The 30th Annual Lasers & Photonics Marketplace Seminar—More good news ahead

The day began early with breakfast and networking before the sessions started at 8:15 am (see Fig. 1).

Keynote Talk: The past, present, and future of high-power laser diodes

Scott Keeney, President & CEO, nLight

In September 1962, the first laser diode was demonstrated. Scientists from General Electric Research Labs found coherent infrared emission from a gallium arsenide (GaAs) semiconductor. Although it then took several decades to solve all the technical problems, laser diodes are now the workhorse for many laser applications—and there is more to come.

Scott Keeney presented that path and projected the future development of high-power laser diodes. As key parameters for the development of laser diodes, he used brilliance on the one hand and cost on the other. Surprisingly, both parameters have followed an exponential curve over the years, similar to Moore’s Law for transistor density growth.

Within the first three decades of development, both brilliance and cost were at a level that permitted only niche applications. That changed in the late 1990s and applications in the telecommunication industry created not only substantial progress, but also the tremendous hype and subsequent destruction of stock value when the telecom bubble burst. That shock led to a faster adoption of laser diode technology for applications in other fields such as material processing and medicine. And now we are at approximately $10 per bright watt (W/cm2-sr), a cost that will further decline (see Fig. 2).Pumping other laser systems turned out to be a strong driver for technological and economic progress. High-power fiber lasers for material processing especially benefitted from both the technical evolution of laser diodes and the telecom crash. And consequently, they have seen a similar exponential growth in market share.

Which leads to an interesting situation that may become critical for the whole laser business: The market valuation of laser companies has seen a dramatic increase within the last three years. In fact, the stock rise has become as steep as during the telecom bubble, with even higher valuations. So, do we face another crash?

There are good arguments against that fear, according to Keeney: First, the laser industry shows an above-average return on investment. Second, the adoption of fiber laser technology in material processing is a healthy process where a new technology makes its way from a tool of technology pioneers to a standard solution on the shop floor. This leads to organic growth. So, perhaps the laser industry has simply been undervalued!

But what comes next, and how far can the technical and economic trends continue? Keeney analyzed both the technological and economic opportunities for such an extension of trends. On the economic side, there are a range of factors driving further cost reduction. There will be several ways to cut costs, from optimized production through enhanced automation, new packaging techniques, and finally power and production volume scaling. He estimated the total potential of further cost reduction is approximately 50%.

Regarding brightness, Keeney suggested that even a 5–20X increase should be possible through advances in device physics (light generation), better heat transfer, and optimized optical design/packaging. The greatest potential may result from advances at the semiconductor chip level.

“Semiconductor lasers will not only change the way things are made, but will also change the things that can be made,” Keeney said. He compared the laser diode development timeline with those of general-purpose disruptive technologies such as electricity and computing technology. It turns out that such processes take time and we may just be seeing the beginning of the full laser diode technology revolution. More observations on the subject appeared in a January 2018 article written by Keeney and colleagues.

Global laser markets: Insights and forecasts

Allen Nogee, Laser Analyst for Strategies Unlimited

Keenly awaited, the review of laser markets by Allen Nogee, president of Laser Markets Research, started with truly good news: There is solid growth on all fields, and some laser market segments showed exceptionally good numbers (see Fig. 3).Nogee looked at national economies first, where the U.S. debuted with a 3.0% increase in industrial production after two negative years and a gross domestic product (GDP) growth of 2.3%. Europe delivered similar numbers (GDP +2.3%, industrial production +3.8%), while China’s growth (GDP +6.6%; industrial production +6.5%) gives hope for healthy development there and in global markets as well. And the outlook for 2018 and 2019 remains sunny: The worldwide GDP growth should remain above 3%.

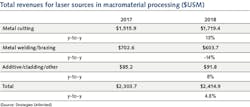

The market for laser sources with its various niches did remarkably better than the general economy with 19.5% revenue growth. While the total market for laser sources is estimated at $12 billion, the largest parts of it grew by 18% (lasers for communications) and even 49% (kilowatt lasers for materials processing).

