Amid crises and challenges, laser markets stay the course

INTRODUCTION

BY CONARD HOLTON, Editor at Large

For reasons we can all easily recite, 2020 was a very hard year—one we hope never to repeat, from a devastating pandemic and economic recession, to political and social turmoil. And yet, for various reasons, many laser sectors did reasonably well and some prospered. Every segment was different and each had its own story.

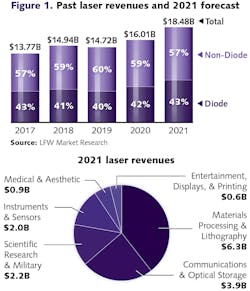

The bottom line: Overall annual revenue growth is estimated to have risen 8.8% in 2020. It followed a revised estimate of a down year in 2019, when revenue fell 1.5%. Pending the final corporate quarterly reports on 2020 (due out in January/February 2021), we expect total laser market revenue in 2020 to be about $16 billion (see Fig. 1).The good news: Our forecast for global laser revenues in 2021 sees a strong year—that is, with a 15.5% revenue growth rate.

How to read this article

For our market analysis and forecast in this article, we divide the global laser market into six major segments, with each containing multiple technology and application areas that may experience very different market conditions and results.

The major segments are:

Materials Processing & Lithography. Includes lasers used for all types of metal processing (welding, cutting, annealing, and drilling); semiconductor and microelectronics manufacturing (lithography, scribing, defect repair, and via drilling); marking of all materials; and other materials processing (such as cutting and welding organics, rapid prototyping, micromachining, and grating manufacture).

Communications & Optical Storage. Includes all laser diodes used in telecommunications, data communications, and optical storage applications, including pumps for optical amplifiers.

Scientific Research & Military. Includes lasers used for fundamental R&D, such as by universities and national laboratories, and new and existing military applications, such as rangefinders, illuminators, infrared countermeasures, and directed-energy weapons research.

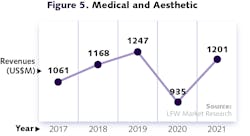

Medical & Aesthetic. Includes all lasers used for ophthalmology (including refractive surgery and photocoagulation), surgical, dental, therapeutic, skin, hair, and other cosmetic applications.

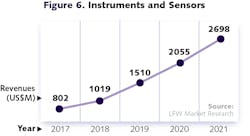

Instrumentation & Sensors. Includes lasers used within biomedical instruments; analytical instruments (such as spectrometers); wafer and mask inspection tools, metrology tools, levelers, optical mice, gesture recognition, lidar, barcode readers, and other sensors.

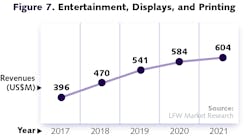

Entertainment, Displays, & Printing. Includes lasers used for light shows, games, digital cinema, front and rear projectors, picoprojectors, and laser pointers; also includes lasers for commercial pre-press systems and photofinishing, as well as conventional laser printers for consumer and commercial applications.

The following sections provide analysis of the markets in each of these six segments in 2020, and a forecast for 2021, along with a graph showing the revenue trends.

For more on materials processing and industrial laser markets, read David Belforte’s article, “COVID-19 leaves its mark on the industrial laser market,” in this issue of Laser Focus World.

For more on the changing U.S.-China relations, see Bo Gu’s article, “Will the U.S. and China decouple?” in the January 2021 issue of Laser Focus World.

An extensive analysis of the laser markets, with updated data and forecasts, will be presented by Allen Nogee at the 33rd Lasers & Photonics Marketplace Seminar, held online March 4-5, 2021, in cooperation with SPIE Photonics West.

The final report, with the most comprehensive data and analysis, will be available in April 2021, from Laser Focus World Market Research, which will publish the Worldwide Market for Lasers: Market Review and Forecast 2021.

Laser segments review and forecast

BY ALLEN NOGEE, President, Laser Markets Research

Materials Processing & Lithography

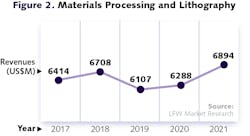

When 2020 began, the laser markets for materials processing were continuing to experience the negative effects of the trade war the U.S. was waging with China, but this was slowly getting resolved as the trade tariffs were reduced and a solution with China was worked out. A second problem was China itself, where economic growth was slowing in late 2019, and that was not good news because China is a very large consumer of lasers for materials processing.

