Keeping the economy in perspective

Years of experience observing the industrial laser market lead to the conclusion that this mature industry will survive economic hard times

by David A. Belforte

So what do you want from me? My crystal ball has a crack in it from overload of really bad economic news. The figures and numbers have disappeared from my Ouija board because of excessive planchette movement as I searched for inspiration from the "other side." The Delphi Oracle has taken a long leave of absence so that I can't bother her anymore, and there are no pictures left on my Tarot cards. Over the past few weeks my mood has had more ups and downs than the roller coasters at Six Flags. Resources I have used in the past have stopped answering my e–mails and phone calls looking for confirmation on the latest perturbations in the markets. My file of bad news clippings trumps the good news files by several inches. And you're expecting a balanced and presumably accurate assessment of the market for industrial lasers in manufacturing?

As the head chef on the Titanic may have said, "It might have been worse; it could have happened before dinner was served," proving that one can always find something slightly positive in a definitely negative situation. It all depends on your perspective.

As this report was being prepared, seven weeks ago, I was a little like the chef, looking for slivers of light in a rather dark environment. Encouraged by contrarian reports from several international machine tool trade shows, there wasn't surprise that the initial market estimates for 2008 were only a few percent lower than projected last January, and that the 2008 numbers would reflect growth.

A glance at Table 1 shows that results in 2008 continued the growth trend for the past 16 years, a 13.5% CAGR for industrial laser system revenues. It also shows the projected results for 2009 could represent only the second year of negative growth in reports since 1970. And now for that sliver of light—2009 projections for laser revenues are 1% higher than 2007 and system revenues may only be 2% lower. And 2007 was a very good year for industrial laser revenues.

There is generally consensus about the economy in the United States, confirmed by the Federal Reserve Bank—it's in recession. In some sectors, such as the housing industry, it's been there for many months. The first half of 2008, except for a laggard recovery in the semiconductor industry, perked along at 2007 rates for the industrial laser sector, even though reports reflecting the rapidly rising global energy costs began to appear in the world press. Examples in the headlines: "U.S. industrial production drops in February," "Dismal factory orders report raises recession fears," and "Industrial new orders down by 3.6% in Euro area."

As the months went by the headlines became more strident as other economic worries appeared on the horizon: "Eurozone industrial output slumps in May," "High fuel costs delay airplane orders," and "Recession fears loom over UK economy."

As the summer drew to a close the headlines brought gloomy news almost daily: "Global manufacturing at a five–year low" and "Germany's manufacturing suffers steep drops in orders." Quotes in economic reports appeared: "Spain and Italy saw new orders fall at the steepest rates since December 2001," "Near stagnation in Italy," "Russian inflation may accelerate to 14% this year," and "Japan lowers economic assessment."

In the third quarter it was "U.S. industrial output plunges" and "Manufacturing index shows sharp decline," while internationally it was "China's economic boom is slowing," "Japan's core machinery orders down sharply," "German industry output falls by 2.4%," and "British manufacturing output slides," all perhaps topped by "U.S. slowdown impacting industrialized regions."

Is it no wonder that exhibitors at the three major third–quarter trade shows featuring industrial lasers were apprehensive about prospects for success? What transpired at these shows confounded the experts as each produced highly optimistic reports of strong attendance, high–quality and volume lead generation, and, above all, orders. In dozens of interviews ILS conducted at the shows, verifiable on video located on the ILS Website (www.industrial–lasers.com), equipment suppliers expressed optimism about meeting 2008 revenue goals and less confidence in prospects for 2009. Summed up, ILS reported that the most optimistic view of 2009 was for a repeat of 2008 (effectively a no–growth year) and a more pessimistic single–digit decline in 2009 sales.