Driven by the advent of fiber lasers, the revenue for metal cutting lasers went up 32.8%. For high-power laser welding (plus brazing), Nogee noted 125% growth. This number may be influenced by some manufacturers’ sales numbers, where the use for cutting or welding was not specified. For the whole market of kilowatt lasers for material processing, Nogee estimated $2.3 billion. The predictions for further growth in cutting and welding were quite different: While the cutting market is expected to expand approximately 13%, the welding/brazing market may shrink at about the same pace (-14%; see Fig. 4).Lidar systems may also drive the sales of vertical-cavity surface-emitting lasers (VCSELs) in the future. In 2017, VCSEL sales were approximately $1 billion, mainly for communication applications (60%), although sensing applications such as face recognition in smartphones may drive these numbers up in 2018. Apple’s prepayment of $390 million to Finisar in 2017 to develop VCSEL manufacturing is a clear indicator of that development.

The market for lasers in telecom, which is mainly restricted to transceivers, was approximately $3.8 billion in 2017. Different from most other laser markets, it is expected to shrink by 5% in both 2018 and 2019. A general slowdown in the telecom industry is expected to last at least through the first half of 2018, while worldwide inventories are building up.

Nogee pointed out interesting changes in the market for medical and aesthetic lasers. A solid growth of 18% was driven by Asia (+20%) and Europe, the Middle East, and Africa (+16%). The cause is the growing acceptance for aesthetic procedures in Asia and in a younger generation, creating a strong potential for the future. Accordingly, solid double-digit growth is expected in the total market for the next few years.

Among the things to watch are direct diode laser applications and ultrashort-pulsed lasers (a.k.a. ultrafast lasers). Both types of lasers are on the brink of a market breakthrough and above-average revenue growth is expected. Excimer lasers, in contrast, have seen a fabulous year in 2017, but the market may soon be saturated.

In painting the overall economic picture, Nogee showed the long-term annual growth rate of 10.8% on average for 20 major laser companies. The growth for 2018 may be less than in 2017, but still substantially above the long-term average. As he ended his presentations, he noted, “There is more good news ahead.”

Nogee added that the numbers he presented during the Seminar were based on updated data from the estimates for the laser market review article in the January 2018 issue of Laser Focus World. In addition, data presented during the Seminar did not include information from fourth-quarter reports by public photonics companies. A complete and final version of the data will be published in March 2018 by Strategies Unlimited.

Policy & Practice: Changes in the Chinese laser markets

Bo Gu, Ph.D., Bos Photonics

The $12.5 trillion Chinese economy is now the second biggest after the U.S., which is $19 trillion. Yet even now, the Chinese markets are decisive for many areas such as the automotive sector. And the laser industry strongly depends on these sectors. Not surprisingly, the expectations for Bo Gu’s presentation on changes in the Chinese laser market were high.

He delivered both short- and mid-term predictions for the Chinese laser market. Most alarming might be his predictions for high-power laser sales. While the low-power laser market in China is already dominated by domestic companies, the high-power laser market with its traditionally larger margins has been dominated by foreigners. According to Gu, this will change within the next 18 months.

This change is not accidental, but is the result of numerous governmental and private activities. To illustrate, the number of laser-related patent applications in China has risen to 14,768 in 2016. And in addition to supporting numerous laser-related academic programs, the Chinese government supports the development of entirely new company strategies.

Based on the idea of a service economy rather than just a product-based industry, Chinese laser companies will change to become solutions providers. They will support the idea of new smart factories and assist manufacturers adapting new manufacturing processes such as Industry 4.0.

In practical terms, this may happen in the following way: A laser system provider does not sell, but instead rents the system to clients. With the system, the provider retains the data continuously sent from the machines to the data cloud. The data allow for complex control schemes, including very detailed algorithms for predictive maintenance. The laser system provider can send out a service technician before the machine breaks and thus realize zero downtime.

Within the last 30 years, Chinese economic development has been driven by manufacturing quantity. For the next 30 years, it will be driven toward manufacturing technology. While China has been the world’s largest manufacturer since 2015, it aspires to become the world’s largest Tier 1 manufacturer by 2045. This involves a very wide range of industrial areas—and lasers will serve most or all of them.

