2012 Annual Economic Review and Forecast

Status-quo for 2013

David A. Belforte

The dynamic world of industrial laser materials processing lived up to its reputation in 2012 as the world's economies fluctuated wildly with random news of: a return to recession in Europe, seeming vacillation on economic policy in China and the market trade consequences of a diplomatic quarrel between that government and Japan, and a hotly contested presidential election in the U.S. that produced a host of promises concerning government influence on manufacturing. And these were just the tip of the iceberg as month-after-month the global economic news gyrated from good to bad, over and over, producing headaches among market analysts charged with predicting the economic impact.

It should be pointed out that ILS forecasts are based on documented reports from four dozen public corporations, including the market leaders, all of whom are obligated to publish their quarterly financial reports, along with company officer guidance statements that project future business. So what you read in these pages is a compendium of these reports tempered with a multitude of other published comments and direct interviews and market assessments. At ILS, we like to think we are only the messengers, even though what we report is our opinion.

In the Mid-Year Market report, presented as a Webcast in June 2012, ILS tweaked the numbers up by a percent or two, factoring in a stronger than anticipated first half with a projected slower second half. Indeed the third quarter numbers from several of the industry leaders were tempered with reports of slowing markets in Europe and the impact of a sudden and deep cutback in exports to China, the single largest market for industrial lasers and systems. The China situation seemed to have a greater impact on laser equipment suppliers located in Europe, where they were already experiencing the fallout of collapsing economies throughout the Euromarkets, and in Japan, where a drop in orders from China caused a 20% drop in laser system sales. Turkey, as described on pp. 26-28, was one of a few bright lights in an otherwise gloomy marketplace. Product suppliers in the U.S. did not begin to feel the impact until late in the fourth quarter, as this country's manufacturing economy was in the midst of one of the best growth periods in its history.

As a consequence, as shown in TABLE 1, the published results for 2012 came in about where ILS predicted and reported in the June Webcast Mid-Year Report, only off by 2% in a more positive direction. Is that the 'fat lady' we hear singing?

The economic year 2012 left many analysts scratching their collective heads, this writer among them. An almost three-inch-thick folder of positive and negative published comments on the global manufacturing situation, sorted into two almost equal piles, serves as an apt analogy for what was experienced this past year. Much of the negative pile, sorted chronologically, has to do with the up-and-down problems of certain economies in the Euromarkets. Waiting for a year-long resolve of the crisis in Greece reminds one of classic 1970's comedy sketches about the lingering death of the Spanish Dictator General Franco, which was a lead on the television network news each night for several weeks. It seems the Greek rescue experience, a model for other economically teetering Euro countries, was judged as the catalyst for the collapse of the Euromarket and even the fall of the Euro as the common currency. The result of this was an almost complete stop of growth in the European Capex market, felt by all the European laser and system suppliers. Somehow Europe muddled through thanks mainly to the strength of the German economy and its leader, who played a key role in reviving Greece, Spain and Portugal from near collapse.

As this report was written the effects of recession were being felt and reported throughout the 27 country Euromarket and in the UK. Worse, the impact of this situation had spread to Central and Eastern Europe, two regions that had in 2011 been cited as among the strengths of the European laser market.

Compounding this problem was a new one in 2012, the softening of the roaring markets in China, which had been the driving force behind laser system sales growth in the preceding two years. All of a sudden, a lack of effectiveness in government handling of the domestic economy led to a secession of activity in that country's Capex market, especially in the 3rd quarter of 2102. No nation is an economic island any longer so China's problems spread to the rest of Southeast Asia and Japan, also dragging down the laser market. Again, as this report was written the new government leaders in China loosened their grip on imported capital equipment funding and the fourth quarter of the year looked to be in recovery.

