Solar industry laser spending to top $300M

Continued capacity expansion across the solar industry during 2010 is providing rich pickings for the equipment supply chain. Not only are top tier cell producers sold out to year's end, but they are fast-tracking both new fab build during 2011 and existing line upgrades for higher efficiencies. As a result, the opportunity for tool manufacturers selling into the solar industry remains one of the most lucrative market sectors on offer today.

Laser-based tools command a somewhat elevated status, compared to alternative tool types used within the solar industry. This is due to the range of applications they can fulfil across different process flows and cell types, and throughout the value chain from substrate to final panel build. The first thing to note though is that there is no obvious "killer" application for laser-based tools offering potential revenues in excess of $500M/year. There is, however, a diverse range of options comprising the overall addressable market, which suggests there is excellent scope for different laser source and tool suppliers to co-exist, each with significant revenue return.

Typically, solar manufacturing is split up by the different value chains for crystalline silicon (c-Si) and thin-film panels. Equipment used within materials supply (silicon, glass, etc.) is then separated out. This restricts the c-Si equipment value chain to the wafer/cell/module midstream stage and thin-film manufacturing to a front-end part (deposition, patterning) and a back-end section (module encapsulation). Applications for laser-based tools also fit neatly into this segmentation.

The addressable market for laser-based tools within the solar industry is actually comprised of several different segments: academic R&D, collaborative academia/industry funded projects, commercial in-house R&D lab pull, pilot-line construction (both cell makers and equipment manufacturers), and production tools used in mass production. During the past few years, the revenues offered from the non-production segments have provided a range of opportunities for tool makers, in part due to the strong process development carried out for incremental improvements to the standard means for cell and panel production. As the solar industry grows, however, these components will decrease in relative size and tools for fab implementation will constitute by far the greatest opportunity for laser tool builders. Therefore, dissecting reported equipment spending into 'production-line integrated' and 'all-other' categories enables a much clearer understanding of laser tool adoption within the solar industry as a whole.

Equipment spending

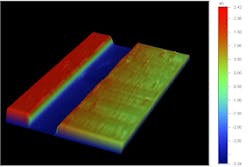

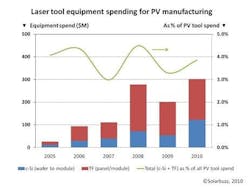

FIGURE 1 represents equipment spending for each of c-Si and thin-film cell types when restricted to fab production lines between 2005 and 2010. Laser based tooling is defined as the complete drop-in turn-key subsystem, typically including the laser source, the beam delivery and scanning components, and substrate (wafer or glass panel) handling. With laser tooling the de facto tool choice for thin-film patterning during a-Si/mc-Si and CdTe production lines, it is no great surprise that spending for thin-film dominates the picture here. The dip during 2009 is not so much a consequence of any macroeconomic knock-on effect, but a reflection of a change in equipment spending trends observed during this time period. First, thin-film equipment spending reached a somewhat artificial peak during 2008 with the heightened demand then for large glass panel turn-key a-Si fabs, and for c-Si cell production. Wet chemical etching started to replace laser-based scribing as the preferred tool choice for laser edge isolation within leading cell makers in China and Taiwan. Removing the peak from the 2008 laser-tool equipment spending shows a flatter growth curve indicative of the industry's gradual acceptance of laser-based tooling across a wider range of process steps.

Equipment spending for 2010 looks set to pass the $300M level for the first time. The drivers here are somewhat different than the applications highlighted above. Within c-Si cell production, edge isolation no longer dominates: rather, several selective ablation processes are being performed within production, including passivation layer mask forming on front and rear surfaces, in addition to rear contact isolation and through via drilling as wrap-through cells start to show some signs of market penetration. Laser tools are also finding widespread application for secondary diffusion (through induced melting of precursor layers) during c-Si selective emitter formation.

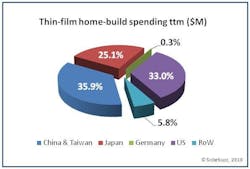

The thin-film pull too has shifted: from the large glass panel turn-key fabs to the plethora of a-Si/mc-Si home-builders emerging across the Asia Pacific region. FIGURE 2 illustrates the regional percentage breakdown for equipment spending for the trailing twelve month period at the end of 3Q10 for home-built thin-film production lines. In contrast to the large panel turn-key fab spend during 2008, the opportunities for low volume sales are much greater today especially as end-users start to dictate the tool specification with increased ownership of their supply base. New applications for laser-based tools exist, too, within the different types of R2R process flows adopted by tier 2 and tier 3 players seeking to move from pilot to mass production status.

While laser tool equipment spending is predicted to maintain strong double-digit growth rates moving forward, the relative standing of laser processing within the solar industry can be illustrated best by noting that the spend on laser tools has remained consistently at 3 to 4% of overall industry equipment spending. And a separate analysis of tier 1 cell producers (who account for greater than 90% of production output today) reveals even lower percentage shares assigned to laser tools. This aptly sets the scene for laser tool suppliers moving forward: plenty of opportunities but a great deal of competition (and scepticism) from established tool types (screen printers, etching tools, etc.) and alternative approaches looking for market entry (inkjet printers, ion implanters, etc.). Diligent customer and supply-chain selection will become a prerequisite for success far more than before, together with a better understanding of the complementary features of upstream and downstream process steps within the different fab types. But with the market share for laser based tools spread across a wide range of suppliers today, the scope for both revenue growth and tool supply leadership remains more attractive than ever before.

Solarbuzz, owned by The NPD Group, is a globally recognized market research-based business focused on the solar energy and photovoltaic industries since 2001. Solarbuzz clients include many of the largest global PV manufacturers, together with major investment banks, equipment manufacturers, materials suppliers, hedge fund companies, a wide range of other multi-nationals considering participation in this industry, and the largest PV system integrators. Solarbuzz offers a wide-array of reports, including Marketbuzz®, an annual global PV industry report, and Solarbuzz QUARTERLY, which provides historical and forecast data on the global PV supply chain. The company's research also provides annual Downstream PV Market Reports by region for the European, Asia Pacific and US markets. In addition, Solarbuzz.com is a recognized and respected online resource for the solar industry.

About the Author

Finlay Colville

Dr. Finlay Colville has been Head of Research at PV-Tech and Solar Media Ltd since 2015. Before this, he spent 5 years as VP and head of solar at market research firm NPD Solarbuzz, and 10 years in various sales and marketing roles at Coherent, Inc. Dr. Colville holds a BSc in Physics from the University of Glasgow and a PhD in nonlinear photonics from the University of St. Andrews.