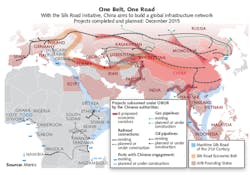

With its One Belt One Road (OBOR) program (see Fig. 5) and other short-term initiatives such as Made in China 2025, a competitive supply system is both required and planned. China is working on that with new five-year plans and the highest political motivation. Gu showed a list of 10 areas for industrial development, reaching from advanced CNC robotics to bioengineering medical devices. Lasers play a role in all of these areas, so lasers enjoy priority in China.In a final overview, Gu presented a number of evolving laser applications and markets in China. For instance, ultraviolet and ultrafast laser technology will continue to grow rapidly, depending on further projects from a single (U.S.) company, Apple. Besides that, laser cutting will rapidly expand, even as fiber laser systems with more than 10 kW of power enter the market. This seems particularly helpful for large infrastructure projects as intended in the OBOR initiative.

In the subsequent Q&A session, a number of interesting questions came up. Will China outsource? Yes, but maybe not so soon for laser systems since it’s not a mass product. Will the prices for fiber lasers in China decline? Yes.

Executive Panel: Global laser markets and technology trends—What is happening and what to expect

Moderator:

Martin Seifert, Executive Advisor, Booz Allen Hamilton

Panelists:

Dave Allen, General Manager, MKS Instruments /Spectra-Physics

Basil Garabet, President and CEO, NKT Photonics

Berthold Schmidt, Ph.D., CTO, Trumpf

Sri Venkat, Senior VP & GM, High Power Fiber Lasers & Global CO2 Lasers, Coherent

The value of public photonics companies is running from one height to another, and we see a growing M&A activity as well. All of the panelists had taken part in such activities recently, so it was wise to ask them about the driving forces and expectations in all those purchases. Put in two words, the answer was synergies and people. And on a longer time scale, it’s about growing profits, of course (see Fig. 6).Bringing together two large and complementary entities like Rofin and Coherent is a cultural challenge, as Sri Venkat from Coherent pointed out: “Not right or wrong, but they were run differently.” And he sees proper timing as crucial for conducting changes successfully. Venkat estimated that Coherent has gone 60–70% of its way through its acquisition and, so far, the experience has been very positive.

For a smaller company, innovation is the only way to stay at the leading edge and so, as Basil Garbaret from NKT Photonics put it, the smaller company has to invest heavily in engineering. NKT does so with 20% of its revenue. On the other hand, a certain amount of vertical integration seems mandatory for smaller companies as well. For example, he explained that when he had been president of JK Lasers, one reason he had sold the company to Trumpf was the lack of an in-house pump laser diode supply.

On the technical side, there was much debate about the decline of CO2 lasers and the rise of direct diodes. It turned out that while the decline has bottomed out and CO2 lasers are experiencing a modest growth in the high-power niche, direct diodes still have to fulfill some promises. And so, it ends up that multiple technologies in the end will coexist.

After short excursions on the topics of additive manufacturing and biotech, the question of acquisition vs. organic growth dominated the discussion. For Berthold Schmidt from Trumpf, the company’s recent acquisition of Amphos was a move to acquire a pool of talent and to reduce the time to market for a specific technology.

Dave Allen from MKS/Spectra-Physics added that organic growth is certainly the most preferred way. But if there is a new market opportunity, then there is always the question of making it yourself or purchasing a company that accelerates growth and adds to your team’s success.

While the discussion on the podium ended on that point, it was continued in a lively manner during the lunch break, when people gathered around the panelists.

Keynote Discussion: A conversation with Chuck Mattera, II-VI Incorporated

Chuck Mattera, Ph.D., President & CEO, II-VI Incorporated

This keynote discussion had two parts: First, Editor in Chief Conard Holton talked to Chuck Mattera from II-VI, and then a vivid discussion with the auditorium unfolded. The first question, “What kind of company are you?” turned out to be rather complex. While II-VI makes revenues of roughly $1 billion today, it still carries the genes of a small company. It makes laser diodes and VCSELs on the one hand and still nurtures a growing CO2 laser business on the other. As a vertically integrated manufacturer, it provides engineered materials and optoelectronic components to a wide variety of markets (see Fig. 7).To the surprise of much of the community, II-VI bought at least four fabs in the past few years. Mattera explained the acquisition as making a strategic move from an optics company toward a semiconductor laser company. The move was driven by the expected demand from large markets such as consumer electronics and automotive. And it was a platform approach, giving II-VI the chance to address a large variety of markets. Vertical integration is the best way to do that with high profitability. Today, II-VI is one of the major suppliers for VCSELs.

