Report sees nontraditional markets driving IR detector sales

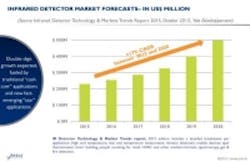

According to research firm Yole Developpement (Lyon, France), the infrared (IR) detector market will grow to approximately $500 million by 2020, driven by applications in smart lighting, smart buildings, and mobile devices. A recent report says technological developments will drive the cost of arrays to as low as $10. The total IR detector market was 247 million units in 2014 and generated a global revenue of $209 million.

Yole’s analysts noted the rapid growth of this market--14% CAGR between 2015 and 2020 (in units). Five of nine potential applications will drive the IR detector market revenue growth: spot thermometry in mobiles devices, motion detection, smart building, HVAC and other medium array applications, and people counting.

The motion detection market is the biggest IR detector business with almost half of total revenue. This mature market will continue growing at 10%/yr until 2020, thanks to the dynamic lighting market increasingly integrating IR detectors to provide smart lighting systems. From the other side, mobile device makers are very interested in having an IR spot thermometer function to measure body temperature. The first wearable applications have already begun. Smartphones are the next step if technical challenges are solved, with attaining sufficiently high accuracy the biggest one. Detector manufacturers are confident that they will find solutions.

Array detectors, ranging from medium size (4x4 to 16x16 pixels) to large size (32x32 and above) are expected to grow at an approximately 26% CAGR over the 2015-2020 period. Medium size arrays are increasingly implemented for better comfort by Japanese HVAC systems manufacturers such as Daikin, Mitsubishi and Hitachi. Large arrays are also deployed widely and successfully for retail sector people counting by Irisys/Fluke. They will be widely introduced into a key new market--smart buildings--in 2016 thanks to new products introduced at lower prices (between $10-$20). These sensors provide a wide variety of useful functions for BMS in order centrally manage lighting, door and window opening, and HVAC.

Yole says that IR detector market growth and emerging applications are attracting new players at various levels of the supply chain and thus changing the competitive landscape. In the small motion detectors and smart buildings field, lighting is the main building function using IR detectors. Lighting manufacturers like Philips Lighting are increasingly providing such sensors to climb the value chain and thus compete with controls companies like Schneider Electric, Siemens, and Honeywell. Motion detectors are a first step before going into more intelligent array detectors for smart buildings.

In the mobile business, multiple sensors integrated into a module and called ‘sensor hubs’ are increasingly used by mobile phone makers to facilitate sensor integration. The question is, which sensor hubs and which company will integrate the new IR spot thermometer function? Will it be inertial hubs from the likes of ST, Invensense, and Bosch, environmental hubs from companies like Knowles, Sensirion, Bosch, and ST, or optical hubs from players including Sony, Omnivision or AMS?

Regarding IR detector suppliers, the small pyroelectric motion detector market is quite stable with three big players, Excelitas, Nicera, and Murata. By contrast, medium and large array products are much more open in terms of potential technologies, including pyroelectric detectors, thermopiles, microbolometers, and thermodiodes, which enables various new entrants, from a startup like IRLYNX, to large groups like Bosch. New entrants from businesses including IR imaging, thermopiles, or even mainstream semiconductors, could also acquire incumbent players.

Source:Infrared Detector Technology & Market Trends (2015 edition), by Yole Developpment