Spreading the interview process to global contacts, it became apparent that the major bugaboo for all industrial laser marketing managers—how to market products to a diverse industry base—had a reverse twist; diversity spread laser sales across many industries, producing active niche markets. And, many of these niche markets appeared to be somewhat recession proof—for example, medical device manufacturing where an aging population, demanding more and better health services funded by government medical plans like Medicare in the U.S, were causing new and sophisticated procedures to be developed, many of which required laser processed components. And it happens that this niche market is a major user of lasers for welding, drilling, ablating, and marking applications.

Other markets that seem to be defying recession are in the marking sector where legislative–directed component identification for traceability is becoming a mandated requirement. An example is the recent U.S. Department of Defense Unique Identification (UID) standards to assist in asset identification. Laser marking of 2D matrix codes is a byproduct that will require a number of laser systems regardless of current capital equipment restrictions.

World demands for food products are driving a spurt in the global agricultural equipment markets, which seem recession proof based on the assumption that people have to eat. Currently that industry seems to be resilient to economic stress as it is hard pressed to meet demand with current production processes and lasers are key to producing the products that aid in attaining more productivity.

A range of industry sectors that seem to defy recession effects may also boost laser equipment sales. A few are: building of double–hulled ocean tankers, supply of military aircraft engines, petroleum drilling off– and on–shore, introduction of new auto body designs to meet energy reduction demands, and laser processing of hardware used in the defense industry.

In a "surprisingly" optimistic report on the health of industrial automation, the ARC Advisory Group notes, "…most automated investments are planned well in advance and designed to support long–term growth and cost reduction plans, and are often therefore less vulnerable than other spending to short–term economics." Because industrial lasers are a part of many automated systems, suppliers can take heart.

Combined, these sectors seem to be recession proof and of a size to attract investment of capital for improvements in manufacturing. Each is not a major factor but taken together they represent a significant piece of the annual laser materials processing business.

The point is that this diversity of markets is partly responsible for the success of many laser companies in the second half of 2008. We heard it many times from exhibitors at trade shows, and may just be a major contributor to sales in what is expected to be a difficult year in 2009. This diversity in niche markets is often cited by industry marketers as a reason their company has outperformed analyst expectations. It isn't just the big sectors, sheet metal cutting, for example, that are market drivers, and it is the combined effect of these many small market niches.

Year in review

Optimism reigned when the ILS annual report appeared in January last year; as stated then "…2008 should emulate 2007 growth at about 6%. Barring any unforeseen economic reversals…" This statement was based on: growth in the Asian market (led by heated activity in China and India and an increase in microprocessing in Japan), growth in European sales led by developing industrialized nations, and a slight increase in North American sales prompted by strength at the other NAFTA partners. That was before the cost of oil leaped to $150/barrel and the attendant slow down in global economies. With one of the biggest being the post–Olympic revelations from China where an overheated economy lost steam.

Through the first half of 2008 news from the industry was mostly positive, but as the months passed small hints began, initially from the job shop industry where reports of random slow monthly sales were heard. Not enough to cause concern because these down months were generally followed by a return to normalcy. But the laser suppliers took note and eventually they recognized that the planned expansion for the year was likely not going to occur. As stated, the positive fallout from the big trade shows had the effect of aiding many companies to achieve their annual plan goals, but those associated with the non–recovering semiconductor industry had to adjust their quarterly reports. The SEMI book–to–bill ratio for October rose due to falling shipments to a "surprising" 0.93, the highest point in more than a year.

As a result the estimated 2008 production numbers for industrial lasers (see Table 2) were adjusted from a projected 6% increase to a more modest 2% growth. The causes: a flat year for low–power CO2 and solid–state laser sales, a lower growth rate for high–power CO2 and diode–pumped solid–state lasers, and slightly softer than predicted low–power fiber laser sales. However, direct diode sales exceeded projections as these lasers found wider acceptance in brazing and surface treatment.

Laser revenues (see Table 3) were close to early year predictions as the sales of higher–power (6–7kW) CO2 lasers for cutting applications and higher–power (6–10kW) fiber and disk lasers occurred. Continuing pricing competition held down low–power CO2 revenue growth, and the semiconductor industry woes was the given reason for turning a projected 5% solid–state number into 2% increase. Led by increasing high–power applications, fiber laser revenues had a solid double–digit growth and the unexpected rise in direct–diode sales offset the lower than anticipated excimer sales to raise the "other" laser category well over predictions.

