Diode lasers track long–term trend

Review and forecast, part 2: Diode lasers

Robert V. Steele, director of optoelectronics at Strategies Unlimited

The Laser Focus World 2008 Annual Review and Forecast of the Laser Marketplace is conducted in conjunction with Strategies Unlimited of Mountain View, CA. Part II covers the diode–laser marketplace. Part I, which reported on nondiode–laser markets appeared last month (see www.laserfocusworld.com/articles/316055 and Optoelectronics Report, January 1, 2008).

MOUNTAIN VIEW, CA––As noted in January’s Laser Focus World article “Laser Marketplace 2008,” Part I, the laser market is strongly influenced by global economic trends. This is especially true for nondiode lasers because lasers and laser systems for industrial and medical applications represent large investments on the part of customers whose revenues and capital budgets can be impacted by general economic conditions. Diode lasers, on the other hand, are generally large–volume, low–price products whose use is strongly affected by the consumer and communications market demand (a significant exception is high–power diodes, which are higher in price and are used in medical and industrial applications; however, they represent just 8% of the diode–laser market). Although the diode–laser market is influenced by general economic conditions, it often has a different dynamic than capital–intensive nondiode lasers.

The telecom market boom of 1998–2000, for instance, was strongly influenced by telecom–carrier perceptions of the growth in demand for bandwidth (by both businesses and consumers), and the willingness to push capital budgets for new capacity far beyond the historical norm. The market bust of 2001–2003 developed as a result of the fact that installed capacity far exceeded the actual demand. Consumer entertainment markets are driven by the desires of consumers for the latest electronic wizardry, and enabled by a continually decreasing pricing structure for “boxes” (such as DVD players), which in turn puts pressure on component pricing (like 650 nm diode lasers). The expectation of continually decreasing prices has been one of the major characteristics of the diode–laser market.

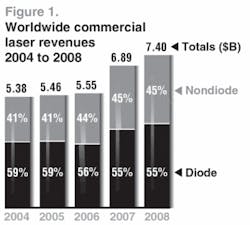

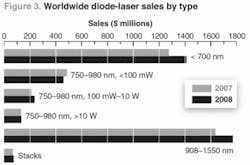

Diode lasers continue to represent 55% of the overall $7.40 billion laser market (see Fig. 1). Consistent with its long–term trend, the diode–laser market grew by 10% in 2007 to $3.81 billion (this gain was calculated based on an adjustment to the 2006 market figure that is discussed below). Growth was experienced in nearly all major market segments. Unit growth was very modest at 0.7%, to a total of 827 million units, indicating that revenue growth resulted from gains in lasers with relatively higher average selling prices.

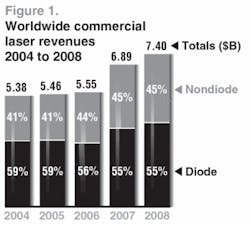

With the exception of the telecom boom/bust cycle of 1998–2003, the market has followed a relatively steady growth pattern, with a compound annual growth rate of 7.6% (see Fig. 2). The dynamics of individual diode–laser market segments are discussed in the sections below.

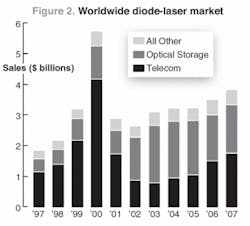

Telecommunications

For the first time since 2001, telecom diode–laser revenues ($1.74 billion) exceeded those of optical–storage lasers. The telecom laser and transceiver market continued to grow, especially in transceivers used in so–called “FTTx” (fiber to the home/node/business) applications. The FTTx volume grew to more than 7 million units, in the form of bidirectional and triplexer modules. This volume is in addition to the volume of devices used for the rest of the network (long haul and metro), which has increased steadily. Note that the FTTx module revenue only amounted to about $430 million because of the low average price (about $60) for these devices. After many years of anticipation, the FTTx market is finally happening and is likely to continue for several years at this rate, but the annual volume may not expand much further. Japan is beginning to complete its build out, and while Verizon and AT&T are key players in the U.S., there are no signs that other providers are ready to ramp up deployment anytime soon.

This year, we adjusted the telecom laser market values for both 2006 and 2007 to account for unexpectedly strong growth in FTTx, raising the overall transmission laser and transceiver market to nearly $1.59 billion in 2007. The increase from FTTx also lowers the average price, and reflects even more of a mix of mostly low–data–rate and low–priced products with fewer, but much more expensive, high–data–rate transceivers. Telecom laser and transceiver prices could stabilize if supply is ever restricted, but there are still no signs of that happening. In fact, profits are still sorely lacking among the several large suppliers with excess production capacity.

