Markets keep getting better

ILS collects industry marketing and sales data and information from a multitude of sources through a variety of methods. While the annual review and forecast conducted with Laser Focus World, is a prime resource, we find that personal contact, especially in these days of regulated public company statements, is the most efficient and effective. This year we relied heavily on contacts, speaking directly to representatives of industry suppliers, at major trade shows and significant technical conferences; this in addition to the routine contact we have with industry sources over the course of the year.

When all is done it falls on us to make sense of what was heard. Comparing raw numbers with published financial reports from certain of the industry’s largest companies gives credence to verbal comments we receive from the market participants. And then there are published reports from the user industries, which act to verify comments on the prospects in key market sectors.

Results of this substantial information gathering, summarized and analyzed, appear as the Annual Economic Review & Forecast. Although we act as the reporter of the data we also exercise some oversight based on 20 years of reporting on the industrial laser market.

As we began this analysis of the industrial laser market it seemed that making predictions was a little like writing the messages that appear in modern Chinese fortune cookies; no longer Confucian wisdom, but more New Age pop philosophy. One’s confidence in the message depends on whether it resonates with their current situation. But, let’s face it, fortune cookies are fun, regardless of positive or negative messages; and this was the thinking behind the cover image of this issue.

However, as the numbers came in and we tallied all the data we came upon an interesting underlying message in the cover image. Asia continues to show strength as a global market for industrial laser products. Granted the comparable numbers are close enough to be covered by error bands, but the significance is that in the past 10 years, industrial laser installations in Asia have expanded from 32% to 37% of the total units installed in a global market that has increased more than 180% in the same period. Perhaps ILS was prescient when we developed the cover concept.

A year ago, when the 2006 market forecast was developed, high single-digit growth was anticipated for an industry that had a 36-year history of compound annual growth rates in the teens. This was done with full knowledge that some readers would see this as an indication of overall market softening. Now, having had time to consider the accumulated data, we find that two significant factors were responsible for keeping the 2006 growth rate numbers just below the double-digit level.

First, 2006 was an off year for industrial laser purchases by the world’s auto companies; not because of lack of interest but because of a lull in the platform introduction schedule. If the auto industry had purchased at the rate experienced over the past five years, the 2006 growth rate could have approached 10%.

Second, the hot product of 2006, fiber lasers, has yet to find and satisfy a preeminent application that will add significantly to overall laser industry sales rather than to shift buying from competing laser technologies, which is the current situation.

Thus we think the laser industry should be quite satisfied with the 2006 results. Certainly those at TRUMPF (sales up almost 18%), Rofin Sinar (12% increase), Coherent (13% increase), Han’s Laser (28% increase), Amada (~19% increase), and IPG Photonics (6 month sales up 56%) are indicative of a strong global market for industrial lasers.

Sifting through all the data, including a batch of anecdotal information from a multitude of laser product suppliers, leads us to conclude that 2006 was, overall, a good year. The aforementioned high sales reports from industry leaders support this. Interestingly, at the midyear point, where ILS traditionally informally surveys industry leaders, we had confirmation that 2006 systems sales would show growth but that growth would be modest.

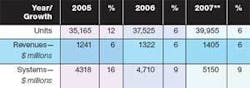

Table 1, a three-year summary of combined industrial laser sales, shows that laser unit sales and revenues in 2006 grew 7% over 2005 and system sales revenues grew 9%. The latter increase reflects higher selling prices as users purchased systems that offered more automation capabilities. (ILS defines a laser as the laser, power supply, cooling equipment, and related controls and a system as that plus any motion systems, load/unload, and automation peripherals. From 1970 through 2006 the compound annual growth rate (CAGR) for industrial laser unit sales revenues is 19.9%.

In 2006 industrial laser system sales surpassed the $4.7 billion level, led in no small part by TRUMPF whose share of this market is 22%. Since we began tracking system sales in 1991 the CAGR has been 9.87%. Compare this to global machine tool sales in the same period, 1.3%, a figure that includes laser sales.

