Regional phone companies in the United States have left fiber rollout to others, but as bandwidth demands increase, fiber to the home is gradually gaining momentum.

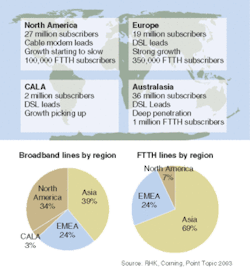

The elusive vision of fiber to the home is finally starting to be realized, although not in the way most observers expected. The world leader is Japan, with fiber lines running to 900,000 homes, and passing millions more, says Bob Whitman of Corning. North America has only 100,000 fibered homes—7% of the world's total—and 30% of those are in Canada (see Fig. 1).

Tables published by the Fiber to the Home Council (www.ftthcouncil.org) count 94 communities in the United States where fiber served at least some homes as of last September. Virtually all of them were built by city, town, or county electric utilities, small town telephone companies, or developers of large subdivisions. Altogether, they have 70,000 fibered subscribers.

Despite years of talk and some highly publicized announcements, the Regional Bell Operating Companies (RBOCs) that provide home telephone service in most of the United States are conspicuously absent from the action. The big phone companies do say encouraging things. Last May, Verizon, SBC, and Bell South announced a joint request for proposals to supply fiber-to-the-premises equipment. Yet, so far only Verizon has followed up by publicly selecting vendors and setting a goal—to pass about a million homes with fiber this year. Even Verizon hasn't said when it will lay fibers to customer's doors. The big cable-television companies haven't even started talking about fiber to the home. Why are a bunch of rural utilities upstaging these giant corporations with far deeper financial resources? The answer lies in the changing nature of the telecommunications industry.

Roots of fiber to the home

The idea of fiber to the home was born three decades ago, with talk of "wired cities" offering a range of advanced telecommunication services. But the plans were rather vague aboutwhat services would be offered. AT&T, then the monopoly telephone carrier in most of the United States, pushed video telephones, while the Federal Communications Commission pushed interactive television. The public yawned, and wound up with one-way cable and a choice of phone colors.

Japan went forward, installing fiber to 150 homes in the "new town" of Higashi-Ikoma. The Hi-OVIS project began service in 1978, pioneering video on demand and an early on-line information service called videotex (see Fig. 2). The technology worked, but over eight years the project cost ×10 billion (then US$80 million).

Other experiments followed. In 1981, the Manitoba Telephone System began a $7 million test of fiber to 150 homes in the tiny rural towns of Elie and Ste. Eustache. Rural residents who had lived with 10-party phone lines and a couple of fuzzy broadcast television channels from Winnipeg were delighted with private phone lines, videotex, and cable television. But the Elie trial and others elsewhere kept coming to the same conclusion—customers wouldn't pay enough for new services to justify the cost. Most didn't care about services such as videotex and automatic meter reading. Phone companies looked again and again, but never found enough revenue to pay for the installation.

Fiber did find a place in distribution networks. Cable television companies developed hybrid fiber/coax systems to distribute signals through fiber to neighborhood nodes. The RBOCs also used fiber to transport signals to local nodes. Phone companies looked again at fiber in the 1990s, as they sought ways to compete with cable companies in the video market, but they settled on Digital Subscriber Line (DSL) because it used existing copper wires to drop signals at homes. Otherwise, fiber spread slowly as carriers upgraded their networks piece-by-piece, with the boldest moves being fiber-to-the-curb networks in large developments where utilities had to be installed from scratch.

The Internet and broadband service

The explosive growth of the World Wide Web changed the picture. Dial-up modems sufficed for electronic mail, but it topped out at 56 kbit/s. The Web's need for serious bandwidth created a market for cable modems and DSL, which telephone companies had repackaged for data transmission. The penetration of broadband services increased steadily, reaching 21.6 million U.S. homes in 2003, according to the Telecommunications Industry Association. That's nearly 20% of American households, a solid number considering that broadband was the bleeding edge just a few years back.

Yet cable modems and DSL have their limits. They aren't available everywhere. Cable service is not universal, and many systems had to be upgraded to handle cable modems. A longer-term problem is that today's broadband isn't always that broad in bandwidth terms. Speeds now range from about 300 kbit/s to 1.5 Mbit/s, which sounds impressive until you try to download the latest Microsoft update or send grandma a video of baby's first steps. Upgrades require pushing fiber closer to homes. Fiber to the home brings all the bandwidth right to the door.