Other products that are coming on strong are tunable lasers and 40 Gbit/s transceivers, and there is even talk of 100 Gbit/s. Tunable lasers are becoming mainstream for use with reconfigurable optical add/drop multiplexers (ROADMs) in flexible WDM networks. The 40 Gbit/s links are finally growing in volume as serial links, and 40 Gbit/s is now also viewed as an alternative step in the eventual (but still distant) trend from 10 Gbit/s Ethernet to 100 Gbit/s Ethernet.

Infinera (Sunnyvale, CA) continues to get attention for its O–E–O (optical–electronic–optical) approach to fiber–optic transmission. It is significant, even though the number of total units is relatively small. First, Infinera makes its own devices for its systems, which is no longer the norm. Second, its devices integrate multiple lasers with other device elements onto one chip, in a way not done in any other commercial products.

The telecom pump market continues to be strong, but with little visibility for the future. These pumps are used in optical amplifiers, which are bought only when existing dark fibers are lit, or new fiber installed, to expand capacity. The high–power diode products include mostly 980 nm single–mode diodes, but also some less–expensive multimode diodes and some very expensive diodes for undersea systems, as well as 1480 nm diodes and 14xx nm diodes for Raman amplifiers. The volume of amplifiers is strong, but they now use fewer diodes than years ago, so that the total pump–diode market amounted to only about $150 million in 2007. Moreover, this business tends to be cyclical, suggesting that the current growth streak may soon be followed by a slower period with little warning.

For 2008, overall growth of 7.2% to $1.86 billion is expected, somewhat less than the robust 15% seen in 2007. This is partly due to slower growth expected for the deployment of FTTx. Although this market will remain strong, the total unit growth will start to level off as the U.S. reaches a steady state and deployment in Japan nears completion.

Optical storage

After declining by 15% in 2006, the optical–storage laser market recovered nicely in 2007, growing by 7.7% to reach $1.60 billion. This growth took place despite a decrease in total units of 1.1% to 714 million. The main driver for revenue growth was the next generation of optical–storage technology embodied in Sony’s Blu–ray Disc and Toshiba’s HD DVD products. From 2004 to 2006, the optical–storage laser market contracted, as unit growth failed to keep pace with declines in average selling prices. A significant contributor to selling price decline was the increased outsourcing of laser production from Japan to Taiwan, where lasers are produced at much lower cost. In 2007, unit sales of 780 nm lasers declined for the first time. A major factor in this decline was the increasing use of dual–wavelength (780/650 nm) lasers in DVD–based drives, players, and recorders. These devices, counted in the < 700 nm category, replace individual 650 and 780 nm lasers, the latter of which are used to read or write to CD–type media.

In 2006 the first commercial HD–DVD and Blu–ray Disc players, using 405 nm diode lasers to achieve high storage density, were introduced to the market. However, sales of these products were modest through 2006. The market for 405 nm lasers did not begin to take off until November 2006, when Sony introduced the PlayStation 3, the third generation of its popular video game player that uses Blu–ray Disc technology. Sony shipped about 2 million PlayStation 3 players in 2006, which helped overall optical storage laser revenue, but not enough to result in an increase over 2005.

Based on a full 12 months of sales, shipments of PlayStation 3 players increased substantially in 2007 to more than 11 million, and they were the dominant source of 405 nm laser consumption. Both Blu–ray Disc and HD DVD players struggled to achieve market penetration in 2007, even with price cuts intended to spur the market. However, fewer than 1 million units of the combined formats were sold. The advantage of these video players is of course that they can play high–definition media that can be watched on the wildly popular flat–panel (LCD and plasma) and rear–projection HDTVs that have taken the home video market by storm in the past several years (more than 40% of the TV sets sold worldwide in 2007 were HDTV). However, a very limited number of movie titles are available in HD format.

Even more problematic is the ongoing format war between Blu–ray Disc and HD DVD that is reminiscent of the Betamax–VHS war of the late 1970s/early 1980s. Current consumers are forced to choose between one of the two formats, knowing that only one will be likely to ultimately succeed in the market, leaving those who invested early in the “wrong” player left with an expensive but useless piece of equipment. A safe choice for consumers in the near term is to buy a relatively low–cost “upconversion” DVD player that provides near–HD picture quality on HDTVs, and can play the tens of thousands of titles available in DVD format.

Over time, either Blu–ray Disc or HD DVD will emerge as the dominant format, player prices will come down, and HDTV will become the broadcast and cable standard (it will happen in the U.S. in 2009, as mandated by the FCC). The latter event will encourage the adoption of HD players and recorders, which will eventually replace DVD players and recorders. Thus, the future of the 405 nm laser market seems ensured. That in turn will ensure continued growth of the optical–storage laser market. Sony (through its Shiroishi Semiconductor operation) and Nichia are currently the only significant producers of 405 nm diode lasers. Sony supplies all the diodes for its PlayStation 3 units, making it, by far, the market leader

In 2008, the market for optical–storage lasers is projected to grow by 5.8% to $1.69 billion. The market for 405 nm lasers is expected to grow by 38% to $381 million, more than offsetting the projected 14% decline of the CD–based market for 780 nm lasers to $312 million. Although the market for DVD–based 650 nm lasers will continue to grow, it is nearing maturity, and increases in both units and revenue are projected to be modest.

