Laser industry reflects larger economic issues

NASHUA, NH––Last September at the Optoelectronics Industry Development Association’s (OIDA; Washington, DC) “Perspectives on the Optoelectronics Industry” forum in San Jose, CA, keynote speaker Henry Kressel of Warburg Pincus (New York, NY) noted that in today’s increasingly competitive global technology marketplace, innovation is critical to sustaining and stimulating growth. “Cross–fertilization in technology is a key driver behind innovation,” Kressel said. “And continuous innovation creates continuous economic value. It trumps cost cutting as a long–term strategy.”

Innovation has long been a hallmark of the lasers and optics industry. Often accused of being too much a technology in search of an application, the last few years have seen this industry reinvent itself, taking manufacturing, packaging, distribution, and marketing cues from the semiconductor and consumer electronics industries. As has been the case since 2002, these new strategies––coupled with ongoing technology and product innovations (see “Photonic solutions find no lack of real–world problems,” Laser Focus World, December 2007, p. 97)––are beginning to pay off. In 2006, for example, nondiode laser sales gained about 10% over 2005, although price declines in diode lasers limited overall revenue growth for the laser industry in 2006 to around 2% (see www.laserfocusworld.com/articles/282527). But as the photonics industry has become more aligned with consumer markets, so is it more affected by the same factors as those markets––notably consumer confidence, consumer spending, housing and oil prices, trade imbalances, interest rates, and the value of the U.S. dollar.

As a result, despite a strong first half, the latter part of 2007 had its ups and downs. Coherent, for example, reported net sales of $142.6 million for its third fiscal quarter (ending June 07), a 4.6% decline from the third quarter of its FY2006 and a 6.3% decline from the second quarter of its FY2007. However, Coherent bounced back somewhat in its fourth quarter (ending September), with net sales of $159 million––an increase of 0.5% compared to Q4 2006 and 11.4% over Q3 2007.

“From a market perspective, we continued [in fiscal Q4] to see outstanding performance in materials processing, bioinstrumentation, and medical, resulting in an annual growth of 24.1% for material processing and 16.9% for the OEM components market,” said Helene Simonet, executive vice president and CFO of Coherent. “Compared to fiscal ’06, microelectronics sales declined 3.9%, primarily due to slow demand in the flat–panel–display market. The scientific market, whose annual growth was 5.5%, showed a strong fourth quarter, partially due to the revenue recognition of some large custom lasers.”

Suffering some of the same issues––weakening in the semiconductor and microelectronics markets––Newport reported sales of $109 million in the third quarter of 2007 (ending September), down 5% from the third quarter of 2006, although orders were about the same. In addition, the company anticipates sales for the fourth quarter to be in the $110 million to $115 million range. JDSU’s Commercial Lasers business reported net revenue of $19.9 million for the first quarter of FY2008 (ending September), down 10% from the previous quarter, and Cymer reported revenues of $382 million for the first nine months of FY2007 (ending September), compared to $406 million for the first nine months of 2006.

At the same time, 2007 was a banner year for some laser companies, especially those in the industrial sector. Fiber–laser maker IPG Photonics (Oxford, MA) saw a 32% increase in revenues for the first nine months of FY2007 compared to FY2006 (from $101 million to $137 million). QPC Lasers (Sylmar, CA) reported a 132% year–on–year increase in revenues for the third quarter of 2007 (from $930,000 to $2.2 million) and significant improvement in net loss for the quarter (from $8.3 million in Q3 2006 to $5.1 million in Q3 2007).

The Trumpf Group (Ditzingen, Germany) finished its 2006–07 fiscal year in mid–June with an increase in sales of 18% to €1.94 billion (US$2.8 billion). Sales in the Laser Technology/Electronics Division rose 8.2% to €474 million (US$695 million). Trumpf expects to realize further sales increases of about 10% to €2.1 billion (US$3.1 billion) for the 2007–08 fiscal year.

