LASER MARKETPLACE 2009: Photonics enters a period of high anxiety

The Laser Focus World 2009 annual review and forecast of the laser marketplace is conducted in conjunction with Strategies Unlimited (Mountain View, CA; a PennWell company) with additional input from Industrial Laser Solutions magazine. Unlike in previous years, when we have covered nondiode lasers in January and diode lasers in February, this month’s article covers the global market for all lasers.

The laser business is already feeling the pinch of the global economic recession. The questions are: how long and how severe will the impact be, what laser segments (if any) will remain healthy, and who will be left standing?

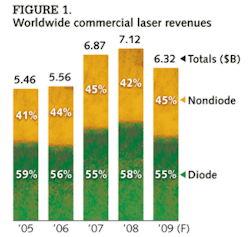

Last year’s annual review and forecast of the laser marketplace revealed a pleasing 9% revenue growth for all lasers from 2006 to 2007, and predicted a 7% gain from 2007 to 2008 for a total laser market forecast of $7.40 billion for 2008. But it also warned of vulnerability in the increasingly consumer-driven laser industry and noted softening in the latter part of 2007 because of the subprime lending fallout in U.S. housing and rising worldwide fuel and commodities prices. Few, however, could have predicted that one year later the world’s financial markets would tumble an average of 30%, and that consumer confidence in the U.S. would hit an all-time low.1, 2

Closer to home, the laser industry has certainly felt the economic pain, with both small and large firms affected by the slump. Diode-laser maker QPC Lasers (Sylmar, CA), for instance, drastically reduced operations in October 2008, citing its inability to raise necessary funds. And revenues were down 11% for laser manufacturer Coherent (Santa Clara, CA) for the quarter ended Sept. 27, 2008, compared to the same quarter in 2007. Coherent serves a broad sector of industries, including R&D, microelectronics, materials processing, and OEM components and instrumentation, and its results serve as a “canary in the coal mine” indicator of the impact of the global economic situation on the laser market.

Coherent is taking steps to deal with the macroeconomic situation, which, in the words of John Ambroseo, president and CEO, “creates churn in the marketplace.” Business was off despite 25% and 10% growth for lasers in medical and bioinstrumentation applications, and a nearly doubling of business in solar-cell processing within the microelectronics sector. “An unprecedented set of macroeconomic events led to a disappointing fourth quarter,” he said. “This is a global effect and not a regional effect; there will be ample debate over the timing of a market recovery.”

At least one industry insider suggests the recovery will be a three-year process, but the industry will emerge stronger. During his plenary presentation at the 2008 International Congress on Applications of Lasers & Electro-Optics (ICALEO; Temecula, CA) in late October, Milton Chang, a photonics industry veteran and Incubic (Menlo Park, CA) managing director, also offered the laser and photonics industry some sound advice. “In this economy, venture-capital funding is likely to dry up,” said Chang. “Close your pending financing round at any valuation–half a loaf is better than none.” He suggests that laser companies streamline operations, mind the cash, and stay liquid–cash is king. “Cut excess staff, postpone making nonurgent capital investments, and keep an eye on receivables,” he said, noting that investors would be looking for solid earnings, as the valuation of laser companies is no longer determined by glamour, but earning power.

History repeats itself

Defined as two or more consecutive quarters of shrinking gross domestic product (GDP), recessions in the U.S. include the great depression of the 1930s, an oil-crisis-fueled recession in the early 1970s, a severe recession from 1981 to 1982 caused by contractionary monetary policies of the Federal Reserve in the wake of high unemployment, the 1979 energy crisis, and attempts to control high inflation, and a significant worldwide recession from 1990 to 1992.3

While not all previous recessions have impacted laser sales, the recession of the early 1990s was global (similar to today’s recession) and did affect industrial-laser revenues. David Belforte, chief editor and publisher of Industrial Laser Solutions, has been tracking the worldwide industrial-laser market since 1970. He said laser sales increased every year during the recession of the early 1990s, except for 1991 (a 5% decrease over 1990) and 1992 (a 17% decrease over 1991). “1992 was the depth of a very severe recession in the U.S. economy,” said Belforte. “I consider 1991 as a no-growth year because my numbers then were ±5%. So I usually say that industrial lasers experienced only one negative growth year [1992] since 1970.”It is important to note that the early 1990s recession had many of the same attributes seen in the current 2008 economic climate: it was a global recession that followed the 1987 Black Monday U.S. stock-market collapse and subsequent savings-and-loan collapse, and was fueled by a 1990 spike in oil prices in the wake of the first Gulf War. A profile on the history of laser manufacturer Rofin-Sinar Technologies (Plymouth, MI, and Hamburg, Germany) at Answers.com explains the situation. “The global recession of the early 1990s hit machine-tool manufacturers, Rofin’s main customers, hard. By 1992, competition for remaining business was so fierce that laser manufacturers were cutting prices, noted a company financial report. Layoffs and other cost-cutting measures followed, including outsourcing, leasing excess office space, and closing a site in San Jose, CA. Rofin-Sinar posted a $20 million net loss on revenues of $60 million in 1993 but was in the black again within a couple of years.”

Similarly, a New York Times article warns that with consumers cutting back on discretionary spending, laser-correction surgeries are declining, as in the last recession.4 “We’re forecasting a 17% drop for 2008,” said David Harmon, president of Market Scope (St. Louis, MO), an eye-surgery market-research company. Harmon said he expects an even sharper decline in laser-assisted in situ keratomileusis (LASIK) surgeries than in 2001, when the sour economy led to a three-year slump in laser procedures. For Q3 2008, Advanced Medical Optics (AMO; Santa Ana, CA) also reported that refractive sales declined 14.4% to $96 million and system sales declined 31.2% to $18.8 million, which it said reflected a sharp pullback in new equipment purchases by LASIK providers on a global basis. Despite stronger sales in Asia, the U.S. sales picture was grim, with the number of procedures using excimer and femtosecond lasers down 35% and 12%, respectively, in the third quarter compared to the same period last year.

