LASER MARKETPLACE 2010: How deep (and wide) is the chasm?

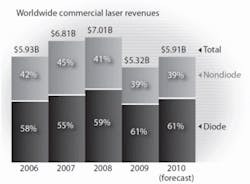

In the latter part of 2008, the economic indicators were so dire that Laser Focus World—anticipating laser sales to remain flat or decrease as much as 20% depending on the market sector—forecast an overall 11.3% drop in the worldwide laser markets to $6.32 billion. But early in 2009, it became obvious that the chasm would be even deeper. Actual laser sales for 2009 were $5.32 billion according to our survey—a 24.1% drop from the $7.01 billion for 2008, setting sales back to 2003 levels. And if Main Street is any indication (forget the ‘subsidized’ rally on Wall Street), this deep chasm is also wide. Even though the U.S. unemployment rate dropped to 10.0% in November 2009 from its 10.2% high (a jobless recovery), many economists predict that it could be three years before jobs return and sales improve to pre-2008 levels.

For the third quarter of 2009, the U.S. Bureau of Economic Analysis (BEA; www.bea.gov) said that Gross Domestic Product (GDP) rose 2.8% from the previous quarter, signaling an easing of the recession according to many mainstream media outlets.1–3 However, 1.45% of that increase was due to automobile sales (helped along by the U.S. government “Cash for Clunkers” program), while sales of computers actually subtracted 0.13% from the GDP figure compared to subtracting just 0.04% for the previous quarter. Indeed, a downward trend in consumer electronics spending does not bode well for the health of the laser industry, considering how closely the two are intertwined.

And what about the GDP figures for Europe and Asia? The official Euro area GDP growth rate from Eurostat (ec.europa.eu) was negative 4.0% for 2009 compared to 2008. But fortunately, Eurostat predicts that GDP for 2010 will move into positive territory, with a 0.7% increase compared to 2009. Asia agrees: The National Bureau of Statistics of China (www.stats.gov.cn) said that Q1, Q2, and Q3 2009 GDP growth rates over the same periods last year were 6.1%, 7.1%, and 7.7%, respectively.

While worldwide GDP numbers are looking better, not everyone is bullish. In the Welcome Address at the financial industry’s Sibos Conference held in Hong Kong in September 2009, respected economist William White, chair of the Economic and Development Review Committee in the Organisation for Economic Co-operation and Development (OECD; www.oecd.org) and one of the few individuals who predicted the 2009 recession, warned that we are headed into a “double-dipped” or “W-shaped” and worst-case “L-shaped” recession. White says that the world has not tackled the problems at the heart of the economic downturn and that short-term government actions to help the economy may be sowing the seeds for future crises.4

A common complaint among companies was indeed directed at the banking collapse. “As a relatively young company, we were very optimistic about 2009 and expected to double our sales,” said Sergey Egorov, president and CEO of Del Mar Photonics (San Diego, CA), which manufactures femtosecond laser systems and measurement tools. “We had orders and plenty of ongoing business, but were unable to obtain capital for the purpose of accelerating volume manufacturing to reduce lead time and drive prices down for our customers. Banks aren’t lending and the stimulus system is obviously for somebody else—not for small businesses.”

But despite the economy, financial performance of individual laser companies was largely a function of the particular market sectors served. While semiconductor, telecom, and materials processing were hit hard in 2009, instrumentation, military, and biomedical sectors fared better. “During 2008, we invested in products to meet applications in several key sectors, most notably biotech, aerospace, and non-destructive testing,” said Lawrie Gloster, managing director of solid-state laser manufacturer Laser Quantum (Stockport, England). “This turned out to be a sound investment as we closed this fiscal year [ending September 2009] showing a doubling of company growth with a headcount now in excess of 60 people. We are now looking at further expansion in Q1 2010 to meet our forecast of a further 45% growth.” Gloster says that the most important reasons for its growth lie in the quality of its products, with rugged designs borne out of the need to meet aerospace requirements, and close relationships with OEM customers. Laser Quantum’s growth is proof that not everyone suffered in 2009.

