The Chinese GDP grew at 8.1% in 2021,1 resulting in a 5.1% average annual growth rate for the last two years. The Chinese economy is about 77% that of the United States’ economy, and the gap is narrowing. The consensus is, that for the next five years, the Chinese GDP annual growth rates will be in the range of 5% while the U.S. growth will be in the 3% range.2

To assess where China stands in the world ranking of manufacturing power before China launched its “Made in China 2025” plan, the Chinese Academy of Engineering (CAE) developed the so-called “Manufacturing Power Development Index” to evaluate every country in the world, their manufacturing capability, and ranking. Released every year since 2015, it has become an authoritative index for objectively evaluating, for the Chinese government, the overall level of China's manufacturing industry. In the recent release, the U.S. is leading the way, followed by Germany and Japan in tiers 1 and 2, respectively. China is in tier 3. In 2021, China increased its index by 5.18 points to a total of 116.02, which is very close to Japan’s 117.16. This puts China on a trajectory of moving up to the tier 2 group together with Germany and Japan before 2025 (see Fig. 1).The Chinese laser market

Looking back on 2020, China’s laser industry achieved growth to the tune of 10 percentage points throughout the year, far exceeding expectations. In 2021, China’s laser industry continued its good trend. The overall size of China’s laser equipment market is increased by 18.3% year-to-year in 2021, reaching a record of 12.91 billion USD. The application of laser technology has become the key for many manufacturing industries to improve the quality of their products and reduce costs, and ultimately their competitiveness amid China’s transition from the old low-tech to the new high-tech industries.

The industrial laser market alone is about 8 billion USD, with laser cutting taking the major share of 40%, followed by laser welding (14%), laser marking (13%), semi/display (12%), precision machining (9%), non-metal processing (7%) and the rest (6%).

Fiber laser market

China is the largest market for fiber lasers in the world. Its fiber laser market grew by 15.3% in 2021 to 1.713 billion USD, accounting for 63% of the global market. Shipment of 6 kW power-level lasers has increased significantly. And even more explosive is the sales of 10 kW, 12 kW, and 20 kW lasers that became the main laser sources in sheet metal cutting in China.

The price of fiber lasers dropped dramatically as more fiber lasers components are manufactured by domestic makers. The opportunity of replacing the old, and often polluting cutting technologies, like plasma cutting, becomes reality as the prices of fiber lasers drop. There are more than 150,000 units of plasma cutting machines sold in China each year.

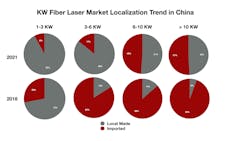

The localization of fiber laser manufacturing in China is accelerating. In addition to the international players, there are at least 11 Chinese laser manufacturers now offering fiber lasers with power levels of 10 kW or more. For example, Max Photonics offers up to 40 kW, while Raycus launched its first 100 kW fiber laser in December 2021.

The portion of the domestically made fiber lasers reached 60.4% of the total Chinese market in 2021; it was only 33.6% in 2017 (see Fig. 3). Fiber lasers with 1 kW power or less are completely made by Chinese companies and 90% are made by Raycus and Max Photonics. The localization of 1–3 kW and 3–6 kW has reached 92% and 86%, respectively, while it is almost a split at above 6 kW. The localization levels are 51% and 49% for 6–10 kW and 10–40 kW, respectively.Capital investment in the Chinese laser industry has increased since the launch of the SSE STAR Market in 20195 and so is the support from the government, especially local governments, through industrial policy and “laser industrial parks or clusters”. These laser parks aim to achieve industrial scales and clusters and to provide support for the local industrial chain. This measure gives significant advantages to the laser industry. One would expect the establishment of many such laser parks in the next five years—that is, during the Chinese “14th Five-Year Plan” period.

The growth rate of the Chinese industrial laser market for 2022 is expected to be above 10%.

REFERENCES

1. See www.stats.gov.cn.

2. According to IMF and World Bank.

3. A Lewis Turning Point occurs when a country’s surplus labor evaporates, pushing up wages, consumption, and inflation rates.

4. CPTPP – Comprehensive and Progressive Agreement for Trans-Pacific Partnership became effective on December 28, 2018, with 11 countries. China has applied for its entry on September 16, 2021. RCEP – Regional Comprehensive Economic Partnership went into effect on January 1, 2022, with 15 countries. These two trade agreements provide a foundation for Asian regional economic integration.

5. See star.sse.com.cn/en. SSE STAR Market – The Science and Technology Innovation Board in Shanghai Stock Exchange was launched on June 13, 2019. This is a registration-based system aimed at high-tech companies with potentially high growth and strong research and development, but below par on revenue and net profit.