A pocket full of opportunities

David A. Belforte

Emerging applications will drive market growth for the rest of the decade

Searching through stacks of information and data collected for this year’s economic review, it struck us that a theme of capitalizing on pockets of opportunity emerged. Rarely in the years we have been preparing this report has the difference between application activities been as clear. That is, while continuing to be the dominant revenue producer, global sales of laser sheet-metal cutting systems have settled into a comfortable 5%-7% annual growth rate pattern. Further, marking/engraving, the largest application for laser units, will continue to experience predictable double-digit growth for the foreseeable future. Both of these applications are mature in that the markets are well known and being exploited by a number of profitable suppliers.

While these markets have been the foundation of Industrial Laser Solutions (ILS) reports for several years, we, like many others, anticipate substantial activity in other applications that will drive market growth for the rest of the decade. For example, welding tends to grow at glacial speeds. The laser is typically selected for new products and thus rarely sees a big push unless some industry, such as automotive, develops a universal demand similar to roof welding a few years ago. And microprocessing, other than via drilling and circuit adjustment, has all the ingredients to be an active laser-processing market, but this hasn’t jelled yet as the semiconductor industry seems to be in a slow technology-innovation phase right now, evidenced by poor bill-to-book ratios.

Traditionally, ILS has not reported sales of excimer-based lithography systems. This industry sector projects sales greater than $2 billion and growth at a healthy 18% annually. If we add these data to those in the report, the total world market for industrial-laser systems would be close to the $9 billion quoted in a well-known European report.

The industrial laser market, with these noted exceptions, has been characterized as an agglomeration of niche markets, none in the hundreds of million dollars range, that collectively represent about 20% of the total systems market. That’s a lot of systems-about $1.2 billion worth. And it is to many of these applications that we look for growth in future sales. ILS has identified a nest of proven applications such as sheet-metal cutting and marking being supplemented by expanding laser manufacturing niche applications in solar cell, flat-panel display, medical/dental/surgical instruments, aerospace, and microprocessing, as well as one not tracked before, replacement and remanufacture of military hardware worn out in the Iraq conflict.

Each year, due to the vagaries of fiscal-year endings that can distort the calendar-year numbers ILS reports, we adjust and tweak previous-year numbers accordingly. For this year’s report, because of a 30% adjustment in the 2006 number of high-power CO2 laser systems manufactured in Germany and Japan, we restated the estimated 2007 sales data dramatically. This is noted in Table 1, a three-year summary of the global industrial-laser market, where strong double-digit growth for 2006 is a one-time aberration.

The 6% growth in laser sales and 8% growth in laser revenues for 2007 continue a string of 18 years of growth, interrupted only by 1991 when there was no growth. This is the only down year in the 37 we have been tracking industrial-laser sales. Since 1970, the compound annual growth rate for industrial lasers is 18.1%. With unit production reaching the 41,000-unit level, every point of growth relies heavily on the contributions from the aforementioned niche markets.

Year in review

At the beginning of 2007, ILS had projected a 6% growth for units produced, and, like any self-fulfilling prophecy, it looks like we nailed this one, as shown in Table 2. The mix was a little different than we envisioned, but even after the corrected 2006 number for CO2 lasers that ratcheted up the 2007 numbers, the percentage gain was about as expected. Fiber lasers continued their penetration into the solid-state market but at a slightly slower pace that still maintained a solid double-digit growth, while the reduction in solid-state lasers was not as deep as projected.

The consequences of the 2006 CO2 laser adjustment were more noticeable where revenues for these lasers gained 10% to crack the billion-dollar mark for the first time, contributing to the 8% overall gain in 2007 revenues. Increased sales of higher-power fiber lasers offset some of the pricing pressures thought to be appearing in the low-power market sector. Solid-state-laser revenue slippage was not as deep as envisioned, due, in part, to substantial sales of high-power disk lasers for a European automotive application.

System sales shot past the $6 billion mark, up 6% over the adjusted 2006 number, although we had projected a 9% increase in last year’s report (see Table 4). This discrepancy is easily offset by the 30% gain in 2006 CO2 sales reflected in the 2007 adjustment. As noted, two applications represent almost half the global systems business-metal cutting and marking/engraving-and if you add in the large markets for microvia drilling and circuit adjustment you account for about 60% of the world market.