As it turned out, those problems would be trivial compared to the pandemic. COVID-19 first shut down factories and caused lockdowns in China, with resulting Q1 2020 revenue for Chinese laser companies dropping up to 80%. American and European laser companies were less impacted, but still saw some revenue drops during the same period.

After the initial manufacturing closure, laser companies had supply-chain problems and shipping delays, but for the most part, existing orders were maintained. A bit more worrisome is the fact that any future slowdown would impact future demand. However, with COVID-19 vaccines being rolled out, we are optimistic that 2021 will be a good year, but likely not a great year for materials processing lasers.

When all is said and done, we believe materials processing and lithography laser revenue will be up about 3% in 2020. This result is a blend of North American materials processing lasers being down a bit, Chinese materials processing laser companies showing strong revenue in 2020, and laser lithography companies doing moderately well due to existing extreme ultraviolet (EUV) laser sales.

As for 2021, much is unknown, but we believe the year will be a return to more normal conditions, with a few segments down a bit. We are forecasting close to a 10% revenue growth in materials processing and lithography laser revenues, with some of this revenue coming from 2020 laser purchases that were delayed (see Fig. 2).Communications & Optical Storage

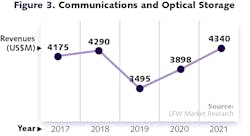

The communications laser segment saw a fairly large drop in revenue in 2019, as this sector was one that was strongly negatively impacted by Chinese trade tariffs. In 2020, laser communications revenue was one of the few markets that COVID-19 has actually helped. The key here was the large number of office employees who have transitioned to work-at-home employees. Internet and voice communications service providers scrambled to install upgrades to their networks to adjust to their changing demands. In addition, more people working from home meant more people using their smartphones from home during the day; this also required updates to wireless networks as well.

Overall communications laser revenue would have increased more in 2020 had there not been so many stay-at-home restrictions, which prevented service personnel in many countries from actually getting out and performing the work.

For many, the transition from being in the office to working from home was temporary, but for others, the change was permanent. This may cause many service providers to rethink their deployment strategies and force them to upgrade underserved residential areas, which ultimately will increase communications laser revenue.

Optical storage laser revenue, also included in this segment, continues its long slide down. While COVID-19 did cause many people to transition to at-home work and this caused a temporary bump-up in computer sales, the end impact on optical storage laser revenues was quite small (see Fig. 3).Scientific Research & Military

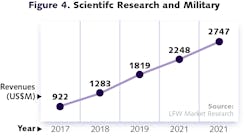

Worldwide spending on lasers for research and development saw a slight increase in 2020, but it was revenue increases in military lasers that really drove up this segment in 2020—more than 23% year-over-year—and we expect about the same growth for next year. In the last few years, not only has the U.S. started a large push to build more laser weapons, other countries and regions have as well. China, Israel, the UK, Germany, and even Japan all have active programs to build laser military weapons.

When lasers were envisioned for the military 20 years ago, the plan was for them to protect against Intercontinental Ballistic Missile (ICBM) strikes, but this turned out to be unrealistic. Many of today’s biggest threats, like drones, swarms of low-cost, low-capability threats, and large quantities of mortars or rocket barrages, are perfect for today’s laser weapons to defend against. Laser weapons only consume power and do not need to be reloaded, so they are cheaper to run in the long-term, and they require fewer personnel to operate (see Fig. 4).Medical & Aesthetic

Of all the laser segments, it was the medical laser segment that was most negatively affected by COVID-19. The reason is quite clear: while the pandemic was overrunning hospitals and doctors’ offices, patients put off nonessential medical procedures and canceled dental, eye, and cosmetic appointments. In response, medical professionals delayed or canceled any medical laser purchases. While some areas such as doctor and dentist appointments have partially recovered, others such as elective surgeries have not.

If there is one positive aspect that COVID-19 has had on medical laser revenue, it is this: lasers are touch-free and this may become a benefit longer-term. For example, many dentists use an ultrasonic scaler tool for teeth cleanings. These tools use a stream of water to clean teeth, but can also produce aerosols that may spread COVID-19. In July 2020, Biolase introduced its Epic Hygiene Laser, which reduces bacteria and manages periodontal disease with a laser and not water. Performing surgery with a laser and not surgical tools such as a scalpel is another example of how COVID-19 might offer a medical laser solution.