“A few years ago, there was a free-spending, drunk-sailor mentality in the laser industry,” said Steve Eglash, an entrepreneur and a consultant to the photonics industry. “Now, there is a more ‘sober’ need to make a business case, justifying new investments. We’re not seeing healthy exponential growth, but it’s not a desert out there either—companies with worthwhile technologies are growing and hiring.” Eglash’s sentiments mirror those of nearly all the laser companies we spoke with in the third quarter of 2009, who said that orders were picking up and the worst seemed to be over.

Pulse of the major players

The financial statements of major, public industry players (> $100 million in sales annually) offer perhaps the best overview of the laser marketplace.

Herman Chui, senior director of product marketing for the Spectra-Physics division at Newport Corporation (Irvine, CA), sees some positive signs across all of its laser markets. However, he doesn’t expect to see sales reach levels on par with the first half of 2008 until well after the first half of 2010. “The life sciences sector is steady, and the scientific side is good thanks to the stimulus,” said Chui. “Our microelectronics and industrial segments are seeing a significant increase in activity, especially in Asia where we have a strong presence. Overall, we are anticipating moderate growth for 2010.” Newport sales in Q3 2009 totaled $88.3 million, a decrease of 15.9% compared with the $105.0 million in Q3 2008. And for the first 9 months of 2009, sales were down 21.5% compared with the same period last year. However, Q3 sales of $88.3 million were up slightly from Q2 sales of $87.5 million, and more importantly, Q3 orders were $92.6 million—a 15% sequential increase over the $80.4 million in orders for Q2 2009.

Coherent (Santa Clara, CA) posted net sales of $107.6 million for its fiscal Q4 ended October 3, 2009, compared to net sales of $142.0 million for the same quarter last year. And for its full fiscal year, sales of $435.9 million were much lower than the $594.0 million reported for the same period last year. However, signs of a turnaround in the laser industry were evidenced by the fact that orders received during the three months ended October 3, 2009 of $133.4 million increased by 50.5% compared to orders received in the previous quarter. “The fourth quarter lived up to our expectations as a turning point for bookings with double-digit, sequential growth in all four end markets,” said John Ambroseo, Coherent’s president and CEO, in Coherent’s Fourth Fiscal Quarter press release. “Microelectronics was particularly robust as service orders responded to higher fab utilization rates, capacity expanded for OLEDs and mobile touch screen displays and additional design wins were secured. The scientific research market was also very active with record total bookings and record unit volumes for our Chameleon and amplifier product lines due to the strength of the products as well as benefits from U.S. stimulus funds. Finally, a number of our instrumentation and medical OEM customers reverted to annual buying patterns, which signals confidence in their end markets,” he concluded.

In April 2009, the Bookham and Avanex merger created a new company called Oclaro (San Jose, CA). Director of America sales and business development for Oclaro’s Advanced Photonic Solutions group, Merrill M. Apter, said, “With a now well-established position in the long-haul and metro telecom market, Oclaro is looking for its next growth engine. As the economy is turning around, our Advanced Photonic Solutions group is creating new exciting revenue opportunities such as VCSELs for consumer applications as well as the continued expansion of our high-power diode laser business.”

Oclaro revenues were $85.1 million for its first quarter of fiscal 2010 (ended September 26, 2009), compared to $66.9 million in the fourth quarter of fiscal 2009, and excluding revenues from Oclaro’s New Focus business of $5.1 million. For the second quarter of fiscal 2010 (ending January 2, 2010), Oclaro expects revenues in the range of $87-$92 million. “While visibility still remains fairly short term, our pipeline suggests the extent of our December revenue growth opportunities may be supply constrained, which is reflected in our guidance range,” said Oclaro president and CEO Alain Couder in the fiscal Q1 press release. The phrase ‘supply constrained’ was fairly rare for the laser industry in late 2008 and throughout 2009; good to see it could be making a comeback in 2010.

