Fiber lasers continue growth streak in 2014 laser market

Revenues increase despite mixed global manufacturing growth

The global marketplace for industrial lasers and systems in 2014 was, to put the most positive spin on it, not the most stable since the end of the Great Recession of 2008/2009. Over the five-year period, sales have risen each year as economies in the developed and newly developing industrialized nations have risen. A slow start to 2014 was occasioned by a soft market in China—the world's largest industrial laser market—a country in a period of change, as domestic manufacturers of products were advised to shift their sights to the global markets served by companies with domestic intellectual property products. A down market in China had immediate effects in Europe, a major exporter of laser products, which contributed to almost-recessionary problems in Europe.

Russia was anticipated to lead the non-aligned industrialized nations (the Brazil, Russia, India, and China [BRIC] region) in 2014 sales, but returned to a bully-on-the-block posture that turned the rest of the world's majors against it with economic sanctions, and the other BRIC nations did not deliver: Brazil, still sorting out political unrest, was negative; India started a third-quarter turnaround led by auto sales, but too little too late; and China's manufacturing purchasing managers index (PMI) went below the magic 50-percent level in November. A sudden downward shift in Germany (a global industrial laser export market leader) caused manufacturing to decline precipitously in the last months—still positive, but not enough to boost European Union (EU) financials.

Two of the brighter lights, manufacturing in the US and the UK, were cause for celebration in these countries, as the UK's economic strength was a surprise to all and US manufacturers continued on an 18-month winning streak that depended on exports. The outlook for 2014-2015 was that the US industrial market's key to growth in the laser sector is improving moderately—construction equipment, automotive, rail car production, commercial aerospace, and energy are up—however, the agricultural equipment market is facing a decline next year.

As 2014 came to a close, the general attitude among laser and equipment suppliers was that 2014 business recovered just enough to meet projections for a turnaround in growth, as order bookings for the 2015 backlog were barely being met.

The global market for industrial lasers

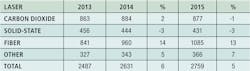

Irrespective of a mixed global manufacturing growth in 2014, industrial lasers, led by booming fiber laser sales, experienced a moderate 6-percent increase over 2013 revenues. In TABLE 1, total revenues for 2013 have been adjusted to reflect final calendar-year results reported by leading suppliers that were published early in 2014.

Industrial lasers integrated into processing systems, from simple marking systems to complex, multi-axis remote welding systems, are employed in a wide variety of manufacturing operations where laser technology allows users to improve in productivity and profitability. These systems have gained acceptance in key industries that were the driving force for manufacturing recovery from the depths of the 2008/2009 global recession: energy, transportation, agricultural machinery, aerospace, communications, medical devices, and fabricated metal products. And these industries are projected to continue to grow and expand in global markets through the second decade of the millennium. In short, industrial laser technology is aligned with growing markets. Since the recession, the compound annual growth rate (CAGR) for industrial lasers has been 12.18 percent.

In 2014, industrial laser revenues grew by 6 percent—primarily as a result of 14-percent growth in the fiber laser sector, which since the recession has shown a CAGR of 33.58 percent. The fiber laser share of the total 2014 industrial laser market was 36.5 percent, up 8 percent from 2013, while the rest of the market grew only 2 percent.

Carbon dioxide (CO2) revenues managed to grow 2 percent even though they lost market share to high-power fiber lasers, which penetrated into the metal cutting sector by more than 30 percent. And solid-state lasers, losing market share to low-power fiber lasers for marking, dropped 3 percent; only the increased revenues from high-power disk lasers and ultrafast-pulse (UFP) lasers for micromachining kept the losses lower. In the Other category, high-power direct-diode and excimer lasers (growing in niche markets) showed a 5-percent revenue growth.

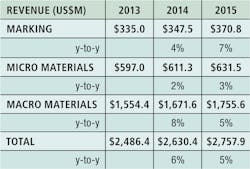

TABLE 2 shows industrial laser revenues by material processing applications. ILS uses categories established by our partner Strategies Unlimited, where Micro Materials includes all applications processing by <1kW of laser power and Macro Materials covers applications at 1kW and higher. ILS does not report revenues for lasers used in both deep- and extreme-UV photolithography. In this sector, Strategies Unlimited reports revenues of $908 million, a 15-percent increase over 2013, and they project an 18-percent increase for 2015. Some international market reports include this application in their reports for lasers for industrial materials processing.In 2014, marking continued to represent about 13 percent of all industrial lasers sold, while Micro Materials using all types of lasers held a 23-percent share and Macro Materials processing dominated with a 63-percent share—typically due to the high selling price of the lasers used. Overall revenue growth of 6 percent in 2014 was supported by increased sales of high-power lasers (8 percent) for metalworking, mostly for cutting and welding. In both of these applications, competition between CO2 and fiber lasers is intense. Some systems integrators such as Trumpf, a self-integrator of CO2, solid-state, and fiber lasers, and Amada, an integrator of their own fiber and CO2 lasers for cutting, can offer their customers a choice of laser source. Others—such as Bystronic, Mazak, Mitsubishi, Prima Power, and Ermaksan, to name a few—also can offer laser cutters powered with either laser technology at a range of output power levels.

