OPTICAL COHERENCE TOMOGRAPHY/BIOIMAGING: One decade and $500M: The impact of federal funding on OCT—Part 2

ERIC A. SWANSON

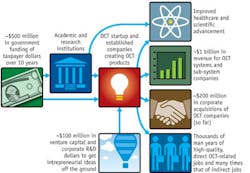

As discussed in Part 1 of this article, determining the impact of research dollars for academic institutions is difficult. Thankfully, it is a little easier to estimate impact on government funding that traces its way from academic institutions to for-profit business, or funding that is given directly to for-profit business. To do this, we can look at the impact commercial products (if any) have had—or may yet have—on the marketplace.

Government grants fuel for-profit growth

Government-sponsored academic research is seeding important for-profit entities, including LightLab Imaging (in collaboration with Massachusetts Institute of Technology), Bioptigen and Oncoscope (separate companies both in association with Duke University), NinePoint Medical (with Massachusetts General Hospital), Diagnostic Photonics (with University of Illinois at Urbana-Champaign), and Imalux (with the Institute of Applied Physics at the Russian Academy of Sciences). These and other for-profit OCT companies—along with estimates of their revenue (small, 0–$10M; medium, $10M–$100M; and large, $100M+), equity financing, and connections to sources of government funding—are listed in Table 10. Note there are smaller OCT system companies and many, many more subsystem and component companies supplying the OCT market that are not listed.

As shown, the amount of venture investment is well in excess of $125M and the current yearly worldwide OCT capital equipment and disposable market is on the order of $300M and numerous analyst firms expect the arena to grow soon to $1B/year as many of the companies obtain FDA and CE approvals and begin to sell their OCT products (including companies such as Terumo and Volcano, which appear to be getting close to FDA approvals for their cardiovascular products). The R&D investment would be substantially higher than $125M of venture capital if R&D investment dollar data for all the companies were shown and higher still if companies that manufacture OCT components or subsystems rather than instruments as well as internal R&D dollars were considered.

So far there has been almost $200M in exits for OCT startup companies, including the $90M LightLab acquisition by St. Jude Medical, $21M Axsun acquisition and $63M Cardiospectra acquisition—both by Volcano Corp., $94M Optopol acquisition by Canon Medical Systems, and $10M Ophthalmic Technologies Inc. (OTI) acquisition by OPKO Health. OCT instrument and subsystem revenue, integrated since the first product became commercial in the mid-1990s, is more than $1B. If only funding from other government programs could pay similar current and ongoing dividends!

While grants invested in for-profit companies can be applied to fundamental research just as in academic institutions, funding from the U.S. Small Business Innovative Research (SBIR) and similar grants are mandated to advance businesses, create jobs, and move products into the marketplace. There are a few examples of repeated government investment in for-profit companies that are not leading to positive for-profit results, and conversely there are for-profit OCT companies that have not taken any direct government money and are doing extremely well. In fact, most of today’s largest OCT companies (e.g., Carl Zeiss Meditec, Optovue, and LightLab) have received little if any government funding. Optovue, an impressive ophthalmic OCT system company founded in December 2003, is an exemplary success story. Optovue raised ~$14M in equity financing, and was the first to commercialize a spectral domain system. It has grown market share rapidly and recorded ~$50M in revenue in 2010. The company was equity-financed and received no direct or indirect government funding for financing or growth. Optovue has announced plans to enter the optometry markets with an innovative, “pay per use” model and has ambitions to bring OCT capital expenditures to a point where it can thrive through the developing world. According to CEO Jay Wei, “it is clear that academia continues to need government funding, but what would best benefit companies like Optovue are tax incentives.”