Glass half full

Fortunately for the laser industry, the downturn of 2009 is not an isolated event. In fact, an analysis of the worldwide laser sales for the last 40 years from Tom Hausken, director of components research at Strategies Unlimited (Mountain View, CA) shows that our industry has suffered a downturn about every eight to ten years. In his Opto Insider blog, Hausken says that even though past performance is not an indicator of future behavior, the pattern of downturns does suggest that there is an underlying cyclical nature to the laser industry.Materials processing

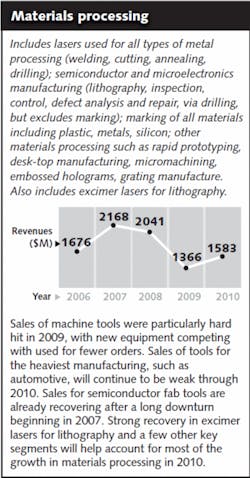

In the 25 years that Industrial Laser Solutions has been tracking the industrial laser markets, only one period from 1991–92 showed no growth in revenues when the global manufacturing economy experienced a severe recession. Even the U.S. dot.com recession of 2000 did not produce a decrease in sales over the previous year, due in part to the overall strength of the global market. The year 2009 will disrupt this otherwise exemplary performance.

For the first time a global economic recession, of unmatched depth, caused 2009 industrial laser revenues to decrease more than 30% over the preceding year—a year (2008) when this market sector had set a new record for revenues. It should be noted that 2008 revenues did not match expectations; Q4 2008 revenues did not meet projections as the economic recession was already underway. It is also significant that unit orders for industrial lasers declined 24% in 2009, which to some degree lessens the impact of the revenue declines.

A major determining factor for the 30% plus revenue decline, other than the overall malaise resulting from disastrous international financial problems, was the sudden and dramatic decrease in global market demand for high-power lasers integrated into sheet-metal-cutting systems—a sector which recorded a 39% decrease in revenues. In 2008 two important late-year trade shows, Euroblech and Fabtech, produced euphoria among equipment suppliers as orders for sheet-metal cutters flowed in until the first of December when a dramatic reversal in buyers’ confidence in the economy precipitated a rash of order cancellations and purchasing delays. The result of this decline in sheet-metal-cutting system sales clearly impacted the total laser revenue picture as this high-power laser application represents more than 80% of high-power carbon-dioxide (COSolid-state laser revenues show a 14% decline in 2009, continuing a trend that started in 2008 as fiber lasers penetrated the marking industry. Compounding this decline was the softness in the marking sector, which was not offset by increases in the solar-power market and the beginnings of growth in semiconductor processing.

Suppliers of fiber lasers for material processing reported their first revenue declines (21%) as this sector experienced the effect of the international recession, especially in marking system sales. However, successes in penetrating the sheet-metal-cutting market with innovative products occurred even as that sector suffered its worst decline in history.

The markets for direct-diode and excimer lasers also reacting to the recession showed their first revenue declines (12%), interrupting several years of growth. Excimer laser suppliers reported improved quarterly revenues as their market sectors such as semiconductor regained some strength.

Although the industrial laser suppliers are extremely cautious about the timing and pace of the recovery in the markets they serve, it is obvious that they expect improved performance building through the first half of 2010 with tangible results by mid-year. Overall, revenues for industrial lasers are expected to grow 9% led by sales increases for fiber (12%) and solid-state lasers (7%) used for marking applications and strength in the semiconductor sector and other lasers (9% growth). Sheet-metal-cutter sales are expected to increase by at least 8% and their high selling prices will boost the overall growth of industrial laser revenues.

Also included in the materials processing market is lasers used for semiconductor lithography. In 2009, lithography laser revenues were around $135 million, a roughly 66% drop from the $399 million dollar levels of 2007. Dominated by Cymer (San Diego, CA) and Gigaphoton (Oyama, Japan), the lithography laser market is expected to grow more than 80% from its 2009 low to levels approaching $250 million in 2010—but still far below 2007 highs. Currently, there is more pressure to gain return-on-investment (ROI) from existing nodes than to push for the next node; furthermore, the uptake of extreme ultraviolet (EUV) lithography may be slowed by three-dimensional (3-D) packaging and Pitch Division (PD) technology.