“The semiconductor industry is noted for being cyclical: though semiconductor device sales and unit shipments will have increased for seven consecutive years from 2002 to 2008, industry spending on equipment grew year-over-year four times and contracted three times during this period, including the estimated 20% to 25% contraction in spending estimated for 2008,” said Dan Tracy, senior director of industry research and statistics at SEMI. “Given the current turmoil and uncertainty in the broader global economy, 2009 looks to be a low- or no-growth year for semiconductor sales worldwide. Device makers are pushing out, delaying, or cancelling new fab projects, so at present it looks as if spending on semiconductor equipment could decline by 10% or more in 2009, pushing spending down to its lowest levels since 2003.”Even before the economy started to affect industrial and medical laser sales, the semiconductor industry and laser sales into microelectronics processing, wafer inspection equipment, and lithography were already in the midst of a slump; in fact, SEMI (San Jose, CA) and Gartner Dataquest (Stamford, CT) both independently predicted an approximate 20% decline in the semiconductor capital equipment market for 2008 (see www.laserfocusworld.com/articles/337115).

Signs of maturing markets

As markets mature and products become a commodity, companies either seek niche markets to keep growth (and profit) high, or consolidate operations through mergers and acquisitions (M&A). The year 2008 saw a large share of M&A activity–a strong indicator that many laser sectors may indeed be entering “commodities” territory.

“The successful IPO of IPG Photonics in December 2006 unleashed a wave of acquisitions seeking to accumulate fiber-laser technology and related components,” said John Harmon, senior analyst at investment banking and asset management firm Needham & Company (New York, NY). “In December 2006, Rofin-Sinar closed its fourth acquisition in the year, culminating in the purchase of Nufern, a maker of specialty optical fiber and fiber lasers; In January 2007, II-VI acquired HIGHYAG Lasertechnologie in Germany; in September, nLIGHT bought Optotools; and in October, Trumpf acquired publicly traded SPI Lasers (the only other publicly traded pure-play fiber-laser manufacturer) for $49 million.” These acquisitions signal maturity in the industrial laser sector for machining, cutting, and welding operations using lasers, although the penetration rate of lasers into some sectors such as welding still lags in comparison to conventional technologies (see www.laserfocusworld.com/articles/341585).

Even outside the industrial laser industry, the 2008 acquisitions of Novalux by Arasor (Sydney, Australia), Aculight (Bothell, WA) by Lockheed Martin (Bethesda, MD), and Excel Technology (East Setauket, NY) by GSI Group (Bedford, MA), are evidence that companies desire to “organically” expand their laser technology offerings and develop system-level products that can better compete in price compared to companies that depend on external laser suppliers. Arasor acquired Novalux, for example, to specifically obtain all the components necessary to offer a complete red-green-blue (RGB) light engine for laser televisions, mobile phones, navigation systems, and other displays by combining the infrared lasers from Novalux with the periodically poled lithium niobate (PPLN) chip from Arasor that converts the infrared lasers to RGB sources. In the acquisition of Aculight by Lockheed Martin, Lockheed cited the ability of Aculight to strengthen its core offerings in guided munitions, airborne self-protection, and advanced sensors, and to create potential for adjacent market expansion. And Antoine Dominic, president and CEO of Excel Technology, cited product advantages in the acquisition of Excel by GSI. “As the industry evolves, geographical reach and breadth of product offerings become paramount,” said Dominic. “By joining forces, GSI and Excel will be in a very strong position to accelerate new product introductions and global market penetration.”

“Laser companies are evolving from being ‘science projects’ to being run as businesses for the benefit of shareholders,” said Harmon. “With hundreds of laser companies chasing a fairly small market ($7 billion), consolidation of the laser industry appears inevitable. Increasing focus of large companies such as Coherent, Newport, and Rofin-Sinar on growth through acquisition and achieving the accompanying economies of scale makes it difficult for smaller companies to compete; investors are becoming less forgiving of lackluster growth and sub-par profitability, so management teams of public laser companies are under increasing pressure to pursue aggressively the benefits of consolidation.

“The IPO of IPG Photonics and its healthy growth rate brought back investor interest in the laser industry and highlighted the strength of the materials processing segment, which offers higher growth than scientific and government research and less cyclicality than microelectronics,” added Harmon. “The contraction of the credit markets is likely to make acquisitions difficult to finance and laser companies are likely to focus more on cutting costs, controlling expenses, and hoarding cash.”

Laser forecasts: a best and worst case

While history can provide some insight as to how laser companies may fare in a recession similar to that of the early 1990s, no one can predict the length or severity of an economic downturn. Last year we predicted total global laser revenues as $7.40 billion for 2008 and reported sales of $6.89 billion for 2007. Actual revenues for 2008 were adjusted down slightly by Laser Focus World to $7.12 billion due to the softened economy going into 2008.

With all that we’ve seen in recent months, however, softening is yielding to a downright free fall. Official GDP figures from the U.S. Bureau of Economic Analysis (BEA) confirmed a negative 0.3% growth rate for Q3 ended Sept. 30, 2008. And Euro area GDP for the 15 major European Union (EU) countries for Q2 was negative 0.2% according to Eurostat, the Statistical Office of the European Economies.