System revenues (see Table 4), the least verifiable and most conservatively estimated market sector, came in at a 4% increase, significantly under early year projections. While fiber laser and "other" laser systems sales more than held their own, sales of solid–state systems for semiconductor and a flat low–power CO2 market combined for a 3% drop over 2008 projections. According to suppliers, the solid–state laser numbers might have been worse except for a spurt of sales into the booming photovoltaic manufacturing sector.

This is a good point to stop and reflect on the 2008 numbers presented. On balance, considering the variety of pressures experienced by changes in the manufacturing sector, industrial lasers had a reasonably good performance. If you compare to 2007, a very good year for industrial laser sales, 2008 performance was more than acceptable. A good measure of the relief third–quarter sales brought can be seen on the ILS Website (www.industrial–lasers.com) in the videos from the Fabtech show, the archives of Industry News items about the IMTS and EuroBlech shows, and My View editorials for September–November.

The details

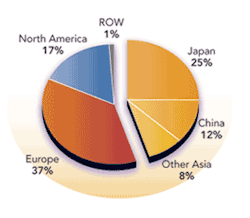

Figure 1 presents the ILS perspective on the 2008 industrial laser market shares of the major producing regions. Compared to 2007, shares of units changed slightly reflecting the market situation outlined above. The 2% shift in North American production is directly attributable to decreases in semiconductor/microelectronic industry demand and the impact of this on major U.S. solid–state laser producers. The market share increases in Asia and Europe are indicative of the market growth in the former and the increasing exporting numbers in the latter.

Revenue shares, in Figure 1, show the impact of continuing pressure on unit selling prices for low–power CO2 and low–power fiber lasers in North America, which is the home to major producers of these products. These have been offset somewhat by the increased revenues from high–power fiber lasers. The market share growth of higher–power CO2 for metal cutting applications pushed up the European revenues even though the markets saw modest growth, although two of the world's leading suppliers of industrial lasers, TRUMPF and Rofin Sinar, reported overall business growth for the year. Early stage exports of Chinese lasers and domestic and export successes by Japanese suppliers resulted in an increase in Asian share.

Segmenting the number of lasers produced in 2008 by type, as shown in Figure 2, did not cause any changes in the CO2 category for North America, essentially the United States, which remains as the largest producer of low–power units. The small changes in solid–state numbers are indicative of the reported travails at two of the largest U.S. manufacturers, Newport Corporation and Coherent, Inc., and the continuing growth of suppliers of that laser type in Asia such as Han's Laser in China. A slight shift in low–power fiber laser production from the U.S. to Europe and Asia resulted from competitive products being introduced into the market. In its quarter report, fiber laser industry leader IPG Photonics advised stockholders that lower sales of its pulsed lasers in Asian markets would offset stronger high–power laser sales gains. For example, a major Asian maker of lasers for marking and welding applications says that fiber lasers accounted for 5% of substantial 2008 sales and that number will double in 2009. Strong sales of direct diode lasers manufactured in Europe precipitated a shift in shares in the "other" category as Cymer, a leading suppler of excimer lasers, cited the "severity of the slowdown in the economy and semiconductor industry" for a decrease in its workforce.

The changes in revenues by laser type, as shown in Figure 3, are interesting because a small shift in share can mean a difference in the millions of dollars in revenue. CO2 revenue shares changed from last year with Europe gaining 2% as the revenues from higher–power CO2 lasers increased. North American shares slipped as increased competition continued to put pressure on low–power CO2 sales and a slight increase in the higher–power CO2 sales improved the Asian share.