In the U.S., a very good year in manufacturing ran counter to the bad international economic news. Exports were at a recent-times high and strength in the: energy, transportation, aerospace, agricultural/heavy equipment, and medical device industries presented a ripe market for industrial laser materials processing system sales. The economic future, however, was cloudy as the warring political parties argued over a solution to the "fiscal cliff" end-of-year budget problem, causing companies to restrict Capex commitments for the second half of the year. A fourth quarter slowdown in manufacturing output was accompanied by predictions of a flat to low growth 2013, reminiscent of 2012.

All the above led to visions of the 'fat lady' again as summarized in the low growth 2013 numbers in TABLE 2 and 3. Generally, industry participants and observers are opting for a reasonable growth first quarter, as 2012 backlogs are reduced, followed by three quarters of flat or low growth rate sales and shipments.

The Details

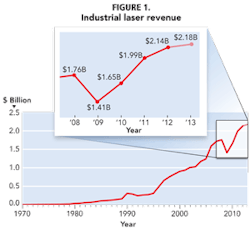

TABLE 1 is a snapshot of the industrial laser market since the end of the recession of 2008-2009; a period in which this industry defied the experts' predictions of a long, slow recovery, and led by booming sales of solid-state lasers for face plate applications in hand-held devices and fiber laser for marking/engraving and sheet metal cutting, snapped back in 15 months to pre-recession revenue levels. Record shipments in 2011 set the table for a strong first half of 2012, even though the aforementioned economic problems should have stultified sales. FIGURE 1 shows the history of industrial laser revenue in that now classic fishhook curve that illustrates how the post-recession revenue growth has significantly affected the CAGR since 1970 of 18.12%.

In all fairness, it should be pointed out that laser and laser system sales in 2008 set a record. After two international trade shows, the order books of most system suppliers were full, with backlogs extending into the second quarter of 2009. And then disaster in the shape of the recession of 2008/2009 trashed all the backlogs with cancellations and many project delays. It was the latter that produced some of the impetus for the rapid market recovery of 2010, proving a point that ILS has made many times: industrial lasers have experienced an illustrious growth rate since the early 1990s. Among the applications that these lasers serve are many that are themselves in a steep growth period: communications, transportation, medical and energy. And these laser applications are for the most part unchallenged by competing or advancing technologies. So when the recession ended that pent-up buying demand for the canceled or delayed orders, it gave an instantaneous boost to company backlogs, a situation that held for more than 15 months. In this period, the beginnings of the hand-held communications device business provided a boost to industrial laser sales with multitudes of solid-state and excimer lasers being directed into the manufacture of smart phones and now tablets.

The increased penetration of fiber lasers into markets (TABLE 2) held by other laser types continues, as that laser's high efficiency, compact footprint and low maintenance costs are proving attractive in buying decisions when the fiber competes directly with other laser power sources. In 2011, high-power fiber laser sales grew at a fast pace and began a serious penetration into the market for sheet metal cutting. This situation intensified in 2012 as evidenced by the dominant presence of fiber-laser-powered metal cutters at all the major trade shows featuring fabricated metal product processing equipment. Further support for the high-power fiber lasers' market growth is the appearance, in 2012, of a number of companies offering fiber lasers in the metal cutting sector: Amada/JDSU, Rofin Sinar, Hypertherm, and GSI Groups JK Laser. Also providing kilowatt-level fiber lasers for other cutting operations are Coherent, Miyachi, and SPI Laser, the latter part of the Trumpf group. In 2012, high-power fiber lasers are estimated to have taken up to 20% of the market from equivalent power CO2 lasers.

Fiber lasers were the winner in the growth-rate race in 2012, showing a 16% increase in laser revenues, mainly at the expense of high-power CO2 lasers, which lost market share by as much as an estimated 10–15%.

In the markets where fibers have been eroding sales of solid-state lasers, the fiber continued to be the laser of choice among marking system integrators; however, solid-state laser retained market share and actually increased this a bit in microprocessing applications, where it is preferred as a processing laser in the manufacture of hand-held communications devices.