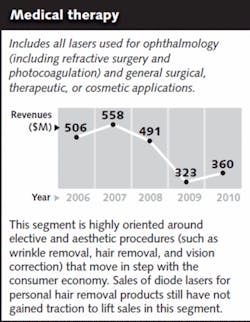

Medical therapy and diagnostics

Ophthalmic, surgical, and aesthetic laser sales in 2009 within the medical therapy and diagnostics sector were largely impacted by the economy and its negative effects on ‘discretionary’ spending; that is, consumers tightened their belts and spent dollars only on necessary rather than cosmetic laser treatments. Combined revenues for the seven major laser-based medical system companies Biolase (Irvine, CA), Candela (Seattle, WA), Cutera (Brisbane, CA), Cynosure (Westford, MA), Iridex (Mountain View, CA), Palomar (Burlington, MA), and Syneron (Yokneam, Israel) have been falling since mid-2008 and were down 40% for the first three quarters of 2009 compared to the first three quarters of 2008. Not surprisingly, sales of lasers into this sector were down 34% in 2009 to $323 million ($83 million ophthalmic, $240 million therapeutic) from $491 million in 2008.Aesthetic medical laser sales for clinical in-office systems for hair and wrinkle removal, skin rejuvenation, varicose vein removal, and low-level light therapy are trending down, with consumers favoring hand-held or portable in-home devices. Unfortunately, lackluster revenues for aesthetic laser procedures are slowing the market availability of these items: In June 2009, Palomar received U.S. Food and Drug Administration (FDA) approval for a patented, over-the-counter, home-use laser device for the treatment of periorbital wrinkles. Even though the product was developed jointly with Johnson & Johnson, an October press release said that Johnson & Johnson had terminated its agreement with Palomar to develop, clinically test, and commercialize the product due to the “current unfavorable economic conditions.” In addition, a 2007 partnership between Syneron and Procter & Gamble to jointly develop and market a home-use skin rejuvenation device has yet to materialize. And yet another partnership on hold is an August 2008 joint development and marketing agreement between Reliant Technologies (now Solta Medical headquartered in Hayward, CA) and Philips for a home-use laser skin-resurfacing device.

Scientific research and military

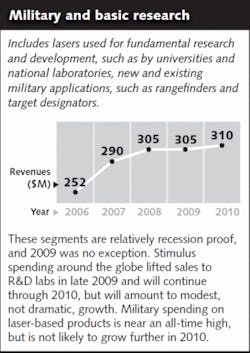

Laser sales for scientific research (R&D) are relatively recession-proof, and 2009 was no exception. Sales were flat at $180.6 million in both 2008 and 2009, while forecasted to grow 4% to $187.8 million in 2010. Military spending for lasers used in new and existing military applications, such as rangefinders and target designators, was at an all-time high in 2008 and 2009 and flat at $124.4 million; however, growth will decline somewhat in 2010 to $122.6 million. Overall, scientific research and military laser sales are expected to reach $310 million in 2010.The U.S. accounts for about 33% of worldwide R&D spending and U.S. overall R&D spending was forecast to grow at 0.3% in 2009. A big shift in recent years is outsourced R&D, especially to Asia, China, and India. Japan and China are neck and neck at number two and number three in total R&D spending after the U.S., with China targeting R&D spending at 2% its GDP by 2010. A September 2009 article in Optics & Photonics News (OPN) stated that 2009 appropriations legislation set U.S. federal R&D spending at $172 billion for 2009, up from about $140 billion in 2008, while noting that President Obama is urging the private sector (which currently accounts for two-thirds of U.S. R&D investments) to join the government in raising R&D spending to at least 3% of the U.S. GDP in the near future.5

Notable events in the scientific research markets in 2009 were the completion of the National Ignition Facility (NIF), successful operation of the free-electron X-ray laser or Linac Coherent Light Source (LCLS) at Stanford, and the high-intensity ultrafast laser being built at the Extreme Light Infrastructure (ELI).

In addition to these large-scale projects, research dollars also went to high-power and ultrafast fiber lasers for microelectronics and materials-processing application development, wavelength-specific lasers for biomedical applications in ophthalmology and low-level light therapy, and mid-infrared quantum-cascade lasers (QCLs) for sensing applications. “As power levels have increased and tuning ranges have expanded throughout the entire mid-infrared, commercially available external-cavity QCLs have really gained traction as indispensable tools in spectroscopy research labs,” said Timothy Day, co-founder and CEO of QCL maker Daylight Solutions (Poway, CA). “Fueled by the technical performance advantages that external-cavity geometries provide in terms of wavelength coverage, tuning range and power, the market for QCL-based scientific instruments saw a greater than 2X year-over-year growth in 2009.” Day added, “These turn-key instruments are now serving to develop applications that we see leading to significant market growth in the scientific market as well as OEM opportunities starting in 2010 and beyond.”

