Industrial lasers and systems in Japan

KUNIHIKO WASHIO

The population in Japan peaked in December 2004 at 127.84 million and the current population as of December 2019 is 126.15 million. The work population from 15 to 64 years of age is 75.18 million as of July 2019, a decrease of 0.52% from the previous year. The work-age population in Japan is forecast to decrease about 34.4% to 49.3 million by 2050.

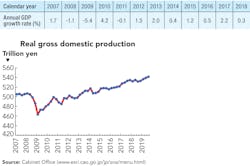

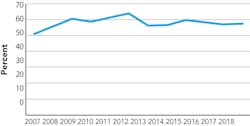

FIGURE 1 shows the trend of Japanese quarterly gross domestic product (GDP; real, seasonally adjusted) and a table of annual GDP growth rates since calendar-year 2007. In spite of the above-mentioned decrease in work-age population, the Japanese GDP is steadily increasing since 2012, though the average annual growth rate is about 1.2 %, which is much smaller than China’s recent years’ GDP that is in the range of about 6% to 6.8%.

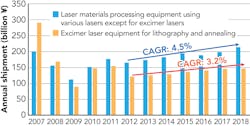

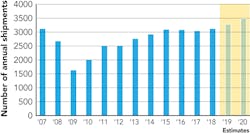

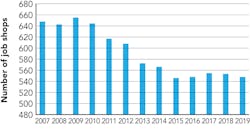

FIGURE 2 shows the annual shipment trend of laser processing equipment by laser types produced by Japanese manufacturers (including export and local production), plus imported foreign manufacturers’ laser-processing equipment sold in Japan. The data were collected from Japan Laser World & Trend’s 14th to 25th reports published yearly in September since 1995 by Simpo Corporation, which celebrated its 35th anniversary in 2019. As seen in FIGURE 2, the 4.5% compound annual growth rate (CAGR) for laser processing equipment using various lasers (including CO2 lasers, fiber lasers, and solid-state lasers), except for excimer lasers, is slightly higher than that of 3.2% for excimer laser equipment (for lithography and annealing).As compared with the reports by the Optoelectronic Industry and Technology Development Association (OITDA), there are some differences in the amount of revenues partly because Simpo’s data includes oversea local production by Japanese manufacturers and sales of the imported foreign manufacturers’ equipment in Japan. Furthermore, the OITDA reports are in fiscal-year base and those by Simpo are in calendar-year base.

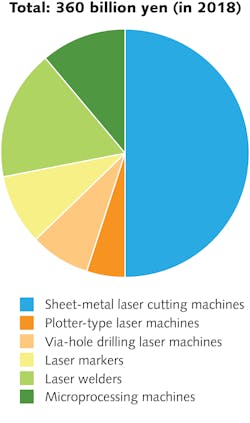

FIGURE 3 shows shipment of laser processing equipment in 2018 by applications by Japanese manufacturers (including export and local production), plus imported foreign manufacturers’ equipment sold in Japan. The share of 50.5% of the sheet metal cutting machines (considered to be mostly using fiber lasers or CO2 lasers) is dominantly large. The amount of shipments for sheet-metal cutting machines was 108 billion yen (about $983 million) for 2018, partly due to the fact that many devices such as displays for consumer electronics and solar-cells are now manufactured outside Japan and partly because current Japanese microprocessing equipment may not be competitive enough. The share of microprocessing machines is not so large as compared with the data reported by Industrial Laser Solutions for global revenues by laser applications.Current status of advanced laser materials processing

In 2018, Keidanren (Japan Business Federation) announced the vision and concept of Society 5.0 and proposed Japan’s action plans. Society 5.0 is an emerging form of society characterized as creative imagination society enabled by digital transformation and imagination & creativity of diverse people. The actions to realize Society 5.0 include aiming to resolve social issues in harmony with nature and to share a common direction with the blueprint of United Nations sustainable development goals (SDGs).

One of the noteworthy trends in the manufacturing industry seems to be the shift towards smart manufacturing, which is accompanied by digital transformation—for example, by effectively utilizing the Internet of Things (IoT), artificial intelligence (AI), robotics, etc. Another remarkable trend seems to be the promotion of full-scale joint studies and smart cooperation between industry, academia, and government.Future

In 2016, the New Energy and Industrial Technology Development Organization (NEDO) started “High-Brightness and High-Efficiency Laser Technology for Next-Next Generation Laser Processing” as a five-year project. Because fiscal-year 2020 is the final year of the project, many innovative laser processing machines incorporated with high brightness and high-power blue diode lasers or picosecond deep-UV pulsed lasers are expected to become commercially available in the market.

Furthermore, under the SIP (Cross-ministerial Strategic Innovation Promotion) Program of “Photonic and Quantum Technology for Society 5.0,” a new five-year project on “Laser Processing” started in 2019. Its R&D themes are as follows:

1. Proof of smart manufacturing based on advanced integration of cyber (simulators) and physical (laser material processing systems): Development of CPS-type laser materials processing systems for specific uses;

2. Smart processing based on Japan’s core spatial light modulator technology: Development of high-power resistant and highly accurate space control technologies; and

3. High-power operation of Japan original photonic crystal lasers.

Therefore, the future looks much brighter in Japan, at least in the laser material processing sector.

Dr. KUNIHIKO WASHIO ([email protected]) has his own consulting firm (Paradigm Laser Research Ltd.) and is also an Editorial Advisor on Japanese markets to Industrial Laser Solutions.