Job shop industry retools

A combination of factors has caused job shops to reposition for future growth

It’s been more than two years (May 2005) since the last ILS review of the job shop industry in the United States. A little self-praise, ILS is the only known public resource for this type of report. At that time the market for laser processing services had recovered from a serious slump and companies offering these services were optimistic about the future, even though there were some concerns about off-shore competition and the high cost of metal. This year we surveyed the entire ILS database and, while the return numbers were low (we are getting used to this industry’s quirky disregard for surveys), we received enough responses, supplemented by personal discussions, to at least get a flavor for the attitudes in the industry.

A majority of respondents indicated they expected revenues for 2007 would be greater than 2006, due primarily to increased business in laser processing, and not due to any pricing impact resulting from material costs. Our survey of almost 1700 shops included laser-only shops, sheet metal fabricators, and other companies offering contract processing services. So we tallied responses from those that are heavily involved in laser processing, assessing how this service affects their company, and most said it was 50% or greater of annual revenues. A note is in order here; at some companies the laser activity is only a small portion of overall shop activity so we eliminated those on this question.

This year companies tended to cut back on laser operation hours by running extended two-shift operation or by extending single shifts on an overtime basis. At the time this survey was conducted, several respondents indicated they were coming off a slow first quarter with solid second-quarter performance. Our analysis is that, while business is good generally, it is spotty and adjustments in shifts and hours are being used liberally to compensate for order fluctuations. Several respondents, those that have major customers, did tell us that they were running full bore, 24/7 to meet customer demand.

Because we received responses that suggest 2008 business will either stay the same as this year or increase, we weren’t surprised that a majority of those answering our question on equipment indicated they will increase laser capacity next year. Again the more bullish were the companies with major customers representing more than 50% of their workload. Almost universally, respondents indicated that the number of customers served in 2007 had increased.

Perhaps the timing of the survey, end of the second quarter, was responsible but we received an assortment of responses to factors affecting a shop’s laser business; availability to find and retain skilled operators, raw material costs, increased local competition, customer pressure on quoted prices, and laser capacity. What did not seem as important this year was the effect of off-shore competition, specifically in China. Several shops commented they had seen work returned to them from earlier outsourcing based on poor quality and slow turnaround time. We also heard this from a number of companies we visited, so we can surmise that the great fear of off-shore outsourcing for job shops has been eased by astute domestic shop management, improved equipment productivity, and problems customers have experienced with off-shore suppliers.

The ILS database of shops offering laser processing services comprises those companies that, in the past three years, receive this magazine. From this a much smaller number return information for a free listing in the Job Shop Buyers Guide, a situation we have experienced for the past three years, although the mix of companies changes yearly. We don’t know why this industry reacts this way to a free listing, but we have grown (somewhat) used to it.

In the United States, according to an unpublished resource we maintain, there are more than 4100 companies offering some form of laser processing services: sheet metal fabricating, laser-only, marking, rapid prototyping, prototyping, die board cutting, and others such as machine shops and manufacturers offering some cutting services. Figure 1 shows the demographic breakdown of these shops in the 50 states and Puerto Rico taken from this source’s data. This is a 10% increase from the 2005 report, and it returns the job shop base to pre-recession levels of 2002.

California is joined by Ohio and Illinois this year in the category of states with more than 300 shops, actually the first two have more than 400. Pennsylvania and New York moved up to the 201-300 shop category this year, and Tennessee moved to the 51-100 level while little Rhode Island shifted into the 21-50 category.

A look at the map shows the strong position of the Southeast now where six states represent 12% of the nation’s shops, gained mostly in the last few years. Of course, this pales in comparison to the seven Great Lakes states that tally 42% of the total. States that experienced a proportionally larger growth rate were: Pennsylvania at 38%, Florida at 33%, Missouri at 23%, and Washington at 17%.