For solid–state revenues the shifts from 2007 reports are not as dramatic and most of it results from the fallout from the semiconductor market problems. The changes in fiber laser shares are subtle but explicable by the increase in higher–power unit sales being made at IPG, the world leader in this technology, and competition in Asia at the low–power level. In the "other" category, Europe and Asia gained in direct diode revenues.

Tracking laser system installations worldwide (see Figure 4) is accomplished mainly through anecdotal information gained from interviews with suppliers as there is no verifiable and reliable import/export data published by the user countries. Asia continues to be the largest market for industrial laser systems, with Japan's loss of 2% made up by East Asia's increase of 3%. Europe picked up 2%, the same amount that North America slipped. These changes are most likely a result of market shifts in 2008. Industry leader TRUMPF, forecasting its 2008/2009 fiscal year growth in its 2007/2008 fiscal year report, predicted a 7% growth compared to 10% growth.

For the past few years ILS has noted that many of the applications served by industrial lasers seem to have matured, at least in terms of market shares. Figure 5, 2008 applications by units, shows some interesting changes with drilling gaining 3% as applications such a turbine blade drilling for new military engines ramped up and the increased use of lasers for perforating applications in food and medical packaging. Microprocessing, dragged down by the semiconductor industryproblems, lost3%. Marking and cutting shares were down slightly, reflecting the slowing economy, while the "other" category, which includes rapid prototyping and manufacturing and surface treatment applications, expanded by 2%.

Market shares (see Figure 6) in the largest global market for systems, flat sheet cutters, with slightly more than 5200 units worth more than $3 billion, shifted a little. Asia gained 2% over 2007, even though China, feeling the effects of economic tightening, was down 1%. Increases in Japan and other markets such as India and Southeast Asia contributed to that region still holding the top spot. Despite 2008 being an up–and–down year for job shops, the North American market share remained steady as unit sales matched those of 2007.

The future

ILS has been projecting market growth for so many years that faced with projecting a down year we sought ways to soft peddle bad news. Like it or not the numbers, in Tables 2–4, for 2009 are all negative. Like the Titanic chef, ILS finds some consolation that the 2009 numbers are close to those for 2007 and that's a good thing, as another pseudo chef says. Also, as this was being written the price of a gallon of gas at the local filling station had dropped more than $2 from the 2008 high, and that is definitely a good thing. If it holds, that's like $2000 in the pocket of the average SUV driver, maybe enough to get them consuming again with the attendant economic fallout.

Here in the United States a new President is to be inaugurated who says he will bring a fresh economic team with him. He also says he intends to develop a consensus among the major economic powers that will precipitate a faster global recovery from the malaise that is causing the slowdown in manufacturing; and that is a much desired good thing.

A favorite saying among politicians of all stripes is that the fundamentals are all good, usually mentioned when economic news is not good. ILS is not above using an apt phrase when it suits us, and as we look at the industrial laser markets we can say with confidence that the fundamentals are all strong. Laser materials processing is still on a technology growth curve and in that regard the best years may be ahead of us.

We constantly look for technology competition that will erode major laser markets, and frankly the only "threats" will come from new laser technology such as ultrafast pulse lasers with their cold processing capability. So technology is there for growing markets, if and when economic pressures are relieved, be it in 2009 or later.

Two of the largest suppliers of industrial lasers present conflicting market perspectives. TRUMPF recognizes that new products will have a positive effect that enables the company to project a 7% growth in its 2009/2010 fiscal year. Rofin Sinar, on the other hand, revised its first quarter sales (period ending December 31, 2008) downward by about 17%, citing a dramatic change in the business environment.

It took the laser industry three years to return to growth from the 1992 recession low point. But then markets were just developing and applications such as marking/engraving were immature. Metal cutting had not spread globally into nations developing an industrial base. Today the laser industry sells to tens of thousand of customers, not the thousands of 1992. It doesn't take much for a positive buying atmosphere to drive sales up millions of dollars today.

The economic forces that are stultifying the industrial laser market are serious and the timing of a recovery is, as this is being written, not clear. But recovery will come, and the markets will regain their health, and the industry will grow again.