Factoring in the laser industry’s growing dependency on consumer sectors and historical recession trends, a worst-case scenario for 2009 could see industrial, medical, and semiconductor laser markets falling by as much as 20% or more. But many in the industry do anticipate that laser sales into defense and security applications will remain strong enough to contribute some upside in this gloomy forecast scenario. However, the newly elected U.S. President Barack Obama and the Democratic-dominated Congress intend to end the war in Iraq, which many believe would signal an end to lucrative defense contracts.“We’re all reading the tea leaves to some degree, but the new U.S. president is much more sensitive to commercial technology applications than was the former administration,” said Michael Lebby, president and CEO of the Optoelectronics Industry Development Association (OIDA; Washington, D.C.), a not-for-profit association aimed at growing the optoelectronics industry. “I’m not entirely optimistic, but am encouraged that the nondiode laser market for solar and biomedical applications will do well in areas such as materials processing, medical, and instrumentation; unfortunately, with the $4 trillion credit squeeze, the new administration will have its hands tied even in the face of a long wish list.”

Already impacted in previous quarters by slowing in the semiconductor space, Newport Spectra-Physics (Irvine, CA) reported $337.9 million in sales for the first nine months of 2008 ended September 27, an increase of 3.3% from the $327.2 million for the same period in 2007. However, sales for its Q3 2008 (ended September 27) were $105.0 million, a decrease of 3.6% compared to the $109 million for Q3 2007. “While we have seen weakness in the semiconductor market, “Diode-laser sales for flat-panel-display-related applications have increased,” said Merrill Apter, Newport Spectra-Physics’ senior director of diode-laser sales and business development. Indeed, display market research firm DisplaySearch (Austin, TX) reported in its Q3 2008 Quarterly TFT LCD Supply/Demand and Capital Spending Report that 2008 spending on thin-film transistor (TFT) liquid-crystal display (LCD) manufacturing equipment is expected to reach historic highs; unfortunately, rapidly dropping panel prices, low fab utilization, and concerns about the worldwide economy will cause fab expansion delays, pushing down forecast 2009 spending by 21% to $10.6 billion.

Rofin-Sinar Technologies’ financials in Q3 2008 were similar to those reported by industrial-laser manufacturer Trumpf (Ditzingen, Germany). Rofin-Sinar saw record net sales for its Q3 ended Sept. 30, 2008 of $154.3 million, up 18% from the same quarter last year and up 20% overall for the full-year period through its Q3. “As expected, fourth-quarter sales were impacted by slower business in the machine-tool and semiconductor markets, which was offset by solid business in the electronics and solar-cell industries,” said Günther Braun, Rofin-Sinar president and CEO. “Our success in this challenging macroeconomic environment will depend on our ability to further diversify our markets, enhance our global presence, and serve a broader customer base.”

For its fiscal 2007/2008, Trumpf–with 64% of its products based on laser technologies–achieved an 11% sales increase to record sales of $2.7 billion. For its fiscal 2008/2009, however, Trumpf’s group president Nicola Leibinger-Kammüller “anticipates a restrained course” and hopes sales will remain flat.

Competing in the same space with its primary fiber-laser offering, IPG Photonics (Oxford, MA) saw phenomenal growth in 2007, with full-year revenues increasing 32% to $188.7 million from $143.2 million in 2006. By Q3 2008, however, even with record Q3 revenues increasing by 29% to $62 million, IPG was cautious. “As we enter what promises to be one of the most challenging economic times in recent memory, we believe that IPG and its products are well positioned,” said Valentin Gapontsev, IPG Photonics’ CEO. “We expect high-power laser sales to remain strong in the fourth quarter. However, we expect that this strength will be offset by lower sales of our pulsed laser products in certain Asian markets. Also, the effect of a weakening Euro has lowered our estimates by approximately $3 million.”

With all of that said, a best-case picture for the 2009 laser industry would show zero growth and remain at $7.12 billion for 2009. Between the worst-case scenario of a 20% drop, and a best-case scenario of flat sales for 2009, Laser Focus World is taking the middle road with an “official” 2009 forecast of $6.32 billion for laser-industry sales, an anticipated 11.3% drop from the 2008 $7.12 billion actuals.

Laser technology trends

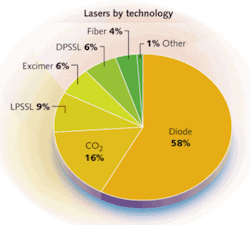

Companies like IPG Photonics and Trumpf have worked hard in 2008 to expand their technology offerings to include gas, solid-state, and fiber lasers, clearly recognizing the “one-stop-shopping” mantra of offering a range of laser technologies for their customers. While CO2 lasers may be great for rapidly cutting stainless steel, technology advances in fiber lasers and ultrafast lasers mean that these technologies are rapidly making inroads into gas, Nd:YAG, and Ti:sapphire laser territory, as well as enabling new applications such as textile seaming (see www.laserfocusworld.com/articles/332968), and in the case of ultrafast lasers, microfluidic device machining, semiconductor and PV singulation and patterning, and tissue imaging (see www.laserfocusworld.com/articles/341575). “As prices decrease, solid-state lasers are becoming a common replacement for bulkier and less-efficient gas lasers in some of the fastest-growing markets such as biomedical and materials processing,” says Amr Khalil, product line manager at Edmund Optics (Barrington, NJ). “HeNe and argon ion lasers are declining roughly 5% to 10% annually, but will continue to be used in certain applications where coherence length is important, such as phototypesetting and image processing.”But no one can argue that one of the biggest technology trends for lasers (and everything photonics, for that matter) in 2008 was their role as an energy-efficient “green” technology (see “The solar bubble?” p. 58). Besides assisting the PV market in solar-cell processing, lasers are becoming commonplace in supporting display manufacturing for both legacy and improved-wall-plug-efficiency technologies such as organic-light-emitting-diode (OLED) and flexible e-paper displays (see www.laserfocusworld.com/articles/330416) and are moving closer to being demonstrated as viable ignition sources for laser fusion with “...the potential to revolutionize our energy future,” in the words of California Gov. Arnold Schwarzenegger, who toured the National Ignition Facility at Lawrence Livermore National Laboratory in November 2008 and was briefed on an even more ambitious high-power energy project, Laser Inertial Confinement Fusion-Fission Energy (LIFE).5