Instrumentation and sensors

Because lasers for instrumentation are primarily targeted at the life-sciences sector (flow cytometry, microscopy, fluorescence spectroscopy), sales did not suffer nearly as much for this segment compared to others; in fact, revenues held nearly steady at $93.8 million in 2009 compared to $94.4 million for 2008. Unfortunately, sales of lasers used in biomedical and analytical instrumentation only comprise roughly 4% of the overall worldwide laser sales, doing little to help raise overall laser sales.An analysis of the ‘four B’s’ of biomedical laser-based instrumentation companies Bruker Corporation (Billerica, MA), Bio-Rad (Hercules, CA), Becton Dickinson (Franklin Lakes, NJ), and Beckman Coulter (Brea, CA) shows that sales for the combined companies fell approximately 10% for the first nine months of 2009 compared to the same period in 2008. However, Bruker saw a 9.5% increase in calendar Q3 2009 sales to $265.1 million compared to the same quarter last year, thanks to robust booking by its academic and government customers benefiting from various global stimulus programs. Bruker offers laser-based Fourier-transform infrared (FTIR), crystallography diffraction, and near-IR and Raman spectroscopy instruments. Specializing in drug delivery, diagnostics, and proteomics, Becton Dickinson attributed much of its gains to flu-related sales. For the period ended September 30, 2009, Becton Dickinson saw year-over-year sales growth of 1%; however, its Q4 sales rose 5% from the same quarter last year, pointing to positive sales growth heading into 2010.

“We went into 2009 expecting a 10% drop in the first half, aiming to make that up in the latter half,” said Chris Karp, sales manager at Chroma Technology (Rockingham, VT). While Chroma doesn’t make lasers, it manufactures and supplies optical interference filters and provides applications support to the laser industry, specifically for life-science instrumentation. “Much of the latter year recoup will be fueled by R&D spending related to the government stimulus package, especially in the life sciences.” Indeed, woven throughout the life-sciences sector is a strong leaning on “stimulus” dollars. Fortunately, much of the stimulus money remains to be spent, and could offer upside to the forecasted $103.2 million in laser sales for this sector in 2010.

Also included in this segment are lasers used in such sensors as optical mice, light detection and ranging (LIDAR) instruments, and bar-code sensors, as well as lasers used for metrology instrumentation. With lasers for sensors contributing $64.2 million in 2009, and metrology lasers adding $23.8 million, total laser sales in the instrumentation and sensors market segment were at $181.8 million and forecasted to grow overall to $198 million in 2010.

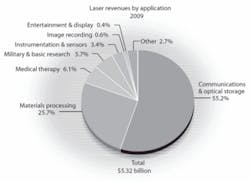

Communications and optical storage

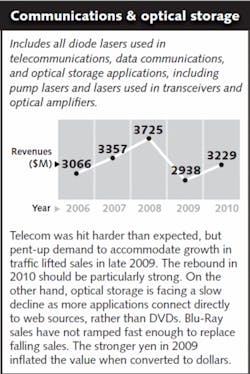

Lasers sold into communications applications (representing approximately 28% of the worldwide laser market revenues for 2009) declined more steeply in 2009 than expected, despite claims that Internet traffic continues to grow at steep rates. Claims of growth rates on the order of 50% per year are difficult to place in context, but it’s clear that traffic only increases, not the other way around, maintaining demand for new systems.Nonetheless, whether due to tight credit or general caution, network providers cut back on capital spending through most of 2009, allowing their network utilization rate to float upwards while they invested their precious capital into wireless networks. Network providers also saw weaker sales from one of their most faithful customers, the financial sector. Whatever the actual rate of growth in traffic, providers cannot go too long without adding upgrades, however. Spending is already on the rise: Cisco’s (San Jose, CA) overall revenues have been increasing since Q1 2009. And pent-up demand suggests that 2010 should return to 2008 levels, a growth of 25% over 2009. This would make the recovery in the communications segment one of the strongest.