Tables 2-4 are the standard format by which ILS presents a review of the industrial laser market. In 1989 we established the practice of reporting on laser unit sales because the supplier industry, at that time, began to share this data with us. At the same time we began to use suppliers’ price list information to average unit selling prices. In 1993 we began reporting our estimates for the laser systems business based on a set of multipliers that we evolved from supplier sources. We have continued this practice, adjusting our multipliers as systems became more powerful and complex over the years.

Last year we changed the Tables by adding a category for fiber laser sales. This was done to more accurately reflect this disruptive activity in the market. Readers can combine fiber and solid-state laser numbers to get an accurate picture of the total solid-state market. This year we have added ultrafast-pulse lasers to our radar screen and, although total numbers are currently small, we think they deserve to be tracked, although not yet given their own category. These are combined into solid-state sales in Tables 2-4.

Year in review

A good but, for some suppliers, not a great year is the view of the 2006 global market. Simply meeting 2005 levels and then adding another 7% in laser sales and 9% in systems revenues is a significant accomplishment because the 2005 growth rates were higher than anticipated.

Market growth in Asia was led by resurgence in Japan where a 12% increase in domestic installations and an 18% increase in domestic unit production were featured. China, still an engine driving laser production and sales, has calmed down from the overheated sales of prior years and in 2006 experienced the same growth rate as the previous year. Elsewhere in Asia: growth continued at prior years’ levels in South Korea and there was considerable action in the metal cutting market in India. Appearing for the first time was news of activity, albeit very preliminary, in Vietnam, a country seemingly on the move to compete with China as a low-labor-rate manufacturing competitor.

In Europe, Germany, the major market for industrial lasers, returned to the growth mode and improved sales in the Benelux countries, Spain, and France added significantly to overall sales. Italy, Switzerland, and the UK showed lower growth rates, offset by increasing sales in the Eastern Europe sector. More than one source suggested to ILS that the acceptance of new nations in the European Union stimulates investment in those countries so that they are becoming a factor in unit sales volume.

In North America laser sales held their own at 2005 rates, an unusual result considering that the housing market experienced a severe drop in new starts and the domestic auto industry made minimal investment in new laser equipment as that industry is in the middle of major platform changes in 2007. Countering this was the continued strength in the defense sector, where laser sales grew significantly as a result of massive government spending.

Increasing activity in Central and South America, now counted in ROW sales, causes ILS to consider adding these sales to those in North America in a new category for next year called America. Other sales into the ROW category continued at the pace of the previous years.

Reviewing the numbers

Table 2 shows an overall increase of 7% in the production of industrial lasers. A 14% decline in solid-state lasers was more than offset by a 57% increase in fiber lasers. For the first time ultrafast-pulse lasers are added into solid-state unit production, so that the total share for solid-state production is actually 40%. As stated earlier low-power fiber lasers continue to be an alternative to lamp- and diode-pumped units, taking significant market share, especially in the marking laser sector. CO2 laser sales grew 9% and, because of the large number of low-power units built, these lasers represent almost 60% of all industrial lasers produced. High-power diode and excimer lasers grew at a 16% level, a trend now apparent for the coming years.

Laser revenues, Table 3, reflect two factors that held growth to 7% overall. First there continues to be strong selling price pressure, especially in the low-power CO2 market. And the strength of fiber lasers in the market causes competitive suppliers to aggressively counter with creative pricing policies. Meanwhile fiber laser pricing seems to have held firm. In this low-power market sector it takes a lot of unit sales to dramatically alter sales trends.

On the other hand, any movement in the high-power, high-selling-price sector can dramatically change total revenues. Such was the case in 2006 where strong sales growth in unit sales, easily 10%, in the sheet metal cutting market can mean an increase of 3-4% in laser revenues. This is one reason why ILS tracks the fabricated metal products market for economic trend changes.

Returning to the issue of unit selling prices, ILS has noted that a combination of technology innovations, competitive pressures, and market influences (the demands of OEM integrators) have effectively held unit prices in check against inflation. And yet the major laser suppliers have reported excellent sales numbers for 2006, suggesting that volume has finally become an industry factor. In the words of some obscure pundit, “the big get bigger,” and more appropriately in the words of a major supplier, “we are obviously gaining market share.”