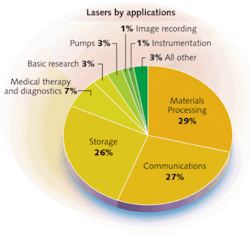

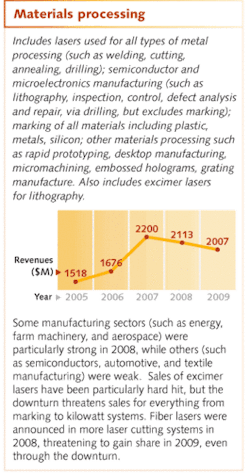

Materials processing

For many industrial laser and system suppliers, strong calendar Q3 sales driven by successes at major trade shows produced results that ensured a positive revenue picture for 2008. According to one senior company executive, success at the 2008 EuroBlech trade show in Germany enabled his company to meet its annual plan. Initially it seemed that the laser business was running counter to other industry sectors. But as the tsunami of bank failures, record stock-market declines, and a global credit crunch hit, quarterly and final reports of public companies made it abundantly clear that 2008 would be a squeaker and that 2009 would see a best-case (sales flat) or worst-case (single-digit negative growth) scenario.

Putting the 2008 numbers into context, laser units shipped will show a token 2% increase, affected primarily by slowing of low-power CO2, lamp-pumped, and diode-pumped solid-state (DPSS) laser sales. The culprits: softness in the semiconductor industry and continuing market erosion from fiber lasers. High-power CO2 laser shipments experienced a modest 5% growth led by cutting system sales in Eastern Europe and China. High-power fiber lasers–up 9%–found expanded markets, for example, in the auto industry. Sales of direct diodes were strong as markets began to respond to their capabilities. Excimer laser sales were soft due to the semiconductor sector problems.

Laser revenues were up by 6% in 2008 as the sales of higher-power CO2 (6 to 7 kW) and fiber lasers (6 to 10 kW) offset competition-driven declining prices for low-power CO2 and fiber lasers. Increased sales of direct diode lasers for welding and brazing applications boosted revenues in the “other” category, somewhat meliorating the softening of excimer laser sales.

Laser systems sales for 2008 mirrored laser sales with growth of $6.3 billion–a 4% increase over a strong 2007 sales year; pricing pressures faced by the laser suppliers have not yet influenced the selling prices of systems. Lower-than-anticipated sales revenue numbers are due in most part to the lethargy in the semiconductor markets and slower growth in the low-power CO2 market.

Setting aside high-power-laser selling prices, market suppliers have generally reacted to increased competition by lowering unit selling prices, especially in volume discount sales. This has been a factor for the past two years in the low-power CO2 sector and is becoming more apparent as suppliers of DPSS lasers face increasing penetration into their markets from fiber lasers. With an increasing number of fiber and disk lasers finding their way into the high-power processing markets for cutting and welding, pricing pressures on high-power CO2 lasers are real.

On balance the 2008 market came close to meeting the projection made by Industrial Laser Solutions (ILS) in January 2008 (see www.industrial-lasers.com/articles/316170) where it was cautioned that low-single-digit growth was possible “barring any unforeseen economic reversals.” But the picture for 2009 is extremely complicated. One key indicator, domestic sales projections for laser sheet metal cutters, produced a range from 10% growth to 25% decrease–with the average being a 6% decrease. The message: even the systems suppliers are uncertain about the impact of what is now being termed by the Manufacturers Alliance/MAPI (Arlington, VA) as a severe recession.

With mostly negative forecasts emanating from all sectors, the 2009 ILS projection shows a 4% decrease in units shipped, a 4% decrease in laser revenues, and a 6% decrease in system revenues. If this projection holds, it will be the second time in the 39-year history of industrial lasers that the market has turned negative, the first being in 1992.

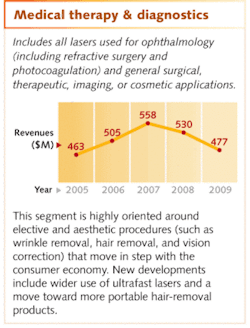

Medical therapy and diagnostics

Increased market penetration may benefit this segment. “Although bio weathers the storm better than some other sectors, we are also encouraged that higher power levels, broader wavelength-range offerings, smaller packages, and price reductions can result in further penetration of lasers into many biomedical instruments for DNA sequencing and disease analysis, flow cytometry, and microscopy,” said Phil Crowley, president of MarketTech (Scotts Valley, CA), a laser distribution, sales, and service company that offers products from primarily European laser manufacturers. “Lasers that sold for $5000 to $8000 just a few years ago are now priced at $3000,” said Crowley. “However, price drops must continue if these instruments are to penetrate huge third-world-country markets.”

Despite anticipated revenue decreases in 2009 for excimer- and femtosecond-laser-based ophthalmic procedures and for consumer-driven erbium-laser-based skin rejuvenation and hair-removal procedures, lasers continue to advance technologically for laser-induced fluorescence spectroscopy and other laser-based spectroscopy and imaging applications for disease diagnosis and for optical coherence tomography (OCT)–a market expected to top $800 million by 2012.6 Carl Zeiss Meditec (Jena, Germany) just released its second-generation OCT system, the Cirrus HD-OCT high-definition spectral-domain OCT system. While the new system is anticipated to be even more successful than its predecessor, the Stratus OCT Fourier-domain system, Carl Zeiss Meditec was already seeing weakness in its diagnostic and ophthalmic surgical systems in the summer of 2008, noting that revenues for the Americas–specifically the U.S.–had fallen by about 30%.