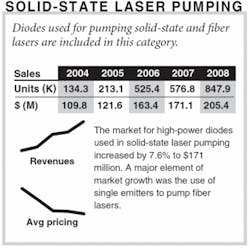

High–power diode lasers

The overall high–power market grew by just 1.4% in 2007, representing the slowest growth rate in several years. As in previous years, pumps for solid–state lasers, including fiber lasers, were the largest factor in the high–power diode–laser market. These devices accounted for $171 million (59%) of a $290 million market. With the rapid growth in fiber lasers, single–emitter pumps for this application are becoming an increasingly important part of the high–power diode market. The dominant supplier of these devices is IPG Photonics (Oxford, MA), which is also the dominant supplier of fiber lasers, and provides all of its own pumps from internal manufacturing.

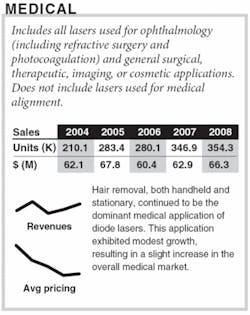

Aside from pump lasers, which grew by 4.7% in revenue, growth in most other high–power applications was flat to negative. The medical diode–laser market, whose growth has been driven in recent years by handheld hair removal, grew only slightly to $62.9 million, as the handheld hair–removal market remained steady. The stationary hair–removal market reversed its trend of recent years, growing by 10% to $8.3 million.

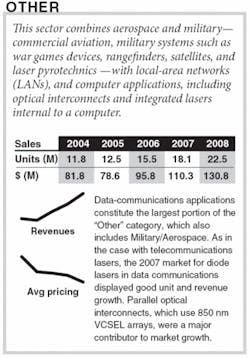

The use of high–power diode lasers, both single emitters and bars, in printing and graphic arts applications continues to be a significant market, accounting for $22.7 million in revenue in 2007. However, as noted last month in “Laser Marketplace 2008,” Part I, there is an ongoing trend in this market toward violet diodes and the corresponding violet wavelength–sensitive printing plates, and away from high–power infrared diodes and thermal plates, especially in the newspaper printing market. This is largely due to the rapidly decreasing costs, as well as improving quality, of violet diodes. Note that these trends for violet––that is, 405 nm––diodes are likely benefiting from the increased production volumes of the same devices for the Blu–ray Disc and HD–DVD markets.

The only other significant application for high–power diode lasers, materials processing, has not displayed any major trends in recent years. Split roughly equally between low–power (brazing and soldering, for instance) and high–power (such as for heat treating or welding) metal processing applications and nonmetal processing applications (plastics welding and joining), this market decreased slightly in 2007 to $15.9 million.

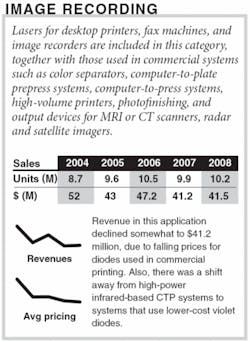

Other applications

Data networking continues to be the largest and fastest growing element in the “Other” category, accounting for 86% of this segment. The market for 850 nm VCSELs and 1310 nm Fabry–Perot lasers used in fiber–optic data networking (local–area networks, storage–area networks, and point–to–point interconnects) increased by 17.3% to $95 million in 2007. Parallel optical interconnects finally started to come on strong in the past year. These types of interconnects, using 850 nm VCSEL arrays, are mainly used as backplane interconnects for supercomputers and terabit routers. They have been used for years, but the prices have not been competitive enough with copper interconnects to attract wider use. One version that has created a lot of buzz is the so–called “active cable” and its various cousins. These products attach to existing copper connectors, and often include the cabling so that the user wouldn’t even know that optical fiber is being used.

An emerging form factor known as SFP+ is now seen as the next step in 8 Gbit/s (Fibre Channel) and 10 Gbit/s (Ethernet) transceivers, as XFP fails to meet expectations. XFP does well in DWDM and other telecom applications, but the SFP+ form factor is the coming favorite for datacom. It removes even the clock and data recovery electronics to separate chips on the board. This reduces the size of the transceiver, and allows the customer to integrate the electronics to reduce chip costs. But it also cedes control of the electronics to the customer, and reduces the value of the transceiver yet more.