Our estimates for 2015 revenue growth are predicated on the anticipated muddled global economic situation. This is best exemplified by a quote made at the close of the contentious November 2014 G-20 summit in Australia by the Prime Minister of the UK: "red warning lights are flashing" for the world economy.

Marking/engraving remain solid

The marking/engraving market, as seen in TABLE 3, has long been the foundation for growth in the Low-power Laser category. Tracing the history of industrial lasers from 1970, there have been only two significant market reversals: 1993 and 2008-2009, in which marking/engraving revenues declined. The negative revenue growth in 2014 for sealed-off CO2 lasers for engraving operations and solid-state lasers for marking applications is not indicative of the active market for these lasers; it only reflects the current selling price competition situation common in Asia, the largest market for these lasers. This commodity-like market is very much quantity-driven, as the cost of low-power fiber and CO2 lasers makes profit margins difficult to sustain. However, unit sales continued to increase at a modest single-digit rate in 2014 and will increase slightly more in 2015.

Microprocessing takes off

It's a given that a significant portion of the industrial laser market is fragmented into a multitude of niche markets. As an example, microprocessing lasers are used to manufacture metal and bioasorbable stents and filters for medical and biological applications, and they also find use in the fabrication of microfluidic components, glass PCB substrates, lab-on-a-chip, and displays for phones and tablets. UFP lasers process materials such as Teflon and Nylon that longer-pulse solid-state lasers cannot—a situation that frustrates analysts trying to come to grips with this vibrant industry. ILS has chosen to group laser processing on a micro-scale (TABLE 4) into four broad categories: Semiconductor/PC Board, Fine Metal Processing, Additive Manufacturing, and Other, which are served by all laser types producing output power <1kW. This allows for summation of available supporting data on laser usage from these niche industries.

Sorted into three large sections along with the miscellaneous group under the collective title Microprocessing, TABLE 4 shows the impact of a slowdown in equipment orders from the semiconductor industry, a typical downer in that notoriously cyclical industry sector. This, coupled with uncertainty in regions where fine metal processing is a major industry, led to a low 2-percent gain in 2014 revenues. But on the more positive side, seemingly insatiable commercial interest in 3D Printing, leading to industrial acceptance of higher-power laser direct-metal deposition for producing parts in a broader sector called Additive Manufacturing, produced a 34-percent increase in revenues and elicited such promising opportunities for 2015 that this sector is expected to grow by 62 percent in 2015.

Laser applications involved with processing solar cells and the components for solar cell farms, as government subsidies acted to boost consumer demand, contributed to a 12-percent growth in the ubiquitous Other category. Lasers have proven their worth in roles spanning the solar cell/module manufacturing chain: trimming and dicing silicon wafers instead of sawing, replacing high-temperature diffusion furnaces for doping solar cells, scribing cell surfaces, detecting defects in solar cells, and characterizing and testing solar cell properties. To the extent that lasers can continue to demonstrate competitive or superior performance quality or cost (or both) than other established processes and technologies, especially as newer solar cell structures and platforms are embraced, this leads experts to see their use continue to grow in this sector.

And for the first time in recent years, shipments of CO2 laser systems for via drilling decreased and in some cases halted as the PC board industry slowed in 2014.

New technology boosts microprocessing

The numbers for solid-state lasers in TABLE 5 indicate the impact of a new wave of fiber laser products aimed at the growing microprocessing market. These fiber lasers, operating at the fundamental and shifted wavelengths, compete with equivalent solid-state lasers in terms of process capability, while offering the operating cost advantages of power efficiency and low maintenance. The most fertile market sector, UFP microprocessing, is currently dominated by solid-state laser products supplied by more than two dozen companies offering pico- and femtosecond lasers, and another half-dozen companies offering fiber lasers in the Picosecond category.

High power-where the action is

At 63 percent of industrial laser market revenues and outperforming in growth, high-power lasers for macro-processing are the main attraction because their high selling price noticeably moves the market numbers. Because most of the applications are in metal processing in extremely visible industries such as aerospace, transportation, and fabricated metal products (installations for cutting and welding of high-speed trains in China; aircraft components in the US; automotive parts in Europe, China, and the US; and shipbuilding in Europe), it seems that these lasers always garner the highest interest.

Seventy-five percent of the 2014 macro-processing revenues reported in TABLE 6 resulted from laser cutting of metals, mostly sheet metal cutting. In the grander view, this sector alone represents almost 50 percent of all industrial laser revenues, so it substantiates the claim that high-power lasers are where the action is—at least from a revenue standpoint. It may come as surprise to some, but laser welding revenues grew 10 percent in 2014, raising this sector to almost 14 percent of all industrial laser sales.