Revenue for both dental lasers and cosmetic lasers dropped in excess of 25% in 2020 compared to 2019. Ophthalmic laser revenue dropped almost 20% from 2019, while surgical laser revenue was actually up slightly in 2020 over 2019. We expect medical laser revenue to rebound in 2021 to just below 2019 levels (see Fig. 5).Instrumentation & Sensors

The instrumentation and sensors laser segment is not one of the largest laser segments, but it is a segment that has been growing very strongly lately. This segment includes lasers used for spectroscopy and flow cytometry, lasers used in lidar, and lasers used in smartphones for other 3D sensing applications. Of these applications, 3D sensing in smartphones is driving the most growth, and COVID-19 doesn’t seem to have impacted this segment at all.

Of the nine subsegments we follow in sensing, 3D sensing laser revenue is almost 5X larger than the next largest subsegment, flow cytometry, and it represents almost 60% of the sensing laser segment. So how did 3D sensing grow so large so fast? One word—smartphones.

Apple more or less started the 3D sensing craze by adding “Face ID” to its iPhone X in 2017, although other smartphones have used laser sensors for face proximity detection and camera autofocus for years. Once Apple added Face ID to its smartphones, it was only a matter of time until Android and Chinese smartphone makers added it as well. But Apple was not going to stop there—the iPhone 12 Pro contains a rear-facing lidar unit, and smartphones of all types are only getting more and more laser 3D sensors. They are inexpensive, they enable lots of applications, and they are what consumers want. With about 1.5 billion smartphones sold every year, laser revenue quickly adds up.

Other than 3D sensing, other laser sensing applications continue to grow. These include lidar, flow cytometry, and various forms of spectroscopy. In the short-term, COVID-19 has not slowed laser revenue growth for these technologies, but they could slow if a recession results from COVID-19 (see Fig. 6).Entertainment, Displays, & Printing

Laser revenue for the Entertainment, Displays, & Printing segment is one of the smallest areas we track, but within the displays category, you find lasers for digital cinemas, and this is the largest subsegment of displays. Because of COVID-19, many orders for laser cinema projectors have been put on hold; however, we are hopeful that by the middle of this year, there will be some recovery.

Laser light shows and office laser projectors also took a drop due to COVID-19. Zoom calls have largely replaced office meetings. But on the plus side, more time at home could translate into more home laser projection TVs sold. These changes due to COVID-19 are only in their early stages of playing out, so stay tuned as more data is accumulated (see Fig. 7).About the Author

Allen Nogee

President, Laser Markets Research

Allen Nogee has over 30 years' experience in the electronics and technology industry including almost 20 years in technology market research. He has held design-engineering positions at MCI Communications, GTE, and General Electric, and senior research positions at In-Stat, NPD Group, and Strategies Unlimited.

Nogee has become a well-known and respected analyst in the area of lasers and laser applications, with his research and forecasts appearing in publications such as Laser Focus World, Industrial Laser Solutions, Optics.org, and Laser Institute of America. He has also been invited to speak at conferences such as the Conference on Lasers and Electro-Optics (CLEO), Laser Focus World's Lasers & Photonics Marketplace Seminar, the European Photonics Industry Consortium Executive Laser Meeting, and SPIE Photonics West.

Nogee has a Bachelor's degree in Electrical Engineering Technology from the Rochester Institute of Technology, and a Master's of Business Administration from Arizona State University.

Conard Holton

Conard Holton has 25 years of science and technology editing and writing experience. He was formerly a staff member and consultant for government agencies such as the New York State Energy Research and Development Authority and the International Atomic Energy Agency, and engineering companies such as Bechtel. He joined Laser Focus World in 1997 as senior editor, becoming editor in chief of WDM Solutions, which he founded in 1999. In 2003 he joined Vision Systems Design as editor in chief, while continuing as contributing editor at Laser Focus World. Conard became editor in chief of Laser Focus World in August 2011, a role in which he served through August 2018. He then served as Editor at Large for Laser Focus World and Co-Chair of the Lasers & Photonics Marketplace Seminar from August 2018 through January 2022. He received his B.A. from the University of Pennsylvania, with additional studies at the Colorado School of Mines and Medill School of Journalism at Northwestern University.