And the company is a major supplier for pump diodes, plus all the other components needed to build a fiber laser. That has already fueled the fiber laser market in China and beyond.

When asked for his experiences within the Chinese markets, Mattera referred to the Photop acquisition: “For the first five years after we acquired Photop, I dedicated myself to go to China once a month for five years. You can’t read it in a book about how you actually integrate companies or stitch together great global companies with a base in China.” Today, Photop has doubled its workforce to nearly 6000 and “we’re not done yet,” as Mattera put it.

There were many interesting topics in the interview, including fiber lasers, VCSELs, and the growing demand for CO2 lasers. And looking at the breadth and successes of the company’s product portfolio, the essence of Mattera’s management idea sounds particularly intriguing, “Somebody said that strategy means to decide. The biggest and most important element of deciding, usually—and what I’ve found in my 35 years—is deciding what not to do.”

Company valuations & markets: Unicorns vs. averages and the walking dead

John Dexheimer, President, LightWave Advisors

While previous presentations were dominated by a more technical point of view, John Dexheimer from LightWave Advisors looked at the photonics business from the investor’s perspective. The main question there is, “How to be better than average” when it comes to the valuation of a company. Scalability, team, and market opportunities are just some of the answers.

And then there is timing—being in the right place at the right time with the right idea is not always easy. But people need to recognize this fact. Dexheimer explained that IPG Photonics, with its current market valuation of $13 billion, moved from the “walking dead” (in terms of valuation) to a “unicorn” in part because of timing.

Many startup founders strive for a good exit, with expectations driven by Facebook or Apple valuations. The reality in the photonics market is different: Dexheimer showed a list of recent deals done in the photonics industry. Most valuations ended up between 1.5 and 3.5X the revenue or about 10X the earnings before interest, tax, depreciation, and amortization (EBITDA), where larger acquisitions (Coherent/Rofin, MKS Instruments/Newport) tend to lower multiples.

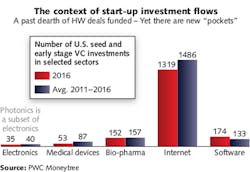

When it comes to seed financing, photonics as a sector seems negligible compared to Internet companies. According to some data he showed, 30–40X more Internet startups received early-stage investments compared to electronics firms, where photonics can be considered a sub-category (see Fig. 8).Dexheimer also shared some ideas for payment options such as earnouts in successful exit strategies. The success of such clauses may very much depend on the details, as he showed in several examples. Summing up, the valuation of companies turns out to be a complex game, where many different types of information are involved. In the end, it is all about being disruptive and having an enabling technology. In the right place, at the right moment, of course.

Trends and needs in photobiomodulation therapy

Praveen Arany, DDS, Ph.D., Assistant Professor, Oral Biology & Biomedical Engineering, School of Dental Medicine, Engineering & Applied Sciences, University at Buffalo

Will low-intensity laser light have a medical impact? While the experienced laser user may strongly doubt that, this presentation delivered good reason to believe that the effect is not only proven in clinical tests, but there are also scientific explanations of when and why it works.

First, it is specific light with a specified range of wavelengths and specific intensities that works in this field of photobiomodulation (PBM). Even in the early days of lasers, it was found that certain nondestructive and even nonthermal effects may influence wound healing or hair growth.

In the meantime, more than a dozen applications of PBM have been identified. From our personal perspectives, we know that a reasonable dose of sunlight is good for health. In clinical terms, light has been tested for treatment in a similar fashion as any other drug. There is even a name for such medication: photoceuticals. This light has an influence on biological processes, just as pharmaceuticals have. And similarly, proper light parameters strongly depend on the biological process to be controlled. As with any drug, the new PBM procedures must be tested for therapeutic thresholds and phototoxicity.

