Marking enables manufacturing in Malaysia

An ongoing industrialization program provides incentives for local manufacturers to adopt high technology

K. H. Leong

Many readers may associate the country of Malaysia in Southeast Asia with the Petronas Towers (taller than Sears Tower), the fixed exchange rate of the Malaysian Ringgit against the U.S. dollar, or more recently the tsunami disaster. However, in the manufacturing area Malaysia is well known for its exports of semiconductors, disk drives, and consumer electronics. Laser marking is widely used in semiconductor manufacturing here and is gaining popularity in other manufacturing sectors, and emerging next generation products.

Malaysia, a former British colony, consists of West Malaysia, which is the peninsular part that is south of Thailand, and East Malaysia, which is the northern part of Borneo. It is a multiracial country with a population of about 26 million, of which 65 percent are Malay, 26 percent Chinese, and 8 percent Indian. With its rich cultural heritage and regional and western influence, the diversity of the cuisines makes for a gastronomic heaven, but we shall not dwell on this topic.

The Institute for Management Development (www.imd.ch) ranks Malaysia as the fifth most competitive country, even ahead of China. Its relatively low labor cost and attractive business environment have made it one of the preferred contenders for off-shore business. Malaysia’s electronics industry started in the mid-1970s, and it is now a leading exporter of semiconductor chips, computer hard disks, audio video products, and room air conditioners (see www.statistics.gov.my).

Laser applications

Several multi-kilowatt lasers are used in sheet metal cutting by sheet metal suppliers and stainless steel component suppliers. There is a growing local automotive manufacturing and assembly industry, but lasers are not considered a standard processing tool, unlike North American, European, and Japanese automotive manufacturers. Hence laser welding is not common with the automotive manufacturers, but more popular with the CRT or electronic component manufacturers.

Marking is the major laser application in Malaysia. In the 1990s, hundreds of laser markers were used in the local semiconductor and disk drive industries for marking wafers, chips, and components. These marking applications have more or less matured. With the migration of part of semiconductor manufacturing to China, this sector is not a growth area for laser applications here. However, laser use is spreading to other manufacturing sectors.

Malaysia has no local laser manufacturing although approximately 1000 markers are in the semiconductor area alone. Some assembly of mechanical systems is carried out locally. For example, LKT Automation (www.lkta.com.my), a local automation system supplier to the worldwide semiconductor industry, supplies laser marking systems as a subsystem specification for its customers. Lumonics introduced laser marking of semiconductors and components in the 1980s but is no longer active in the field; NEC pulsed Nd:YAG lasers followed but laser marking for semiconductors is now dominated by Rofin-Sinar (www.rofin.com) and EO Technics (www.eotechnics.com).

Nevertheless, other laser manufacturers have established a presence in Malaysia. The nearest laser manufacturer, Hylax, is located in Singapore (www.Hylax.com). Excel Technology Asia (www.Excel TechAsia.com) has its regional applications center in Penang and a satellite operation in Kuala Lumpur, using Quantronix (www.quantronixlasers.com) lasers. These two companies, unlike the other laser manufacturers, provide local support of their products. Let’s examine how Excel Technology Asia and Hylax compete effectively against the established laser manufacturers.

Excel Technology

Excel Technology Asia is a unit of Excel Technology Inc., a multinational corporation that owns Quantronix, Synrad, Continuum, and several other laser processing system manufacturers and optics companies. P.C. Ooi, Excel Technology Asia president, was instrumental in establishing the company in December 1999 in Penang, where many manufacturing companies in addition to most of Malaysia’s semiconductor manufacturing are located. Being a local but with experience in both the U.S. and Malaysia working for Lumonics, he understands the conservative and risk-averse nature of the local companies. This is in contrast to the highly adaptive companies in China that are very receptive to new technology (see ILS January 2003 and April 2004). Consequently, the 8500-sq-ft facility is geared towards assisting local companies in adopting lasers in manufacturing as well as selling laser systems and offering job shop services.

Ooi has a staff of 14 and a facility that is well equipped with lasers in the 100W range with wavelengths from deep ultraviolet to near infrared. Special applications systems for deep engravers and micromachining lasers are also available. The company is well equipped to optimally process most materials with an emphasis on marking applications, deep engraving, or two-axes micromachining. Bolstered by the U.S.-based technology, these systems assist the sales division to find or develop replacement laser process technology as new alternatives for traditional manufacturing processes. The need to be able to demonstrate such processes to assist decision making on new technology and the flexibility to address new laser applications later with upgrade options often justify these investments.