Excimer and diode lasers, the latter a fast-growing product in the manufacturing world, continue to show strong growth that started in 2011 and increased their market share by 7% in 2012. They are finding niche markets where they are the lasers of choice in semiconductor and microprocessing applications and for the high power diodes in macro applications in the auto industry. New market entrants Teradiode and Direct Photonics are bringing a new vitality to the market as they introduce high power, up to 3 kW, products that are seen by many as the "ultimate" solution for on-line manufacturing operations.

TABLE 3, laser system revenues, shows the same trends as in TABLE 2 since ILS assumes that most laser sales result in system integration. To support this assumption, one cannot find a very active market for individual laser sales to end users. To put this into perspective, ILS has identified more than 150 marking system and over 60 cutting-system suppliers that integrate lasers into their products. The former use more than 25,000 low-power lasers and the latter 5000 high-power lasers for a total of 51% of all lasers installed. ILS market estimates are for the basic laser system and do not account for ancillary material handling and other complementary processing operations.

It should be noted that ILS has traditionally not included sales of excimer lasers used in photolithography in the reported system and application numbers. This application has been outside of those that ILS tracks. If system sales of the two main suppliers were to be included, they would increase the 2012 system total by about $800 million.

The sales of high-power laser metal cutting systems are a significant portion of total laser system revenues. In 2012, sales exceeded $5 billion or 60% of the total. As a consequence, any perturbations in the market for fabricated metal products have a major impact on the industry suppliers; thus this market is closely watched as an indicator of global manufacturing economics. This was very evident in 2012 when economic troubles in the Euromarket and in China, two major laser cutter users, had a noticeable 50% decline in the revenue growth rate for the system market.

Applications segmentation

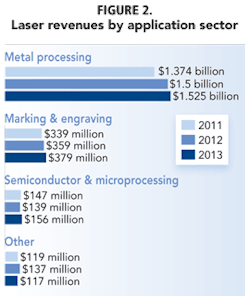

FIGURE 2 is a three-year summary of laser revenues broken down by applications in which they are used. It is obvious from this figure that Metal Processing (TABLE 4 and FIGURE 3) is the largest segment, representing more than 70% of total laser revenues. That is why sheet metal cutting, a major portion of the Metal Processing market, is so important. Whereas this sector grew 6% over 2011 sales, it is estimated to only grow 2% in 2013, translating into a potential loss of at least $325 million in system sales, as the fabricating sector experiences a slowdown in 2013. Within the market segment CO2 lasers dominate, but fiber lasers, which grew 30% in this sector at the expense of CO2 lasers, are becoming a factor. In 2013, fiber lasers are estimated to grow 7% versus the 1% decline in CO2 sales. Also contributing are the sales of high-power disk lasers from Trumpf, the world's largest industrial laser and system supplier.

Marking/Engraving (TABLE 5 and FIGURE 4) is the second largest laser application in terms of revenues and the largest in terms of unit numbers sold. Solid-state lasers, lamp and diode-pumped, have steadily been losing market share to fiber lasers — a trend that is expected to continue as the fiber laser makers meet increasing competition from new fiber laser suppliers by reducing selling prices. Marking is as close to a commodity as any other industrial laser application. Some industry observers have compared laser markers to ink-jet printers in terms of: reliability, adaptability, low maintenance, and lowering selling prices. Laser marking growth is assured because more government and industry standards are in place to factor in laser as the marking source, especially in the area of 2D bar code matrix marking. Another target market is penetration into the ink-jet marking arena, where second and third harmonic wavelength lasers, with no consumables, are showing advantages in marking otherwise difficult to mark materials.

Laser activity in the Semiconductor/Microprocessing markets (TABLE 6 and FIGURE 5) continued to lay the ground work for substantial revenue increases in the coming years as microprocessing is thought to be a growth area for the rest of the decade. This sector is home to one of the fastest growing laser types: ultra-fast pulse, which produced a 60% growth in 2012 and looks to be continuing a double-digit growth for the next few years. Applications in the semiconductor segment range from micro-via drilling (where hundreds of units per year were installed in 2011 and 2012 in SE Asia) to laser scribing and ablation. Microprocessing applications include texturing and etching, applications that have sustained diode-pumped solid-state sales and, new to the scene, pulsed fiber lasers, at the fundamental and frequency shifted and single-mode wavelengths.