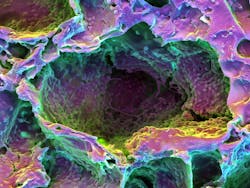

Praveen Arany from the University at Buffalo showed some examples of typical PBM mechanisms, where specific light triggers specific reactions on a sub-cellular level, which, for example, can be connected to anti-inflammatory effects. Or, and this would be truly revolutionary, to regrow tooth material, as described in a recent article in BioOptics World (see Fig. 9).As Arany noted, several key molecular mechanisms for PBM have been identified and are now well understood. Pathophysiological (disease) and anatomical site-specific PBM mechanisms are currently under investigation for optimized treatment parameters. PBM is not a wonder drug, but it promises an additional dimension in healthcare.

The wish list that Arany closed with may have attracted the interest of laser and optical component makers: top-hat profile with up to 100 mW/cm2, tunable from 400 to 1200 nm, and delivered through a fiber. Or, the light may be delivered by scanners or even whole-body systems. It seems there are plenty of opportunities for medical device manufacturers to build new systems.

Technology and Markets Panel: What bioinstrumentation developers need from the photonics industry

Moderator:

Barbara Gefvert, Editor in Chief, BioOptics World

Panelists:

Muhammad Al-Qaisi, Ph.D., Associate Director, R&D, Alcon, A Novartis Division

Wenyi Feng, Ph.D., Principal Engineer, Illumina

Peter Heim, Ph.D., CTO and General Manager, Thorlabs Quantum Electronics

The bioinstrumentation forum united some of the most fascinating developments in life sciences on the stage. First, there was Muhammad Al-Qaisi, working with Alcon on eye care, a market that relates to several hundred million, if not billions, of patients. The second panelist was Wenyi Feng from Illumina, which is the company that brought the price of a DNA profile down to less than $1000 and the time scale to less than a day. Finally, Peter Hein from Thorlabs’ OCT group joined the panel. His team is working on different OCT systems that, after 20 years of development, may allow up to meter-depth insights into material (see Fig. 10).The panelists were faced with the question of how suppliers of components and subsystems can work better with the instrumentation developers, and they came to two maybe-not-so-obvious points: First, medical products usually have a long product lifetime—on the order of 20 years. Suppliers must adapt to this fact.

The second point came out of recent trends in medicine: medical product lines split off into large systems for clinical use and smaller systems for personalized medicine. The latter may lead to higher volumes at lower prices. That may also lead to different scalability requirements. In fact, a fast path to higher output numbers may be crucial here. Of course, all are subject to rigorous standardization and tracking requirements.

Consumables may add a third path on that list. And if cost pressure on personal devices is high, it is even higher on consumables, so scalability and cost reduction are the substantial trends coming with a more personalized medicine. It may help to drive down component costs if there is either a chance to sell devices into non-medical markets or use components out of other markets. Both options may apply for OCT, while it is hard to find such solutions for other product lines.

In the end, biomedical technologies represent a highly innovative business with many opportunities. Component suppliers and system integrators have a close relationship, and, for the disruptive changes to come, they need an even closer relationship and joint development efforts.

About the Author

Andreas Thoss

Contributing Editor, Germany

Andreas Thoss is the Managing Director of THOSS Media (Berlin) and has many years of experience in photonics-related research, publishing, marketing, and public relations. He worked with John Wiley & Sons until 2010, when he founded THOSS Media. In 2012, he founded the scientific journal Advanced Optical Technologies. His university research focused on ultrashort and ultra-intense laser pulses, and he holds several patents.

![FIGURE 2. High-power semiconductor laser brilliance fuels applications (Normalized cost per bright watt*) [*Bright Watt = Brilliance (W/cm2 -sr)]. FIGURE 2. High-power semiconductor laser brilliance fuels applications (Normalized cost per bright watt*) [*Bright Watt = Brilliance (W/cm2 -sr)].](https://img.laserfocusworld.com/files/base/ebm/lfw/image/2018/03/rsz_1803lfw_lpmssupp_f2.png?auto=format,compress&fit=max&q=45?w=250&width=250)