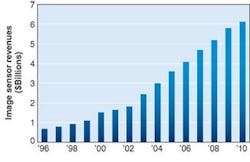

These are the best of times for image sensors, with sales continuing to climb in an already sizable market (see figure). Much of this growth is because of advances in VLSI (very large-scale integration) technology developed by the electronics industry. Many CMOS arrays are fabricated at 0.18-µm rules, and some products are going to 0.13-µm rules. These gains have improved the quality in image sensors, reduced the power consumption, and allowed integration with image-processing electronics to form more-compact packages for applications such as mobile phone handsets and a wireless endoscope that is swallowed like a pill.

There are really two markets in image sensors: consumer products and everything else. Image sensors for consumer applications tend to cost a few dollars at most, and can be manufactured in quantities as great as millions per month. Leading the consumer market is the rapid penetration of camera modules into mobile-phone handsets, and the continuing growth in sales of digital still cameras. In both cases, there is still a steady migration to higher-pixel-count arrays, keeping the prices of the imagers high. Other examples of consumer applications include camcorders, PC cameras, scanners, toys, and optical mice.

What we call the specialty market includes everything else: security, machine vision, barcode readers, automotive, medical, radiography, biometrics, military, and scientific applications. Image sensors for these industrial applications tend to be more customized than for consumer applications. They often cost hundreds or thousands of dollars each, with production often only in the hundreds of units, or even single units.

The growth in the specialty market is more modest than in consumer applications, but it has been steady. And, the automotive segment promises to break away into large volumes, forming a new category between the consumer and specialty segments.

In almost every discussion of image sensors, the issue of CCD vs. CMOS designs comes up. The two approaches are actually alike in many ways, and it seems a cliché to compare the two as if that were the only differentiator in the market today. What is important is that the leading image-sensor makers up to now have been large Japanese companies that have specialized in CCDs, particularly Sony (Tokyo, Japan), Sharp (Osaka, Japan), and Matsushita (Osaka, Japan). The new contenders, the underdogs, all use CMOS designs.

The CMOS designs happen to be a great match for the camera phone, which is a blockbuster application if there ever was one. Camera phones require a very compact module and low power consumption to maximize battery life. CMOS sensors can deliver both of those features very well. And, the CMOS designs really pay off in high-volume products, such as the camera phone, that can justify highly integrated and small feature size design. Nearly all of the more than 300 million camera phones shipped in 2005 use CMOS arrays. As this application continues to grow rapidly, CMOS sensors gain in overall market share.

The CCD array remains a good general-purpose image sensor, with its own strengths. In specialty, low-volume niches, CCDs are quite competitive. Revenues for CCDs continue to climb for now, as they are still widely used for megapixel cameras and for video applications. But CMOS arrays are catching up.

Meanwhile, however, the Japanese companies have rapidly ramped their own production in CMOS arrays—in 2004, three of the top suppliers of CMOS arrays were Japanese companies. This means that the new CMOS suppliers may not gain on the Japanese on the advantages of the CMOS concept alone. Also of great importance will be timing, key R&D, good old-fashioned execution, and an experienced sales team.

Another key issue is the business model. In one corner are the companies that fabricate the chips, and the Japanese companies lead in that arena, with a long history of making CCDs and cameras. However, Micron can leverage its older-generation DRAM tools to make CMOS image sensors, which are also large arrays of identical transistors, like DRAMs. And companies like STMicroelectronics (Geneva, Switzerland) can leverage their skill in mixed analog-digital circuits, because an image sensor is also fundamentally a mixed-signal device.

These companies can gain some efficiencies by keeping the design and fabrication in-house. They can keep more profit margin to themselves because they do both design and fabrication. Alternatively, they have the liberty to cut their margins to be more competitive.

In the other corner, there is a wide array of fabless suppliers that contract out the fabrication, testing, and assembly. Leading the fabless group is Omnivision (Sunnyvale, CA), a publicly traded pure-play image-sensor supplier. It has done well by outsourcing the fabrication to TSMC (Hsinchu, Taiwan, China), the Taiwanese foundry. Kodak (Rochester, NY) is a longtime vertically integrated CCD supplier, but for its latest foray into CMOS arrays it also chose the fabless route, also with TSMC as one of its foundries. Fabless suppliers also typically contract out the test and the assembly. Last year, Agilent (Palo Alto, CA) formally divested its assembly operation to Flextronics (Singapore), which matches better with Flex’s handset assembly business. This now makes Agilent a fabless chip supplier (and soon with a new name and owner).

The fabless model has been very successful in other electronic markets. It is a way of breaking up the supply chain to be more efficient by lowering the barriers to entry for designers and filling the capacity of the foundries. As for giving up some of the control of the process and splitting the margin, the fabless companies can point to strong relationships with foundries that can rival the overall cohesion of an integrated fab. And without their investment in a fab, the return on investment for a fabless company can be very good.

Market growth this great attracts talent, and we count more than 50 companies seeking their fortune in designing and selling the image sensor alone. Add to this the many players that also contribute to the imaging function: lenses, filters, contract fabrication and assembly, image-processing electronics, and so forth.

So far, we have seen relatively little consolidation. For the time being, in these times of expanding opportunities, the market is very forgiving of the many approaches that companies are taking.

About the Author

Dr. Tom Hausken

Director, Photonics and Compound Semiconductor Products

Joining Strategies Unlimited in 1999, Dr. Hausken conducts the world’s leading market research in lasers and other photonics markets. He has nearly 30 years in the industry, including a joint project with Japan on optical computing while at OIDA, technology policy at the U.S. Congressional Office of Technology Assessment, and in R&D and production at Alcatel and Texas Instruments. He has a PhD from the University of California at Santa Barbara in compound semiconductor photonics.