There was a lot of talk in 2009 about 40G and 100G systems. Sales of 40G channels are finally gaining some traction for both router-router connections and for conventional long-haul transport. And while some mainstream financial organizations and social-networking sites want 100G technology today, there is still much work to be done to bring down the cost for these systems.

Even as fiber continues to be installed to the home, Intel (Santa Clara, CA) announced a new standard that takes fiber to the last few feet. The standard, called Light Peak, would link consumer products with optical fiber at 10 Gbps. Apple (Cupertino, CA) and Sony (Tokyo, Japan) are said to hope to deliver products based on it, perhaps as soon as the end of 2010. Intel’s role would be to deliver the electronics. It would not be the first use of optical fiber in mainstream consumer products; however, if all goes well, it could be the most successful.

The telecom industry still has its own house-cleaning to finish. Nortel (Toronto, ON, Canada) put its optical networking group up for auction in November, following years of restatements and weakness. And, the merger of Bookham and Avanex into Oclaro may push the laser suppliers out of their years-long and unprofitable stalemate into a healthier position. One can only hope.

Sales of diode lasers for optical storage (which accounted for approximately 27% of worldwide laser sales in 2009) are in a long-term decline, as consumers increasingly connect directly online for their documents. Digital video disc (DVD) players will remain relevant for the indefinite future, but unit sales are in a long decline. For example, netbooks lack DVD drives, Netflix offers many of its movies online, and playing compact discs (CDs) is becoming almost passe.

To make things worse, the market for consumer products slumped with the recession, for a decline of 21% from 2008. The falling value of the laser market was buoyed in part by the rising value of the yen, since the diode lasers for optical storage are made in Japan and the value must be converted to dollars for our survey. The recovery in consumer spending should keep revenues for this segment approximately flat in 2010.

While sales of 650 and 780 nm diode lasers are in decline, sales of blue lasers (at 405 nm) are on the rise. But, sales are mainly limited to Sony Playstations and Blu-Ray HD video players, which still remain relatively limited after late starts in the market. Users have been deterred from buying Blu-Ray players by the high price and limited availability of movies in the new format. Also, Blu-Ray provides little or no added value in personal computers (PCs).

Optical storage technology continues to advance. In 2009, Sanyo (Osaka, Japan) and Sony demonstrated 450 and 500 mW blue diodes (in pulsed operation) for recording on multi-layer discs at 9X to 12X speeds, and TDK (Tokyo, Japan) reported a 10-layer disc with 320 GB capacity using a 405-nm diode laser.

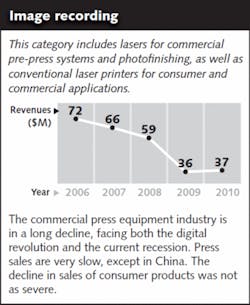

Image recording

Even though print media is in decline and the daily newspaper is rapidly becoming an icon of the past, food packaging, digital, and print-on-demand applications are stable. The economic downturn hit the print industry in mid-2007, bringing laser sales down to levels of just $36 million in 2009, far below the $56 million we originally forecast for last year.A potential technology that could bring ultrafast lasers into the image-recording field is “Miracle-Plate” technology from J P Imaging (JPI; Birkenhead, England). Miracle-Plate technology uses ultrafast lasers to pattern the aluminum plates used in conventional printing processes; the lasers can re-image the surface of the plate up to five times, drastically reducing the consumption of virgin aluminum in the print industry. John Adamson, JPI business manager, says, “This is still a technology rather than a product, but we are confident that the ultrafast lasers may eventually eliminate the need for coated litho plates. This will reduce cost and have eco benefits for the whole industry.”

