2005. After several months of improvement, the industry’s book-to-bill ratio apparently peaked in August when it reached 1.05, going above parity for the first time in a year-although at $1.1 billion, equipment orders (bookings) were still 26% below those of the previous year. Then in September orders fell back slightly to $1.09 billion and the book-to-bill ratio fell to 1.02.

The book-to-bill ratio is a comparison (based on a three-month rolling average) of orders received versus product billings for the period: a book-to-bill ratio of 1.0 (parity) means that $100 worth of orders was received for every $100 of product billed.

Referring to the September numbers, Stanley T. Myers, president and CEO of the Semiconductor Equipment and Materials International (SEMI; San Jose, CA) trade group noted that the book-to-bill ratio was essentially unchanged from the prior three-month-average period. “Chipmakers are currently maintaining conservative spending patterns although we see indications of improving capacity utilization levels,” he said.

Meanwhile, another industry group, the Semiconductor Industry Association (SIA; San Jose, CA) in November forecast a tepid 6.8% (to $227.6 billion) growth in chip sales for 2005.

Not surprisingly, sales of lasers and related equipment for semiconductor and microelectronics processing reflect the uncertainty in the industry, and the Laser Focus World survey shows a 3% drop in net sales of lasers to this sector. Other examples include Cymer (San Diego, CA), which reported orders off about 6% compared to the prior year period in the quarter ended Sept. 30, 2005; equipment manufacturer KLA Tencor (San Jose, CA), whose orders for the same period were down 17% compared to the prior year; and Electro Scientific Industries (ESI; Portland, OR), which saw its orders fall 49% for the quarter ended Aug. 27, 2005, compared to the prior year period.

The complexity of the microelectronics arena leaves plenty of wiggle room for analysts trying to predict what 2006 and beyond will bring, and opinions do vary. Nonetheless, as far as chip sales are concerned two forecasts are actually in fairly good agreement: World Semiconductor Trade Statistics (WSTS; San Jose, CA) projects that after achieving 6.6% growth in 2005, the worldwide chip market is set to grow 8% in 2006 and 10.6% in 2007. And the SIA expects moderate growth of 7.9% in 2006 chip sales followed by 10.5% in 2007.

Increasing demand-albeit in single digits-for devices along with higher capacity utilization in fabs would appear to bode well for the equipment industry. Although some analysts are suggesting that capital expenditure will be moderated both by ongoing caution among device makers and by macroeconomic factors, our survey suggests that revenues in the semiconductor and microelectronics segment will grow 9% in 2006. Some of this gain is driven by the increasing average sales price of lithography systems emitting in the deep UV.

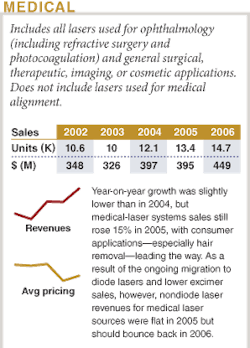

Medical therapy

For many years in the medical field, lasers were seen primarily as surgical tools for the ablation, cutting, or coagulation of tissue. During the last decade, though, some of the most successful medical-laser applications have been noninvasive: selective laser trabeculopasty, skin rejuvenation, hair removal, photodynamic therapy, low-level laser therapy, and, more recently, laser treatments of psoriasis, acne, cellulite, and dental bacteria. In addition, laser-based diagnostic tools such as optical coherence tomography and multiphoton microscopy have gained acceptance among the medical community for noninvasive imaging, while optical sensors are finding their place in the detection and monitoring of chronic and other diseases (see www.laserfocusworld.com/articles/226765).

For the time being, however, the consumer continues to drive the bulk of medical laser sales, particularly for vision correction, wrinkle removal, hair removal, and, more recently, benign prostatic hyperplasia (BPH; see “Patients driving growth of laser BPH,” Medical Laser Report, October 2005, p. 1). Hair removal once again is spurring sales of solid-state and especially diode lasers. The excimer remains the primary laser source for vision correction: sales fell in 2005 but are expected to bounce back by 9% in 2006. Overall, while the year-on-year growth was slightly lower than in 2004, sales of medical-laser systems still rose 15% in 2005 to about $2.7 billion, according to Medical Laser Report (January 2006). This growth is expected to continue in 2006, with systems sales projected to top $3 billion for the first time ever.

As a result of the ongoing migration to diode lasers and lower excimer sales, nondiode laser revenues for medical laser sources were flat in 2005, at almost $395 million. Sales of nondiode lasers in 2006 are expected to rise 14% to $449 million.