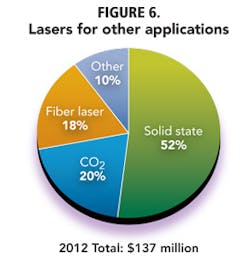

The ubiquitous "Other" laser category, TABLE 7 and FIGURE 6, includes excimer lasers for annealing silicon in smart phone manufacturing and higher power solid-state, fiber and CO2 lasers as the power sources for additive manufacturing processes, one of the future growth applications for laser processing. As these applications reach a visible market level, ILS tries to shift them into one of the more definable categories.

Installations

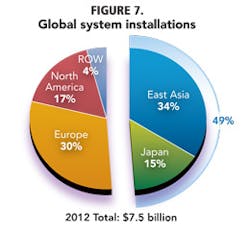

So where do all the above-mentioned lasers end up? Using a variety of resources ILS can generate a view of where industrial lasers were installed in 2012. FIGURE 7 is a projection of our analysis. Even though imports of laser systems into China slowed down in the middle of the year, the picture for 2012, taken on a global basis considering the slowing markets in Europe, will look similar to last year's ILS report.

European countries, led by slow-downs in Italy, Spain, and the Central European nations, slipped two points to 30%. Only the continuing strength of the German market kept this percentage from slipping even further.

The brightest performance in an otherwise slowing market was in North America, where manufacturing boomed in an otherwise slow economy. In the U.S., several industries, heavy users of industrial lasers, had a stellar year, and records were set for U.S. manufacturing orders during the year. The industries that seemed to defy global manufacturing slowdown are: aerospace, transportation, energy, agriculture and heavy equipment, and medical devices. Laser products used ranged from low-power laser marking units to high-power laser metal cutters and welders. As a result, North America gained a point over the 2011 share.

The scenario as this report was being prepared has similarities to two past events. The first and least likely is the situation that developed when preparing the 2009 ILS report, where enthusiastic business results from two big laser shows, EuroBlech 2008 and Fabtech 2008, followed by the effects of the big market crash starting in December 2008, led to ILS projecting the first laser market decline in two decades. Little did ILS know then, but we grossly underestimated the decline, which went from the estimated low single-digit loses to mid-double-digits numbers as the world economies went into recession. The similarity was that EuroBlech and Fabtech this year were very upbeat shows with strong order placement immediately following each, a dichotomy because, except for the U.S., the global manufacturing economy was not very healthy. The difference between the two scenarios is that the financial disaster of 2008/9 is not in the offing in 2012/13

The second similarity is the too-familiar market conditions today compared to one year ago when the 2012 report was being prepared. A very strong second half of 2011 led to substantial backlogs, which distorted forecasting for 2012. As stated earlier in this report, ILS took a conservative approach to forecasting the year, and time proved this correct. For this report, we have again taken a conservative approach, this time supported by manufacturing industry opinion of business in 2013. We do not expect to have to wait until the 'fat lady' sings.

Cautionary guidance remarks by the leading industrial lasers and systems suppliers paint a picture of a global manufacturing economy still in disarray as a consequence of unresolved economic issues in Europe and, as this was written, uncertainty in last year's bright light, the U.S. manufacturing sector, awaiting the fall-out from the U.S. government 'fiscal cliff' resolution.