Entertainment and displays

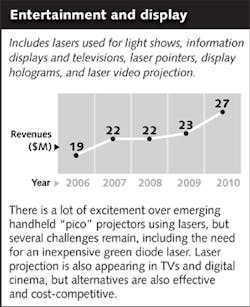

While 2008 was a record year for thin-film-transistor (TFT) liquid-crystal display (LCD) equipment spending, the worldwide economic crisis caused the equipment segment to suffer its largest drop ever in 2009, with revenues falling 50% year over year according to DisplaySearch (Austin, TX). Fortunately, DisplaySearch forecasts a whopping 51% growth in 2010. Charles Annis, DisplaySearch VP of Manufacturing Research said in a Q4 2009 release, “Rapid panel price declines from the end of 2008 through the spring of 2009 helped push demand further than expected. Additional strong demand from China is now encouraging panel makers to move forward with capacity expansions in 2010.”But on the entertainment side, DisplaySearch also reported that large (26 inches and larger), non-consumer LCDs had their highest sales quarter ever in U.S. commercial distribution in Q3 2009, with shipments up 41% quarter-over-quarter and 19% year-over-year. The increase in Digital Signage display sales for out-of-home (OOH) environments signals another move towards increasing digital advertising revenues, a trend that Laser Focus World will continue to monitor in the coming quarters and years.

Other

Laser products not discussed in this review include laser pointers and pump lasers, which contributed approximately $6.4 million and $149.7 million, respectively, to worldwide laser sales in 2009. For detailed information on these and other sectors, please contact Strategies Unlimited’s Tom Hausken at [email protected].

REFERENCES

- www.cbsnews.com/stories/2009/09/09/business/main5297928.shtml

- abcnews.go.com/Business/wireStory?id=8478957

- www.foxnews.com/politics/2009/09/15/bernanke-recession-likely/

- Staff Report, “Chief BIS economist warns of double-dip recession,” The Daily Bell, issue 411 (September 15, 2009).

- Tom Price, “Global Investments in Scientific R&D,” Optics & Photonics News (OPN) 20, 9, 12–13 (September 2009).

About the numbers

The estimates and forecasts of laser shipments were based on both supply and demand side analyses by Strategies Unlimited, a PennWell business. Strategies Unlimited has been conducting market research in photonics products for nearly 30 years, with specialties in lasers and high-brightness LEDs.

The analyses used information gathered from interviews conducted throughout the year for Laser Focus World, as well as from financial statements and news reports. The demand side analysis focused on the relevant trends in 2009 and in recent years for sales of laser-based systems and the buying trends of customers of those systems. The supply side analysis focused on the corresponding trends of suppliers of lasers and their suppliers. The effort considered both quarterly trends and long-term historical trends; results were then compared and adjusted to correct for known errors.

The Laser Focus World quantitative market survey remains the only comprehensive market survey of the laser industry. More information will be available from Strategies Unlimited and at the Lasers & Photonics Marketplace Seminar (www.marketplaceseminar.com) held in conjunction with Photonics West in San Francisco on Monday, January 25th.

About the Author

Gail Overton

Senior Editor (2004-2020)

Gail has more than 30 years of engineering, marketing, product management, and editorial experience in the photonics and optical communications industry. Before joining the staff at Laser Focus World in 2004, she held many product management and product marketing roles in the fiber-optics industry, most notably at Hughes (El Segundo, CA), GTE Labs (Waltham, MA), Corning (Corning, NY), Photon Kinetics (Beaverton, OR), and Newport Corporation (Irvine, CA). During her marketing career, Gail published articles in WDM Solutions and Sensors magazine and traveled internationally to conduct product and sales training. Gail received her BS degree in physics, with an emphasis in optics, from San Diego State University in San Diego, CA in May 1986.

David Belforte

Contributing Editor

David Belforte (1932-2023) was an internationally recognized authority on industrial laser materials processing and had been actively involved in this technology for more than 50 years. His consulting business, Belforte Associates, served clients interested in advanced manufacturing applications. David held degrees in Chemistry and Production Technology from Northeastern University (Boston, MA). As a researcher, he conducted basic studies in material synthesis for high-temperature applications and held increasingly important positions with companies involved with high-technology materials processing. He co-founded a company that introduced several firsts in advanced welding technology and equipment. David's career in lasers started with the commercialization of the first industrial solid-state laser and a compact CO2 laser for sheet-metal cutting. For several years, he led the development of very high power CO2 lasers for welding and surface treating applications. In addition to consulting, David was the Founder and Editor-in-Chief of Industrial Laser Solutions magazine (1986-2022) and contributed to other laser publications, including Laser Focus World. He retired from Laser Focus World in late June 2022.