Overall, sales of both diode and nondiode lasers for biomedical applications including ophthalmic diagnosis and surgery, therapeutic and imaging applications, and aesthetic skin-related procedures, decreased slightly in 2008, and are forecasted–due to reduced consumer spending–to fall 10% in 2009 to $477 million. This forecasted 2009 decrease is heavily attributed to poor revenues from aesthetic laser sales. Calendar Q3 revenues for aesthetic laser companies Palomar Medical (Burlington, MA), Cutera (Brisbane, CA), and Candela (Wayland, MA) were all down anywhere from 21% (Cynosure) to 32% (Cutera) on quarterly revenues ranging from $19 million to $38 million per company.7

Basic research

According to reports in R&D (Rockaway, NJ) and IEEE Spectrum (New York, NY) magazines, global R&D spending (not just for photonics) was estimated to grow 7.6% in 2008, with 24% growth in China far surpassing the 3.7% growth estimated for the U.S. After the U.S. and Europe, China is ranked third in the total money spent on R&D.

For 2008, laser R&D revenues were driven mostly by anything energy, medical, and homeland-security related: solar/ photovoltaics, energy fusion and fission reactors, new microscopy and spectroscopy methods; photoluminescence of exotic materials; terahertz sources and detectors, and infrared/thermal vision and surveillance systems. But in 2009, economic reality seems likely to dictate that spending for military R&D applications will shrink worldwide, even while energy and medical spending remains flat. Reductions in military spending will hit the U.S. harder than other countries because the U.S. accounts for 45% of global military spending.

Previous Laser Focus World laser market data indicates that sales of lasers for R&D applications increased between 1994 and 2007, from about $100 million to $180 million, with a significant drop in 2000 to $100 million from $140 million in 1996, likely due to the telecommunications bubble. Laser R&D revenues tend to remain in step with funding from such government sources as the National Science Foundation (NSF) and the National Institutes of Health (NIH) in the U.S., and the German Research Foundation (DFG) and the Engineering and Physical Sciences Research Council (EPSRC) in Europe, for example, so sales grew approximately 3% to 4% in 2008, but the larger economic issues are expected to flatten out 2009 sales to about $180.6 million.

Separate articles in Physics Today (Melville, NY) point to disturbing news concerning general government R&D funding in the U.S. While not laser-based, the ITER fusion project and the International Linear Collider (ILC) did not receive the $150 million and $60 million contributions, respectively, that were targeted by the U.S. toward these projects, and International Space Station (ISS) contributions are also at risk.8 And figures from the NSF said federal funding in 2007 (totaling $30.4 billion) for university research failed to keep pace with inflation for an unprecedented two-years running, despite the 2006 American Competitiveness Initiative that pledged to double federal spending for physical sciences R&D over a ten-year period.9 The good news is that 2007 nonfederal funding for academic research rose nearly 8% (5% after inflation), university-based funding climbed 6.6%, state and local funding was up 6.1%, and industry support increased 11.2%.

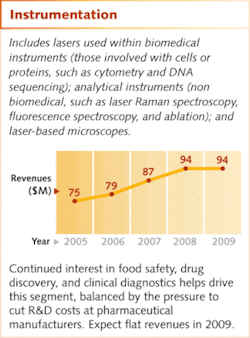

Instrumentation

The life sciences account for the majority of lasers sold into instrumentation, with a significant fraction of funding coming from profitable pharmaceutical firms for drug discovery. While a few industry players hoped life sciences would provide some immunity from the economic slump, it turns out there appears to be no escape. “In October 2008, GlaxoSmithKline announced a reduction of about 1200 jobs in research positions,” said Michael Tice, vice president consulting services at Strategic Directions International (SDi; Los Angeles, CA), a strategic consulting and market analysis firm for the analytical and life science instruments industry and publisher of the twice-monthly Instrument Business Outlook newsletter. “In the same month, Merck announced plans to close its Rosetta research facility in Seattle by the end of 2009, eliminating 240 jobs,” added Tice. “In addition, Merck has plans to reduce its global workforce by more than 7000 employees by the end of 2011, although these reductions would affect all areas of operations, not just research. Some of these displaced researchers may find positions with other pharmaceutical firms, but the overall effect is going to be a reduction in operating laboratories, and a concomitant reduction in demand for new and replacement instrumentation.”

Tice says that whether Wall Street is up or down, people still require food, medical care, and pharmaceuticals; however, problems in the housing and lending markets have begun to propagate even into these areas of life science production and research. He is even concerned that the crisis will propagate further and affect those who supply diagnostic and research instruments to the medical, pharmaceutical, and food industries. For 2008, instrumentation laser sales reached $94 million with 2009 revenues remaining flat.

But the scenario is not entirely one of doom and gloom. “On the positive side, public funding for life-science research remains solid for the time being,” said Tice. “Originally, the financial year 2009 appropriation for the National Institutes of Health was set to be the same as the 2008 appropriation of $29.5 billion. However, action in the Congress has increased the NIH appropriation for next year by about 3%.”

Tice added that another source of growth in life-science spending is in food safety. “Scandals regarding the adulteration of food products with melamine have increased interest in this area, particularly in China,” he said (see www.laserfocusworld.com/articles/345509). “Efforts to protect the safety of the food supply should lead to increased activity in the U.S. and other industrialized nations as well. Currently, detection of melamine is carried out with chromatography and chromatography-mass spectrometry–techniques that do not significantly rely on lasers. Nonetheless, if other areas of food safety also gain added resources, this could be an important source of growth in demand.”

