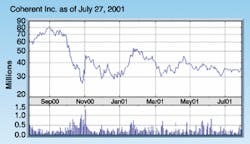

You know a business sector is full of too much uncertainty and too many frustrations when the market leader decides it has had enough. Long considered the leading pioneer in medical-laser technologies and applications, Coherent (Santa Clara, CA) decided to sell its medical business to ESC Medical Systems (Yokneam, Israel) earlier this year to focus on the telecommunications, test and measurement, and semiconductor manufacturing markets.

The acquisition was finalized in April, and the new company now operates under the name Lumenis at the old Coherent Medical facility in Santa Clara. The deal netted Coherent $203 million in cash and stock and made the company the largest stockholder in Lumenis, with 5.4 million shares (16.5%). Coherent will continue to supply its lasers and components to medical-systems manufacturers, including a six-year contract with Lumenis.

Coherent said several factors led to the decision to divest its medical-systems business. Despite record sales increases of 26% between 1999 and 2000 (total revenues for FY2000 were $205 million, due in large part to pent-up demand for products related to the treatment of age-related macular degeneration; AMD), the medical group saw only a 1% year-over-year increase in revenues for the first quarter of FY2001—$47.2 million this year vs. $46 million in 2000.

Such numbers pale in comparison to Coherent's other businesses, particularly those related to telecommunications and semiconductor manufacturing. The market opportunities for the company's electro-optics group alone top $8 billion, compared to the $2.3-billion medical market. In fact, combined revenues in Coherent's electro-optics and Lambda Physik divisions rose 34% in the first quarter of 2001.

The company also believed its medical business did not fit well with the rest of the company in terms of products and product cycles, according to Peter Schuman, manager of investor and public relations for Coherent. Coherent Medical had evolved over the years into a systems manufacturer, while the rest of the company operates primarily as an OEM supplier of lasers and optoelectronic components. "The medical market was taking too much time, and the profitability wasn't where we thought it should be compared to the rest of our business," Schuman said.

Larger factors likely played a part in Coherent's decision as well. The medical-laser market has matured to single-digit revenue growth, creating an increasingly competitive climate. In addition, the medical-laser industry as a whole is struggling to find the next great application and market opportunity, following the phenomenal successes of skin resurfacing, hair removal, and vision correction. Each of these markets has now peaked, leaving many companies—especially those with limited product portfolios—wondering where their next revenue stream will come from. Laser-based devices for the diagnosis and treatment of AMD, cancer, chronic skin conditions, and other large-scale consumer applications hold promise, but with so many companies vying for market share, each piece of the pie inevitably ends up smaller than is needed for most of these firms to survive.

Market dominance

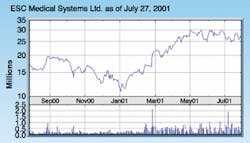

All of this is good news for Lumenis, which is now expected to become the global leader in the design, manufacture, and marketing of light-based medical solutions. Combined sales for ESC and Coherent last year were $360 million: aesthetics ($180 million), ophthalmic ($70 million), surgical ($60 million), and service ($50 million). This compares to $69 million for Candela, the companies' closest competitor in the aesthetic and surgical markets.Just two years ago, ESC reportedly held nearly 50% of the medical-laser market, in large part through an aggressive merger-and-acquisition campaign. But 1999 proved to be a tumultuous year for the company, as market competition and internal financial and management struggles pushed the company to the brink of bankruptcy. Ultimately, a shareholder group succeeded in ousting much of the company's management team.

Such aggressive moves began paying off less than a year later. After watching its revenues fall from $225 million in 1998 to $142 million in 1999, ESC reported $46 million in revenues for the fourth quarter of 2000, a 15% year-over-year increase, and topped $150 million in revenues for the year. The Coherent acquisition is expected to help ESC double these numbers, at least in the short term. Lumenis forecast revenues in excess of $80 million for the second quarter (ended June 30), up from $42.5 million in the same quarter of 2000.

Lumenis has reorganized into three business units. The aesthetic unit will focus on photorejuvenation, hair removal, vascular and pigmented lesions, acne, and other applications under development. The surgical unit will focus on hospital and in-office medical procedures such as gynecology, urology, and ENT. The ophthalmic unit will focus on diabetic retinopathy, AMD, open-angle glaucoma, and refractive surgery.

About the Author

Kathy Kincade

Contributing Editor

Kathy Kincade is the founding editor of BioOptics World and a veteran reporter on optical technologies for biomedicine. She also served as the editor-in-chief of DrBicuspid.com, a web portal for dental professionals.