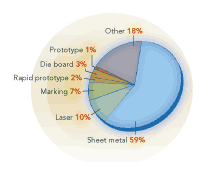

The shop descriptions established by ILS years ago remain: shops with more than 50% of their annual revenue from metal cutting are called sheet metal shops and, as shown in Figure 2, they represent 59% of all laser systems sold, mainly CO2 laser powered, down 1% from 2005. Laser shops, those that operate only laser systems, jumped 110% over 2005 to a 10% share of the total market. However the trend to these shops offering more than laser processing services to remain competitive continues, and we may have to consider reclassifying some of these in the next report.

Marking shops, those shops offering 3D prototyping services, and shops cutting die board remained at 2005 shares, and rapid prototyping grew 20% over 2005 but actually dropped market share this year. The trend with these shops now is to offer rapid manufacturing services on small-volume orders. The “Other” category, a catch-all for the other shops that offer some laser processing services, dropped 12% to an 18% share of the total market.

The above referenced shops operate more than 7000 lasers, up 17% over 2005 segmented as shown in Figure 3. The number of shops operating three or more laser systems grew 14% over 2005, a somewhat deceptive number when looking at lasers per shop comparison due primarily to the large number of single-laser shops entering the market in this period. If, as ILS has heard from the system suppliers, a significant number (~50%) of first-time users will, in a short time, purchase a second unit then the multiple-unit numbers in our next report will increase dramatically.

So what types of lasers do the shops use? Figure 4 reflects the dominance of metal cutting shops in the database with these shops using mostly high-power CO2 lasers, up 58% from 2005 numbers to an 88% share of the market. Solid-state lasers experienced a 10% growth from 2005 but dropped to a 6% total share. Shops using both CO2 and solid-state grew 6% but dropped to a 5% market share while excimer laser use remained constant. We have said it before and we’ll repeat it again. An installed base of more than 7000 lasers is a healthy market for the suppliers of replacement components such as: beam delivery optics, gas jet nozzles, and laser and assist gases.

The number of employees in job shops gained about 7% over 2005 to an estimated 150,000. We say estimated because we used averages from the data in Figure 5 because the shops tend not to share employment numbers. There were no significant changes in the number of employees per shop over the 2005 report.

Establishing a verifiable number for the total laser processing business in the U.S. is difficult, so ILS has used a formula for several years where we estimate the average revenue per laser system per shift and extrapolate to a total. This year we estimate that the laser processing business totals about $5 billion, up 15% over the 2005 report. Keep in mind that we are tracking laser processing revenues only so shops that gain 50% of revenues from laser processing are obviously doing much better in total revenues. We acknowledge this number is conservative, but because we have used the formula for years it is a traceable trend.

After we had completed this year’s survey we continued to ask shop management we interact with about their business. Apparently a slow third quarter affected many shops that rely on laser processing for the majority of their revenues. Shops that also either make a product or supply to major customers have had a prosperous third quarter. So on balance we see mixed results for the U.S. laser job shop industry. If we can generalize-shops with multiple lasers seem to be finding more business opportunities, and those shops offering additional services, such as welding, assembly, painting, and so on, are enjoying increased business.

A trend we have noted for several years now is that laser processing shops have had to diversify to continue business growth. There are a multitude of shops in the high-density manufacturing regions of the U.S. so those with broader capabilities are gaining market share at the expense of laser-only shops. This is a trend we expect to see increase in the coming years.

And finally a word about the job shop industry in general. It is a dynamic business that is subject to the vagaries of the overall manufacturing climate in North America. A glance at the map in Figure 1 will show where the action is. Currently we have been hearing rumbles about that dreaded “R” word. Having survived countless business cycles, we always anticipate another slow down will eventually occur, however rarely in election years. In our contacts with the job shop industry we have not received any indications of a slow down, even though the financial and political pundits seem to be sensitive to this. So we are assuming 2007 will end on a positive note and the first half of 2008 will remain solid.