Similarly, Rofin–Sinar (Plymouth, MI, and Hamburg, Germany), reported net sales of $130.5 million for the fourth quarter (ended Sept. 30), up 12% from the previous year’s fourth quarter, and net sales of $480 million for the year, up 14% over the previous fiscal year. Sales of lasers for macro applications increased 20% to $248 million, while net sales of lasers for marking and micro applications increased 9% to $232 million.

Overall, the global numbers for 2007 are not quite what anyone expected. The industrial sector is on the upswing, fueled by new and growing markets, such as China and India, and by well–established veterans such as Germany. And the research market continues its steady growth––in fact, despite funding uncertainties in the U.S. for FY 2008, this sector showed rare double–digit growth in 2007. A slowdown in the microelectronics sector, on the other hand, put a damper on laser sales in many regions. Similarly, some segments of the medical market saw a slowdown in 2007 due to its dependence on consumer spending, although the market for certain dermatology and optical diagnostic products (notably optical–coherence tomography) has taken off.

While it has been obvious for a long time that the photonics market is far from being a homogenous entity, the conflicting trends evident in this year’s laser market survey serve to highlight the fact that many factors––both large and small––affect each market sector in vastly different ways.

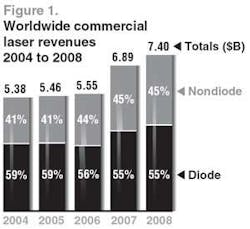

Global revenue growth for all lasers for 2007 over 2006 came out at about 9%––within one percentage point of last year’s projection and something of a pleasant surprise given the mixed results of individual firms noted earlier. For 2008, we expect a global revenue increase of 7% for all lasers with total sales reaching $7.40 billion. Since we report revenue in current U.S. dollars, average price changes may result year–on–year from exchange–rate fluctuations that occur during the year. In 2007, the U.S. dollar fell to new lows in Europe (and elsewhere). It lost about 14% against the euro, effectively raising prices for Euro–zone laser manufacturers exporting to the U.S., while lowering the prices of U.S. exports.

Economic factors

Looking more closely at some of the macroeconomic factors, what was behind the uncertain performance of many laser companies? In part, it paralleled a similar flattening in micro–electronics and semiconductor manufacturing, which can, in turn, be blamed on cutbacks in consumer spending. But what prompted the changes in consumer behavior? According to Sam Kahan, senior economist at the Federal Reserve Bank (Chicago, IL), the primary culprit is the U.S. housing market and, more important, the lending practices that fueled it the past few years.

“We had two stupendous years of growth in the United States, and world economic activity also expanded and spread out,” Kahan said. “Two to three years ago, the major engine for growth was the U.S. But now a lot more of the growth is self–generated in other countries. Japan is a bit better off, as is Europe, and the profile for China and India as engines for growth is good.”

The worrisome news, he added, is the decline in the housing market and the events of August, when the bottom fell out of the subprime lending market. Together these phenomena changed the overall perception of the housing market. “Prices are down, employment is down, and now sales of furniture, carpets, washing machines, and so on, are going down,” said Kahan. “So the concern is whether there is going to be more response in this regard because a lot of people’s wealth is tied up in their homes, which means they may become more cautious in general spending than before.”

In fact, consumer confidence in the United States hit a two–year low in October 2007, due primarily to higher fuel costs and the declining housing market. The Index of Consumer Sentiment was 80.9 in the October 2007 survey, down from 83.4 in the August and September surveys and significantly below the 93.6 recorded in October 2006.

On the flip side, while the U.S. dollar has weakened significantly in the last two years, this trend has had a positive impact on the trade deficit. According to Haver Analytics (New York, NY), in September 2007 the U.S. foreign trade deficit fell to $56.5 billion, the smallest since May 2005. This in turn had a positive effect on the U.S. gross domestic product, which grew 3.9% in the third quarter, higher than expected by the U.S. Commerce Department.

“The housing market has been weak but other sectors, such as trade and nonhousing business investment, have had growth, which is offsetting the weakness in housing and possibly even creating a net–net positive,” Kahan said. “But one other element in all of this is the question of what the consumer will do.”

Emerging markets

And what the consumer will do has more impact on the laser and optoelectronics industry today than ever before, especially given the increasing role that these technologies are playing in electronics for applications ranging from gaming and handheld computing to laser TVs and miniaturized laser projectors.

