Wrinkles and unwanted hair keep sales of medical lasers in double digits

Throughout 2006 and into 2007, many Wall Street analysts were quite bullish about the market for consumer-based medical-laser applications—particularly wrinkle and hair removal.1 The American Society for Aesthetic Plastic Surgery (ASAPS) reported that the total number of laser skin-resurfacing procedures performed in the United States increased from 116,901 in 2000 to 556,172 in 2006.

As a result, companies such as Candela, Cutera, Cynosure, Lumenis, Reliant, and Syneron have experienced strong growth in recent years, particularly with their erbium-laser systems (including the erbium-based fiber lasers from Reliant/IPG Photonics).2 According to the 2007/2008 market review and forecast compiled by BioOptics World, sales of erbium- and holmium-laser systems for surgical and aesthetic applications topped 3200 units in 2007 (up from 2800 units in 2006), generating $275 million in revenues.

Even more impressive is the laser hair-removal market. According to ASAPS, laser hair-removal procedures in the United States have increased from 487,807 in 2000 to 1.48 million in 2006. And it appears this market segment is nowhere near the point of saturation. According to Millenium Research Group (Toronto, Ont., Canada), 3.1 million laser hair-removal procedures were performed worldwide in 2006—a 22% increase over 2005—and, with a projected annual growth rate of 18%, that number is expected to double by 2010.3 This in turn has fueled healthy increases in sales of diode lasers (notably the hair-removal systems sold by Palomar). According to our numbers, sales of diode-laser systems for hair removal topped 3600 units in 2007 (up from 3100 in 2006), generating nearly $400 million in revenues.

In addition to wrinkle and hair removal, laser lipolysis (body sculpting) is another emerging growth market in the aesthetic sector. Cynosure, for example, reported a 70% increase in revenues for the third quarter of FY2007—$31.5 million compared to $18.6 million for the third quarter of 2006—which, according to Cynosure President and CEO Michael Davin, reflects rapid market penetration of the company’s Smartlipo body sculpting product, a 1064 nm Nd:YAG system. This trend is reflected in our numbers, with sales of surgical Nd:YAG lasers increasing from 2100 units ($179 million) in 2006 to 2370 units ($202 million) in 2007.

However, with the instability and uncertainty that began creeping into the U.S. economy in the latter part of 2007—prompted largely by a sudden and rapid downturn in the U.S. real estate market and related financial fallout in the lending sector—consumer confidence and spending took a nosedive as well. This unexpected turn of events had a trickle-down effect on the medical-laser market, particularly in the second half of 2007. While worldwide sales of medical-laser systems once again reached double-digit growth in 2007, it was up only 10% year-over-year, down from 15% year-over-year in 2006 (see Table 1).

Vision correction still stalled

A key factor behind the slowdown in medical-laser sales was a nearly flat laser-vision-correction market, which negatively impacted sales of excimer lasers and per-procedure royalties for the second year in a row. Alcon (Hünenberg, Switzerland), for example, saw its laser-based revenues drop quarterly throughout FY2007, from $12 million in the first quarter to $8.5 million in the third quarter (see Table 2). If this keeps up, the company will realize less than $40 million in revenues from its laser-vision-correction business for the year, compared to $51.5 million in 2006 and $58 million in 2005.This trend is also reflected in the 2007 financials of vision-correction service providers such as LCA-Vision (Cincinnati, OH). Commenting on LCA-Vision’s third-quarter financials—in which revenues doubled year-over-year but still fell short of expectations—CEO Steve Straus predicted that earnings would decline “significantly” in the fourth quarter, primarily because of disappointing procedure volumes and the weakening U.S. economy’s effect on consumer confidence.

“Our ability to obtain a higher average price per procedure during the quarter favorably offset weaker same-store procedure volume as we continue to face headwinds due to softness in consumer discretionary spending and tightening credit markets,” he said. “However, a more cautious consumer has resulted in slower growth in procedure volume.”

On a more positive note, Alcon is in the process of buying Wavelight Technologies (Erlangen, Germany), which saw its revenues jump from $85 million in 2005 to $104 million in 2006 and is on track to top $100 million again in 2007.4 WaveLight develops and markets refractive-laser and diagnostic systems, including the Allegretto laser system for refractive eye surgery. According to Wavelight and Alcon, the Wavelight Allegretto has a global installed base of more than 800 units, offers the fastest ablation speed on the market today, is easy to use, and provides consistent clinical outcomes.