Readers should note that the laser source revenues reported in the medical section of the Laser Focus World Market Review and Forecast are compiled by tracking medical-system end-user sales within this market sector. Revenue projections are based on medical-laser system sales to end users, and the laser is only one component of these system sales. The numbers in the Laser Focus World tables, however, are based on revenue estimates for the laser source itself.

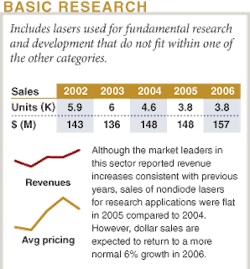

Basic research

Over the years, sales of lasers and other optoelectronic components for fundamental research-much of it government funded-have been the “bread and butter” business of many photonics-component companies. In fact this market segment holds a place in the top three laser applications by revenues and has done so for years. While individual laser sales can be quite competitive, this marketplace has provided the industry with a mostly profitable foundation of advanced technologies that ultimately can find their way into the commercial marketplace. Although annual revenue growth rates for this sector are generally in the single digits, growth was flat for 2005 compared to 2004. Nonetheless, Newport/Spectra-Physics reported 8% growth in sales to this market for the first half of FY2005, and Coherent claims double-digit growth in the research and scientific market in 2004-2005, driven largely by emerging biomedical research. For 2006, according to our survey, the overall outlook is a more-typical 6% gain over 2005.

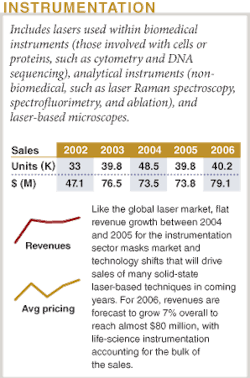

Instrumentation

Like the global laser market, flat revenue growth between 2004 and 2005 for the instrumentation sector masks market and technology shifts that will drive sales of the most favorable laser-based techniques in coming years. For 2006, revenues are forecast to grow 7% overall to reach $80 million, with life-science instrumentation accounting for the bulk of the sales.

Since the completion of the Human Genome Project in 2003, there has been an accelerating shift from the study of DNA (genomics) to the study of proteins (proteomics), notes Michael Tice, vice president of Strategic Directions International (SDi; Los Angeles, CA) and contributing editor of Instrument Business Outlook, published by SDi. Although both disciplines are very active, proteomics is in clear ascendance. Proteomics research involves the use of a wide array of tools, many of which utilize lasers for fluorescence stimulation and/or imaging. For some of these applications, blue 488-nm lasers are de rigueur, and the market has grown more competitive as laser suppliers continue to introduce novel solid-state laser solutions to a problem that was once solely the province of ion laser technology.

One established technique, matrix-assisted laser desorption ionization (MALDI) mass spectrometry, is undergoing a small burst of interest that may well flower into an important new market. Although MALDI mass spectrometry can be used in non-life-science applications such as polymer analysis, much of its current growth stems from biological applications. One new development is the use of MALDI mass spectrometry for chemical imaging of a surface in applications such as pharmaceutical drug discovery, where they would replace or augment current laborious (and mostly non-laser-based) techniques. Unfortunately, the lasers used in conventional MALDI (nitrogen and Nd:YAG) are not ideal for imaging applications, but this has provided a spur to innovation. Last February Bruker Biosciences (Billerica, MA) announced a proprietary solid-state laser that offers a number of features better suited for MALDI imaging and other MALDI mass-spectrometry applications.

Raman spectroscopy remains an active and growing market in both life-science and industrial laboratories. Most lasers in Raman spectrometers emit in the IR, but some applications use visible and UV devices. Instrument manufacturers have used various methods to overcome the limitations of Raman spectroscopy, which is helping to fuel the current growth of the technique. One such development is the exploitation of surface-enhanced Raman spectroscopy (SERS), an effect that increases the Raman signal by up to a millionfold when a sample is in contact with specially prepared surfaces. The increased sensitivity may affect the laser market in two ways: increasing the overall Raman market by enabling new applications and enabling the use of much less powerful lasers in Raman spectrometers.

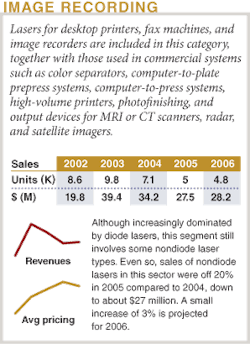

Image recording

The graphics arts market is going gangbusters as far as lasers are concerned and aggressively continuing its transition to diode lasers. Coherent, for example, reported 353% increase in orders in the graphic arts and display market in the fourth quarter of FY2005 compared to the same quarter of FY2004-due in large part to an annual purchase of a recently released product platform: a multielement diode laser that facilitates rapid exposure of high-volume printing plates.