According to Ooi, the facility also offers laser job shop services to potential entrepreneurs if they are unable to incorporate laser-related processes in their manufactured products because their startup volumes are inconsistent, or because their existing facility lacks the infrastructure or the semi-skilled resources necessary to own and maintain a laser. “We provide opportunity to entrepreneurs, who fear investing in new process technology, to be exposed to the technology without taking the risk of investment,” he says.

A satellite 1800-sq-ft operation with process evaluation capability, marketing and sales, technical support, and job shop capabilities in Kuala Lumpur started operation in late March. According to Ooi, “Excel Technology Asia’s role in providing unique facilities to promote and advance lasers in manufacturing in Southeast Asia and China is our way of becoming the best laser solution provider in Asia-the bridge between Asian manufacturers and western cutting-edge solutions.”

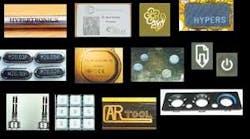

He commented that marking is the major market in Malaysia addressing diverse manufacturing fields. Deep engraving is a developing market with the availability of higher power and intensities (see Figure 1). Other applications like photomask repair, in which Quantronix is well established, are concentrated in Taiwan, Singapore, Japan, and more recently China, these countries having the bulk of the semiconductor manufacturing. Examples of recent successful and high (quantity) output applications include two-dimensional matrix marking of disk drive components for traceability and engraving part or serial numbers on miniature model cars where a single Nd:YAG marking system, running three shifts, marks 50,000 parts/day. Another successful application is the ablation of automotive panel buttons for illuminated display found in the front instrumentation panel (see Figure 2).

Hylax

Hylax Hypertronics started as a laser (markers) distributor for NEC in 1991 mainly for the semiconductor industry. With funding from the Singapore government the company developed a diode-pumped system in 2000 and fiber-coupled end pumping in 2002. It is the first laser manufacturer in SE Asia and markets its products to China in addition to countries in the region.

Malaysia is a major market with more than 70 installed marker units using sealed CO2 and Nd:YAG lasers. Hylax has sales offices in Penang and Kuala Lumpur, with each office having two engineers who provide marketing and engineering support. Fon Wai Kin and Yeon Ng represent the Kuala Lumpur office and assisted the author in preparing this article.

Hylax targets the same markets as Excel Technology, which include semiconductor, plastics, automotive parts, and jewelry. Metal marking using Nd:YAG lasers is a major application for identification of components such as cans, tooling, and jewelry (see Figure 3). CO2 lasers are used for marking and trimming of plastics and semiconductor components.

Hylax competes with established manufacturers through lower pricing, local technical support either onsite or in Singapore, and a quality product being an integrated manufacturer. It provides mainly diode-pumped lasers of its own design for the near-IR and sealed CO2 lasers from a third-party manufacturer. Green and UV lasers are under development internally but are available from a third party. The company’s emphasis is on compact, low-maintenance, high-performance systems.

Conclusion

Malaysia’s ongoing industrialization program provides incentives for local manufacturers to adopt high technology. Lasers that are imported are not taxed. Although the lower cost of labor and the size of the market in China have affected Malaysia’s semiconductor industry, manufacturing in Malaysia is still vibrant. There is a growing local automotive manufacturing and assembly industry in addition to semiconductor devices, computer hard disks, consumer electronics products, and room air conditioners. Adoption of laser processing in many of these industries other than semiconductors and disk drives are just starting.

There are already several hundred installed markers in non-semiconductor areas in addition to approximately 1000 in semiconductor and disk drive sectors. With facilities such as that of Excel Technology Asia that eases the adoption of laser technology, we see continued growth in the use of markers in non-semiconductor areas. The automotive industry should be a good driver where increased adoption of laser technology to world standards will provide growth in laser cutting, trimming, and welding in addition to the widely used marking.

The stable government with a local environment of relatively low wages, attractive tariffs, common English, and familiarity with western business practice, coupled with increasing local demand will continue to attract both local and foreign investments in manufacturing. With competition being worldwide, we expect that laser processing will be a vital component in increasing manufacturing competitiveness in Malaysia.