This enthusiasm, however, should be tempered by concerns regarding the ability of the U.S. Food and Drug Administration and other worldwide organizations to keep pace with food-safety research (see www.bioopticsworld.com/articles/334511). “TheObama Administration is expected to lean more heavily on industry in the form of increased user fees for product safety testing,” said Susan Reiss, consultant and Washington, D.C., contributing editor for BioOptics World (www.bioopticsworld.com). “However, this action could actually benefit industry by enabling the agency to hire more staff. More reviewers mean fewer delays in moving new device and drug applications through the system. The good news about the FDA in 2009 will be expanded monitoring operations in China and other key locations, providing new opportunities for portable devices capable of real-time monitoring and feedback.”

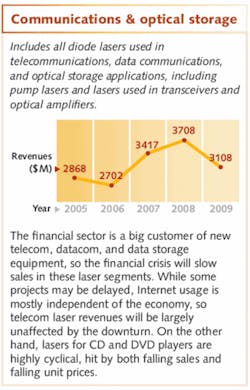

Communications and optical storage

While OIDA’s Michael Lebby may be encouraged about the prospects for nondiode lasers in biomedical and solar going into 2009, he’s cautious about diode-laser sales. “The diode-laser side is a tough road to hoe,” he said. Based on his more than 20 years of experience in the optoelectronics industry, Lebby predicts that telecom average-selling-price (ASP) margins will plummet for diode-laser components. “Excluding Blu-ray optical disks for read-only applications, optical storage and telecom diode revenues will be hit hard by major competition from flash memory in cameras and laptops and increasing use of low-cost Fabry-Perot and distributed feedback (DFB) telecom lasers in new consumer interconnect products such as active optical cables (AOCs)–electrical cables with embedded optics,” said Lebby. “The advent of dynamic networking has generated excitement with tunable lasers, functionally more capable, but with much lower volumes compared to their replacement grid lasers. In optical storage, as flash products march toward 64 Gbytes, the question being asked is not how, but when will this maturing optical storage market decline?”

Lebby sees 2012 as the time frame when nondiode-laser revenues exceed diode-laser revenues for the first time. “While nondiode-laser revenues maintain, diode-laser revenues will be subject to margin squeeze of its two main market segments: optical storage and telecom,” said Lebby. “In fact, in late 2008, we are seeing a significant reduction in capital spending for telecom and datacom. Given that demand for bandwidth is accelerating, one could predict that within a few years, this may lead to network traffic jams and reduced quality of service–a pretty tough time all around.”

Regarding optical storage, 405 nm blue-laser-diode growth continues–first with the late 2006 introduction of Sony’s PlayStation 3, and now with the emergence of Blu-ray disc video players–while dual-wavelength 650/780 nm lasers are reducing demand for pure 780 nm lasers in DVD applications. For 2009, we anticipate that the overall optical storage laser market will decline 28% to $1.3 billion, based on the convergence of 20% ASP declines for all lasers, a 20% and 10% unit decrease in 780 and 650 nm diodes, respectively, and despite the 25% unit increase in 405 nm devices.

On the telecom and datacom side, financials for communications components manufacturer JDSU (Milpitas, CA) reflected the economic picture and were generally improved for calendar Q3 compared to the same quarter last year, but were down from the previous quarter–signaling that telecom is feeling the effects of recession. And for its fiscal Q1 ended Sept. 27, 2008, Bookham (San Jose, CA) saw revenues of $66.5 million, a 23% increase compared to the same quarter last year, but only a 6% increase compared to the previous quarter.

Now seven years post-bubble, the telecommunications industry and sales of laser diodes for transceivers, amplifiers, and fiber-laser pumps have seen steady growth over the past six years. In his 2002 review and forecast of the diode-laser markets (see www.laserfocusworld.com/articles/136283), Robert V. Steele, director of optoelectronics at Strategies Unlimited (Mountain View, CA), noted that the 36% market drop in 2002 was an anomaly, and that for diode lasers, “The trend line for the period from 1996 to 2002 corresponds to an average annual growth rate of 16.9%.” An analysis of quarterly revenues from major public optical communications companies including Avanex, Bookham, Finisar, JDSU, Opnext, and Optium indicates that while growth was relatively slow between 2006 and 2007, 2008 grew significantly even if Q4 2008 is anticipated to drop.

According to Strategies Unlimited, revenues for communications giant Cisco Systems (San Jose, CA) are a good indication of the health of both datacom and telecom markets; unfortunately, while Cisco’s revenues grew about 6% in 2008, they are entering a period of decline. So although fiber-to-the-home (FTTH) continues what many say is a recession-proof rollout, 40 Gbyte sales are expanding, and talk of 100 Gbyte systems is already far advanced (see www.laserfocusworld.com/articles/323294), LFW anticipates a 5% drop in communications laser revenues in 2009 to $1.81 billion.

But now for the emotional upside. In his November editorial in Lightwave magazine (Nashua, NH), Stephen Hardy, chief editor, explains “Why this downturn is different” (see lw.pennnet.com/articles/344993). “You somehow managed to survive the Optical Ice Age. And then this...this...recession happened,” wrote Hardy. To the many company leaders who are likely thinking that they cannot survive another downturn, Hardy offers words of comfort. “First and foremost, this one isn’t your fault. This time it is unlikely that you owe your employment to over-exuberant investors,” he said. “Instead, analysts continue to insist that the bandwidth fundamentals that provide the foundation for the optical communications industry remain sound. The amount of capacity currently available is more closely aligned to actual bandwidth demand than in 2001 or 2002.” While Hardy believes the recession will impact the bottom line, he sees a new round of consolidations taking place. “The current downturn isn’t at all like the last one, and will likely result in a healthier industry.”

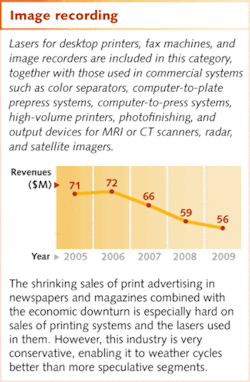

Image recording

Sales of lasers for desktop printers and fax machines, as well as for computer-to-plate graphic arts printing applications, were originally forecast to grow slightly in 2008. But actual numbers show a 10% decline compared to 2007 to $59 million, with a forecasted decline of nearly 5% in 2009 to overall revenues of $56 million, blamed on a shrinking global economy and reduced capital-equipment demand.