“These days so many companies are just focused on today, but an innovative technology company cannot do that,” said Kevin Drehmer, general manager of Tessera North America (Charlotte, NC), a provider of miniaturization technologies for the electronics industry, including advanced packaging, interconnect, and consumer optics. “You must have roadmaps that reach out into the future that are ever–evolving. Tessera has a seven– to ten–year vision, which means we are looking at things like consumer electronics and solar energy, but also at high–value–added opportunities.”

In fact, while there are clearly reasons to be cautious about the next 12 months, there is an undercurrent of technology and product development taking place in several emerging––and potentially large––markets. And this R&D surge should pave the way for the next wave of industry growth.

“What is striking is the tremendous number of new technologies being developed right now: photonic crystals, bright LEDs, solar energy, plasmonics, attosecond physics, laser ceramics for next–generation megawatt–level direct–energy weapons,” said Tom Baer, director of the Stanford Photonics Research Center (Stanford, CA). “There are so many breakthroughs on the technology side, but we are also at this point where it is not just technology for technology’s sake. This industry has woken up to the fact that we can have a tremendous impact on society. As a result, there is more innovation going on now in photonics technology than in my 30 years in this industry.”

One of the strongest of the “new” markets for lasers and optoelectronics is photovoltaics. At the 2007 SEMICON West conference, more than 160 semiconductor equipment, subsystems, and materials suppliers marketed their expertise in the burgeoning solar–cell/photovoltaic (PV) manufacturing sector. According to SEMI, the combined PV equipment and materials sector generated $3.7 billion in 2006, with polysilicon–driven materials accounting for most of the total. By 2010, the association forecasts the overall market will top $10 billion.

Another market with great growth potential for optical technologies is the life sciences. Sales of biomedical optics products tripled between 1995 and 2005 to $6 billion, and should increase fivefold by 2010.1 There are a number of reasons for this growth, including a convergence of market forces and technology advances; optical tools and techniques are now available to the medical community that enable diagnosis and treatments in ways never possible before. In addition, for the past seven years the United States government has committed more money to life–sciences research via the National Institutes of Health (NIH; www.nih.gov) and the National Science Foundation (www.nsf.gov) than to any other sector of R&D, including military and defense.

Outside the U.S.

The picture is slightly different outside the United States, although not dramatically so. Factors such as oil prices, the value of the U.S. dollar, and trade deficits affect economies in Europe, Asia, India, and elsewhere nearly to the same extent as in the U.S. At the G20 summit in South Africa in November 2007, finance ministers and bankers from 20 nations expressed concern about a slowdown in global economic growth, coupled with rising food and energy prices. They warned that turbulence in currency and financial markets will continue over the next 6 to 12 months as the global economy copes with near–record oil prices, rapid Asian growth, and a global credit crunch sparked by the crisis in the U.S. subprime mortgage market.

But as noted by Kahan and other leading economists and politicians, several geographic markets are gaining strength and influence on the global market––including Japan, China, India, and various parts of Europe. According to analysts, Asian stock markets have been among the world’s best–performing this year. Throughout 2007 international investors rushed to purchase stock in China, India, and the rest of Asia, although Japan’s stock market was less attractive for most of the year.2

Overall, the more stable Asian and European markets helped many laser and optoelectronics companies offset the sluggish U.S. economy in 2007, especially in the industrial sector (see www.laserfocusworld.com/articles/305722). While Rofin–Sinar saw its sales in North America fall 11% in FY2007 to $113 million, the company’s sales in Europe and Asia jumped 25% to $367 million. GSI Group Laser Division (Rugby, England) began manufacturing pulsed Nd:YAG lasers in Suzhou, China, to serve the growing market there for its 125 and 300 W industrial lasers; GSI says that Asia–based companies currently represent over 50% of the Laser Division’s customer base. Even smaller companies are leveraging the growth in Asia. In mid–2007 fiber–laser manufacturer IPG Photonics (Oxford, MA) opened an office in Beijing to provide local support and service for that company’s fiber lasers and fiber amplifiers in the region, while Qioptiq Singapore, a division of Qioptiq (St. Asaph, England) expanded into China with a $1.7 million investment to establish Changchun Qioptiq Co.