And therein lies the rub: the bulk of the applications (and thus, sales) for lasers in the graphic arts involve diode lasers-red diode lasers for thermal platesetters and violet diodes for computer-to-plate (CTP) applications. It’s no surprise then to find that sales of nondiode lasers in this sector were off 20% in 2005 from 2004 to about $27 million. A small increase of 3% is projected for 2006.

Diode-pumped solid-state green lasers are still used for imaging photopolymer plates and also in some niche applications such as holographic printing and film writing, but overall “no one is buying Nd:YAG lasers for prepress applications,” according to Dan Gelbart, CTO at CREO (Burnaby, BC), now part of Kodak. Hence, sales of DPSS lasers in this segment are essentially flat. And after a 32% drop in 2005 over 2004, fiber lasers-which displace DPSS lasers in some flexo CTP applications-are showing 10% sales growth for both 2006. On a much smaller scale, CO2 lasers (200 to 300 W) are still used for engraving flexo plates and for direct imaging on the copper cylinders used in gravure printing. In addition, UV lasers are finding application in printed-circuit-board imaging.

Entertainment & display

Diode-pumped solid-state lasers continue to supplant ion lasers for large-scale displays, and are poised to do the same in home-entertainment systems such as rear-projection TVs (see www.laserfocusworld.com/articles/243300). However, the general consensus is that affordable laser-based rear-projection TVs are still two to three years from commercial reality. In the mean time, those companies building solid-state lasers for this application are under the gun to make them more affordable and easier to manufacture in large volumes.

As has been the case for the past few years, the traditional entertainment and display market has experienced much consolidation, leaving a handful of systems companies, primarily in Europe and Asia, providing the bulk of the equipment. At the same time, the number of companies offering solid-state RGB lasers for this market continues to grow, creating an increasingly competitive environment. In addition, regulations governing the use of laser systems in public continue to curtail their use in the United States; the International Laser Display Association (ILDA; Portland, OR) is currently lobbying the U.S. government to ease some of these regulations and perhaps stimulate the U.S. market. The worldwide nondiode laser market fell around 12% in 2005 to a little over $10 million with a meager 4% gain expected in 2006.

“We are still seeing new solid-state products coming out from Europe and Asia for entertainment,” said David Lytle, executive director of ILDA. “And they are doing a lot of engineering for products specifically geared to the entertainment market. The real hot spot is in Asia, where there is a lot of manufacturing and purchasing. But we are hoping that if we can get the variance procedure (in the United States) relaxed and streamlined, it would really help this market in the United States.”

Military/aerospace

Anecdotal reports suggest that the military/defense/security market is strong and growing, from laser weapons to missile detection and biosensing systems. The U.S. military in particular is investing in many laser-based projects for defensive and offensive purposes: the Airborne Laser, the Joint High Power Solid-State Laser, High Energy Liquid Laser Area Defense Systems, Robot-Enhanced Detection Outpost with Lasers, Personnel Halting and Stimulation Response, Paveway II Dual Mode Laser-Guided Bomb, Aircraft Countermeasures, Architecture for Diode High Energy Laser Systems . . . the list goes on and on, and so, apparently, does the depth of the Department of Defense’s pocketbook.3 And that doesn’t even cover the number of projects involving imaging, displays, and sensing systems.

As has historically been the case, however, getting an accurate read on what the military is spending on lasers and related components is difficult at best. Some projects are announced, such as the $50 million contract Lockheed Martin (Archbald, PA) received last September to deliver laser-guided bomb kits to the U.S. Air Force in 2006-a contract that represents more than half of the U.S. Air Force’s requirements for the current fiscal year-and the $124.5 million contract awarded by the U.S. Navy to Northrop Grumman (Melbourne, FL) to built production units of the Airborne Laser Mine Detection System, a lidar-based large-area-coverage system designed to detect, classify, and localize floating and near-surface moored sea mines. But overall, our survey numbers for military and aerospace reflect the lack of transparency in this sector and are certainly incomplete; even so, an upward trend is evident-overall unit sales for 2005 were up 35% from 2004 to reach $63 million. In 2006 another 31% gain is anticipated.

Other markets

Market segments not specifically discussed above but that are listed in our data include inspection and measurement, optical communications, barcode scanning, and data storage. Most of these are either segments that have moved solidly into the diode-laser camp or they involve a mixture of many smaller applications that do not lend themselves to a detailed discussion in the space available. Diode-laser markets will be addressed in detail next month.❏

REFERENCES

1. “Best Inventions of 2005: Fruit tattoos,” Time, Nov. 21, 2005.