Major suppliers of lasers for plate engraving in digital printing applications include Coherent, with its family of Compass 315 and 415 nm DPSS lasers, and Intense (Glasgow, Scotland), with its INSlam quantum-well intermixed family of 650 or 780 nm laser arrays consisting of hundreds of single-mode emitters on a monolithic chip. As companies like Kodak (Rochester, NY) continue to embrace digital printing using 830 nm thermal laser heads and other diode lasers that offer photographic quality in offset printing applications, sales of nondiode lasers into the image recording market continue to drop. Fortunately, new applications for lasers are emerging in the graphic arts space. Heidelberger Druckmaschinen (Heidelberg, Germany) is exploring the use of 808 and 980 nm high-power diode lasers for efficient drying in sheet-fed offset printing processes. Drying time is a significant bottleneck due to inefficient air-dried processes. The laser evaporates some of the oil within the printed ink (without heating the paper) and can reduce a 30-minute drying process to six minutes.

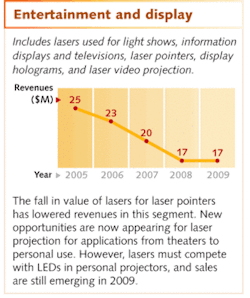

Entertainment and display

Still a relatively small market with 2008 revenues of $17 million and forecasted to remain flat for 2009, the laser-based entertainment and display industry for such products as light shows, planetariums, simulators, advertising displays, laser pointers, and laser video projectors may see a Renaissance in 2009 with the late 2008 introduction of the first laser television: the 65 in. LaserVue model L-5-A90 from Mitsubishi. Even at $7000, “The laser TV is a phenomenal success. You’ll never see one in the store because they sell out as soon as they are manufactured,” said Greg Niven, vice president of marketing at Arasor.

“While the success of laser TV remains to be seen, what’s exciting for me is laser-based RGB projectors for large venues, including the key segment of digital cinema,” says Niven. “Because the RGB projection market is just starting to grow and we don’t anticipate it to take off until 2010, the current economic situation is not a major factor–sales in 2009 will still be dramatically better simply because they were relatively small in 2008.”

Niven points out that the potential for laser-based projection for large venues is significant, anticipating that current lamp-based digital projectors will eventually sport a higher-efficiency, improved-color-gamut, higher-brightness, longer-life, laser-based engine that is cheaper to maintain by thousands of dollars per year, per projector. In late 2008, entertainment joint-venture Digital Cinema Implementation Partners (DCIP; Upper Saddle River, NJ), announced that it was partnering with five major movie studios to deploy digital projection systems to nearly 20,000 movie-theatre screens across the U.S. and Canada. And much has already been written about the use of RGB lasers for cell-phone projection displays (see www.laserfocusworld.com/articles/341582)–an emerging entertainment and display application promising even larger RGB laser unit sales.

REFERENCES

- P. Krugman, www.princeton.edu/~pkrugman/contagion.pdf (October 6, 2008).

- www.conference-board.org/economics/ConsumerConfidence.cfm.

- wikipedia.org/wiki/Early_1980s_recession, and en.wikipedia.org/wiki/Late_1980s_recession.

- B.J. Feder, New York Times, Business News section (April 24, 2008).

- T. Diaz de la Rubia and E.I. Moses, ICALEO 2008 Plenary, Temecula, CA (Oct. 20, 2008).

- G. Smolka, Optical Coherence Tomography: Technology, Markets, and Applications 2008-2012, PennWell Corp., www.BioOpticsWorld.com/resourcecenter/OCTreport.html.

- D. Cress, www.onemedplace.com/blog/archives/1002 (Nov. 4, 2008).

- D. Kramer, Physics Today 61(10) p. 26 (October 2008).

- D. Kramer, Physics Today 61(10) p. 33 (October 2008).

The solar bubble?

Technology research firm Lux Research (New York, NY) forecasts that new solar photovoltaic (PV) installations will expand fivefold between 2008 and 2013, fueling a $100 billion global solar market by 2013 and feeding a frenzy of laser manufacturers eager to jump into such solar-cell processing applications as wafer cutting, patterning, and edge polishing (all of which are included in our materials-processing segment). Robert J. Phillippy, Newport Spectra-Physics’ president and CEO, echoed the sentiment of most laser manufacturers vying for a piece of the solar-cell processing pie. “During these difficult macroeconomic market conditions, which could continue for some time, we will focus on reducing our operating costs and generating cash, while investing selectively in areas, such as the photovoltaic market, where we see growth opportunities,” he said.

Despite the enthusiasm, some fear that there are too many laser players vying for a piece of that pie, and others fear that the telecom explosion and corresponding implosion (or bubble) of 2001 could possibly be repeated in the solar-cell market. But Paula Mints, principal analyst PV Services Program at Navigant Consulting (Palo Alto, CA), disagrees. “We are currently in a period of overcapacity; but, I would not describe this as a bubble,” said Mints. “Photovoltaic technologies will play an important part in the energy mix in the very near future, and indeed, are playing an important part today. Future significant markets such as China and India are still emerging, and India has put in place incentives to stimulate its market.” Mints’ position is supported by solar-cell manufacturers such as Q-Cells (Bitterfeld-Wolfen, Germany), which has invested a stunning $3.5 billion into a North American module manufacturing facility in Mexicali, Baja California, Mexico (see www.laserfocusworld.com/articles/345508).