European optics suppliers also fared well in 2007. The Jenoptik Group (Jena, Germany) reported strong growth in the first half of 2007; while overall sales grew 12.8% to €254 million (US$377 million), growth in the Laser and Optics division was 20.4%. Präzisionsoptik Gera (POG; Gera, Germany)––which attributes a significant part of its growth to complex optical systems for applications in machine vision and metrology in the semiconductor, aerospace, and defense industries––reported sales of $8.5 million compared to 2006, which saw an increase of more than 25% compared to 2005.

The European defense sector also was buoyant in 2007. Optical projects contributed to the success of BAE Systems (London, England), thanks in large part to several major contracts with U.S. government agencies. Qioptiq (www.qioptiq.com), a group of optics companies that were part of Thales until 2005, continue to do well in defense–related areas. The company secured a contract to supply the Australian Defence Forces with Thermal Weapon Sights. In addition to its military business, Qioptic has been expanding its commercial optics capabilities, including establishing the new China–based operation and acquiring Linos, a German optics firm that generated €87 million (US$129 million) in 2006.

Another growth sector in Europe is the LED and OLED business, due in large part to some key collaborations. In February 2007, a Frost and Sullivan report noted that although Asia Pacific is the dominant region for the production of organic light–emitting diodes (OLEDs), technological development in the European region has enabled companies based there to maintain footholds in the global market. (For more on the European and Asian markets, see p. 12).

Focus on the numbers

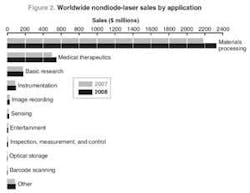

Aside from the various forces at play in the markets, there are also important shifts occurring in the laser technologies, most notably the impact of fiber lasers on nondiode–laser markets, and the ongoing displacement of nondiode lasers by diode lasers for many applications, from medical therapy to the graphic arts. Growth of solid–state lasers continues, driven in part by an ever–wider array of output choices and by continuing improvements to the semiconductor pump lasers. Fiber–laser sales gained almost 40% from 2006 to 2007 and continue to challenge established markets, especially for industrial applications where most sales are not into new applications but into those previously served by other lasers.

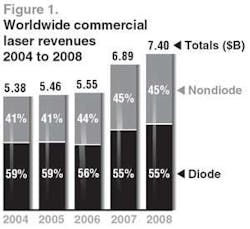

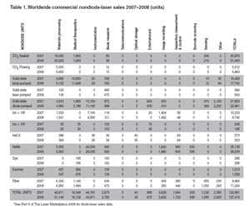

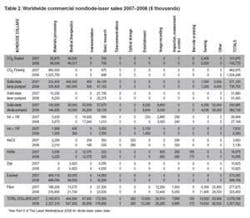

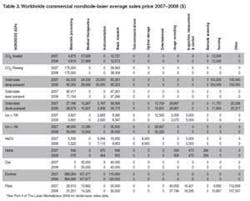

The application groupings or market segments we use here are intended to make manageable a complex and interlocking picture of laser technologies and applications. Because of the complexity, the following discussion of the nondiode–laser market presents a necessarily brief look at some of the key segments from this year’s market review. Part II of the Marketplace Review 2007, published in February, will include a detailed discussion of the diode–laser market.

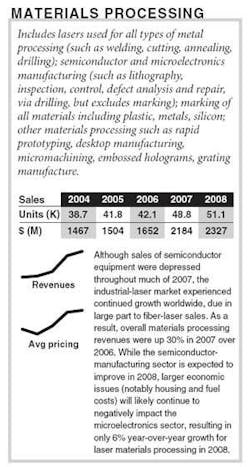

Materials processing

Semiconductor manufacturing continues to be a primary market driver in the laser and optoelectronics industry. Both Newport and Coherent, for instance, derive roughly 30% of their revenues from the microelectronics sector, while excimer–laser maker Cymer (San Diego, CA)––which makes lasers for photolithography––alone accounts for roughly 4% of all laser sales tracked in this report. Readers should note that in our efforts to gage the markets as accurately as possible we have adjusted the 2007 sales of excimers in this category based on information from Japan that was unavailable last year. This adjustment is incorporated into the accompanying tables but has not been used in the percentage comparisons made here with 2006.