2. Y. Kageyama, “Japan Economy Expands on Consumer Spending,” Assoc. Press Business Wire (Nov. 11, 2005).

3. J. McHale, “Chasing the goal of an efficient battlefield laser,” Military & Aerospace Electronics (Oct. 1, 2005).

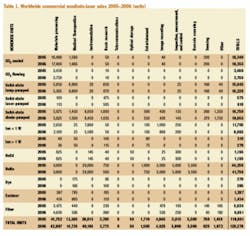

Presenting the data

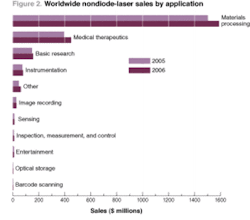

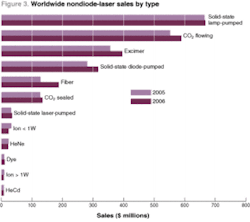

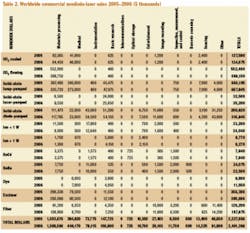

Nondiode-lasers sales data for 2005 and forecast for 2006 are charted in detail by application and by type in Figures 2 and 3, respectively. Nondiode-laser sales data by unit shipment and dollar revenues are shown in Tables 1 and 2, respectively-corresponding charts and tables for diode lasers will appear next month. For an explanation of our methods, see “Where the numbers come from” on p. 89.

The data presented in the tables here are available with additional commentary in the January 1 issue of Optoelectronics Report (see www.optoelectronicsreport.com)

The survey data will also be analyzed at the 19th annual Laser and Photonics Marketplace Seminar on Jan. 23. Held in conjunction with Photonics West (San Jose, CA) the seminar is hosted by Laser Focus World in conjunction with Strategies Unlimited. (For more information, see www.marketplaceseminar.com.

Where the numbers come from

The Laser Focus World Annual Review and Forecast of the Laser Marketplace is based on a worldwide survey of laser producers and covers 27 types of lasers and 20 applications. Diode-laser market information is provided by Strategies Unlimited (Mountain View, CA; a PennWell company). Industrial-laser market information is provided by Industrial Laser Solutions, and the Medical Laser Report newsletter provides the medical market analysis. This review is the only major survey of its kind in this industry whose results are made public.

For many, both inside and outside the industry, from private-sector investors to foreign and U.S. government bodies, this report is the only objective summary of major trends in our industry that is readily available. Part I examines the overall market trends with more detail on nondiode lasers. Part II will be published in February and will cover the diode-laser marketplace.

Readers interested in the detailed results of both surveys will find them in the January 1 and February 1 editions of the Optoelectronics Report newsletter, published by Laser Focus World. A more extensive review of the data, with supporting commentary from market analysts, will be available to attendees at the Lasers and Photonics Marketplace Seminar, held in conjunction with Photonics West (San Jose, CA) on January 23. For more information see www.marketplaceseminar.com.

Collecting the data

We conducted our research and analysis for the Review and Forecast during October and November 2005. We asked manufacturers to provide a confidential estimate of total worldwide market size (dollars and units) for 2005, based on year-to-date actual data, and a forecast for 2006. In addition to the information provided by the manufacturers, we also used data from other more narrowly focused market surveys, and we incorporated commentary provided by industry analysts who added market insight for specific segments.

Changes from last year

A comparison of last year’s 2005 estimates with this year’s restated 2005 numbers will show differences and occasional discontinuities in the numbers. In general, no attempt has been made to explain these differences in detail. We request “bottom-up” market estimates, and the respondents to our survey do vary from year to year-both in terms of the companies involved and the individuals-so variations in the results are inevitable. In addition, changes in market visibility occur as market shares change. Differences in the overall numbers for 2005 last year and for 2005 this year may also reflect whatever degree of optimism or pessimism was inherent in last year’s forecast (see www.laserfocusworld.com/articles/218996). -SGA

About the Author

Kathy Kincade

Contributing Editor

Kathy Kincade is the founding editor of BioOptics World and a veteran reporter on optical technologies for biomedicine. She also served as the editor-in-chief of DrBicuspid.com, a web portal for dental professionals.

Stephen G. Anderson

Director, Industry Development - SPIE

Stephen Anderson is a photonics industry expert with an international background and has been actively involved with lasers and photonics for more than 30 years. As Director, Industry Development at SPIE – The international society for optics and photonics – he is responsible for tracking the photonics industry markets and technology to help define long-term strategy, while also facilitating development of SPIE’s industry activities. Before joining SPIE, Anderson was Associate Publisher and Editor in Chief of Laser Focus World and chaired the Lasers & Photonics Marketplace Seminar. Anderson also co-founded the BioOptics World brand. Anderson holds a chemistry degree from the University of York and an Executive MBA from Golden Gate University.