Discussion surrounding the presence of a solar bubble ranges from adamant opposition to complacent agreement. But for laser manufacturers, the question is strategy. “The valuable discussion should be centered around how laser and PV companies take advantage of the current opportunity,” said Steve Eglash, former president and CEO of PV startup Cyrium Technologies (Ottawa, ON, Canada). Eglash recently led a solar-energy strategic planning project with the U.S. Department of Energy and the National Renewable Energy Laboratory (NREL). “Right now, there are two opposing trends in the solar industry,” he said. “On the one hand, the worldwide recession and falling oil prices will no doubt put an end to 40% compound annual growth rates for the solar market for now. On the other hand, the long-term trend is clearly for continued investment to stem pollution, reduce global warming, and eliminate the fossil-fuel-based energy and political dependence that facilitates quagmires like the Iraq War. There is no doubt that the rate of energy consumption slows during a recession.”

Eglash said solar company valuations have been dropping and supply and demand are coming into balance; however, laser manufacturers shouldn’t see this as a bubble bursting, but as a time to retrench and position themselves as suppliers of a return-on-investment (ROI)-rich technology. “Laser suppliers must prove to solar-panel manufacturers that laser processing increases both manufacturing efficiencies and the PV watt/dollar ratio for money spent on capital equipment. Only those companies that actively ‘market’ the ROI benefit of laser processing–rather than just any laser they happen to have in their portfolio–will be successful.”

About the numbers

The estimates and forecasts of laser shipments were based on both supply- and demand-side analyses by Strategies Unlimited, a PennWell business. Strategies Unlimited has been conducting market research in photonics products for nearly 30 years, with specialties in lasers and high-brightness LEDs.

The analyses used information gathered from interviews conducted throughout the year for Laser Focus World and Industrial Laser Solutions, as well as from financial statements and news reports. The demand-side analysis focused on the relevant trends in 2008 and in recent years for sales of laser-based systems and the buying trends of customers of those systems. The supply-side analysis focused on the corresponding trends of suppliers of lasers and their suppliers. The effort considered both quarterly trends and long-term historical trends; results were then compared and adjusted to correct for known errors. Revenue for applications sectors includes both diode and nondiode lasers, unlike in previous years when nondiode results were reported in January and diode results were reported in February. Laser Focus World would like to acknowledge significant contributions from David A. Belforte and Tom Hausken, director Components Practice at Strategies Unlimited.

The Laser Focus World quantitative market survey remains the only comprehensive market survey of the laser industry. A more detailed look at the laser marketplace with additional commentary will be presented at the Lasers & Photonics Marketplace Seminar held in conjunction with Photonics West in San Jose, CA, on Monday, Jan. 26 (see www.marketplaceseminar.com). Photonics market information is also available directly from Strategies Unlimited (www.strategies-u.com).

This is a corrected version of this article. The original version incorrectly stated that QPC Lasers (Sylmar, CA) had closed it's doors. The company has drastically reduced operations, but is still in business. Also, Cynosure (Westford, MA) was included with other companies in the medical and diagnostics category that had lost revenue. In fact, Cynosure reported increased revenue for the year.

About the Author

Gail Overton

Senior Editor (2004-2020)

Gail has more than 30 years of engineering, marketing, product management, and editorial experience in the photonics and optical communications industry. Before joining the staff at Laser Focus World in 2004, she held many product management and product marketing roles in the fiber-optics industry, most notably at Hughes (El Segundo, CA), GTE Labs (Waltham, MA), Corning (Corning, NY), Photon Kinetics (Beaverton, OR), and Newport Corporation (Irvine, CA). During her marketing career, Gail published articles in WDM Solutions and Sensors magazine and traveled internationally to conduct product and sales training. Gail received her BS degree in physics, with an emphasis in optics, from San Diego State University in San Diego, CA in May 1986.

Stephen G. Anderson

Director, Industry Development - SPIE

Stephen Anderson is a photonics industry expert with an international background and has been actively involved with lasers and photonics for more than 30 years. As Director, Industry Development at SPIE – The international society for optics and photonics – he is responsible for tracking the photonics industry markets and technology to help define long-term strategy, while also facilitating development of SPIE’s industry activities. Before joining SPIE, Anderson was Associate Publisher and Editor in Chief of Laser Focus World and chaired the Lasers & Photonics Marketplace Seminar. Anderson also co-founded the BioOptics World brand. Anderson holds a chemistry degree from the University of York and an Executive MBA from Golden Gate University.

Dr. Tom Hausken

Director, Photonics and Compound Semiconductor Products

Joining Strategies Unlimited in 1999, Dr. Hausken conducts the world’s leading market research in lasers and other photonics markets. He has nearly 30 years in the industry, including a joint project with Japan on optical computing while at OIDA, technology policy at the U.S. Congressional Office of Technology Assessment, and in R&D and production at Alcatel and Texas Instruments. He has a PhD from the University of California at Santa Barbara in compound semiconductor photonics.

David Belforte

Contributing Editor

David Belforte (1932-2023) was an internationally recognized authority on industrial laser materials processing and had been actively involved in this technology for more than 50 years. His consulting business, Belforte Associates, served clients interested in advanced manufacturing applications. David held degrees in Chemistry and Production Technology from Northeastern University (Boston, MA). As a researcher, he conducted basic studies in material synthesis for high-temperature applications and held increasingly important positions with companies involved with high-technology materials processing. He co-founded a company that introduced several firsts in advanced welding technology and equipment. David's career in lasers started with the commercialization of the first industrial solid-state laser and a compact CO2 laser for sheet-metal cutting. For several years, he led the development of very high power CO2 lasers for welding and surface treating applications. In addition to consulting, David was the Founder and Editor-in-Chief of Industrial Laser Solutions magazine (1986-2022) and contributed to other laser publications, including Laser Focus World. He retired from Laser Focus World in late June 2022.