In storage–area networks 8 Gbit/s Fibre Channel is growing in volume, just as 4 Gbit/s transceiver prices fall to the price of 2 Gbit/s transceivers. Standards efforts for 17 Gbit/s transceivers are now beginning, but the introduction of transceivers operating at this data rate is still some years away.

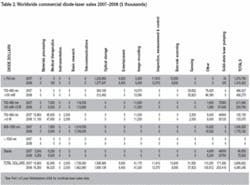

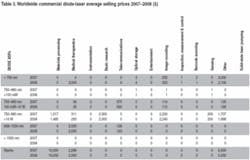

Diode–laser products and configurations

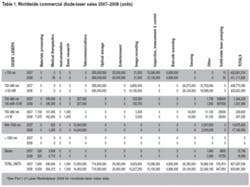

The diode–laser revenue figures shown in Table 2 are based on the unit sales figures in Table 1 and average selling prices (ASPs) for each type of diode laser. The ASPs for diode lasers vary widely and are a function of wavelength, power output, and package type. The revenue figures are for packaged devices as they are sold by diode–laser suppliers to the merchant market or transferred internally to other company divisions to be used in system–level products. Diode–laser packaging is subject to a wide range of configurations according to the device type and application requirements, and includes variations such as thermal control and fiber coupling. Short–wavelength (<1000 nm) diode lasers at power levels less than 300 mW are almost always single–lateral–mode, single–stripe devices that are sold commercially in hermetically sealed TO–type packages. The lasers are typically mounted on a heat sink, and the complete package includes a back–facet photodetector for monitoring the laser output level. The selling prices of such devices range from about $0.60 for a high volume CD–type laser to around $1 for a low–power visible (650 nm) laser to around $3 for a 50–100 mW, 660 nm laser used in rewritable DVD applications. Some low–volume specialty devices can be priced much higher.

An increasingly important packaging concept in the low–power diode–laser market––originating in audio CD and CD–ROM applications that use 780 nm laser diodes, but now used widely in DVD applications that use 650 nm laser diodes––is to carry out hybrid integration of the diode–laser chip, detector chips, and optical elements in a single package. These integrated optical pickups are lower in cost than pickups fabricated from discrete components, and result in easier assembly for the optical disk drive manufacturer. This concept was introduced by Sony in 1991 for its very thin (15 mm) Walkman CD player. Such pickups are now manufactured in volume by Sony, Sharp, and Matsushita, with prices around $1.30 (780 nm) to $2.30 (650 nm), compared to much less than $0.60 to $1 for discrete packaged diode lasers. The value of such pickups is included in the diode–laser market units and revenues in Tables 1 and 2. The concept of integration has also extended to combining 780 and 650 nm lasers in a single package. These are used in DVD players and DVD–ROM drives so that CD–type media can be read in the same drives. This type of integrated package, which is priced at around $2.60, is included in the statistics on lasers in the < 700 nm category in Tables 1 and 2.

For high–power diode lasers (> 1 W) there is a wide range of power levels and configurations. Up to 10 W CW, a wide (up to 500 μm) single stripe, multimode device is the norm. These devices are usually supplied in TO–type packages that can include Peltier coolers for temperature control. Beyond about 10 W, the only commonly used approach is a multistripe, multimode array. The standard product at these power levels is a 1–cm–wide diode–laser bar, which consists of a single multistripe array or a grouping of several arrays to build up higher power levels. Pricing for high–power diode lasers ranges from under $200 for a 1 W discrete device in quantity to more than $2000 for a 50 W bar. Single laser bars are now available at power outputs up to 60 W CW, although 50 W is still the most common configuration. Increasingly, these high–power devices are sold with fiber coupling to provide a more usable output beam for the end user. Higher–power arrays are typically available on a heat–sink submount that can be attached to a water–cooled heat–removal system. For applications requiring high peak power, these arrays can be operated in the pulsed (quasi–CW, or QCW) mode at peak powers up to 100 W.

For power levels above 60 W CW, high–power diode–laser bars can be stacked in the vertical dimension (these products are included in the Stacks category in Tables 1 and 2). The packages for these devices typically include water cooling. With the development of more–efficient heat removal techniques (like microchannel coolers), CW stacks have become available.

The packages for long–wavelength (>1000 nm) diode lasers used in telecommunications applications include special adaptations for coupling the laser output to single mode optical fiber with tolerances on the order of +1 μm. These are in the form of fiber pigtails or single–mode connectors. Telecommunication laser packages range from less than $50 for the lowest performance 1310 nm Fabry–Perot devices in a connectorized coaxial package to $500 to $1000 dollars for a high–performance distributed–feedback (DFB) laser in a cooled butterfly package. Diode lasers used in short–distance data communications applications with multimode fiber have much lower prices; 850 nm VCSELs packaged in several different configurations are priced at under $5.