As stated previously, both the semiconductor industry and the laser industry have become increasingly dependent on consumer spending habits. Mid–2007 forecasts from SEMI (www.semi.org) indicated that the semiconductor manufacturing market would grow only 1% in 2007, compared to 23% growth in 2006––although stronger growth is expected to return in 2008. According to SEMI, the semiconductor equipment market is expected to reach $40.9 billion in 2007, compared to $41 billion in 2006. However, SEMI anticipates 7% growth in 2008 and 4% the following year, reaching $45.5 billion in 2009.

In the traditional materials processing sector, the numbers for 2007 are more inspiring. According to David Belforte, editor–in–chief of Industrial Laser Solutions, economic expansion in Europe, driven by continuing growth in the German laser industry (the world’s second largest), is good but still expected to lag last year’s robust numbers. In Japan, 2007 numbers will be slightly lower than projections; while in China, the laser market is expected to lag behind last year’s 40% record growth, only because that number was so high. (For more on the industrial laser market, see p. 14).

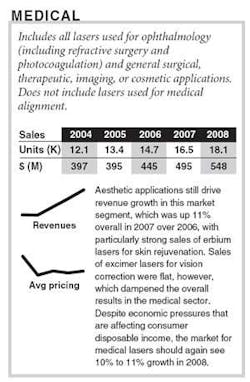

Medical therapy

Throughout 2006 and into 2007, Wall Street analysts were quite bullish about the market for consumer–based medical–laser applications––particularly wrinkle and hair removal. And it appears the hair–removal market is nowhere near the point of saturation; according to Millenium Research Group (Toronto, ON, Canada), 3.1 million laser hair–removal procedures were performed worldwide in 2006––a 22% increase over 2005.

Another growth sector for medical lasers is in diagnostics; according to a new market report from Laser Focus World and BioOptics World, the market for optical coherence tomography imaging systems is around $150 million and growing at an annual rate of 25% to 30% (for more information about this OCT market report, go to www.BioOpticsWorld.com).

Overall, according to our survey sales of nondiode medical lasers gained 11% in 2007 to reach $495 million and will grow another 11% in 2008. (For more on the medical market, see p. 15).

Basic research

For 2007, basic research retained its rank as the third largest global market for nondiode lasers. In fact, revenues from lasers for photonics–enabled research projects jumped 13% in 2007 over 2006––a rare double–digit growth rate for this typically sedate market. This despite funding uncertainties surrounding the next fiscal year’s (FY2008 beginning Oct. 1) budget in the U.S. that center around disagreements between President George W. Bush and Congress over domestic spending levels. None of the FY 2008 appropriations bills providing funding to the government’s discretionary programs had been signed into law by late November. Although the final outcome is by no means certain, however, some funding increases are in the wings. The $459.3 billion FY2008 Department of Defense Appropriations Bill, for example, increases DOD funding for basic research 4.5%, to $1.6 billion. This bill has passed both the U.S. Senate and House of Representatives and awaits the okay from the President.

Longer term, this market segment is becoming ever more ill defined, as the line between basic and applied research becomes increasingly blurred. Company–funded “basic research,” for instance, is typically applied research with a very definite commercial motive, so the relevant revenues may not always be captured here. Furthermore, the very nature of some of the applicable laser products has evolved to the extent that turnkey systems now enable researchers in fields like biology to use lasers in their studies that were previously inaccessible. Perhaps ultrafast systems are the best example of this trend: not so long ago, a femtosecond system required its own lab, whereas today’s ultrafast lasers can be quite compact. Revenues in this segment are expected to rise again in 2008 by 4% to reach $179 million.