In the Other category are high-power lasers used for industrial applications such as surface treatment and drilling, the latter enjoying a renaissance as drilling demands from turbine engine businesses spiked—a result of increases in multi-year jet engine orders for passenger aircraft offsetting a lowering of orders from the defense sector as the US began to wind down military spending.

Glancing ahead, expectations are that a third year of modest, spotty global economic growth looks to slow down capital spending again, especially for metal cutting and welding in China, the largest market for high-power lasers. As a consequence, 2015 is shaping up as a modest growth year (5 percent) for the high-power macro-processing sector.

Fiber vs. the others: war won?

In the two previous industrial laser categories, growth was for the most part driven by the further penetration of fiber lasers into markets served by other laser types. The best case for this is in the high-power macro-processing sector, where kilowatt fiber lasers have successfully made inroads into markets previously held by high-power CO2 lasers. An example of this is the sheet metal cutting market, where a multi-thousand-unit, kilowatt-level CO2 laser business has had fiber lasers penetrate by more than 30 percent, with projections for more than 50-percent penetration by 2016.

An estimated 6000 high-power lasers integrated into cutting systems were sold in 2014, of which CO2 lasers powered the majority—a situation that, according to fiber laser proponents, may be the nadir for these lasers in metals manufacturing applications. TABLE 7 shows a 3-percent increase in CO2 revenues vs. a 17-percent increase in fiber laser revenue; most of the fiber's growth is at the expense of CO2 lasers. In 2014, CO2 lasers held a 43-percent share of total revenues vs. fibers at 36 percent. In 2015, this split is expected to be essentially equal, with CO2 at 40 percent and fibers at 39 percent. At the biennial EuroBLECH show in October 2014, 49 industrial laser systems were on display—43 were fiber laser-powered and six used CO2 lasers. Just over six years ago at this same show, the split was CO2 at 23 units and fiber at 4 units.

Solid-state lasers, even with the revenue strength of UFP lasers and the significant contribution of the Trumpf high-power disk laser, lost revenue in 2014 because of the growth of fiber lasers in their key application sectors. Solid-state lasers continue to hold a small share of the marking market for deep engraving, but even in this sector, pricing pressures are driving down revenue growth.

The future

World economic conditions for 2015, as predicted by most economists, are not the most encouraging. The International Monetary Fund reduced its 2015 global growth forecast to 3.2 percent after projections three years ago that it would rise to 4.8 percent. There are just too many question marks—China, Central Europe, Russia, the Middle East, Brazil, and Japan—to bravely predict the market prospects for 2015. Many industrial laser product suppliers are taking a wait-and-see attitude, seeking shelter behind terms like "modest and spotty" when they report to investors, analysts, and journalists. ILS's survey of dozens of suppliers of industrial lasers, laser systems, and related products produced a consensus that 2015 will likely be a repeat of 2014, with overall revenue growth of 5 percent. Behind this number are anticipated declines in high-power CO2 lasers for sheet metal cutting and continuing declines in high-power solid-state laser usage, for example, in the aborted application of cutting sapphire cover plates for smartphones.

On the other hand, there are other revenue contributions that continue to add to overall market revenue growth. Fiber lasers are expected to attain double-digit growth at 13 percent and high-power diode lasers for applications in the auto industry will gain over 2014 numbers.

In an aside, fiber, high-power diode, and excimer laser sales together will surpass, for the first time, combined sales of CO2 and solid-state lasers.

This report opened with two presumptions. First, industrial lasers now satisfy demand from the global manufacturing market; therefore, they are sensitive to world economic pattern changes. Second, industrial lasers are now an integral part of global machine tool sales and, like machine tools, are responsive to international economic changes. Monitoring trends in machine tool revenues is now a useful tool for predicting global industrial laser sales.

Industrial laser revenues have, except for two international economic financial downturns, had a 45-year run that has seen a CAGR of 17.43 percent, according to ILS collected data. And according to industry perspectives shared with us, future near-term markets, in the strong industries that comprise the current industrial marketplace, seem assured to support high single-digit growth for the next several years.

Methodology

The methodology uses a bottom-up, demand-based process for each segment followed by a top-down approach; then, the numbers are compared to previous forecasts.

The information, other than the forecasts, comes from both public sources and private briefings held with those in the industrial laser business. Information gained from briefings typically isn't sourced, and the author of this report ultimately remains responsible for its content.

We gathered information from a wide variety of sources, including:

• Interviews with end users, product vendors, component and module suppliers, suppliers of subcomponents, and independent industry experts;

• Press releases, sales literature, filings with the Securities and Exchange Commission (SEC) and other government agencies, and other public information;

• Statistics gathered by trade associations and research firms that follow specific markets, with our own interpretation as necessary; and

• Information gathered from PennWell resources—Strategies Unlimited, Laser Focus World, the Lasers & Photonics Marketplace Seminar, and Industrial Laser Solutions.