Bioptigen is an example of a successful startup spawned from academic research dollars of co-founder Joseph Izatt at Duke University and Case Western Reserve University (~$10M funding OCT-related research) that grew with the aid of for-profit government funding (~$4M). According to Bioptigen CEO Eric Buckland, “Grant funds have been invaluable to Bioptigen and allowed us to explore underserved and niche applications, including preclinical research and pediatric ophthalmology that may not have found funding otherwise, but are nevertheless important markets. The rules for winning the grants are clear and the open, competitive nature of the process allows good ideas to get through. They are particularly valuable as seed financing, particularly in a financial environment where risk capital (e.g., corporate and venture capital) moves upstream to more developed technologies and larger addressable markets. Furthermore, SBIRs are accessible to geographic areas with much less well-developed pools of risk capital. The major problem with building a company with SBIRs is it is a very slow process.” Due to the U.S. government budget battles, SBIRs have been on life support for the past year and without reauthorization, they could expire or be substantially altered in the future.

A global phenomenon

In the UK, startup Michelson Diagnostics has received substantial assistance from the regional and central government (~$800k) and has introduced an impressive OCT product for dermatology and other markets. Michelson also licensed some patents from the University of Toronto. The UK government “Enterprise Investment Scheme” program promotes early stage investment by providing tax relief to angel investors. Along with other similar programs, this has created an environment in the UK favorable to ‘angel’ investment in seed and very early-stage investments. According to CEO Jon Holmes, “The Enterprise Investment Scheme has been critical to Michelson in enabling us to raise finance in early years.” It seems many programs in the UK and EU are required by law to have grants to companies be matched, or more than matched, by privately sourced funding. Although there are U.S. government grant programs that have matching requirements (e.g., NIST ATP/TIP), some people have suggested that more matching of private capital on for-profit government grants could help the U.S. to avoid repeatedly funding companies that either do not transition to real products and profitability, or are not commercially oriented.

Dr. Felix Feldchtein, an OCT pioneer at the Institute of Applied Physics at the Russian Academy of Sciences and co-founder of Imalux (along with A. Sergeev, V. Gelikonov, and G. Gelikonov), stated that “early support by the Russian Foundation of Fundamental Research was instrumental for early technology development of OCT in Russia prior to founding Imalux.” Feldchtein, a long-time resident of the U.S. and serial entrepreneur, thinks that many SBIR and equivalent programs are not sufficiently business-oriented. “Programs are often judged mainly by academically minded panels focusing on academic merit,” he said. “As a result, scientifically innovative proposals with very questionable commercial potential are winning over innovative technologies which are ready for the market, but have already lost academic attractiveness.” This statement seems to have merit: It is easy to find examples of for-profit companies (inside and outside the OCT market) that have repeatedly won government SBIR or other money and have never produced a successful product.

Optiphase, a private company in the OCT space (and other spaces) primarily doing OEM business, did not take equity financing in its early years (1990s), but won several SBIR grants and a NIST TIP grant exceeding $1M that collectively functioned as venture capital funding without dilution. Optiphase business has been up in 2011 and over the past three years, and the company still reviews government solicitations, but is cautious to pursue only ideas that are aligned with fundamental corporate needs. CEO and founder Jeff Bush cautions, “Grants and similar R&D government-sponsored funding vehicles are generally hazardous to your bottom line. However, for startups with little or no external funding, they are the essential ingredients to future livelihood, which I fully condone and encourage.” Many successful businessmen would agree with the idea of carefully weighing whether to chase government funding because doing so can put companies at risk of running like a government instead of as the nimble, efficient, creative, and profit-driven entities they need to be to survive in today’s globally competitive markets.

LLTech, a startup with offices in France and the U.S., develops a full-field OCT microscopy system with sub-micron resolution in 3-D, and recently introduced its Light-CT product for digital pathology and other markets. The company has raised ~$1M in equity and about $3.2M in direct and indirect grants from the French government. Founder and CEO Bertrand Le Conte de Poly stated, “It is hard to access private capital in France for early-stage startups without a proof-of-concept completed. Access to grants for LLTech directly or access for grants from third parties that use LLTech equipment have been greatly beneficial for moving our vision of digital pathology forward. For the future it would be beneficial to reduce the amount of paper work and the long process.”