The BRIC (Brazil, Russia, India, and China) nations have been targeted by several laser product suppliers as expanding markets in 2013. Conditions in China have already been cited. Brazil is a promising growth market, but it is in the throes of economic stagnation with inflation rising, fiscal reform still on hold, and little growth in the capital investment area. One domestic supplier to the medical device sector describes it as an economy running sideways. India, a giant population market, has similar problems with a government in disarray that is unable to cure economic discord, leaving manufacturers with uncertainty as to when and how to invest in capital equipment. Several international suppliers describe the country as a potentially good market for laser processing equipment, but the horizon for substantive growth seems to always move out of reach. The Russian market is thought by many European laser suppliers to be a fruitful market, developing more quickly under a manufacturing-oriented government. However, the prospects for this nation making a strong contribution toward capital equipment sales in 2013 remain marginal at best, and suppliers are looking at 2014 for some positive movement. ILS looks to the BRIC nation markets as a near term opportunity to expand sales of industrial laser products, acting as a relief valve for the slowing 2013 international markets.

As shown in TABLE 2, both carbon dioxide and solid-state lasers in 2013 are projected to experience a repeat of 2012, with little or no growth in sales revenues, resulting from the increasing inroads of fiber lasers into their markets and the sluggish world economies. On the CO2 laser side, low power units should show a small gain, but a projected small (1%) decline, brought on by increased high power fiber laser sales will impact total CO2 numbers. The flat market for solid-state lasers in 2013 is also expected from the incursion of fiber laser sales into their market sectors. The 2013 laser numbers directly impact the 2013 laser system revenue numbers (TABLE 3), which, at best, are expected to show very small increases from flat global markets.

Fiber laser, excimer, and diode laser revenues should enjoy modest growth (TABLE 2) as fiber lasers increase market share in the sheet metal cutting sector, from today's 15% to at least 20% in 2013, and excimer and diodes will experience growth through new industrial applications and markets that suppliers have developed. Increased laser sales produce equivalent revenue growth in the system sector, as shown in TABLE 3.

Overall 2013 revenue results should show a slight 2–3% gain over 2012. In and of itself, this is not a disappointment, as many suppliers told ILS, the laser equipment results will be in line with other capital equipment markets experiencing predicted flat growth in 2013. Application segments that will sustain and in some cases drive growth in 2013 are: metal processing (TABLE 4 and FIGURE 3), which will represent about 70% of industrial laser revenues with CO2 43% of total laser revenues and fiber lasers 13% of total revenues, together contributing 56% of total laser revenues.

Laser marking/engraving (TABLE 5 and FIGURE 4) is an application that is driven by company and government regulations and standards for traceability and security, thus even in a slipping economy, this support for annual revenues will keep this application as the number two revenue producer. Fiber lasers will dominate the laser marking sector at about 75% of total laser marking revenues in 2013. Additionally, fiber lasers for marking will represent about 13% of all industrial laser revenues for 2013.

Microprocessing applications revenues in 2013 (TABLE 6 and FIGURE 5) will show the largest increase (12.2%) over 2012 sales, with diode-pumped solid-state lasers and ultra-fast pulsed lasers producing over 40% of the revenues in this category. This sector is one of the most active in terms of advanced laser material processing technology, and it is the target for fiber laser suppliers in Europe and Asia.

On a final note, ILS has been working to reduce the size of the "Other" category by shifting applications into others. Thus, the 2013 revenue number for other applications in TABLE 7 and FIGURE 6 will show a 17% decrease.

In summary, the 2012 market for industrial lasers and systems came in just about where ILS had predicted, well below the double-digit numbers of non-recession years, but in the minds of many suppliers, satisfactory given world economic conditions. Entering 2013, projections from industry suppliers, even the powerhouse duo of Trumpf and IPG Photonics—both strong double-digit revenue growth producers—were for a mixed year in manufacturing ranging from flat to low single-digit growth. Most laser and system suppliers, having survived the past recession by trimming their operations, opted to continue this practice in 2012 and most will do so in 2013 as well. There is no sentiment for market loss through the appearance of new non-laser competition, so the industry is prepared for an anticipated strong fourth quarter in 2013, followed in 2014 by a return to double-digit revenue growth. ✺

David Belforte([email protected]), the Editor-in-Chief of Industrial Laser Solutions, has for the past 28 years produced and reported on the global market for industrial laser material processing.

More Industrial Laser Solutions Current Issue Articles

More Industrial Laser Solutions Archives Issue Articles