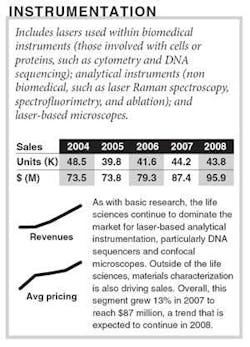

Instrumentation

Numerous important analytical techniques used in the laboratory rely on the properties of laser light. Because of its utility, the laser has become almost ubiquitous in instrumentation. Life–science research continues to dominate the market for instrumentation. One area in which interesting developments are taking place is DNA sequencing, according to Michael Tice, vice president of Strategic Directions International (Los Angeles, CA) and contributing editor of Instrument Business Outlook, published by SDi. Following the completion of the Human Genome Project, demand for DNA sequencing instrumentation continues to increase at mid–single–digit rates. Even so, the future use of lasers is not necessarily a sure thing in this segment. Although the dominant method currently involves the use of lasers to excite fluorescent tags on DNA molecules, second–generation systems using novel technologies are beginning to make their presence felt.A typical example is the Genome Sequencer FLX system, released jointly by 454 Life Sciences (Branford, CT) and Roche Applied Science (Basel, Switzerland) at the beginning of 2007. Instead of being laser–based, this system uses a sensitive CCD detector to capture the chemiluminescence emitted by the DNA sample during the analysis. In March 2007, Roche announced its acquisition of 454 Life Sciences, followed in May by the announcement that the GS FLX had sequenced the complete genome of Nobel Prize winner James Watson at a cost of less than $1 million––a record for economy in DNA sequencing.

Other second–generation–sequencers still depend on lasers as part of their fundamental technology. For example, Agencourt Personal Genomics, acquired in July 2006 by Applied Biosystems (Foster City, CA), developed a system that uses fluorescence ligation to carry out laser–based fluorescence analysis in a massively parallel fashion, thus increasing analysis speed by almost two orders of magnitude.

Another analytical technology experiencing rapid development is confocal laser–scanning microscopy, which has moved from the lab of the academic microscopist into drug discovery in the pharmaceutical industry, where automated systems carry out high–content screening of cells. Examples include the ImageXpress Ultra system manufactured by Molecular Devices (Sunnyvale, CA). The system includes four solid–state lasers (405, 488, 532, and 635 nm) and uses sophisticated image–analysis algorithms to automate the evaluation of results. Molecular Devices was acquired in March of 2007 by MDS (Mississauga, Canada). PerkinElmer’s (Waltham, MA) April 2007 acquisition of Improvision (Coventry, England) was another relevant development in confocal analysis. Improvision developed a powerful suite of imaging software tools that will augment PerkinElmer’s line of live–cell imaging products, such as the Opera LX, introduced in September 2007. The LX is an entry–level three–laser configuration of the more powerful four–laser Opera HEQS system.

Outside the realm of life science, there are other opportunities for lasers and optical components in the laboratory. One fairly traditional area of materials characterization is the analysis of particle size distribution, which has application in industries as varied as cement, metal powders, food, and pharmaceuticals. Two recent products that can measure down to 10 nm include Microtrac’s (Montgomeryville, PA) Bluewave, which uses a 780 nm laser and two 405 nm lasers, and the Partica LA 950 from Horiba (Kyoto, Japan), which incorporates a blue LED.

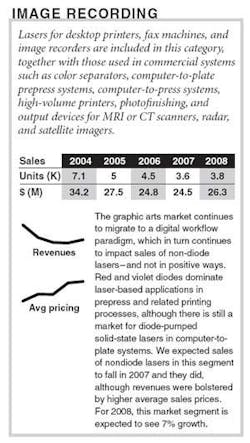

Image recording

The graphic–arts market continues to migrate to a digital workflow paradigm, which in turn continues to impact sales of nondiode lasers––and not in positive ways. Red and violet diodes dominate laser–based applications in prepress and related printing processes, although there is still a market for diode–pumped solid–state (green) lasers in computer–to–plate (CTP) systems. In terms of laser suppliers to this market––which currently includes only three companies, Kodak, Fuji, and Agfa––Coherent dominates; 75% of the installed base of CTP equipment worldwide contains Coherent lasers, including 830 nm bar diodes, 830 nm fiber–coupled diodes, and its Compass green laser.