In addition to successful OCT system companies founded directly by university researchers who were funded by government grants, there are success stories of established companies that acquired OCT technology. Among these is Volcano Corp., which acquired intravascular OCT technology from Cardiospectra for $63M in 2007. Cardiospectra was founded out of government-sponsored OCT research at the University of Texas at Austin.

The European Canon Medical Systems acquired Optopol, a private company founded in Poland in 1992, for $94M in 2009. Most of Optopol’s income came from the resale of brand-name ophthalmology and dermatology equipment as well as in-house production of perimeters and topographers for ophthalmology. Optopol wanted to move from services to “high-tech production” of an industry-leading product, and had access to a world-leading OCT research group at Nicolaus Copernicus University (NCU)—publisher of leading research papers in OCT and ophthalmology. Over the past decade NCU has received ~$4.2M (~$11M Zloty) of public-sponsored research (Polish government, European Science Foundation, and EC). NCU worked to transfer critical technology “know-how” across a wide range of engineering and manufacturing fronts into Optopol, which resulted not only in a $94M acquisition by Canon, but created important high-tech jobs in Poland. According to Maciej Wojtkowski, a leading NCU researcher, “For our group at NCU it was more about having an industrial partner, which in the long term could give job opportunities for MSc and Ph.D. students and Ph.D.s from our group—one of the conditions of our collaboration was creation by Optopol an R&D office at NCU.” Many people would agree that this seems an excellent decision on the part of Dr. Wojtkowski, one that created a winning situation that hopefully will continue to pay dividends for Poland and future NCU alumni.

Future offerings and funding

Other system, subsystem, and component companies may be on their way to bringing important products to market or already have commercial products. One example is Praevium Inc., which just demonstrated an impressive high-performance OCT swept source based on optically pumped VCSEL technology that will soon be commercialized, and was supported in part by NIH and other U.S. government agencies for profit-oriented funding. Currently there is a dearth of choices for commercially available high-performance, low-cost, compact frequency swept light sources.

Another example of government dollars transitioning to commercial dollars includes Goodrich/Sensors Unlimited, which is turning defense dollars into high-speed NIR camera systems that appear imminently useful for spectral-domain OCT imaging.

There has been, and continues to be, tremendous scientific and commercial progress in OCT technology and its application. Government funding has not only helped spur that progress, it appears that it was instrumental and that the payback to society has been exceptional in terms of advancing clinical care to millions of people, creating new businesses and jobs.

Within the U.S. and elsewhere, however, it is unlikely that that the government funding base will continue to grow by 25% per year as it did in 2010: The competition is already fierce and it will become more difficult for institutions and PIs to keep the funding levels they now have. Research that is not “high-impact” will probably get weeded out. Funding pressure will be especially difficult on weaker, for-profit companies unable to show profit. Comments from a sampling of successful CEOs in the OCT space indicate that continued funding is important, but there are ways to improve the funding process.

It would be interesting to compare the funding and impact on other fields outside OCT or medical diagnostic equipment. For example, a field such as nanotechnology, which is often viewed as over-hyped, is frequently featured in the mainstream media and thus is in the consciousness of the public. By contrast, OCT is not well known—either to the public or at the highest levels of funding agencies. However, OCT has made major fundamental scientific and clinical advances and appears to continue to pay back handsomely in terms of for-profit company and jobs creation, and is growing mostly due to its widespread utility rather than hype.

The future still looks bright as OCT begins to have major impacts beyond ophthalmology and is integrated with other diagnostic imaging modalities and therapeutic procedures. Despite the increased pressure on government funding, the use of OCT will likely continue to grow as it is increasingly used in clinical studies in many medical and surgical specialties. A strong argument could be made to funding agencies that OCT is not a place to cut because of strong potential for growth, impact, and return-on-investment.

A pioneer in optical coherence tomography (OCT) and a serial entrepreneur, Eric A. Swanson is co-founder of such companies as Advanced Ophthalmic Devices and LightLab Imaging. Among his activities in technology research and development, he serves on various boards for companies, including NinePoint Medical. He is also editor of the non-profit news outlet, OCT News (www.octnews.org). Contact him at [email protected].