Rolling out fiber

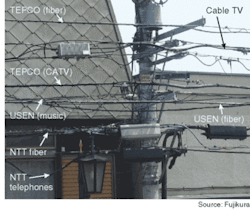

Japan has become the global leader in fiber to the home through the "e-Japan Priority Program," which, by the end of next year, seeks to reach 10 million homes with 100 Mbit/s fiber links and 30 million with 10 Mbit/s versions of DSL—several times the speed of standard U.S. DSL. The program encourages phone companies and electric utilities to offer the service, but does not subsidize it. The dominant phone companies, NTT East and NTT West, have installed fat distribution cables that pass millions of homes and have high fiber counts. Whitman says the two NTTs account for about 70% of the 900,000 households that have signed up for the fiber service, only about 20% of the homes passed.

The numbers may not meet the ambitious target of 10 million fibered homes by the end of next year, but they are nonetheless impressive in light of Japanese regulations. Japan has yet to break down the barriers between cable television and telephone service, so phone companies can't offer video service. Nor do they want to shift telephone traffic to voice on Internet Protocol over fiber, because they would lose lucrative income from conventional telephone service over existing wires. All subscribers get is data transmission at 100 Mbit/s. Only now is Japan starting the second phase of its program, developing content and applications for the high-speed systems.

The U.S. has a higher "take rate" with about a third of 200,000 homes passed taking the fiber service. But that leaves the total number of homes served well under 10% of the number in Japan. The Federal Communications Commission has made broadband one of its six strategic goals, but fiber is hardly on its radar except for regulations on what facilities phone companies must share with competitors. As a result, the RBOCs have done little, leaving home fiber installations to others.

Developers of upscale suburban subdivisions have embraced fiber as a useful sales tool. Laying fiber doesn't increase their costs greatly because they have to provide utilities throughout the subdivision anyway. Public utilities are another driving force behind fiber to the home.

Independent phone companies and cooperatives serving small communities are also laying fibers to homes and businesses. Those that serve rural areas and small towns can tap government loan programs, and they don't have to worry about stockholder approval if they are upgrading their plants anyway.

A battle over utopia

The movement is spreading to mid-sized cities. Last year, Provo, Utah, voted to go ahead with plans for the city-owned Provo City Power to build a city-wide fiberoptic network after running a demonstration with 300 homes. A consortium of 18 other Utah cities, including Salt Lake City, has formed the Utah Telecommunication Open Infrastructure Agency, or UTOPIA, to build an ambitious statewide fiber network serving homes and businesses. Like other city officials, they complain that investor-owned cable and phone companies are too slow to invest in infrastructure needed by their communities.

The movement is encountering resistance from established phone and cable companies. Provo had planned to offer its own Internet service over its network, but Qwest and AT&T Broadband (now Comcast) successfully lobbied the Utah legislature to block public utilities from retailing service. The new law allows Provo to wholesale service over the network they built, but they have to license others to offer retail service. A case now pending before the U.S. Supreme Court will decide on the legality of such restrictions, which several states have imposed.

Verizon's big plan

In an ironic twist on the traditional dichotomy between rural and urban areas, few residents of big cities and suburbs have seen the benefits of home fiber links. The fate of Verizon's much-publicized plans will be an acid test for the ability of the big phone companies to deliver.

With SBC and BellSouth, Verizon has already taken an important step by blessing the FSAN (Full Service Access Network) standard. The International Telecommunications Union has approved the 100-Mbit/s passive optical network (PON) design as ITU standard G.983. The ITU also has approved a Gigabit PON design. The PON design still faces serious competition from the Ethernet-style point-to-point architecture used in other places, including Japan, but the decision gives the phone companies much-needed focus.

What remains to be seen is how well they can follow through. Costs for fiber-to-the-home equipment continue to drop, but installation costs remain high. Running new drop cables is expensive, especially where utilities are buried underground and every house needs it own trench from curb to entry point. Private phone company CEOs have looked at that budget and put their plans back on the shelf because they can't justify the low returns to their stockholders. That doesn't bother the publicly owned utilities. As a spokeswoman for Provo City Power says, "Our customers are our stockholders."