Because we make use of published company reports, we are somewhat handicapped by a provision of a US Securities Exchange regulation that places restrictions on publicly traded companies making forward projections. This necessitates gaining market projections from personal interviews and analysis of published international reports.

At several recent conferences and trade shows we were impressed by the upbeat comments of industry suppliers. Most expressed optimism for business prospects for the first half of 2008, and some even anticipate reasonable growth for the year. For example, at the last of the big 2007 systems shows, fabtech, we received almost unanimous views on a positive 2008 business based on order bookings that will ship in the first half of 2008, with some companies commenting that delivery dates would be stretched out.

Sheet-metal cutting is a major portion of industrial laser sales, so good news in this market sector goes a long way toward overall health in the total marketplace. Thus, we are projecting 2008 will be a repeat of 2007 results, with growth rates in the 6%-7% range.

The details

Figure 1, our view of the market shares of the major producing regions, shows Asia and Europe gaining shares and North America lagging, slipping three points. This was not unexpected because industry in the United States is feeling the effects of negative numbers in the housing industry, leading to slowdowns in the appliance and hardware industries; the impact of high energy costs led by superinflated petroleum prices; and increasing offshore competition, even as a weak dollar benefited export.

Two of the leading suppliers of solid-state and low-power CO2 lasers reported less-than-stellar results in their most recent financial reports. A key indicator, laser metal-cutting sales, shows a 15% decline from 2006, even though the system suppliers seem comfortable with this market estimate.

The weak dollar produced some benefits, as US manufacturing companies, at a definite selling-price advantage, are experiencing record export shipments. One major supplier of heavy-duty off-the-road equipment reportedly is hiring several thousand manufacturing employees, so job creation seems to be defying the negative news that dominates the domestic media. The other nafta countries experienced stronger sales of large cutting systems, but their volumes are not large enough to offset any slippage in the US.

Europe saw market share increase as vibrant new markets in Eastern Europe developed and new nations entering the European Union added to positive growth in the German market, which dominates European sales. With suppliers such as trumpf (18% growth) and Rofin-Sinar (14% growth) leading a host of other suppliers of solid-state, diode, and excimer lasers, Germany, in reality, is the second-largest industrial-laser revenue producer and user, trailing Asia and leading North America. So any turbulence in the German machine-tool market can be an important factor. According to industry reports, a reversal in the German machine-tool market forecast is cause for optimism, and reports are that the laser-systems business is outpacing the growth rate of traditional machine tools.

Significant gains were made in the Asian market share, where industrial laser and systems sales in China approached the $800 million level after a 40% growth over the last reported year, and in Japan, where continued positive economic activity raised laser materials processing equipment output by 15% (this includes lithography, a category that ILS does not track). Add in notable, but modest, growth in sales in India, Thailand, Malaysia, Korea, and Taiwan, and it is clear that Asia is the hot market for domestic suppliers.

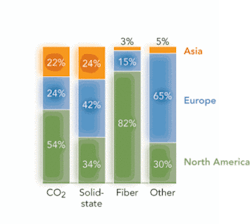

Market categories for all lasers are detailed in Figure 2, which shows how each type performed in each of the major producing regions. As noted, lethargy in the United States caused North American market shares to decrease in all categories, mitigated by increased activity in global producing regions. Low-power CO2 lasers are still the dominant province of US suppliers, led by Synrad and Coherent, which are both market and technology leaders.

Solid-state laser sales dropped slightly, as leading suppliers Coherent and Spectra-Physics reacted to continued softness in the semiconductor industry. The bright light, fiber lasers, continues to shine, as industry-leader ipg reported an impressive 32% year-on-year growth rate that is more than four times industry averages. And sales of high-power diode and excimer lasers did not keep pace with growth rates in other producing regions.

In Europe, suppliers of CO2, fiber, diode, and excimer lasers saw growth in market shares, while solid-state lasers remained at the same level as last year, due, in part, to slow sales into the automotive market. High-power CO2 laser leaders trumpf, Rofin-Sinar, and Bystronic combined to boost share, while LaserLine, Lambda Physik, and Jena Optik increased sales in the other categories, and spi and a host of smaller producers caused an increase in fiber-laser production.