For the last few years, CTP has been the leading application for lasers in image recording, especially for large commercial presses that produce magazines, flyers, brochures, and so forth. While the U.S. has been the largest market for CTP technology in commercial printing, some changes are afoot, according to Rosemarie Monaco, president of GroupM (Englewood Cliffs, NJ), a marketing communications and consulting firm that specializes in the graphic arts. In particular, as the cost of violet diodes has gone down and the quality has gone up, newspapers have leap–frogged adoption of the higher–quality thermal CTP techniques and are now integrating visible–laser CTP systems into their printing processes.

“I see growth for violet diodes in the United States for CTP applications in the newspaper market,” Monaco said. “In Europe they’ve been doing this for a while, while in Asia the printing community overall is just beginning to make the transition to the laser technology. In fact, I see Asia as a growth market (for lasers) as well.”

Other segments of the image–recording business, such as digital photo–finishing, digital film writing, and printed–circuit–board imaging, remain viable for nondiode lasers, primarily blue and green solid–state lasers. There is also limited use of diode–pumped Nd:YAG and CO2 lasers (primarily for flexo engraving), but the total market for these lasers is less than 100 units per year.

Our latest numbers reflect these trends. In 2007, sales of nondiode lasers for image recording fell slightly; however, the 2008 forecast sees revenues in this segment rising 7%.

Entertainment & display

The international market for entertainment–based laser products continues to have a positive impact on nondiode lasers in this sector, although the strongest revenue growth is now coming from China, not Europe. However, according to Jim Hardaway, CEO of Neo–Laser, the laser lighting and laser entertainment business for Neo–Neon International (Hong Kong), and current board member and former president of the International Laser Display Association (ILDA; Orlando, FL), while unit sales are up there is pricing pressure, particularly for those lasers in the sub–2 W market.

“Between 2006 and 2007, there’s been an incredible boom globally for entertainment–based laser products,” said Hardaway, who is based at NeoNeon’s Heshan, China, production facility. “This trend cycle started in 2004 and has not peaked yet. However, the market is probably going to start experiencing saturation effects.”

In addition, since the introduction of the solid–state green laser in 1997, there has been a 10–year downcycle in price for entertainment lasers. The thrust behind all of this has been the increased China–based manufacturing of these lasers, which has affected the development of solid–state RGB and RGY projectors and led to the rapid decline in prices, according to Hardaway.

“Prices now are 20% of what they were in 1997, and there has been an 80% decline in price for green lasers in the sub–1 W market,” he said. “Unless some new technology comes into the entertainment marketplace, RGB, and RGY lasers could be seeing their last product lifecycles. This could lead to a natural realignment in the market and price stabilization.”

For lasers above 1 W, China’s quality control and consistency (in laser manufacturing) are not yet high enough to impact Western manufacturers like Melles Griot, Coherent, or Jenoptik, he added. In addition, the price differential between the western countries and China is not yet very large because the pump lasers and drive electronics still come mostly from outside China.

“The only cost benefit for manufacturing high–power solid–state lasers in China is the labor and that’s not a great differential,” Hardaway said. “So for 2 W and above people outside of China are still buying mostly from outside China. Inside China, service pushes people to purchase domestically, although there are still good opportunities for offshore companies.”

Another trend in the entertainment laser business is the introduction of multisource diode–laser projection systems, which could further affect sales of nondiode lasers (2 W and above) in the next couple of years. According to Hardaway, some companies (primarily in Germany) are combining 200 mW 440 nm diode lasers (blue) with 650 nm diode lasers (red) to create very nice white–balanced laser projectors for the professional market, such as theme parks, large production companies that do tours, large laser–show companies, and world–class nightclubs.

Our numbers for 2007 reflect Hardaway’s comments. While unit sales and revenues for nondiode lasers were both up 6% over 2006, in 2008 unit sales are expected to decline 3% and revenues are expected to decline 6%.