A 9% increase in laser systems revenues, Table 4, was led primarily by increased installations of sheet metal cutting systems, with some assistance from higher-than-expected sales of excimer and high-power diode systems. Other than the usual pressures from the market, system builders have been able to sustain unit selling prices, but because these units are asked to be more productive there has been an increase in unit selling price. ILS conservatively estimates total system sales because we use anecdotal information to establish average selling prices because many of the leading suppliers are multi-divisional companies that do not break out laser sales.

ILS assumes that almost every laser sold ends up in a system, that is, the replacement market is small and negligible when total unit production is considered. On this basis it is important to keep in mind that almost 50% of all lasers end up in marking/engraving units that carry a relatively low selling price. So the total number of laser marking/engraving systems installed in 2006 is slightly over 22,000 units with a dollar value of ~ $800 million. With more than $2.0 billion of laser metal cutter systems sold, these two applications represent about 60% of the total system market.

The details

Figures 1-6 present the reported sales and market data as analyzed by ILS. Figure 1, location of laser production, shows that North America, at 51%, continues to be the world leader because more than 80% of low-power CO2 units are produced in the United States, as are 87% of fiber lasers and significant volumes of low-power solid-state lasers. Europe leads in the production of high-power lasers, while China and Japan concentrate on low-power solid-state and CO2 lasers, with Japan holding a significant share of the high-power CO2 business.

The picture changes when looking at revenues where the selling price of high-power lasers vaults Europe to a 46% share. The sheer volume of lower-power units made in North America has this region at 32%, an increase of 2% from 2005. The Asia share remains steady as the product mix is heavily loaded with low-power, low-cost units.

Figure 2 breaks out unit production shares by region and by laser type, with North America gaining market share through the increase in the number of low-power CO2 and solid-state lasers manufactured and the presence of the largest supplier of fiber lasers. The “Other” category includes high-power diodes and excimer lasers.

Where revenue ends up is always a conundrum in this economic review. We have taken the position that all revenue eventually flows to the headquarters location. So while a multi-divisional company may report 25% of its sales in one country, we consider that this amount should be credited to the corporate location in a different country. Besides, few companies break out sales details that would allow us to track point-of-manufacture, even if we could. We have been consistent with this approach since these reports were first published. Thus, in Figure 3 Europe dominates in terms of sales revenue except in the fiber laser category, because it is home to major suppliers such as TRUMPF, Rofin Sinar, and Bystronic. North America gained 4% in solid-state revenues based on good performance by the leading supplier of fiber lasers.

Figure 4 is our attempt to quantify where all these industrial laser systems are installed, by tapping published annual reports and personal contacts among the leading suppliers. For the second year in a row, thanks to improvement in the Japanese economy, Asia holds the honor as the largest market for industrial laser units, with Europe a close second thanks to increasing sales in the Eastern European countries.

Because the applications picture showed little change in 2006, market segmentation remained about the same as the previous year, as shown in Figure 5. Marking/engraving slipped a point but not as a result of process usage but more a reflection on increases in laser metal cutting, welding, and microprocessing. The latter gained strength as the semiconductor industry shifted out of the doldrums leading to order increases in circuit adjustment and mask alignment systems, and new markets for micro-scribing in solar cells began to produce process demands.

Close to $2 billion of laser powered sheet metal cutters were sold in 2006, making this market sector the most important in terms of revenues. Market shares increased in North America where some suppliers had sold out their 2006 deliveries before the end of the year. At the mid-year ILS surveyed the suppliers and came up with a projection of 850 units. As the year came to a close, reacting to reports, we increased that number to 900 units. Increased sales in Japan improved their share by two points.

The future

As the year starts expectations are that 2007 should be a repeat of 2006. Unit sales should be close to 40,000 with revenues crossing the $1.4 billion level, and systems revenues should crack the “magic” $5 billion mark rising to almost $5.14 billion. Our sense of the markets this year is that key sectors-metal cutting, marking/engraving, and microprocessing-will continue to show growth and, because these three sectors represent more than 80% of global applications, achieving these goals is reasonable. For this we didn’t need a fortune cookie.