Suppliers in Asia led by Fanuc, Miyachi, Mitsubishi, and Han’s Laser, to name a few, enjoyed increased laser production in all categories except nonlithographic excimer lasers. Reported China production of more than 12,000 CO2 laser tubes includes replacements, a market sector that ILS does not track. We assume that 25% of these tubes may be used in new systems, and that is the portion for which we account.

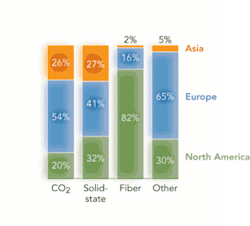

When estimating market splits for laser revenues in all categories (Figure 3), the picture changes from that in Figure 2. North American markets in all categories decreased compared to 2006, due more to increased activity in other global production than to major changes in the domestic market. The significant increase in high-power CO2 laser revenues in Germany, growth of fiber-, excimer-, and diode-laser sales in Europe, and solid-state and CO2 laser sales in Asia were results of a more active market in the other regions.

European suppliers edged up in all categories, led primarily by companies in Germany. On a revenue basis, Europe is now the number-one supplier of industrial lasers. Meanwhile, Asia, and particularly Japan, continues to gain market share in all categories.

Where are the lasers?

Gaining a perspective on where industrial lasers are installed is a bit like working a jigsaw puzzle and finding, when close to completion, that one or two final pieces are missing. These missing pieces often are found later, such as the case with late reports we receive after this review has been published (thus, the annual adjustments we make). This year, as shown in Figure 4, we find that Asian installations at 37% top the market segments, led by Japan, which experienced 30% growth in solid-state welding installations and a 10% growth in solid-state marking installations. In China the aforementioned 40% growth rate is mostly attributable to domestic installations, as Chinese suppliers have yet to attain strong export positions.

The installation base in Europe decreased slightly, as German suppliers enjoyed another strong year tallying about 40% in export sales, according to a vdma report. Installations in North America were down slightly, a result of the semiconductor market situation and a decrease in sheet-metal cutters. The row sector, composed mainly of Australia and South America, held steady thanks to strength in Brazil.

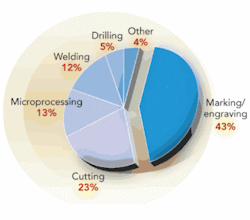

And just what are all these lasers being used for? As shown in Figure 5, the makeup of applications shifted a little from last year. Marking/engraving still dominates with 43% of the units installed, while cutting slipped a little to 23% and welding dropped to 12%, as large sales into the auto industry were not present in 2007. Drilling, led by microvia and plastic perforating processes, gained to 5%, and microprocessing held steady.

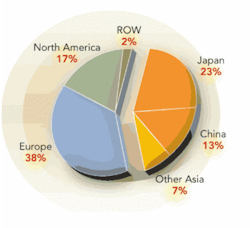

In 2007, about 5000 high-power CO2 and fiber-laser-powered metal-cutting systems were sold globally, with the latter being a very small but growing element (see Figure 6). Asian installations, led by rapid growth in China, now represents about 43% of the world market, followed by Europe at 38%, North America at 17%, and row at 2%. The 12% growth in Asian sales means about $120 million was added to total world systems sales over 2006, demonstrating revenue impact of sales of these systems. Indications are that sales in China will continue strong double-digit growth, while sales in Japan are expected to level at 2007 numbers, North America should stay even, and Europe is expected to inch up a bit.

Looking to the future

As this is being written, enough uncertainty exists about manufacturing in the US to cause us to anticipate a repeat of 2007 performance. Sales in Mexico and Canada should contribute to a slight overall increase in the North American market. European sales should edge up slightly, as activity in the developing industrialized nations should remain strong regardless of general economic conditions elsewhere.

Asia will remain a hot market, led by sales in China, which should crack the $1 billion level, and increasing markets in India and the other producing nations. Japan’s sales project to about a 4% increase, as activity in microprocessing ramps up.

This leads us to conclude that 2008 should emulate 2007 growth at about 6%. Barring any unforeseen economic reversals, this figure seems readily attainable.