ALLEN NOGEE, Laser Analyst for Strategies Unlimited

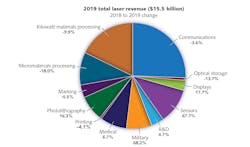

2019 was a year with very mixed results for the laser manufacturing community. On the one hand, revenues for laser systems for material processing were down 12%, while the overall laser market increased 4.8%, as Allen Nogee, president of Laser Markets Research, estimated based on numbers from the end of 2019 (see Fig. 1). The big winners were sensors and military lasers, both growing 50 to 60%—but the medical laser, photolithography, and display manufacturing segments also gave positive signals.

Nogee showed some global economic data to deliver the context and background of these developments. Most importantly, the industrial production in China grew more slowly in 2019, with only 5.1%, after 5.9% (2018) and 6.5% (2017). This is a 17-year low in China. In Europe the industrial production actually declined (-1.6%) whereas the U.S. industrial sector remained flat, with 1.2% growth (2018: 4.1%).

If a single indicator could explain the trend, then it was the Chinese automobile market. The unit sales were down 8.2% in 2019, and for 2019 and the first half of 2020, China expects 6000 car dealers to close—20% of the total number.

So, there is not much optimism for further growth of industrial laser manufacturing in China. Still, the number of unit sales in this laser market is slightly rising. But with a 30% decrease in the average sales prices for kilowatt laser systems, profits for laser companies have diminished. A growing number of lower-cost lasers (especially fiber-based) entered the market and are driving extended adoption of the technology. Similar trends are expected for ultrashort-pulse lasers. At this stage of market development, lasers have become a commodity and, as a result, competition is based on sale price.

The tariffs from the U.S.-Chinese trade war have added problems, but not as much as the actual market developments in China. In the end, the trade war has spurred further growth of laser companies in China.

Besides regional markets, Nogee discussed individual market segments (see Fig. 2). Lasers for lithography stood out with 16% market growth, reaching $1 billion. This growth is mainly driven by the advent of extreme ultraviolet (EUV) systems, which require very powerful CO2 lasers.The market for communication lasers is estimated to be approximately $4 billion, and decreased 3.6% in 2019. The primary reasons for the decline are, again, located in Chinese economic uncertainties and a delay in the rollout of 5G wireless systems. Conversely, the market for medical lasers prospered with a healthy growth of 6.7% (2018: 10.1%).

The flat-panel-display market saw a great transition toward OLEDs in 2019. Samsung alone converted 50% of its LCD capacity to OLED manufacturing. And in reality, the market strongly depends on Apple, which apparently plans for the iPhone 12 to have 100% OLED displays. In total, the flat panel display market was estimated to be $480 million in 2019, similar to the year before.

With a growth of 48%, the market segment for sensing with edge-emitter diodes and VCSELs performed best. The total revenue of $1.5 billion was mainly driven by the hundreds of millions of new VCSELs produced each year. While smartphones and perhaps future lidar applications will drive further growth, manufacturers may experience growing competition and lower selling prices in the future.

The most interesting observation was Nogee’s outlook on 2020. For the total sales number in the laser market, he expects a growth of 11%, to approximately $17 billion (2019: $15.5 billion). This number was estimated in January 2020, when no impact from the COVID-19 epidemic was included.

As of now, Nogee estimates that material processing and medical lasers will remain at a moderate 5% growth. He expects strong growth of 12% in the communication lasers segment and another 11% for displays. With an increase of 29%, the sensors market is expected to perform best. All these forecasts will depend, of course, on the ongoing impact of the COVID-19 disease in China and beyond.

A final version of the data will be published in the annual report titled: The Worldwide Market for Lasers: Review and Forecast, March 2020, by Strategies Unlimited.

CONTINUE READING >>>

DOWNLOAD FULL REPORT

About the Author

Andreas Thoss

Contributing Editor, Germany

Andreas Thoss is the Managing Director of THOSS Media (Berlin) and has many years of experience in photonics-related research, publishing, marketing, and public relations. He worked with John Wiley & Sons until 2010, when he founded THOSS Media. In 2012, he founded the scientific journal Advanced Optical Technologies. His university research focused on ultrashort and ultra-intense laser pulses, and he holds several patents.