Military/Aerospace

Given that 2008 is a U.S. election year, it is surprising to see how big of a hit certain parts of the U.S. defense budget took in the final FY2008 budget. Funding for defense–related R&D is on the decline; the FY 2008 Department of Defense Appropriations Bill, for example, calls for a $459.3 billion budget, with $12.8 billion going to three defense science and technology programs. This represents 2.78% of the total funding in the bill, down from 2.98% in FY2007 and 2.96% the year before.

According to Laser Focus World contributing editor Jeff Hecht, who tracks both the telecom and defense markets, the U.S. Armed Services are complaining that they have worn out a lot of equipment in Iraq and Afghanistan, but it is not clear whether that includes laser equipment, or if money is being spent to replace it. In fact, the drain of money going into the war supposedly is affecting hardware spending.

As for missile defense, the biggest project is still the Airborne Laser (ABL), which was the subject of much debate in the U.S. Congress during 2007. Even so, despite proposed cutbacks of $400 million, the program is now expected to be funded at the requested level of $549 million in FY2008.

According to Hecht, the biggest part of the defense/national–security budget involving optical technologies is infrared equipment. One U.S. defense project that has run way over budget but has yet to be killed off is the Space–Based Infrared System (SBIRS) program. The U.S. relies on infrared satellites to provide early warning of enemy missile launches. In 1996, the U.S. Department of Defense (DOD) initiated the SBIRS program to replace the existing missile–detection system and provide expanded capabilities to support intelligence, surveillance, and reconnaissance missions. DOD expected to field SBIRS by 2004 at a cost of about $4 billion. However, SBIRS has proven to be technically challenging and substantially more costly. The DOD thus implemented a parallel effort in 2006 known as the Alternative Infrared Satellite System. At this point, while both programs are still being funded, it is unclear how much longer the U.S. government will support them.

In terms of overall laser equipment sales, Hecht says the biggest dollar volume in the military market is still in rangefinders and target designators. There is also growing interest in technologies such as laser dazzlers, which utilize 532 nm (green) lasers or LEDs to temporarily “visually impair” individuals who are considered threatening or will not heed warnings to stop.

One interesting byproduct of the military conflicts in the Middle East and overall concerns about homeland security is that the U.S. government has turned increasingly to U.S. companies to supply key technologies. According to Drehmer, the military market has been a growth market for Tessera in recent years, a trend that should continue.

Quantifying the military and defense market for lasers and optoelectronics is always a challenge, given that so many companies and agencies are hesitant to reveal what could be construed as military secrets. Even so, as Drehmer and others have pointed out, this is a vibrant market sector. For 2007, revenue growth was significantly higher than anticipated––up 24%––although this trend is expected to level off to about 10% growth in 2008.

Other markets

Market segments not specifically discussed above but that are listed in our tables include inspection and measurement, optical communications, barcode scanning, and data storage. Most of these are segments that have moved solidly into the diode–laser camp or involve a mixture of many smaller applications that do not lend themselves to a detailed discussion in the space available.

REFERENCES

- D. Benaron, president, Spectros (Portola Valley, CA), speech at the 2007 Laser Focus World Marketplace Seminar.

- L.P. Norton, “Stocks Look Tasty in Japan,” Barron’s (Nov. 19, 2007).

About the Author

Kathy Kincade

Contributing Editor

Kathy Kincade is the founding editor of BioOptics World and a veteran reporter on optical technologies for biomedicine. She also served as the editor-in-chief of DrBicuspid.com, a web portal for dental professionals.

Stephen G. Anderson

Director, Industry Development - SPIE

Stephen Anderson is a photonics industry expert with an international background and has been actively involved with lasers and photonics for more than 30 years. As Director, Industry Development at SPIE – The international society for optics and photonics – he is responsible for tracking the photonics industry markets and technology to help define long-term strategy, while also facilitating development of SPIE’s industry activities. Before joining SPIE, Anderson was Associate Publisher and Editor in Chief of Laser Focus World and chaired the Lasers & Photonics Marketplace Seminar. Anderson also co-founded the BioOptics World brand. Anderson holds a chemistry degree from the University of York and an Executive MBA from Golden Gate University.