Alcon made its bid for Wavelight after passing on the purchase of Bausch & Lomb (Rochester, NY), which was instead acquired by Warburg Pincus (New York, NY), a venture-capital firm that subsequently took the company private. Based upon three quarters of financials—and despite ongoing issues with product-recall (not in the laser sector) and related financial problems—Bausch & Lomb is on track to realize total revenues of $130 million from its laser-vision-correction business, up from $122 million in 2006 and nearly in line with 2005 revenues of $139 million.

Another success story in vision correction is American Medical Optics (Santa Ana, CA), which is now the proud owner of both VISX and IntraLase. In 2006, IntraLase reported $130 million in revenues, and its “all laser” approach (a diode-pumped Nd:YAG laser manufactured in-house) has become the de facto standard for LASIK worldwide. In 2007, with the addition of IntraLase, American Medical Optics saw its laser-vision-correction revenues jump from $64 million in the first quarter to $102 million in the second quarter. The company’s U.S. excimer procedure volumes grew 8.6%, while its U.S. femtosecond procedure volumes grew 35.8%. System sales increased 175.4% to $27.3 million; on a unit basis, placements of the VISX Star S4 excimer laser rose 2.7%, while IntraLase femtosecond-laser placements rose 36.7%.

Diagnostic market growing

Other positive trends in the ophthalmic market include sales of diode and Nd:YAG lasers for diagnosing and treating a number of eye conditions such as glaucoma and cataracts. In addition, the growing market for optical diagnostic systems is being fueled by sales of laser- and light-based products in ophthalmology.

Carl Zeiss Meditec (Jena, Germany)—which receives 60% of its revenues from laser-based diagnostic equipment for ophthalmic diseases and is gaining ground in the refractive-surgery sector—reported a 21% increase in revenues in 2006, to $91 million. As of the third quarter of 2007, the company had already reported $104 million in revenues, which means it is on track to top $130 million in revenues for 2007. According to Zeiss management, compared with the same nine-month period in 2006, consolidated revenue for its diagnostics business segment increased 25% to €229 million (US$340 million), driven primarily by sales of its Stratus OCT, Humphrey Field Analyzer, IOLMaster, and OPMI Visu products. Looking ahead, the company is developing and/or preparing to launch additional products that will further extend its presence in the ophthalmic market, including a femtosecond laser and a new laser system to treat retinal disease.

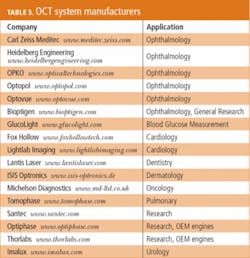

In fact, OCT—invented at MIT in 1991 and first commercialized for medical imaging applications in 1996—is enjoying a dramatic expansion driven by advances in several photonic technologies. The global market for OCT systems is estimated to be nearly $200 million and growing at an annual rate of 25%. The first commercial application for OCT—ophthalmology—is expected to remain the dominant commercial application through 2011. Currently, an estimated 37,000 OCT scans are taken daily in the United States for diagnostic purposes in ophthalmology; at the 2007 American Academy of Ophthalmology meeting in New Orleans last November, at least seven companies had OCT imaging systems operating on the show floor, and several more are expected to be introduced in the coming year (see Table 3). In addition, new applications and commercial OCT products are emerging in cardiology, dentistry, cancer detection, and dermatology.“In 2006, a number of companies introduced spectral-domain OCT systems to the ophthalmic market,” said Greg Smolka, author of a new market report on OCT technology and applications to be released in February 2008. “These systems offer speed increases of 30 to 100 times and two times better resolution than the existing time-domain technology. This speed increase allows for not only much faster image capture but, more important, much higher image accuracy. These new instruments were all over the floor at the AAO, and many see them becoming the dominant diagnostic-imaging system in ophthalmology.”

REFERENCES

- R. Duprey, “The Beauty of Lasers,” Motley Fool, April 10, 2007.

- Millenium Research Group, “U.S. Markets for Aesthetic Lasers 2006,” (May 2006).

- K. Kincade, “Aesthetics continue to drive sales,” Medical Laser Report (Jan. 1, 2007).

- K. Kincade, “Alcon makes takeover bid for German eye-laser firm,” Medical Laser Report (July 2007).

About the Author

Kathy Kincade

Contributing Editor

Kathy Kincade is the founding editor of BioOptics World and a veteran reporter on optical technologies for biomedicine. She also served as the editor-in-chief of DrBicuspid.com, a web portal for dental professionals.